Government securities are debt instruments issued by a government to finance its expenditures and obligations. These securities are considered among the safest investment options because they are backed by the full faith and credit of the issuing government.

Origin

The history of government securities, or G-secs, can be traced back to the 16th century. The Dutch Republic was the first state to issue bonds to finance its debt in 1517.

- Ministry:

- The Ministry of Finance

- Chairperson:

- Madhabi Puri Buch ( Chairperson of the Securities and Exchange Board of India (SEBI))

What Are Government Securities?

- Government securities (G-secs) are bonds or debt instruments issued by government to raise funds. When you purchase a government security, you are lending money to the government for a specific period in exchange for periodic interest payments and the return of the principal at maturity.

- These securities typically come with low risk since they are backed by the government’s creditworthiness. They are considered safer than corporate bonds or other forms of debt because the government has the authority to raise taxes or print money to meet its obligations.

What are the Rules Under Which RBI Transfers its Surplus to the Government?

- The RBI transfers its surplus to the government in accordance with Section 47 (Allocation of Surplus Profits) of the Reserve Bank of India Act, 1934.

- A technical committee of the RBI Board headed by Y H Malegam (2013), which reviewed the adequacy of reserves and surplus distribution policy, recommended a higher transfer to the government.

- According to this section, after making provisions for reserves and retained earnings, the RBI transfers the surplus to the government.

- The amount transferred is determined based on various factors, including the RBI’s income from sources such as interest on holdings of domestic and foreign securities, fees and commissions from its services, profits from foreign exchange transactions, and returns from subsidiaries and associates.

- On the expenditure side, the RBI incurs costs such as printing of currency notes, payment of interest on deposits and borrowings, salaries and pensions of staff, operational expenses of offices and branches, as well as provisions for contingencies and depreciation.

Government Securities and the Reserve Bank of India (RBI)

The Reserve Bank of India (RBI) plays a significant role in the issuance, management, and regulation of government securities.

Issuance and Management

- Issuance Process:

- G-Secs are typically issued by the government through the RBI, which acts as the agent of the government. The RBI handles the issuance of these securities through auctions, which are conducted regularly. These auctions can be either competitive or non-competitive, and they are targeted at various investors, including banks, financial institutions, and individuals.

- Types:

- These can include Treasury Bills (short-term debt), Government Bonds (long-term debt), and Savings Bonds, among others. The RBI manages these securities’ issuance and helps maintain liquidity in the government securities market.

Monetary Policy and RBI’s Role

- Monetary Policy Transmission:

- The RBI uses government securities as a tool in its monetary policy. Through open market operations (OMO), the RBI buys and sells government securities to manage liquidity in the banking system and influence short-term interest rates.

- Repo and Reverse Repo Operations:

- The RBI conducts repo (repurchase) and reverse repo operations using government securities as collateral to either inject or absorb liquidity from the market. These operations help the RBI control inflation and stabilize the currency.

Regulation and Settlement

- Clearing and Settlement:

- The RBI operates the Clearing Corporation of India Ltd. (CCIL), which facilitates the clearing and settlement of government securities transactions. This ensures that trades in government securities are settled efficiently and securely.

- Regulation of Market Participants:

- The RBI, along with the Securities and Exchange Board of India (SEBI), regulates market participants like banks, financial institutions, and foreign investors in the G-Secs market. These regulations aim to ensure a smooth and transparent functioning of the debt market.

Monetary and Fiscal Policy Coordination

- The RBI works closely with the government to coordinate fiscal and monetary policies. This collaboration ensures that government borrowing through G-Secs does not disrupt the broader economy. For instance, the RBI manages the debt to ensure that it is issued at appropriate times, considering inflationary pressures and interest rates.

Financial Stability

- Government securities are often used by banks and financial institutions as collateral for loans or as part of their reserve requirements. This use of G-Secs ensures financial stability and promotes trust in the financial system.

- The RBI also plays a role in ensuring that the G-Sec market remains liquid, which provides stability to the financial system.

Foreign Investment in Government Securities

- The RBI regulates the limits and conditions under which foreign investors can buy Indian government securities. The government has allowed foreign institutional investors (FIIs) and foreign direct investors (FDIs) to invest in these securities, helping bring foreign capital into the Indian economy.

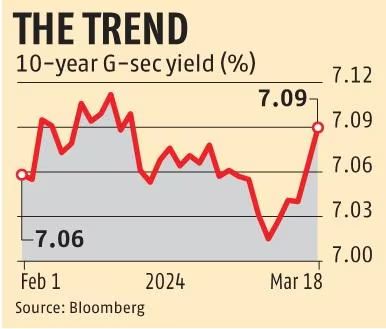

Interest Rates and Yield Curve

- The yields on government securities serve as benchmark rates for other debt instruments in the economy. The RBI monitors these yields as part of its broader strategy to manage inflation and interest rates.

