Introduction

Health insurance has become a vital financial tool in today’s world where medical costs are skyrocketing. Among various types of health insurance policies, floater insurance is gaining popularity, especially among families. It offers a comprehensive coverage solution by insuring multiple members under a single policy.

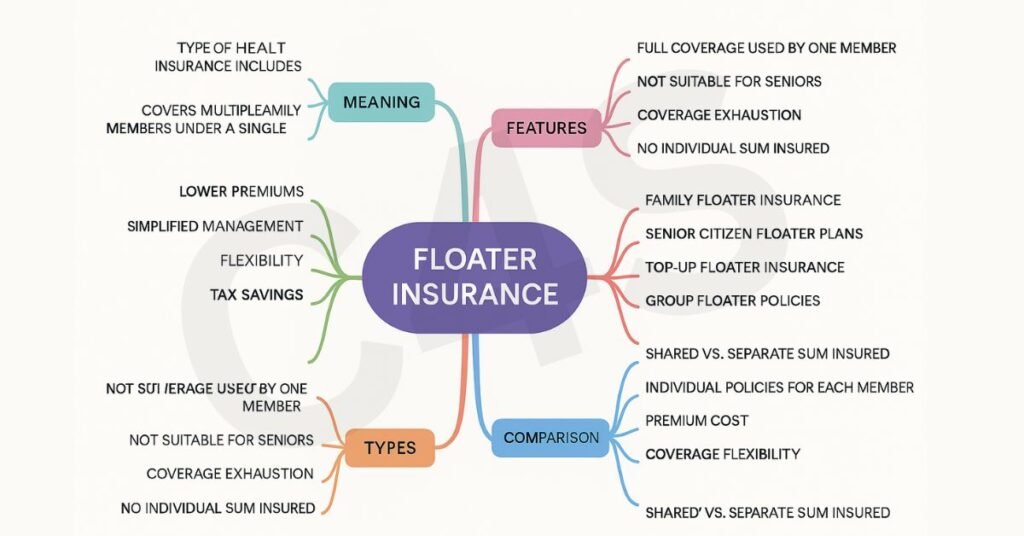

What is Floater Insurance?

Floater Insurance (or Family Floater Insurance) is a type of health insurance policy in which the sum insured is shared among multiple family members. Instead of purchasing individual policies, a floater plan provides unified coverage under a single premium.

Example:

A family floater policy of ₹10 lakhs may cover a husband, wife, and two children. The total ₹10 lakhs can be utilized by any one member or shared among all during the policy tenure.

Objectives of Floater Insurance

- To provide affordable healthcare coverage for families.

- To reduce administrative burden by managing a single policy.

- To enable flexibility in fund utilization within the insured sum.

- To cover multiple health risks without buying multiple policies.

Key Features of Floater Insurance

| Feature | Description |

|---|---|

| Coverage | One sum insured for the entire family |

| Premium | Generally lower than buying separate individual policies |

| Policyholders | Self, spouse, children, parents, in-laws (depending on insurer) |

| Age Limit | Varies; adults up to 60–65 years, children up to 25 years |

| Renewability | Lifetime renewability in most modern policies |

| Cashless Facility | Available in network hospitals |

| Tax Benefits | Eligible under Section 80D of the Income Tax Act |

Types of Floater Insurance

| Type | Description |

|---|---|

| Family Floater Health Insurance | Covers self, spouse, children, and sometimes parents |

| Senior Citizen Floater Plans | Limited availability; higher premiums due to age factor |

| Top-Up Floater Insurance | Offers additional coverage once base coverage is exhausted |

| Group Floater Policies | Offered by employers for employees and their families |

Advantages of Floater Insurance

1. Cost-Effective

- One premium for multiple people—more affordable than individual plans.

2. Simplified Management

- Easy to renew, track, and maintain one policy instead of many.

3. Comprehensive Coverage

- Covers hospitalization, surgeries, day-care procedures, etc.

4. Flexibility in Fund Usage

- Sum insured can be used by any insured member depending on medical needs.

5. Tax Deduction

- Up to ₹25,000 (₹50,000 for senior citizens) under Section 80D.

