Why in News ?

On 21 February 2025, the Reserve Bank of India (“RBI”) issued directions to permit bond forwards in government securities by way of the Reserve Bank of India (Forward Contracts in Government Securities) Directions, 2025[1] (“Bond Forward Directions”). The Bond Forward Directions will come into effect from 2 May 2025.

Introduction

In the intricate world of finance, forward contracts play a pivotal role in managing risk and speculating on price movements. Among them, Bond Forwards have emerged as essential instruments for investors, fund managers, and institutional players who deal in fixed-income securities. These contracts allow parties to lock in the purchase or sale of bonds at a future date, offering hedging opportunities and price certainty in uncertain markets.

What is a Bond Forward?

A Bond Forward is a customized over-the-counter (OTC) forward contract between two parties to buy or sell a specific bond at a predetermined price on a specified future date. It is not traded on an exchange and typically involves government or corporate bonds as the underlying asset.

Key Features:

| Feature | Description |

|---|---|

| Underlying Asset | Government or corporate bonds |

| Settlement Date | Future date agreed upon by both parties |

| Contract Type | OTC (Over-the-counter), bilateral negotiation |

| Price Determination | Based on bond’s current price, interest rate expectations, and time to maturity |

| No Initial Exchange | No cash or bond exchanged until maturity |

Mechanism of Bond Forwards

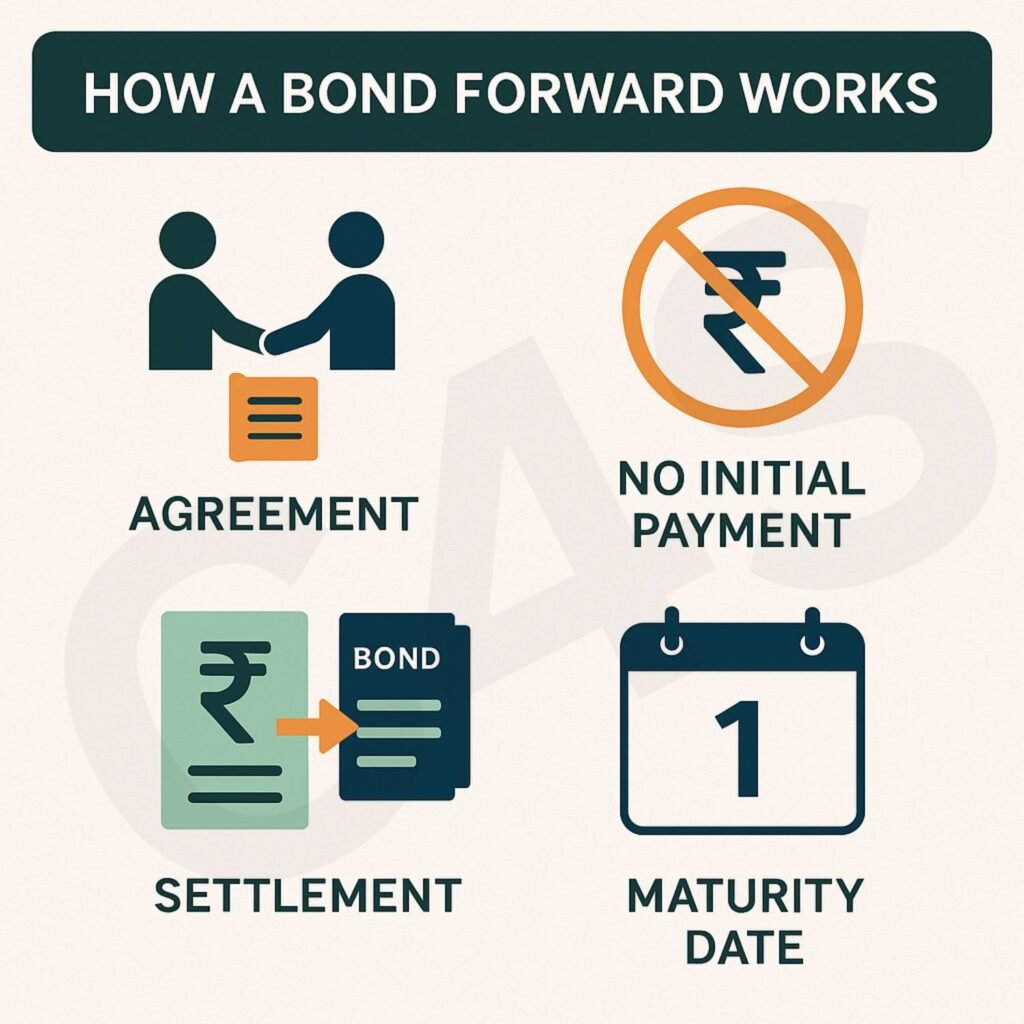

A bond forward contract works through the following steps:

- Agreement:

- Two parties agree to buy/sell a bond at a specific price and date in the future.

- No Initial Payment:

- Typically, there’s no cash flow at initiation.

- Settlement:

- On the settlement date, the buyer pays the agreed price and receives the bond; the seller delivers the bond.

Example:

Suppose Party A agrees to buy a 10-year Government of India bond from Party B for ₹105 on December 1st, 2025. Regardless of the bond’s market value on that date, Party A pays ₹105 and receives the bond.

