Introduction

If you’ve ever taken a loan or kept money in a bank, you might have wondered how banks manage money and why they can’t lend all the deposits they receive. This is where banking regulations like the Statutory Liquidity Ratio (SLR) come into play.

SLR is a rule set by the Reserve Bank of India (RBI) that ensures banks always have enough liquid assets (like cash, gold, and government-approved securities) before lending money. This keeps banks safe from sudden financial crises and helps control inflation in the economy.

What is Statutory Liquidity Ratio (SLR)?

Statutory Liquidity Ratio (SLR) is the percentage of a bank’s net demand and time liabilities (NDTL) that must be kept in the form of liquid assets before lending money.

Let’s break this down:

- Net Demand and Time Liabilities (NDTL):

- This is just a fancy way of saying the total money that people and businesses have deposited in a bank.

- Liquid Assets:

- These are things like cash, gold, and government-approved securities that banks can quickly convert into money if needed.

Banks cannot use this portion of their money for lending or investing in risky assets—they must keep it safe as per RBI’s instructions.

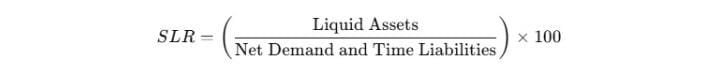

Formula for SLR

This formula simply means that SLR is the proportion of a bank’s total deposits that it must hold in liquid form.

Why Do Banks Need to Maintain SLR?

There are several reasons why RBI makes it mandatory for banks to keep a portion of their deposits in liquid assets:

1. To Ensure Bank Stability

Imagine if banks lent out all the money deposited by customers. What if too many people wanted to withdraw their money at the same time? The bank wouldn’t have enough cash to give them!

By keeping a portion of their deposits in safe and liquid forms, banks can handle unexpected withdrawal requests without going bankrupt.

2. To Control Inflation and Credit Growth

- If inflation is high, RBI increases SLR to reduce the money available for lending. This slows down spending and controls inflation.

- If the economy is slowing down, RBI reduces SLR to encourage banks to lend more money, boosting economic activity.

3. To Support Government Borrowing

Banks must invest a part of their deposits in government-approved securities, ensuring there’s always demand for government bonds. This helps the government raise funds for infrastructure, development, and welfare programs.

How Does SLR Work in the Real World?

Let’s say you deposit ₹10,000 in your bank. Your bank cannot lend all ₹10,000. If the SLR is set at 18%, it means:

- The bank must set aside ₹1,800 in cash, gold, or government securities.

- The remaining ₹8,200 is available for lending.

If the RBI increases SLR to 20%, the bank now has to keep ₹2,000 in liquid assets, leaving only ₹8,000 for lending. This means banks will have less money to give as loans, which reduces the money supply in the economy and helps control inflation.

SLR vs. Cash Reserve Ratio (CRR)

People often confuse SLR with CRR (Cash Reserve Ratio). While both are banking regulations, they are different in important ways:

| Feature | Statutory Liquidity Ratio (SLR) | Cash Reserve Ratio (CRR) |

|---|---|---|

| What it includes | Cash, gold, and government securities | Only cash |

| Where it is kept | With the bank itself | Deposited with the RBI |

| Purpose | Ensures liquidity and bank stability | Controls money supply in the economy |

| Impact on Banks | Reduces lending capacity | Reduces the amount of money banks can use for lending |

How Does SLR Affect the Economy?

The Statutory Liquidity Ratio (SLR) plays a crucial role in shaping the economy. Here’s how:

1. Impact on Interest Rates

- Higher SLR → Less money available for lending → Interest rates increase

- Lower SLR → More money available for lending → Interest rates decrease

So, if you’re taking a loan, a lower SLR means cheaper loans, while a higher SLR means you’ll pay more interest.

2. Impact on Inflation

- If inflation is high, the RBI increases SLR to absorb excess money in the economy, making borrowing more expensive.

- If the economy is slowing down, the RBI reduces SLR to make loans cheaper and encourage spending and investment.

3. Impact on Businesses and Industries

- High SLR → Banks lend less → Businesses find it hard to get loans → Slower economic growth

- Low SLR → Banks lend more → Businesses get loans easily → Economy grows faster

So, when the RBI lowers SLR, businesses expand, create jobs, and boost economic growth.

Current SLR Rate in India

As of now, the SLR in India is 18%. However, this rate changes from time to time depending on economic conditions. The RBI reviews SLR regularly to balance growth and inflation.

You can always check the latest SLR rate on the official RBI website or in financial news updates.

Conclusion

Even if you’re not a banker, SLR affects your daily life. Here’s how:

- It impacts the interest rates on loans and savings accounts.

- It affects inflation, which influences the cost of everything from groceries to housing.

- It determines how much banks can lend, affecting job creation, business expansion, and overall economic growth.

In simple terms, SLR is one of the key tools that RBI uses to keep our financial system safe, stable, and growing at the right pace. The next time you hear about an SLR change, you’ll understand what it means for your savings, loans, and the economy as a whole!