RBI Grade B and NABARD Grade A exams might appear quite similar at first glance, as both are prestigious avenues for securing a career in India’s financial and development sectors.

However, they have distinct differences in terms of job roles, responsibilities, and career progression. Deciding which path to pursue can be challenging but crucial for aligning with your career goals.

In this article, we provide a clear and concise comparison of RBI Grade B and NABARD Grade A, helping you determine which is the better fit for your professional aspirations.

Read on to discover more!

Table of Contents

ToggleOverview of RBI Grade B Exam

The RBI Grade B exam is conducted by the IBPS to recruit officers into its various departments. The exam is known for its challenging syllabus and high competition.

RBI Grade B Exam Phases:

- Phase I: Preliminary Exam

- Phase II: Main Exam

- Interview

RBI Grade B Phase I Syllabus:

- General Awareness

- English Language

- Quantitative Aptitude

- Reasoning Ability

RBI Grade B Phase II Syllabus:

- Paper I: Economic and Social Issues

- Paper II: English (Writing Skills)

- Paper III: Finance and Management

Overview of NABARD Grade A Exam

The NABARD Grade A exam is also conducted by the IBPS to recruit officers for rural development banking services.

NABARD Grade A Exam Phases:

- Phase I: Preliminary Exam

- Phase II: Main Exam

- Interview

NABARD Grade A Phase I Syllabus:

- General Awareness

- English Language

- Quantitative Aptitude

- Reasoning Ability

- Decision Making

- Computer Knowledge

NABARD Grade A Phase II Syllabus:

- Paper I: English (Writing Skills)

- Paper II: Economic and Social Issues, and Agriculture and Rural Development

Syllabus Comparison

General Awareness:

- RBI: Focus on RBI Circulars, Schemes of various ministries, Economic news, Banking and Financial Awareness.

- NABARD: Includes NABARD Circulars, Economic news, Banking and Financial Awareness, plus State news and static GK.

English:

- Both exams test vocabulary, grammar, sentence framing, reading comprehension, cloze tests, and essay writing skills.

Quantitative Aptitude:

- Both exams cover percentages, averages, time & work, ratios, quadratic equations, interest calculations, profit & loss, mixtures, number series, and data interpretation.

Reasoning Ability:

- Common topics include ranking, series, coding-decoding, input-output, syllogism, directions, blood relations, seating arrangements, puzzles, inequalities, and data sufficiency.

Phase II Specific Syllabus:

● RBI:

- Economics and Social Issues: Growth and Development, Indian Economy, Globalization, Social Structure in India.

- Finance and Management: Financial systems, Financial markets, General topics, Basics of accounting, Inflation, Management principles, Organizational Behavior, Ethics, and Corporate Governance.

● NABARD:

- Economic and Social Issues: Similar to RBI but with added emphasis on the rural economy, globalization impacts, poverty alleviation, and employment generation.

- Agriculture and Rural Development: Covers agronomy, cropping systems, soil conservation, water resource management, farm machinery, plantation & horticulture, animal husbandry, fisheries, forestry, agricultural extensions, ecology, climate change, and rural development programs.

RBI Grade B and NABARD Grade A: Are there any topic overlaps?

What about similarities between RBI Grade B and NABARD Grade A exams?

