Context:

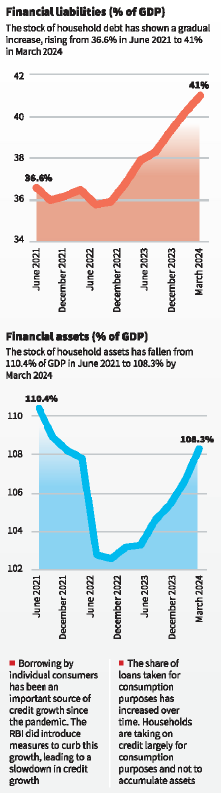

The Financial Stability Report (FSR) 2024 released by the Reserve Bank of India (RBI) increasingly expresses concern over household debt and rising consumption loans. The household debt to GDP ratio of India is quite low in comparison with most emerging economies, yet it is steadily increasing from 36.6% in June 2021 to 42.9% in June 2024.

Shift from Asset Creation to Consumption Borrowing

- On one hand, household borrowing is increasing, but on the other hand, household assets are on the decline (110.4% of GDP in 2021→108.3% in 2024).

- This means that most of the borrowing is for consumption rather than asset creation (homes, cars, education, etc.).

- While the RBI states that borrowers are getting healthier, the rising consumption loans might signal weakness in the macroeconomy.

Is Borrowing Becoming Healthier?

- The increase in debt is driven by more borrowers, not increased indebtedness per borrower.

- Sub prime borrowing has declined, while two thirds are now prime or super prime borrowers.

- Super prime borrowers use loans primarily for asset acquisitions, whereas sub prime borrowers are increasingly using loans for consumption.

- Since September 2023, credit control measures introduced by the RBI have had the effect of tightening borrowing among sub prime borrowers.

Growing Concern Over Consumption Loans

- Prime Borrowers

- 64% of their loans are for asset utilization.

- Sub prime borrowers

- Almost half of their loans are taken for consumption purposes.

- Low income households (whose income is <₹5 lakh/year) usually incur borrowings through credit cards and unsecured loans, while rich households borrow for the purchase of houses.

- Delinquencies in personal loans and credit cards rose in September 2024, which indicates financial stress is rising.

- If most of the borrowers usually borrow multiple loans, thus a default on a small loan (credit card debt, etc.) can trigger defaults on bigger loans (housing loans, etc.).

Macroeconomic Risks of Rising Consumer Debt

What’s Driving the Surge?

- Economic Insecurity Post Pandemic: Because of income instability, households are borrowing against consumption, which points to economic weakness.

- Easier Credit Accessibility: Financial innovations may be ensuring that lower income households are taking unsustainable debt.

- Regardless of the cause, more debt for consumption are threats to the stability of economy:

- Low income households have a higher income multiplier, which means they spend more on immediate consumption, thereby stimulating the economy.

- This is not good news because if they are heavily indebted, more of their income will go towards debt repayments, reducing consumption and subsequent economic growth.

- Tax cuts may have limited impact if household debt remains in high territory.

Key Policy Recommendations

- Strengthen credit regulations to prevent excessive debt.

- Encourage asset-based borrowing for financial stability.

Enhance financial literacy programs to help borrowers manage debt. - The RBI’s measures have slowed risky borrowing, but policymakers must remain vigilant about rising consumer debt and its broader economic impact.