Introduction

Asset Liability Management (ALM) is a strategic framework used by financial institutions, corporations, and even individuals to manage financial risks arising from mismatches between assets and liabilities. ALM is particularly crucial for banks, insurance companies, pension funds, and investment firms, where interest rate fluctuations, liquidity risk, and regulatory compliance play a pivotal role in financial stability.

This blog delves into the fundamentals, objectives, strategies, risks, and best practices of ALM, providing a detailed and long-form guide to this essential financial discipline.

Understanding Asset Liability Management (ALM)

At its core, ALM focuses on optimizing the balance sheet to ensure that assets generate sufficient returns to cover liabilities while mitigating risks such as interest rate fluctuations, credit risks, and liquidity shortages.

Key Components of ALM

- Assets –

- These include loans, investments, cash reserves, securities, and real estate holdings that generate income.

- Liabilities –

- These consist of deposits, borrowings, bonds, pension obligations, and other financial commitments.

- Risk Management –

- Identifying and mitigating financial risks associated with mismatches between assets and liabilities.

- Regulatory Compliance –

- Adhering to financial regulations imposed by authorities such as Basel III, Solvency II, and IFRS 9.

- Liquidity Management –

- Ensuring the availability of cash and liquid assets to meet short-term obligations.

Objectives of ALM

The primary goals of ALM include:

1. Interest Rate Risk Management

Financial institutions must balance the effects of fluctuating interest rates on their assets (loans, bonds) and liabilities (deposits, borrowings). A rise in interest rates may benefit depositors while reducing the profitability of banks offering fixed-rate loans.

2. Liquidity Risk Management

Ensuring that an institution has enough liquid assets to meet its short-term obligations is critical. A mismatch in liquidity can lead to solvency issues.

3. Profitability Optimization

By carefully structuring assets and liabilities, financial institutions can enhance profitability while maintaining financial stability.

4. Regulatory Compliance

Regulations such as Basel III mandate specific capital and liquidity requirements. ALM ensures that institutions remain compliant with such frameworks.

5. Capital Adequacy & Solvency Management

Institutions must maintain an adequate level of capital to absorb potential losses and meet financial obligations without distress.

RBI Norms on Asset Liability Management (ALM)

- The Reserve Bank of India (RBI) has established Asset Liability Management (ALM) norms to help banks and Non-Banking Financial Companies (NBFCs) manage liquidity and interest rate risks effectively.

- The ALM framework consists of three key pillars:

- ALM Information System

- ALM Organization

- ALM Process which include liquidity risk management, interest rate risk management, and funding strategies.

- Banks and large NBFCs must maintain Liquidity Coverage Ratios (LCR), follow maturity bucket classifications, and conduct stress testing to ensure financial stability.

- An Asset Liability Committee (ALCO) oversees the ALM process, ensuring compliance with RBI guidelines.

- The RBI’s 2019 Liquidity Risk Management Framework introduced stricter liquidity norms, requiring institutions to maintain a buffer for short-term obligations.

- Regular reporting, regulatory audits, and adherence to risk-based supervision ensure that financial entities minimize asset-liability mismatches and remain resilient against economic fluctuations.

Key Risks in ALM

1. Interest Rate Risk

Interest rate fluctuations impact both assets and liabilities, leading to variations in net interest income and market value of assets.

2. Liquidity Risk

A bank or institution might face a liquidity crunch if it cannot convert assets into cash to meet obligations.

3. Market Risk

Market volatility can influence asset values, particularly for institutions with significant investments in equities or bonds.

4. Credit Risk

The risk of borrower default affects the asset side of the balance sheet, reducing profitability.

5. Currency Risk

For institutions dealing with multiple currencies, exchange rate fluctuations can significantly impact financial stability.