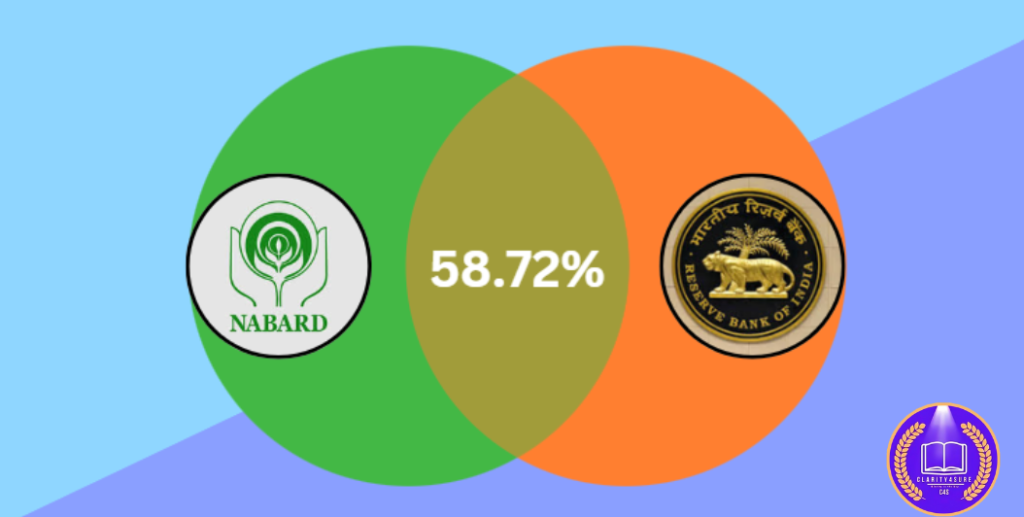

A significant part of the NABARD Grade A exam is covered by the RBI Grade B syllabus, with most of the overlap found in the Phase 1 and Economics & Social Issues section of Phase 2.

We estimate that about 58.72% of the NABARD Grade A syllabus is covered by the RBI Grade B exam, whereas the remaining syllabus contains unique topics specific to each exam.

This is an interesting insight for those who are preparing for both RBI and NABARD exams and aim to optimize their study time effectively.

Both exams cover a variety of subjects, but each has unique topics specific to the job roles they are targeting in their respective organizations.

The NABARD exam is tested in 3 phases:

- Phase 1: Preliminary Exam

- Phase 2: Main Exam

- Interview

On the other hand, the RBI Grade B exam is also tested in 3 phases:

- Phase 1: Preliminary Exam

- Phase 2: Main Exam

- Interview

Let’s take a closer look at each exam topic area and point out the main areas of overlap between the RBI Grade B and NABARD Grade A syllabus.

