Introduction

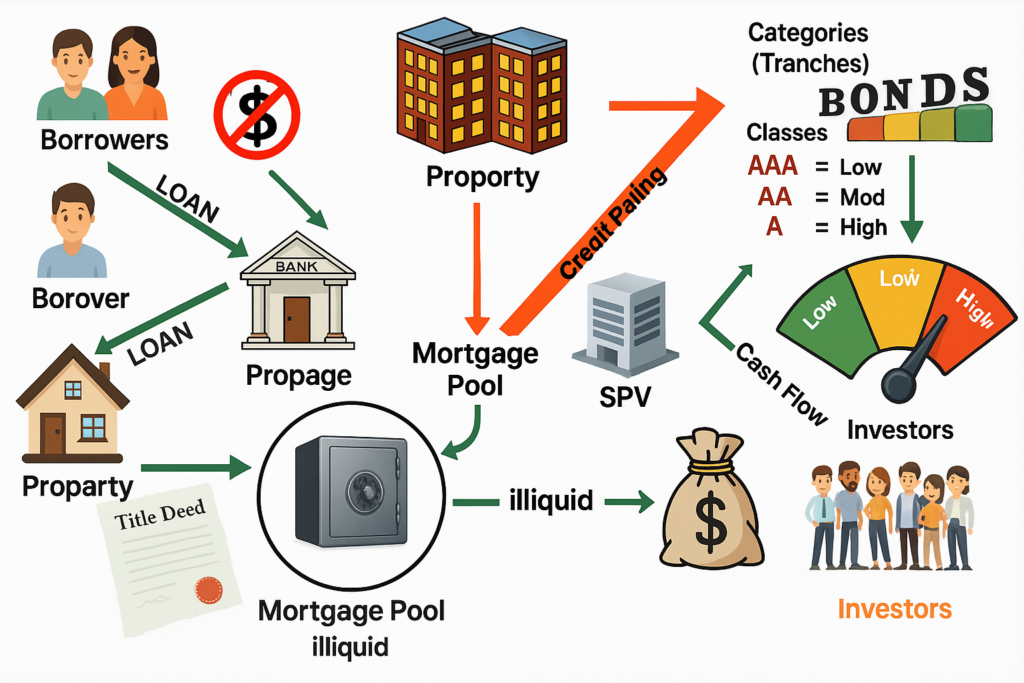

Securitization is a financial innovation that converts illiquid assets into tradable securities. More simply, it is pooling together non-tradable or hard-to-trade assets e.g., loans and issuing securities against these pools. Investors subsequently receive returns from the underlying assets’ cash flows. In the Indian context, securitization mainly refers to financial assets such as housing loans, vehicle loans, microfinance loans, and credit card receivables.

Whereas securitization internationally involves such assets as cryptocurrencies or real estate investment trusts, in India its central pertinence lies in financial intermediation involving mortgage loans, microfinance, commercial vehicle loans, and consumer debt.

Key Takeaways

- Securitization in India generally involves combining retail loans such as home loans, car loans, and microfinance loans.

- Such grouped assets are made into marketable securities and disposed of to institutional investors.

- Investors receive returns on principal and interest received from borrowers.

- Common instruments in India are Mortgage-Backed Securities (MBS) and Asset-Backed Securities (ABS).

- Governed by the Reserve Bank of India (RBI) under the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002 and applicable RBI guidelines.

Steps in Securitization Process

- Loan Issuance (Asset Origination)

- A bank or NBFC (Non-Banking Financial Company) gives out loans — like home loans, car loans, or business credit lines — to borrowers.

- Forming a Loan Pool

- The lender selects similar loans (same type, term, or risk level) and bundles them into a group — called an asset pool.

- Creating a Special Purpose Vehicle (SPV)

- A new legal entity called a Special Purpose Vehicle is created. It keeps the asset pool separate from the lender’s main balance sheet, protecting investors if the lender fails.

- Transferring Assets to the SPV

- The lender sells the asset pool to the SPV. This allows the lender to remove the loans from its books and use the money it gets from the SPV to issue more loans.

- Breaking into Tranches (Tranching)

- The SPV slices the asset pool into pieces (called tranches) based on risk —

- Senior Tranche (low risk, first to be paid)

- Mezzanine Tranche (moderate risk)

- Junior or Equity Tranche (high risk, last to be paid)

- The SPV slices the asset pool into pieces (called tranches) based on risk —

- Adding Safety Nets (Credit Enhancement)

- To make the securities safer and more attractive, the SPV adds safeguards like:

- Extra collateral

- Reserve funds

- Insurance or third-party guarantees

- To make the securities safer and more attractive, the SPV adds safeguards like:

- Getting Ratings

- Credit rating agencies (like CRISIL, ICRA, CARE in India) rate the tranches based on how risky they are. Better-rated tranches attract more investors.