Types of Bond Forwards

| Type | Description |

|---|---|

| Forward Bond Purchase | Agreement to buy a bond at a future date |

| Forward Bond Sale | Agreement to sell a bond at a future date |

| Cash-Settled Forward | Settlement in cash based on difference between forward and spot price |

| Physically Settled Forward | Physical delivery of the bond on the settlement date |

Uses of Bond Forwards

Bond forwards serve multiple purposes in fixed-income markets:

1. Hedging

Investors use forwards to protect against adverse movements in bond prices or interest rates. For instance, if interest rates rise, bond prices fall—investors can lock in a selling price using a forward contract.

2. Speculation

Traders bet on interest rate movements and bond price changes by taking long or short positions in bond forwards.

3. Arbitrage

Bond forwards can be used to exploit price differences between the spot and forward markets when arbitrage opportunities arise.

4. Portfolio Management

Fund managers use bond forwards to adjust portfolio exposures without immediate buying/selling in the cash market.

How is a Bond Forward Priced?

The forward price of a bond is primarily influenced by the spot price of the bond, interest rate differentials, coupon payments, and time to maturity.

Forward Price Formula:

F=(P−C)×er×tF = (P – C) \times e^{r \times t}

Where:

- FF = Forward price of the bond

- PP = Spot price of the bond

- CC = Present value of coupons during the contract period

- rr = Risk-free interest rate

- tt = Time to maturity (in years)

- ee = Exponential constant (~2.718)

Advanced Strategies Involving Bond Forwards

Bond forwards are not just simple hedging tools; they form part of complex financial strategies:

1. Yield Curve Strategies

Portfolio managers may use bond forwards to take advantage of anticipated changes in the yield curve (normal, inverted, flat, or humped). By buying or selling bonds of different maturities via forwards, they can bet on the steepening or flattening of the curve.

2. Duration Matching

Bond forwards are used to fine-tune the duration of a portfolio. For instance, if a portfolio manager expects inflows in 3 months and wants to maintain duration neutrality, they may use bond forwards to lock in bond purchases today for that date.

3. Forward Rate Agreements (FRAs) and Bond Forwards

While FRAs are rate-based and not bond-specific, traders sometimes use combination strategies involving FRAs and bond forwards to hedge rate-sensitive liabilities or income streams.

Benefits of Bond Forwards

| Benefit | Description |

|---|---|

| Risk Management | Helps hedge against interest rate fluctuations |

| Custom Contracts | Flexible terms tailored to both parties |

| No Initial Capital Required | No upfront investment needed at contract initiation |

| Liquidity Management | Useful for fund managers to time bond acquisitions or sales |

| Market Anticipation | Enables speculative positions based on bond yield or interest rate outlook |

Risks Involved in Bond Forwards

| Risk Type | Description |

|---|---|

| Counterparty Risk | One party may default on the contract, as it is OTC |

| Market Risk | Adverse interest rate movements can cause losses |

| Liquidity Risk | Forward contracts are not easily transferable or tradable |

| Valuation Complexity | Pricing depends on multiple variables including time value and coupons |

| Settlement Risk | Especially in physically settled contracts, timely delivery may be uncertain |

Taxation of Bond Forwards (India)

For Investors:

- Gains/losses from bond forwards may be treated as capital gains or business income, depending on the nature of the participant.

- Taxability is assessed on settlement.

- STT (Securities Transaction Tax) is not applicable as these are OTC.

For Businesses:

- Mark-to-market (MTM) losses may be disallowed unless settled.

- Hedging contracts should be backed by actual exposure to avoid tax scrutiny.

Real-world Applications

1. Central Banks and Primary Dealers

In countries like India or the US, bond forwards are used by central banks and primary dealers to manage debt issuance and interest rate strategies.

2. Fixed-Income Fund Managers

Managers of bond mutual funds or pension funds use forwards to align bond purchases/sales with expected cash flows.

3. Corporate Treasury Departments

Large corporations with significant debt or bond investments use bond forwards for hedging or reinvestment planning.

Bond Forwards vs. Bond Futures

| Feature | Bond Forwards | Bond Futures |

|---|---|---|

| Trading Venue | Over-the-counter (OTC) | Exchange-traded |

| Standardization | Customized | Standardized contracts |

| Counterparty Risk | High | Low (Cleared by exchanges) |

| Liquidity | Lower | Higher |

| Margin Requirement | Typically none | Requires margin |

| Settlement | Often physical | Often cash-settled |

Regulatory Framework

In India, Bond Forwards are primarily used in institutional circles under RBI or SEBI oversight. In global markets, such instruments are common in the US and Europe and may be reported under ISDA (International Swaps and Derivatives Association) agreements.

Conclusion

Bond Forwards are powerful instruments in the arsenal of financial professionals seeking to manage interest rate risk, speculate on bond price movements, or align portfolio strategies with future financial needs. Though not as accessible as exchange-traded futures, they offer customization, flexibility, and strategic advantage for sophisticated market participants. However, with these advantages come complex risks, particularly related to counterparty and liquidity concerns, necessitating robust risk management practices.

FAQs on Bond Forwards

What is the difference between a bond forward and a bond future?

Bond forwards are private OTC agreements, while bond futures are standardized contracts traded on exchanges.

Are bond forwards available for retail investors?

Generally, no. Bond forwards are used by institutional players due to their complexity and risk.

Can bond forwards be settled in cash?

Yes, some contracts are cash-settled based on the difference between spot and forward prices.

What happens if interest rates rise after signing a bond forward?

Bond prices typically fall when interest rates rise. If you’re the buyer in the forward contract, you may end up paying more than the bond’s market value at settlement.