About

- A Public-Private Partnership (PPP) investment model is a cooperative arrangement between a government and private sector companies to finance, build, and operate projects that are typically in the public interest.

- These projects often involve infrastructure, healthcare, education, or other services that benefit society, but require large capital investment, which the public sector may not have the capacity to fund alone.

Budget Allocation 2025

- The fund will finance up to 25% of the cost of bankable projects with a stipulation that at least 50% of the cost is funded from bonds, bank loans, and PPPs.

- An amount of INR 10,000 crore has been proposed to be allocated for 2025-2026.21 hours ago

Key Features of the PPP Investment Model

- Shared Risks and Rewards:

- In a PPP, both the government and the private sector share the risks and rewards of the project. The private entity usually contributes capital and expertise in exchange for the potential to earn a return over time. The government provides the legal framework, public interest protection, and sometimes, guarantees or subsidies.

- Long-Term Commitment:

- PPP projects typically span many years, ranging from 10 to 30 years or even more. The private sector’s participation is typically long-term, allowing for the repayment of the investment made in the infrastructure.

- Public Interest Focus:

- While the private partner aims to make a profit, the main goal of a PPP is to serve the public interest. Government oversight ensures that the project meets the required social and environmental standards.

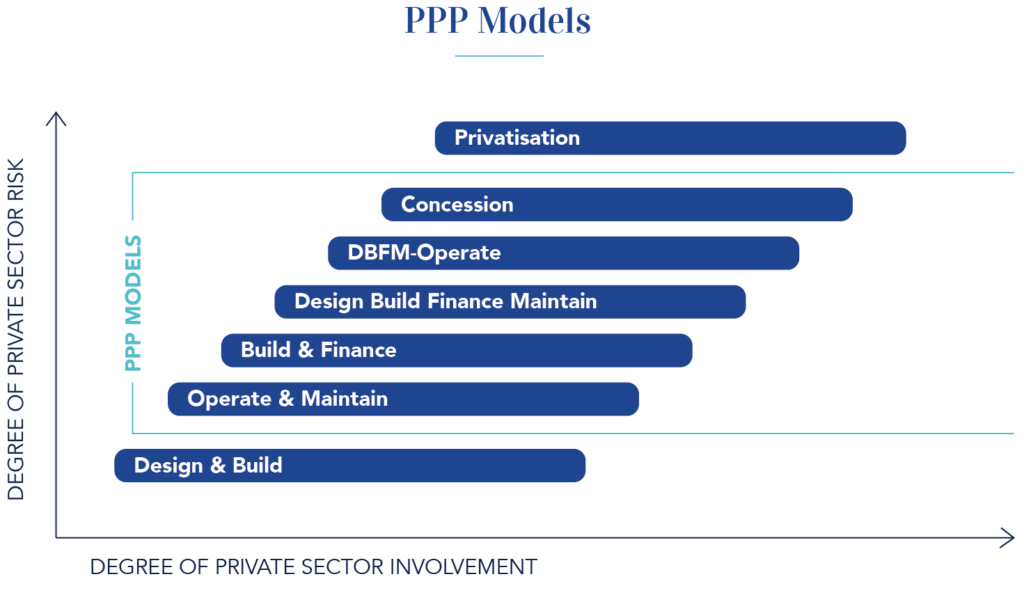

Types of PPP Models

There are various types of PPP models, each suited for different types of projects:

- Build-Operate-Transfer (BOT):

- The private sector designs, finances, and builds the infrastructure, then operates it for a set period to recoup its investment. After the period, the facility is transferred back to the government.

- Build-Own-Operate (BOO):

- The private company builds, owns, and operates the infrastructure indefinitely. This model is common in sectors where the private sector is more efficient in operation than the government.

- Design-Build-Finance-Operate (DBFO):

- In this model, the private sector is responsible for the design, construction, financing, and operation of the project. The government might still own the asset, but the private partner runs the operations.