Overlap Analysis: RBI Grade B and NABARD Grade A Syllabus

General Awareness

| General Awareness Topics | RBI Phase 1 Overlap | NABARD Phase 1 Overlap |

| Economic News | ✅ | ✅ |

| Banking & Financial Awareness | ✅ | ✅ |

| National and International News | ✅ | ✅ |

| State News | ✅ | ✅ |

| Important Days | ✅ | ✅ |

| Books & Authors | ✅ | ✅ |

| Awards and Recognition | ✅ | ✅ |

| Static GK | ✅ | ✅ |

| RBI Circulars | ✅ | ❌ |

| NABARD Circulars | ❌ | ✅ |

English

| English Topics | RBI Phase 1 & 2 Overlap | NABARD Phase 1 & 2 Overlap |

| Vocabulary | ✅ | ✅ |

| Grammar | ✅ | ✅ |

| Sentence Framing | ✅ | ✅ |

| Jumbled Words/Sentences | ✅ | ✅ |

| Error Spotting | ✅ | ✅ |

| Sentence Rearrangement | ✅ | ✅ |

| Reading Comprehension | ✅ | ✅ |

| Cloze Test | ✅ | ✅ |

| Essay Writing | ✅ (Phase 2) | ✅ (Phase 2) |

| Precis Writing | ✅ (Phase 2) | ✅ (Phase 2) |

| Business/Office Correspondence | ❌ | ✅ (Phase 2) |

Quantitative Aptitude

| Quantitative Aptitude Topics | RBI Phase 1 Overlap | NABARD Phase 1 Overlap |

| Percentage | ✅ | ✅ |

| Average | ✅ | ✅ |

| Time & Work | ✅ | ✅ |

| Ratio & Proportion | ✅ | ✅ |

| Quadratic Equations | ✅ | ✅ |

| Upstream & Downstream | ✅ | ✅ |

| Simple & Compound Interest | ✅ | ✅ |

| Profit & Loss | ✅ | ✅ |

| Mixture and Allegation | ✅ | ✅ |

| Number Series | ✅ | ✅ |

| Data Interpretation | ✅ | ✅ |

Reasoning

| Reasoning Topics | RBI Phase 1 Overlap | NABARD Phase 1 Overlap |

| Ranking | ✅ | ✅ |

| Alphanumeric Series | ✅ | ✅ |

| Coding-Decoding | ✅ | ✅ |

| Input-Output | ✅ | ✅ |

| Syllogism | ✅ | ✅ |

| Directions | ✅ | ✅ |

| Blood Relations | ✅ | ✅ |

| Seating Arrangement | ✅ | ✅ |

| Puzzles | ✅ | ✅ |

| Inequalities | ✅ | ✅ |

| Data Sufficiency | ✅ | ✅ |

Economics & Social Issues (Phase 2)

| Economics & Social Issues Topics | RBI Phase 2 Overlap | NABARD Phase 2 Overlap |

| Growth and Development | ✅ | ✅ |

| Measurement of Growth | ✅ | ✅ |

| Poverty Alleviation | ✅ | ✅ |

| Sustainable Development | ✅ | ✅ |

| Economic History of India | ✅ | ✅ |

| Changes in Industrial and Labour Policy | ✅ | ✅ |

| Economic Survey and Union Budget | ✅ | ✅ |

| Indian Money and Financial Markets | ✅ | ✅ |

| Role of Indian Banks and RBI | ✅ | ✅ |

| Public Finance | ✅ | ✅ |

| Political Economy | ✅ | ✅ |

| Industrial Developments in India | ✅ | ✅ |

| Indian Agriculture | ✅ | ✅ |

| Services Sector in India | ✅ | ✅ |

| Globalization | ✅ | ✅ |

| Opening up of the Indian Economy | ✅ | ✅ |

| Balance of Payments | ✅ | ✅ |

| International Economic Institutions | ✅ | ✅ |

| Regional Economic Co-operation | ✅ | ✅ |

| International Economic Issues | ✅ | ✅ |

| Multiculturalism | ✅ | ✅ |

| Demographic Trends | ✅ | ✅ |

| Urbanisation and Migration | ✅ | ✅ |

| Gender Issues | ✅ | ✅ |

| Social Justice | ✅ | ✅ |

| Inflation | ❌ | ✅ |

| Population Trends and Policy in India | ❌ | ✅ |

| Rural and Urban Poverty Programs | ❌ | ✅ |

| Agricultural Performance | ❌ | ✅ |

| Structural and Institutional Features | ❌ | ✅ |

| Economic Underdevelopment | ❌ | ✅ |

Additional Unique Subjects

| RBI Phase 2 Finance and Management Topics | NABARD Phase 2 Agriculture and Rural Development Topics |

| Financial System | Agronomy |

| Financial Markets | Cropping Systems |

| Financial Risk Management | Soil and Water Conservation |

| Basics of Accounting | Farm and Agri Engineering |

| Corporate Governance | Plantation & Horticulture |

| Management Principles | Animal Husbandry |

| Ethics at the Workplace | Fisheries |

| Forestry | |

| Agriculture Extensions | |

| Ecology and Climate Change | |

| Rural Development Programs |

This analysis helps candidates preparing for both exams to focus on common topics and streamline their study plan effectively.

| Overlap Percentage |

| 58.72% |

To effectively manage the overlapping syllabus areas, our RBI-NABARD Combined Mentorship & Test Series provides tailored content and practice materials to help you excel in both exams, saving you time and effort in your preparation.

