Origin

- The first Primary Agricultural Credit Society (PACS) was established in 1904.

- The Cooperative Credit Societies Act of 1904 laid the foundation for the cooperative movement in India.

About

- Ministry:

- The Ministry of Cooperation

- Primary Agricultural Credit Societies (PACS) play a crucial role in India’s rural economy, particularly in providing financial services to farmers and rural households.

- They are a central component of the cooperative credit structure in India, aimed at promoting agricultural development and improving the livelihoods of farmers.

What is a Primary Agricultural Credit Society (PACS)?

A Primary Agricultural Credit Society (PACS) is a cooperative society at the grassroots level, which provides credit and other financial services to farmers and rural residents. The society operates in rural areas and functions as the first point of contact for farmers seeking short-term and medium-term agricultural loans.

Key Features of PACS

- Membership:

- PACS are membership-based organizations. Farmers, landowners, and other rural residents can become members and avail themselves of financial services.

- Credit Services:

- The primary function of PACS is to provide short-term and medium-term credit for agricultural and allied activities. PACS generally provide loans for buying seeds, fertilizers, equipment, and other agricultural necessities.

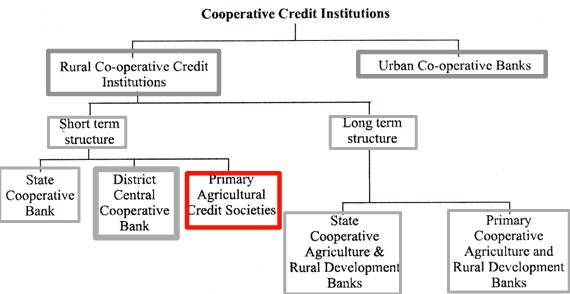

- Cooperative Structure:

- PACS are part of the larger cooperative credit structure in India, which includes the State Cooperative Banks (SCBs) and District Central Cooperative Banks (DCCBs) that provide higher-level financial support.

The Evolution of PACS in India

- The concept of cooperative credit societies in India dates back to the early 20th century. In 1904, the Cooperative Societies Act was passed, which laid the foundation for the cooperative credit movement in India. PACS emerged as an essential tool for providing affordable credit to farmers who had limited access to commercial banks.

- Over the years, the role of PACS has expanded. They have become vital institutions for rural financial inclusion, especially after the nationalization of banks in the 1960s and 1970s.

- Today, there are over 1 lakh PACS functioning across the country, providing access to credit for millions of farmers.

Structure of PACS

- Primary Level (PACS):

- This is the base level of the cooperative credit structure, dealing directly with farmers and rural members.

- They provide short-term and medium-term loans for agricultural activities, along with services like crop insurance, and assistance for farm equipment purchase.

- District Level (DCCBs):

- These banks operate at the district level and serve as intermediaries between the PACS and State Cooperative Banks. They lend funds to PACS for on-lending to farmers.

- State Level (State Cooperative Banks):

- These banks are the apex institutions in the cooperative credit system and are responsible for providing financial support to DCCBs and ultimately to PACS.

Functions of PACS

- Providing Credit to Farmers

- PACS provide short-term and medium-term loans to farmers for agricultural inputs like seeds, fertilizers, pesticides, and farm machinery.

- They also offer working capital for farm activities, such as crop cultivation and livestock management.

- Savings and Deposit Services

- PACS offer savings products to rural members, helping them manage their savings and access small credit lines when needed.

- Promoting Financial Inclusion

- As rural areas often have limited access to banking facilities, PACS serve as the primary institution for financial inclusion. They help farmers and rural communities access formal credit and savings products.

- Disbursement of Subsidies and Grants

- PACS play an important role in the distribution of government subsidies, grants, and financial assistance for agricultural development schemes.

- Insurance Services

- Many PACS offer insurance products, particularly crop insurance, which protects farmers against unforeseen risks like droughts, floods, and other natural calamities.

Benefits of PACS

- Access to Credit

- Farmers can access credit at low-interest rates, reducing their dependence on informal sources of credit like moneylenders, who often charge exorbitant interest rates.

- Promoting Agricultural Growth

- By providing credit for inputs and technological advancements, PACS help increase agricultural productivity, contributing to the overall growth of the agricultural sector.

- Social Upliftment

- PACS serve as community-based organizations, encouraging members to work together for mutual economic benefit. This fosters a spirit of cooperation and solidarity among rural populations.

- Rural Economic Development

- By facilitating credit, PACS enable farmers to invest in new technologies, better irrigation systems, and modern farming practices, leading to long-term rural development.

- Security and Stability

- PACS offer insurance products and assistance in times of crisis, providing farmers with a safety net against crop failures or natural disasters.

Challenges Faced by PACS

Despite the many advantages, PACS face several challenges:

- Financial Sustainability

- Many PACS struggle with financial sustainability due to poor loan recovery rates, insufficient capital, and high operational costs. A significant percentage of loans disbursed by PACS are often not repaid on time.

- Weak Governance and Management

- PACS sometimes suffer from weak management practices, including inefficient use of resources and lack of professional training for staff. This can lead to a lack of trust among farmers.

- Over-indebtedness

- Farmers may take out multiple loans from different PACS or other financial institutions, leading to over-indebtedness. This makes loan recovery difficult and impacts the financial health of PACS.

- Technological Deficiencies

- Many PACS still rely on outdated manual systems for bookkeeping, which can result in errors, delays, and inefficiencies in operations. Transitioning to digital systems is a major challenge.

- Political Interference

- As PACS are often linked with local politics, political interference can affect their smooth functioning and lead to mismanagement and corruption.

The Future of PACS

The future of PACS hinges on several factors, including the adoption of technology, regulatory reforms, and better financial management practices. Some of the key developments that could improve the functioning of PACS include:

- Digitization and Technological Integration

- With the advent of mobile banking and digital platforms, PACS can leverage technology to improve loan disbursement, recovery, and overall efficiency.

- Strengthening Governance and Management

- Improved training and capacity building for the management of PACS can help enhance their operational efficiency and increase transparency.

- Increased Collaboration with Commercial Banks

- PACS can collaborate more closely with commercial banks, leveraging their infrastructure and financial products to enhance credit availability in rural areas.

- Focus on Financial Inclusion

- As the government focuses more on financial inclusion, PACS could receive more support to extend banking services to unbanked rural populations.

Conclusion

- Primary Agricultural Credit Societies (PACS) are indispensable to India’s rural economy. They provide essential credit and financial services to farmers, empowering them to increase productivity and improve their livelihoods.

- However, the challenges they face require concerted efforts from the government, financial institutions, and local communities to ensure that PACS remain financially sustainable and continue to fulfill their critical role in rural development.

By embracing digitalization and improving governance, PACS can overcome these hurdles and continue to drive agricultural and economic growth in rural India.