- Selling to Investors

- Investment banks or brokers help the SPV sell these securities to investors like mutual funds, insurance companies, or even pension funds.

- Paying Investors

- As borrowers repay their loans, the collected money is used to pay investors. Senior tranches are paid first, and junior ones last.

- Monitoring & Reporting

- A servicing agency tracks loan repayments and regularly updates investors on performance and risks.

Types of Securitization in India

| Type | Description | Example in India |

|---|---|---|

| Mortgage-Backed Securities (MBS) | Residential housing loan-backed securities | HFCs such as HDFC Ltd, LIC Housing Finance |

| Asset-Backed Securities (ABS) | Secured by auto loans, consumer durable loans, personal loans | Bajaj Finance, Shriram Transport Finance |

| Microfinance Loan Securitization | Microloan pools to SHGs or JLGs | Widespread in association with MFIs and rural NBFCs |

| Collateralized Debt Obligations (CDOs) | Unusual in India because of complexity and regulatory conservatism | Presence in Indian markets is negligible |

Regulatory Framework in India

Securitization in India is regulated by:

- SARFAESI Act, 2002

- RBI Guidelines on Securitization of Standard Assets (2021 revision)

- SEBI (Securitised Debt Instruments) Regulations, as applicable

- Credit Rating Agencies Regulations

Important RBI Regulations (2021):

- Minimum Holding Period (MHP): Holding of loans for a specified period prior to securitization.

- Minimum Retention Requirement (MRR): Originator required to retain some credit risk.

- Prohibition on “Synthetic Securitization”: Exclusivity of actual transfer of assets.

Example: Indian Mortgage-Backed Securities (MBS)

A common Indian illustration is when HDFC Ltd aggregates a portfolio of home loans and transfers it to an SPV. The SPV issues MBS, which are bought by institutional investors like SBI Mutual Fund, LIC, or Pension Funds.

The interest and principal are paid by the homeowners through monthly EMI to the MBS investors. These securities are usually rated by agencies like CRISIL, ICRA, or CARE Ratings.

Advantages of Securitization

| Advantage | Explanation |

|---|---|

| Liquidity for Lenders | NBFCs and MFIs release capital and recycle funds for new loans. |

| Diversified Risk for Investors | Tranching allows investors to choose risk profiles. |

| Access to Retail Loans | Investors gain exposure to retail lending without originating loans. |

| Boosts Financial Inclusion | Facilitates increased availability of credit in under-served rural and semi-urban regions. |

Risks and Challenges

| Risk | Impact |

|---|---|

| Default Risk | Borrowers can default, particularly in sub-prime or unsecured segments. |

| Prepayment Risk | Prepayment lowers interest income for investors. |

| Lack of Transparency | Limited disclosures and asset quality information can discourage investors. |

| Complexity & Mispricing | Tranching and credit enhancement can mask true asset risk. |

| Regulatory Overheads | Multiple compliance obligations drive up transaction costs. |

RBI’s Role in Securitization

The Reserve Bank of India regulates securitization under guidelines to:

- Ensure stability in the financial system.

- Prevent excessive risk-taking.

- Promote transparency and investor protection.

RBI’s Securitization Guidelines (2021 & 2022 Updates)

| Area | Guidelines |

|---|---|

| Eligible Assets | Only fully disbursed, performing assets (e.g., retail loans, MSME loans). |

| Risk Retention | Minimum Retention Requirement (MRR) by originator to align interest. |

| Risk Transfer | Minimum Risk Transfer (MRT) norms for off-balance sheet treatment. |

| Tranching | Permitted with clear cash flow prioritization. |

| Synthetic Securitization | Prohibited (where credit risk transfer occurs without asset sale). |

| Stressed Assets | Cannot be securitized. |

| Transparency | Full disclosure on asset pool and investor communication. |

Lessons from Global Financial Crisis: India’s Cautious Approach

In contrast to the U.S., India was well insulated from the 2008 Global Financial Crisis, mainly due to:

- CDOs and synthetic securitizations were not common.

- RBI had stringent guidelines on capital adequacy and MHP/MRR norms.

- Indian MBS are typically supported by prime loans and well-known HFCs.

Yet, after the IL&FS crisis (2018), investor confidence in the securitization market has declined. The RBI has since then strengthened regulation and promoted transparency.

India’s Securitization Future

- Digital Securitization:

- Account Aggregators and FinTech integration would make digital pools of loans commonplace.

- Green Securitization:

- Securing securities with loans for green energy or green homes.

- Increased Investor Participation:

- Pension funds, mutual funds, and even retail investors through debt platforms can come into the space.

- Standardization & Transparency:

- RBI’s framework seeks to develop a deeper, safer, and more transparent securitization market.

Conclusion

Securitization in India is a key driver of increased credit availability, liquidity, and risk sharing among lenders and investors. Though it has apparent advantages, it should be addressed with cautious risk management and regulation to prevent experiences of the kind observed internationally.