Context:

Since their introduction in 2012, Category III Alternative Investment Funds (AIFs) have become a significant part of India’s investment landscape, raising over ₹1.29 trillion. However, they continue to operate in a tax grey zone, lacking a dedicated tax regime — a problem that directly impacts investor returns and fund efficiency.

Current Tax Landscape and Structural Challenges

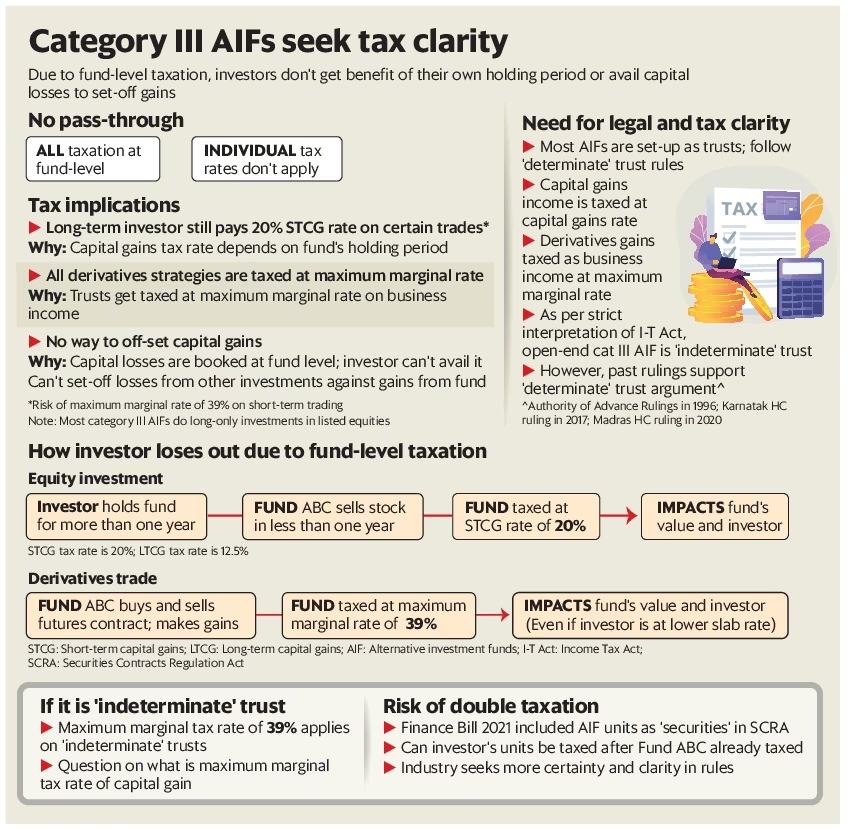

1. No Pass-Through Tax Status

- Category III AIFs are not treated as pass-through vehicles under current tax laws.

- All taxes are paid at the fund level, not the investor level, irrespective of how long an investor holds their units.

- Impact: Investors are taxed on the fund’s asset holding period, not their own, losing out on lower long-term capital gains (LTCG) rates.

2. Taxation on Capital Gains

- If a fund sells assets within a year, the gains are taxed at short-term capital gains (STCG) rate of 20%, even if the investor holds units for over a year.

- No tax deferral or long-term benefits apply at the investor level.

3. Derivatives Taxed as Business Income

- Gains from futures and options (F&O) are treated as business income and taxed at the maximum marginal rate of 39%.

- Investors, even those in lower tax slabs, bear the brunt of this high tax rate.

4. No Loss Set-Off or Carry-Forward Benefits

- Capital losses at the fund level cannot be passed on to investors.

- Investors cannot offset fund losses against other gains or carry forward losses for tax purposes.

Legal Ambiguity: Determinate vs. Indeterminate Trusts

Category III AIFs are structured as trusts, but taxation hinges on whether they are treated as:

1. Determinate Trusts

- Beneficiaries and their shares are identifiable.

- Taxed at the same rate as applicable to the beneficiary (e.g., capital gains rate for capital income).

2. Indeterminate Trusts

- No fixed identification of beneficiaries/shares.

- Entire income taxed at maximum marginal rate (39%).

Conflicting Interpretations

- CBDT (2014) upheld a strict definition requiring named beneficiaries with fixed shares.

- Court Rulings (AAR 1996, Karnataka HC 2017, Madras HC 2020) allowed broader interpretation—identifiability at any point is enough.

Current Practice: Industry follows judicial precedents, treating Category III AIFs as determinate trusts, though this lacks codified certainty.

Double Taxation Risk

- In 2021, AIF units were reclassified as ‘securities’ under the SCRA.

- This raises the risk of double taxation:

- Once on gains made by the fund

- Again on gains made by the investor upon redemption of AIF units

Industry Demand: Clarity, Not Concessions

Key Clarifications Sought:

- Pass-through tax treatment for Category III AIFs

- Definitive recognition as determinate trusts

- Avoidance of double taxation on fund-level and investor-level gains

- Clear application of special tax rates (e.g., 12.5% LTCG, 20% STCG)

Need for a Defined Tax Regime

Despite its scale and growth potential, Category III AIFs suffer from an outdated tax framework that fails to align with the modern investment ecosystem.

What’s Needed:

- A specific tax framework for Category III AIFs, akin to mutual funds

- Investor-level taxation to allow holding period-based tax treatment

- Legal alignment on trust classification and elimination of double taxation risks

Outcome Expected: With regulatory clarity, India can unlock the full potential of AIFs, enabling capital market depth, financial innovation, and investor confidence.