Career Opportunities: RBI Grade B vs NABARD Grade A

Choosing between a career as an RBI Grade B officer and a NABARD Grade A officer can be challenging, as both positions offer distinct opportunities and responsibilities. Here’s a detailed comparison to help you decide which path may be better suited for you:

RBI Grade B Officer Career Opportunities

1. Policy Formulation and Supervision:

- Engage in the formulation of banking policies and regulations.

- Perform onsite and offsite supervision, risk assessment, and data analysis.

- Prepare and issue show-cause notices for enforceable violations.

2. Market Regulation and Development:

- Work on the regulation and development of financial markets.

- Conduct market operations such as Open Market Operations (OMO) and analyze liquidity facilities like LAF and MSF.

- Analyze economic indicators like REER and NEER.

3. Financial Market Operations:

- Examine applications for exchange transactions and interact with government departments.

- Prepare policy notes on regulations and directions.

4. Day-to-Day Operations and IT Management:

Handle daily operations, including IT infrastructure and back-office tasks.

Prepare reports and publications.

5. Government Auctions and Primary Dealer Regulation:

Conduct auctions on behalf of the central and state governments.

Regulate primary dealers and provide policy inputs.

6. Priority Sector Guidelines and Financial Inclusion:

Draft and revise guidelines for priority sectors.

Implement national strategies for financial inclusion and MSME development.

Act as Lead District Officer for Lead Bank Schemes in regional offices.

7. Internal Accounting and Agency Bank Management:

Formulate policies for the opening of accounts for banks and governments.

Oversee internal accounting and agency bank performance.

8. Payment and Settlement Systems:

Regulate and supervise entities like PPIs, wallets, and payment banks.

Ensure smooth operations of NEFT, RTGS, and cheque clearing systems.

9. Currency Management:

Analyze currency demand and supply.

Manage security and logistics for currency remittances.

Act as custodian of vaults in regional offices.

10. Monetary Policy:

Provide technical inputs to the Monetary Policy Committee.

Prepare the Monetary Policy Report (MPR) and conduct pre-policy consultations.

11. Research and Analysis:

Engage in research-oriented tasks and manage exposure visits.

Given the breadth and complexity of roles within the RBI, preparing thoroughly for the exam is essential. Our RBI GRADE B HIGH LEVEL TEST SERIES (PI + PII) is designed to provide rigorous practice and detailed feedback to help you master both the Preliminary and Main exams.

NABARD Grade A Officer Career Opportunities

1. Agriculture and Rural Development Policies:

Work on policies and programs related to agriculture and rural development mandated by central and state governments.

2. Multitasking and General Management:

Perform a variety of tasks as delegated by the Chief General Manager of the Regional Office (RO).

Engage in roles and responsibilities linked to the state government and banking activities in rural areas.

3. State-Level Assignments:

Typically assigned to state capitals, although postings can be anywhere in India.

Home state postings are generally prohibited.

4. Program Implementation and Monitoring:

Implement and monitor various development programs.

Coordinate with state governments and banking institutions for rural development initiatives.

5. Policy Execution and Advisory:

Execute policies related to agricultural credit, rural infrastructure, and other development programs.

Provide advisory services to stakeholders.

Your choice should depend on your interest in either macroeconomic policy and financial market regulation (RBI) or rural development and agricultural finance (NABARD). Consider your career goals and areas of interest to make the best decision for your professional growth.

Which Exam Should You Choose?

- Choose RBI Grade B if: You are interested in central banking, economic policy, and financial regulation.

- Choose NABARD Grade A if: You are passionate about rural development, agricultural finance, and contributing to the growth of rural India.

Conclusion

Both the RBI Grade B and NABARD Grade A exams offer unique and rewarding career paths in the Regulatory Bodies. Your choice should align with your career interests and goals, whether it’s central banking and policy-making or rural development and agricultural finance. Consider the overlapping syllabus areas to streamline your preparation if you’re considering both exams.

For those seeking comprehensive guidance and efficient preparation, our Bundle courses (RBI + NABARD) and Test Series provide the necessary tools and support to help you succeed.

Good luck! 🙂