Types of Government Securities

- Treasury Bills (T-Bills):

- Short-term debt instruments with a maturity period of up to one year.

- Typically issued in 91-day, 182-day, or 364-day maturities.

- T-Bills are issued at a discount to their face value, meaning you buy them for less than their face value, and upon maturity, you receive the full face value.

- No periodic interest payments are made; instead, the investor’s return is the difference between the purchase price and the face value at maturity.

- Government Bonds:

- These are long-term securities with maturities ranging from 1 year to several decades (20-30 years).

- They pay regular interest (referred to as a “coupon”) and return the principal amount at maturity.

- The interest on government bonds is typically paid semi-annually or annually.

- Examples include the U.S. Treasury Bonds or UK Gilts.

- Government Stock:

- Similar to bonds but typically have longer durations and can be redeemable at the discretion of the government.

- These stocks often have fixed interest payments and are issued by the government to finance long-term capital projects.

- Savings Bonds:

- These are relatively low-denomination debt instruments designed for retail investors.

- They typically offer competitive interest rates and come with tax incentives in certain countries.

- Popular examples include U.S. Series I and EE savings bonds.

Benefits of Investing in Government Securities

- Safety and Security:

- Government securities are considered one of the safest investment options since they are backed by the government’s creditworthiness.

- Governments have the authority to tax citizens or create money to meet their debt obligations, making defaults highly unlikely.

- Stable Returns:

- They provide predictable and stable returns, particularly for investors seeking low-risk assets.

- Coupon payments (interest) are fixed and paid at regular intervals, offering reliable income.

- Liquidity:

- Government securities are often highly liquid, particularly those issued by developed countries like the U.S. or UK. This means you can easily sell them in the secondary market if you need to cash out before maturity.

- Portfolio Diversification:

- Including government securities in an investment portfolio can reduce overall risk and improve diversification, especially during periods of economic uncertainty or market volatility.

- Tax Benefits:

- In certain cases, interest income from government securities may be exempt from taxes or eligible for tax deductions, depending on local regulations.

- Inflation Protection:

- Some government securities, like Treasury Inflation-Protected Securities (TIPS) in the U.S., offer protection against inflation by adjusting the principal value with inflation rates.

Risks of Government Securities

- Interest Rate Risk:

- The price of government securities is inversely related to interest rates. When interest rates rise, the value of existing securities tends to fall. This can be a risk for investors holding long-term bonds if they need to sell before maturity.

- Inflation Risk:

- While certain securities protect against inflation, many government bonds may offer fixed returns that are eroded by rising inflation. This could affect the purchasing power of interest payments and principal repayments.

- Credit Risk (for Developing Economies):

- While government securities from developed countries are very safe, those issued by governments of developing countries may come with higher credit risk, including the possibility of default.

- Currency Risk (for Foreign Investors):

- If you invest in government securities from foreign countries, fluctuations in exchange rates may affect the return on investment, especially if the securities are denominated in a foreign currency.

How to Invest in Government Securities

- Direct Purchase through Government Auctions:

- Governments typically auction Treasury Bills, Bonds, and Notes through central banks or financial institutions.

- Investors can participate directly in these auctions by placing bids. The minimum investment amount and frequency of auctions vary by country.

- Secondary Market:

- Government securities can also be bought and sold in the secondary market through brokers and financial institutions.

- Online brokerage platforms make it easy for individual investors to buy and sell government bonds or T-Bills.

- Mutual Funds or ETFs:

- For those seeking a diversified portfolio of government securities, mutual funds or exchange-traded funds (ETFs) focusing on government bonds can be a good option.

- These funds pool investors’ money to purchase government securities of different maturities and risk profiles.

- Bank Deposits and Savings Accounts:

- Some banks offer government securities as part of their savings products, allowing you to invest in government bonds and bills with lower denominations.

Key Considerations Before Investing in Government Securities

- Investment Horizon:

- Consider the maturity of the security to match your investment goals. Short-term instruments like T-Bills are suitable for short-term goals, while longer bonds are more appropriate for retirement planning.

- Interest Rate Environment:

- In a rising interest rate environment, the prices of existing bonds can decline. Conversely, in a declining rate environment, bond prices tend to rise.

- Diversification:

- While government securities are safe, it’s still important to diversify your portfolio by including other asset classes (stocks, real estate, etc.) to achieve better overall returns.

Conclusion

- Government securities offer a low-risk and stable investment option for conservative investors. They provide a predictable income stream, especially for those nearing retirement or those who prefer minimal exposure to market volatility. While they come with some risks—primarily related to interest rates, inflation, and, in some cases, credit risk—they remain an essential part of diversified investment portfolios.

- Before investing in government securities, assess your investment goals, risk tolerance, and the economic environment to make informed decisions. Whether you choose to invest directly in bonds or through mutual funds or ETFs, government securities can play a key role in providing financial stability and peace of mind.