Introduction

In the evolving landscape of global trade and finance, Special Rupee Vostro Accounts (SRVAs) have emerged as a significant instrument in facilitating international trade in Indian Rupees (INR). Introduced by the Reserve Bank of India (RBI), SRVAs are designed to settle international trade transactions in INR rather than relying on foreign currencies like USD or EUR. This move not only promotes the use of the rupee globally but also helps countries with foreign exchange constraints to continue trade with India.

Policy Background & Strategic Vision

The concept of trading in domestic currencies is not new, but the Special Rupee Vostro Account gained momentum post-2022 when Western sanctions on Russia disrupted traditional trade payment systems like SWIFT and USD-based settlements.

In response, India’s Ministry of Finance, along with the Reserve Bank of India, devised the SRVA framework to:

- Mitigate external financial shocks

- De-risk India’s trade from currency volatility

- Internationalize the Indian Rupee

- Support friendly nations during crises

This aligns with the “Atmanirbhar Bharat” (Self-Reliant India) vision and global south cooperation initiatives.

What is a Special Rupee Vostro Account?

A Special Rupee Vostro Account (SRVA) is a type of bank account held by a foreign bank with an Indian bank, wherein the account is denominated in Indian Rupees (INR).

When a foreign trader exports goods or services to India, the Indian importer pays in INR, which is credited to this Vostro account. This account is then used to pay Indian exporters or service providers in INR for goods and services supplied to that foreign country.

Understanding the Term: Vostro Account

| Term | Definition |

|---|---|

| Vostro | A Vostro Account is an account that a foreign bank holds with a domestic bank in the domestic currency (INR, in this case). |

| Nostro | A Nostro Account is an account that a domestic bank holds in a foreign bank in foreign currency (e.g., USD in the USA). |

| SRVA | Special type of Vostro account maintained by foreign banks to facilitate INR trade settlements. |

How Does the Special Rupee Vostro Account Work?

Step-by-Step Transaction Flow

- Agreement:

- Indian and foreign banks sign an agreement to open an SRVA.

- Opening of SRVA:

- The foreign bank opens the SRVA with an authorized Indian bank.

- INR Payment:

- The Indian importer pays the invoice amount in INR to the SRVA.

- Credit to Foreign Exporter:

- The foreign exporter receives payment from the SRVA in their domestic currency, or the funds are retained in INR for future imports.

- Use of Funds:

- The SRVA can be used for payments of exports, project services, and even investments.

Key Stakeholders Involved

| Stakeholder | Role |

|---|---|

| Reserve Bank of India | Issuer of guidelines, regulator of accounts |

| Authorized Indian Banks | Open and manage SRVA with foreign banks |

| Foreign Partner Banks | Maintain SRVA with Indian banks to settle trade in INR |

| Ministry of External Affairs | Involved in geopolitical coordination and country-level agreements |

| DGFT (Directorate General of Foreign Trade) | Ensures proper import/export policy alignment |

| Importers & Exporters | Trade participants who settle payments via SRVA |

Countries Using SRVA with India

As of 2024, more than 20 banks from 18 countries have been approved to open Special Rupee Vostro Accounts. Some key countries include:

| Country | Banks Approved / Partnered |

|---|---|

| Russia | Sberbank, Gazprombank (for rupee-ruble trade due to sanctions) |

| Sri Lanka | Bank of Ceylon, People’s Bank |

| Mauritius | SBM Bank Mauritius |

| Tanzania | CRDB Bank |

| Germany | Deutsche Bank |

| Nepal | Nepal SBI Bank |

Benefits of Special Rupee Vostro Accounts

For India

- Reduces dependency on USD or other foreign currencies

- Enhances INR’s global acceptability

- Helps conserve foreign exchange reserves

- Boosts trade with sanctioned or forex-strapped countries

For Partner Countries

- Continued trade with India despite USD scarcity

- Avoids impact of Western sanctions

- Encourages investment in Indian capital markets using surplus INR

Use Cases & Real-World Impact

India-Russia Trade

Due to sanctions post Russia-Ukraine conflict, Russia couldn’t access USD. The SRVA allowed seamless INR-Ruble trade for oil and defense equipment, bypassing SWIFT restrictions.

India-Sri Lanka Trade

Faced with an economic crisis, Sri Lanka lacked forex to pay for imports. SRVAs allowed it to import food, fuel, and medicines from India in INR.