Limitations of Floater Insurance

- Premium Based on Eldest Member’s Age

– The entire policy premium is calculated based on the eldest member’s age, which can significantly increase the cost. - Shared Sum Insured Risk

– If one family member uses most or all of the sum insured, others may be left without sufficient coverage for the rest of the policy year. - Not Ideal for Elderly or Chronically Ill Members

– Frequent claims by one high-risk member can reduce the utility of the policy for others. - Limited Suitability for Large Families

– The fixed sum insured may not be adequate if many members are covered under the same plan. - Coverage Cap per Illness (in some policies)

– Sub-limits may restrict the maximum amount payable per illness or per person. - No Portability Between Members

– Individual health history is not tracked separately, which can be a problem if one wishes to migrate to an individual plan later. - Waiting Period Applies to All Members

– All insured members are subject to common waiting periods for pre-existing conditions or specific treatments. - Exclusions and Co-payment Clauses

– Policies may have hidden co-payments or exclusions, especially for senior citizens.

| Limitation | Explanation |

|---|---|

| Age Factor | Premium based on eldest member’s age—can increase cost significantly. |

| Exhaustion Risk | If one member uses up the entire sum insured, others are left with no coverage. |

| Not Ideal for Elderly | Better to have separate policies for senior citizens due to higher risk. |

| Limited Coverage in Large Families | May fall short if more members are included with same sum insured. |

Eligibility Criteria

| Criteria | Details |

|---|---|

| Entry Age | Adults: 18–65 yearsChildren: 91 days – 25 years |

| Family Composition | Varies by insurer: up to 6 members or more |

| Medical Tests | May be required for senior citizens or pre-existing diseases |

Government Schemes & Floater Policies

While government health insurance schemes like Ayushman Bharat – PMJAY are not floater plans by nature, their idea of family-based coverage overlaps with floater philosophy.

| Scheme | Relevance |

|---|---|

| Ayushman Bharat | Offers ₹5 lakh per family per year on a floater basis |

| State-Level Schemes | Some offer family-level cashless treatment similar to floater |

What Does Floater Insurance Cover?

- In-patient hospitalization

- Day care procedures

- Pre & post-hospitalization

- Ambulance charges

- Organ donor expenses

- AYUSH treatments (in some policies)

- COVID-19 related hospitalization

Who Should Buy Floater Insurance?

Floater insurance is ideal for young nuclear families with members in good health, such as a couple with young children. It offers cost-effective coverage by sharing a single sum insured among all members, making it suitable for those who want a simple, budget-friendly health insurance plan without managing multiple individual policies.

| Suitable For | Not Ideal For |

|---|---|

| Young couples with children | Families with elderly or high-risk individuals |

| Nuclear families | Joint families with many members |

| People with good health history | People needing frequent or specialized treatment |

Floater Insurance vs Individual Insurance

| Criteria | Floater Insurance | Individual Insurance |

|---|---|---|

| Sum Insured | Shared among members | Separate for each individual |

| Premium | Lower for young families | Higher when added individually |

| Risk Factor | Higher if one member claims exhaust sum | Lower, risk not shared |

| Flexibility | More flexible for one-time large claims | Better for ongoing or separate treatments |

| Best For | Families with healthy members | Individuals with specific health concerns |

Things to Consider Before Buying Floater Insurance

- Claim history and hospital network of the insurer

- Premium increase trends over the years

- Add-on benefits like maternity, critical illness, etc.

- Room rent limits and co-payment clauses

- Restoration benefits if sum insured is exhausted

Real-Life Example: Cost Analysis

| Scenario | Individual Plans | Floater Plan |

|---|---|---|

| Members Covered | 4 (30M, 28F, 5C, 3C) | Same |

| Sum Insured per Person | ₹5 lakh each | ₹10 lakh shared |

| Annual Premium | ₹28,000 total | ₹18,000 approx |

| Verdict | Costlier | More economical |

Exam-Relevant Facts and Data

| Point | Detail |

|---|---|

| IRDAI Regulation | Insurers must disclose all terms, including co-pay, room rent capping, and sub-limits |

| Section 80D | Deduction available for premium paid up to ₹25,000 (₹50,000 for senior citizens) |

| Policy Term | Usually 1–3 years, renewable for life in most cases |

| Waiting Period | 2–4 years for pre-existing conditions in many policies |

| Cashless Network | More than 10,000 hospitals covered under top providers |

Conclusion

Floater Insurance is a smart and cost-effective choice for families with relatively low medical risk. It offers the convenience of unified coverage and reduces the burden of managing multiple policies. However, it may not be ideal when elderly members or those with chronic illnesses are included.

Before purchasing, it’s important to analyze your family’s medical needs, age composition, and budget. Always read the policy fine print to avoid surprises during claims.

Frequently Asked Questions (FAQs)

Q1. Can I add new members to my floater insurance policy?

Yes, you can add newborns or a spouse, usually during policy renewal.

Q2. Is maternity covered under floater policies?

Some insurers offer it as an add-on or after a waiting period.

Q3. What happens if the sum insured is exhausted?

You may opt for restoration benefits or buy top-up insurance.

Q4. What if I want to split into individual policies later?

It is possible during renewal or by porting the policy.