ALM Strategies

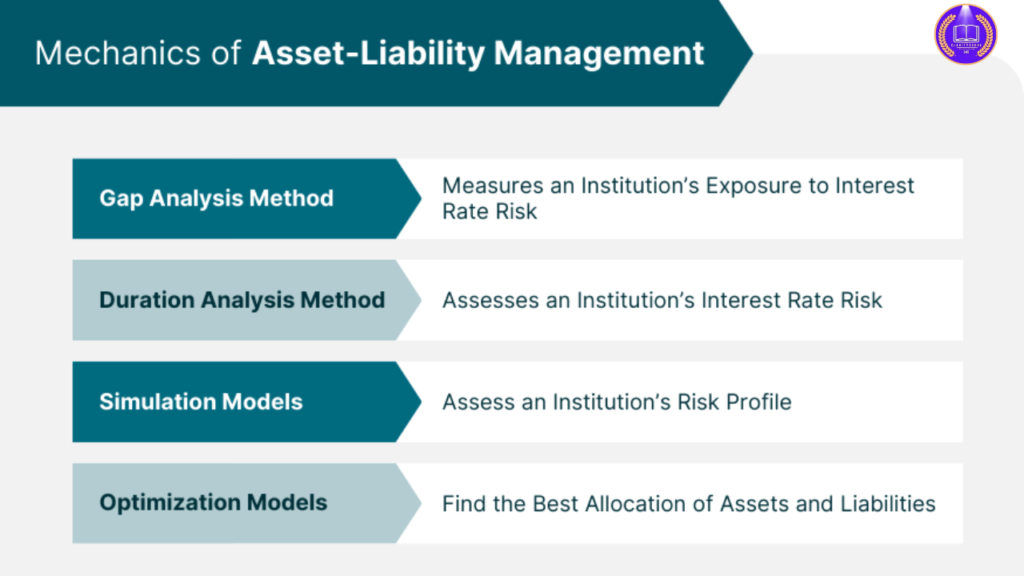

1. Duration Matching

Matching the duration of assets and liabilities helps mitigate interest rate risks by ensuring that asset cash flows align with liability outflows.

2. Gap Analysis

A traditional ALM technique that measures the difference between rate-sensitive assets and rate-sensitive liabilities over different time frames.

3. Hedging Strategies

Institutions use derivatives such as interest rate swaps, options, and futures to hedge against interest rate and currency fluctuations.

4. Cash Flow Matching

Ensuring that expected cash inflows from assets match the outflows required to meet liabilities.

5. Dynamic Asset Allocation

A flexible approach to adjusting asset composition in response to changing economic and market conditions.

6. Scenario Analysis & Stress Testing

Running simulations on different financial scenarios to understand potential risks and prepare mitigation strategies.

ALM in Banking

Banks rely heavily on ALM to manage their balance sheets effectively. The core areas include:

- Managing Interest Rate Risk:

- Ensuring that lending and borrowing rates are balanced.

- Loan-to-Deposit Ratio (LDR):

- Keeping an optimal LDR to maintain liquidity and profitability.

- Basel III Compliance:

- Meeting capital and liquidity requirements to ensure regulatory adherence.

ALM in Insurance Companies

Insurance companies use ALM to ensure that premium collections and investment returns are sufficient to cover future claims. Key considerations include:

- Liability Duration Matching:

- Ensuring that assets match the long-term liabilities of policyholders.

- Solvency II Compliance:

- Managing capital adequacy in line with regulatory requirements.

ALM in Pension Funds

Pension funds manage long-term liabilities, requiring robust ALM frameworks to ensure they can meet future pension obligations. Strategies include:

- Investment in Long-Term Bonds:

- To match the duration of liabilities.

- Inflation Protection Strategies:

- Hedging against inflation risks using inflation-linked securities.

Best Practices in ALM

- Robust Risk Assessment Frameworks –

- Regularly evaluating financial risks associated with assets and liabilities.

- Comprehensive ALM Policies –

- Establishing well-documented policies for managing liquidity, interest rates, and capital.

- Integration of Technology –

- Leveraging AI and machine learning for predictive analytics and better risk management.

- Regulatory Compliance –

- Adhering to Basel III, Solvency II, IFRS 9, and other relevant regulations.

- Stakeholder Communication –

- Ensuring transparency with investors, regulators, and other stakeholders regarding ALM strategies.

Conclusion

Asset Liability Management is a critical financial discipline that ensures institutions remain profitable, liquid, and compliant with regulations. By effectively managing interest rate risks, liquidity, and market volatility, institutions can achieve long-term financial stability.

With evolving regulatory frameworks and financial innovations, ALM strategies will continue to evolve, incorporating advanced analytics, AI-driven modeling, and real-time risk management solutions. Institutions that adopt a proactive approach to ALM will be better positioned to navigate financial uncertainties and capitalize on emerging opportunities.