Origin

- The origin of Foreign Exchange Reserves (FOREX) can be traced back to the early days of international trade, where countries began accumulating foreign currencies to facilitate payments for imports and manage currency fluctuations, with the concept solidifying during the gold standard era when countries primarily held gold reserves, later transitioning to holding a mix of foreign currencies, government bonds, and other financial instruments, primarily managed by a nation’s central bank to maintain currency stability and support the economy during international market volatility; the dominance of the US dollar as the primary reserve currency further shaped the modern FOREX system.

About

- Foreign Exchange Reserves, or Forex Reserves, are assets held by central banks or monetary authorities in foreign currencies.

- These reserves are a critical part of a nation’s economic stability and play a significant role in managing exchange rates, maintaining liquidity in international markets, and facilitating international trade.

What are Foreign Exchange Reserves?

- Foreign Exchange Reserves consist of various types of assets, including foreign currencies, gold, Special Drawing Rights (SDRs), and reserve positions with the International Monetary Fund (IMF). Countries use these reserves to pay for imports, manage currency volatility, and protect their economies from external shocks like financial crises, trade imbalances, or political instability.

Key Components of Forex Reserves

- Foreign Currencies:

- The most common component. These are holdings in currencies such as the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY), among others.

- These currencies can be used to settle international debts and conduct trade.

- Gold:

- Historically, gold was the primary reserve asset, but it still holds significant value today, serving as a hedge against inflation and currency devaluation.

- Special Drawing Rights (SDRs):

- These are international reserve assets created by the IMF. They are not actual currencies but can be exchanged for freely usable currencies between countries.

- Reserve Position in the IMF:

- Countries maintain an account at the IMF, which can be drawn upon if necessary.

Importance of Foreign Exchange Reserves

- Ensuring Economic Stability:

- Forex reserves act as a cushion during economic turmoil, providing governments with the ability to stabilize their currency during times of financial instability. For example, when there is a sudden outflow of foreign capital or an economic crisis, countries can dip into these reserves to stabilize their exchange rate.

- Facilitating International Trade:

- Foreign reserves ensure a country has enough liquidity to conduct international trade and settle debts without relying on external financing. This reduces a nation’s vulnerability to external shocks like trade disruptions or changes in the global economy.

- Confidence in Currency:

- A substantial amount of foreign reserves bolsters confidence in a country’s currency, helping maintain its value in the global market. Countries with low or no reserves can experience depreciation in their currency, leading to inflation and capital outflows.

- Managing Exchange Rate:

- Central banks use Forex reserves to intervene in the foreign exchange market. If the domestic currency is under pressure (either appreciating too quickly or depreciating), the central bank can buy or sell foreign currency to stabilize the exchange rate.

- Payment of International Debt:

- Reserves act as a safeguard for countries that have external debts or liabilities. They ensure that the country can meet its international obligations, especially when facing a liquidity crisis.

- Maintaining Investor Confidence:

- Investors view high levels of foreign reserves as an indicator of a country’s financial strength. It signals that the government is capable of managing its financial obligations and has a buffer against economic downturns.

How Do Forex Reserves Work?

- When a country accumulates foreign reserves, it generally buys foreign currencies or other assets using its own domestic currency.

- These purchases are often made by the central bank or other monetary authorities. Central banks may also earn interest on some of their foreign reserves, particularly if they invest in foreign government bonds or other financial instruments.

- In terms of how these reserves are managed, central banks are typically cautious and conservative. They prefer to hold reserves in highly liquid and low-risk assets, ensuring that they can access funds quickly in times of need.

Example

- If a country has high reserves in US Dollars, they can use these dollars to buy oil or other commodities priced in USD from other countries. If there’s a shortage of foreign reserves, the country may struggle to make payments for its imports, leading to balance-of-payments problems.

How Are Forex Reserves Managed?

Foreign exchange reserves are managed by a country’s central bank, which can invest them in various financial instruments. The main goal is to preserve capital while ensuring liquidity.

- Short-Term Investments:

- A portion of reserves is usually kept in very liquid, low-risk instruments like short-term US Treasury bills, foreign currency deposits, or other government securities.