Comparison with Traditional Forex Trade

| Feature | Traditional Forex Trade | Special Rupee Vostro Account |

|---|---|---|

| Currency Used | USD, EUR, GBP, etc. | Indian Rupee (INR) |

| Forex Dependency | High | Low |

| Settlement Mechanism | SWIFT, international banking networks | Indian banking system |

| Vulnerability to Sanctions | High | Low (as it avoids USD networks) |

| INR Internationalization | No | Yes |

Impact on India’s Economy

The SRVA mechanism holds significant implications for India’s macro-economic stability, trade resilience, and global financial diplomacy.

Economic Impacts:

| Area | Positive Impact |

|---|---|

| Forex Reserve Saving | Reduces outflow of USD and strengthens RBI’s foreign currency buffer |

| Export Promotion | Facilitates smoother payment channels, especially for sanctioned or debt-ridden countries |

| Rupee Internationalization | Enhances global visibility and acceptance of INR |

| Geopolitical Leverage | Enables India to maintain trade relations with countries under Western sanctions |

| Banking Innovation | Promotes adaptation of Indian banking systems to newer global trade mechanisms |

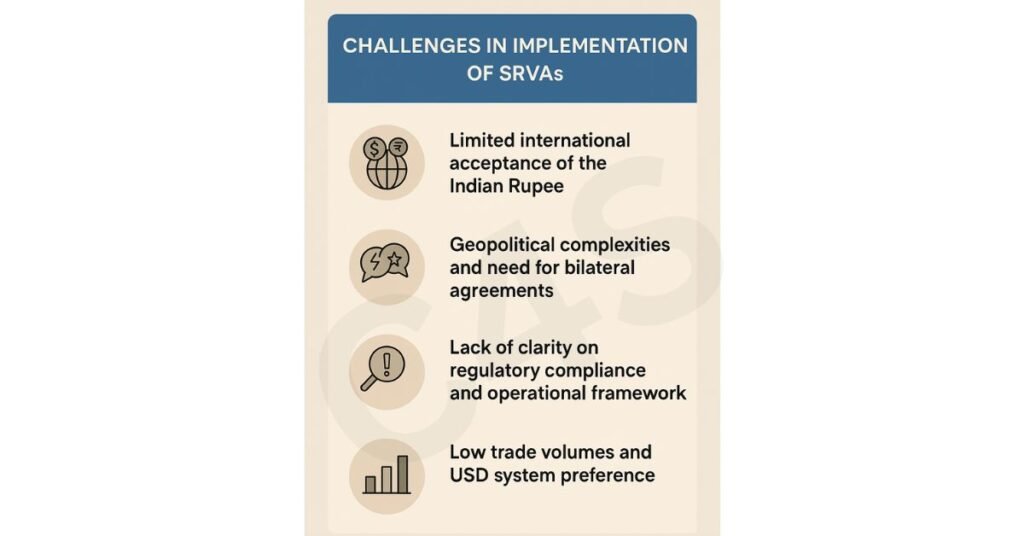

Challenges in Implementation

- Despite the strategic intent behind Special Rupee Vostro Accounts (SRVAs), their implementation faces several challenges.

- A major hurdle is the limited international acceptance of the Indian Rupee, as it is not fully convertible on the capital account.

- Additionally, geopolitical complexities and the need for bilateral agreements with each partner nation slow down widespread adoption.

- Many foreign banks and exporters also lack clarity on regulatory compliance and the operational framework.

- Furthermore, low trade volumes with some partner countries and reluctance to deviate from the USD-based system hinder momentum.

- Addressing these issues requires strong diplomatic coordination, financial incentives, and capacity-building measures across banking systems.

| Challenge | Description |

|---|---|

| Lack of INR convertibility | INR is not fully convertible in capital account, limiting global adoption |

| Limited partner willingness | Many countries still prefer USD due to its universal acceptability |

| Regulatory hurdles | Need for extensive RBI and DGFT approvals delays process |

| Surplus INR usage dilemma | Foreign countries may find limited avenues to use surplus INR |

Way Forward

With increasing geopolitical volatility and de-dollarization efforts, India is likely to expand the SRVA framework further. Key future developments may include:

- More bilateral agreements with African, Middle Eastern, and ASEAN nations

- Use of SRVA for remittances

- Expansion of capital account convertibility

- Promotion of INR as a trade settlement currency through trade fairs, banking tie-ups, and digital rupee integration

Conclusion

The Special Rupee Vostro Account (SRVA) is a pivotal innovation in India’s financial and trade strategy. It not only strengthens the rupee’s global position but also provides a resilient framework for international trade in uncertain economic environments. By promoting INR trade settlements, India is strategically placing itself at the center of a changing global financial order.