- Operation and Maintenance (O&M):

- The private sector only handles the operation and maintenance of an already existing public asset, while the government continues to own and oversee the infrastructure.

- Public-Private Venture (PPV):

- The government and private sector create a joint venture, with both parties contributing to funding, risks, and rewards. This model is often used when the government wants to maintain a higher level of control over the project.

Benefits of the PPP Investment Model

- Access to Private Capital:

- Governments benefit from accessing private sector investment, which is essential for large-scale infrastructure projects, without having to divert funds from other public services.

- Efficiency and Innovation:

- Private sector involvement often leads to better project management, innovation, and efficiency. The private partner has an incentive to complete the project on time and within budget.

- Risk Sharing:

- Both the private sector and government share risks, but the private sector is generally better equipped to handle certain risks, such as construction delays or cost overruns. This can lead to more successful project execution.

- Economic Growth:

- Well-executed PPPs can contribute to long-term economic development, creating jobs, improving public infrastructure, and enhancing the overall business environment.

- Improved Services:

- As private sector companies are incentivized to provide high-quality services, PPPs can lead to improved service delivery in sectors like healthcare, education, or transportation.

Challenges in PPP Investment Models

- Complex Negotiations:

- The process of structuring a PPP can be complex, involving intricate contracts and negotiations between the private sector and government. This can lead to delays and increased costs.

- Long-Term Commitment:

- The long-term nature of PPPs can be a disadvantage if the project does not meet expectations or if the political environment changes during the term of the agreement.

- Profit Motive:

- Since the private sector is driven by profit, there is a risk that cost-cutting measures might negatively impact service quality. Therefore, proper regulation is required to ensure that public interests are protected.

- Debt Burden:

- The large scale of infrastructure projects often leads to significant amounts of debt being incurred. Governments must manage this debt responsibly to avoid fiscal strain.

- Equity vs. Efficiency:

- While the private sector can often run projects more efficiently, it can lead to disparities in service access or quality. For instance, lower-income groups may suffer if the private sector’s priorities are aligned with profit over equity.

The Process of Developing a PPP

- Feasibility Study:

- Before embarking on a PPP, governments conduct a feasibility study to evaluate the potential benefits, costs, and risks associated with the project.

- Tendering and Contracting:

- After the feasibility study, the government invites private sector firms to tender for the project. These firms submit their bids, and the government selects the best proposal.

- Project Design and Financing:

- The selected private partner is responsible for the project design and securing financing for the project.

- Construction and Operation:

- After financing, construction takes place, followed by the operation phase, where the private sector company operates the infrastructure for the agreed period.

- Monitoring and Regulation:

- During the operational phase, the government monitors the project to ensure that the private partner is meeting the contractual terms and providing quality services.

- Transfer:

- At the end of the contract period, the private sector may transfer the infrastructure back to the government, as per the terms of the agreement.

Case Studies of Successful PPP Models

- The London Underground PPP (2003):

- One of the most high-profile examples of a PPP, this involved the private sector financing and maintaining the infrastructure of the London Underground system. While the project faced challenges, it eventually improved the system’s capacity and operations.

- Delhi Metro (India):

- The Delhi Metro is another great example where a government-private partnership has brought an urban transportation system to life. The project has been successful in reducing traffic congestion while providing a reliable and affordable service.

Conclusion

- The PPP investment model is a powerful tool for financing and delivering public infrastructure projects. While it offers significant benefits in terms of capital access, efficiency, and long-term economic growth, it comes with its own set of challenges, particularly in managing risks and maintaining quality.

- Proper planning, transparency, and oversight are crucial to ensure that both public and private interests are protected and that the project delivers the expected outcomes for society.

By carefully considering the different types of PPP models and assessing the feasibility of the partnership, governments can ensure that public-private collaboration results in projects that not only meet immediate infrastructure needs but also contribute to broader economic and social objectives.