- Long-Term Investments:

- Some reserves may be invested in longer-term assets, such as bonds or gold, to earn a return while safeguarding the value of the reserves.

Central banks also have policies in place to ensure that their foreign reserves are diversified and not overly reliant on one currency or asset class. This diversification helps reduce risks in case one asset class or currency experiences volatility.

Factors Influencing Forex Reserves

Several factors affect a country’s foreign exchange reserves:

- Trade Balance:

- A surplus in the trade balance (exports > imports) leads to an increase in foreign reserves, as foreign currency is received in exchange for exports. A trade deficit (imports > exports) can deplete reserves.

- Foreign Direct Investment (FDI):

- Foreign investments coming into the country contribute to higher reserves, as foreign currency flows in.

- Government Debt:

- A country’s need to service foreign debt can influence the use of foreign reserves. If external debt is large, reserves may be used to meet debt obligations.

- Central Bank Intervention:

- If the central bank intervenes in the currency markets to stabilize the exchange rate, it might either sell or buy foreign reserves.

- Global Economic Factors:

- Changes in global commodity prices, interest rates, and capital flows can impact the level of foreign reserves. A sudden surge in commodity prices can lead to increased reserves for an oil-exporting country, while economic downturns can deplete reserves.

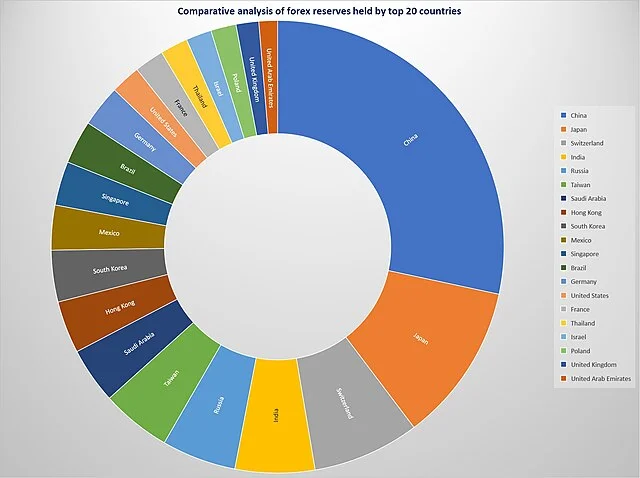

Forex Reserves Around the World

Different countries have varying levels of foreign exchange reserves. For example:

- China holds one of the largest foreign exchange reserves in the world, primarily in US Dollars and other major currencies. These reserves are largely used to maintain the value of the Yuan and manage its exchange rate.

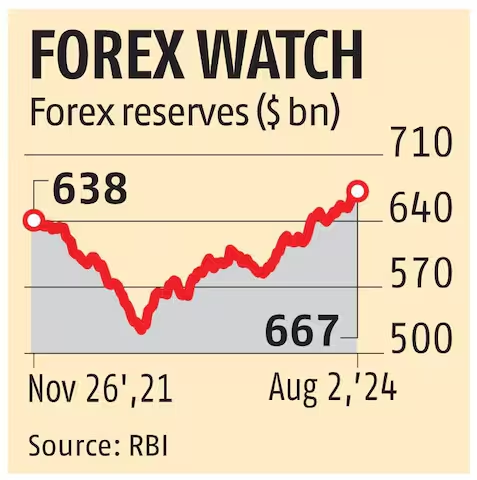

- India has seen significant growth in its foreign reserves in recent years, largely due to increased foreign investments and export growth.

- Oil-Producing Nations, such as Saudi Arabia and Russia, tend to have large reserves due to oil exports, which bring in substantial foreign currency.

- Developed Economies, such as the US and EU countries, generally hold lower reserves since their currencies are widely used in international trade and finance.

Conclusion

- Foreign Exchange Reserves play a fundamental role in stabilizing a country’s economy, ensuring liquidity in the global market, and maintaining confidence in the domestic currency.

- While countries with large reserves are seen as economically stronger and more resilient, the management of these reserves requires strategic decisions to balance the need for liquidity, investment returns, and risk diversification.

As the global financial landscape continues to evolve, countries will likely continue to adapt their reserve management strategies to address new challenges, such as the impact of digital currencies or changes in global trade dynamics.