For businesses, policymakers, and financial institutions, understanding SRVAs is crucial to leverage upcoming opportunities in cross-border trade and finance.

FAQs

Q 1: How is the Special Rupee Vostro Account (SRVA) different from the already existing Rupee Vostro Account provided for under Foreign Exchange Management (Deposit) Regulations, 2016?

Answer: The settlement of International trade through Indian Rupees (INR) is an additional arrangement to the existing system of settlement. SRVA requires prior approval before opening unlike Rupee Vostro account.

2. Whether RBI approval is required for opening such Special Rupee Vostro Accounts?

Answer: Yes, for opening of Special Rupee Vostro Account, prior approval of RBI would be required. The bank willing to open Special Rupee Vostro Account for bank of the partner country should have a good level of business resilience and financial health. Second, they need to have experience in facilitating trade/investment transactions and capability to provide other financial services. Third, AD banks should have good correspondent relationships with banks in partner countries.

3. What is the procedure for opening a Special Rupee Vostro Account with an Indian AD bank?

Answer: The AD bank approaching RBI for seeking approval for opening of Special Rupee Vostro Account must submit the following information along with their proposal/request:

- The details of the arrangement between AD bank and correspondent bank from the trading partner country along with the funds flow.

- A brief write-up on the foreign banks seeking correspondent relationship for Special Rupee Vostro Account.

- Copy of the request letter of the correspondent bank to AD bank.

- Confirmation from AD bank that the due diligence has been carried out by AD bank which establishes correspondent banking relationship as per our extant guidelines {Master Direction – Know Your Customer (KYC) Direction, 2016 dated Feb 25, 2016) (As amended from time to time)}.

- Confirmation from AD bank stating that the correspondent bank is not from a country or jurisdiction in the updated FATF Public Statement on High Risk & Non-Co-operative jurisdictions on which FATF has called for counter measures.

- Confirmation from AD bank that they shall ensure that all the transactions taking place in the Special Rupee Vostro Account of the correspondent bank are strictly in adherence to the instructions given in the A.P. (DIR Series) Circular No. 10 dated July 11, 2022.

- Financial parameters pertaining to the correspondent bank as required for the proposal may be obtained beforehand by email to fedcotrade@rbi.org.in and the same may be furnished by AD bank along with the proposal.

4. Is the Indian branch of foreign bank eligible to open Special Rupee Vostro Account of headquarter branch/any other branch situated in any foreign country?

Answer: Yes, provided Indian branch of foreign bank is an AD bank. This is subject to approval of Reserve Bank as in the case of other such accounts.

5. Can the existing Rupee Vostro Accounts of banks from trading partner countries be used as Special Rupee Vostro Accounts under the new mechanism?

Answer: No

6. Can foreign bank (correspondent bank) maintain more than one Special Rupee Vostro Account with different AD banks?

Answer: Yes

7. Can an AD bank in India open only one Special Rupee Vostro Account from a foreign country?

Answer: No. AD bank in India can open multiple Special Rupee Vostro Accounts for different banks from the same country.

8. Can balances in Special Rupee Vostro Account be repatriated?

Answer: The balance in Special Rupee Vostro Account (SRVA) can be repatriated in freely convertible currency and/or currency of the beneficiary trading partner country depending on underlying transaction i.e. for which the account was credited. For example, for import payments through SRVA like any Rupee Vostro account the fund can be remitted to overseas exporter either in freely convertible currency or in domestic currency of the overseas exporter.

9. Whether income from INR balance in SRVA can be repatriated?

Answer: Yes, the income from INR balance can be repatriated subject to applicable regulatory guidelines and tax provisions.

10. Can balances in Special Rupee Vostro account be used for FDI, ECB?

Answer: Balance in SRVA is like foreign exchange inflow converted into INR, hence balance can be used for any permissible current and capital account transaction under the present FEMA framework.

11. Whether INR balance in SRVA can be hedged?

Answer: Yes, INR exposure can be hedged in terms of applicable guidelines depending upon underlying transactions.

12. For investment in T-Bills and government securities from funds of SRVA with AD bank, whether FPI license is required by the account holder overseas bank?

Answer: No.