Origin

Sukanya Samriddhi Yojana was launched as part of the Beti Bachao Beti Padhao Campaign on January 22, 2015 by Prime Minister Narendra Modi.

Introduction

- Ministry:

- Ministry of Women and Child Development

- The Sukanya Samriddhi Yojana (SSY) is a government-backed savings scheme introduced by the Indian government in 2015 under the Beti Bachao Beti Padhao initiative. The scheme was designed specifically to encourage parents to save for the future of their daughters, ensuring that they are financially secure and can access funds for higher education, marriage, or any other need that may arise in the future.

- Sukanya Samriddhi Yojana offers one of the highest interest rates among various government schemes, making it an attractive option for parents who want to secure their daughters’ future. The scheme not only provides financial security but also promotes the welfare of girls in India.

Key Features of Sukanya Samriddhi Yojana

- Eligibility Criteria:

- The scheme is available for girl children under the age of 10 years.

- Only one account can be opened for each girl child, but there can be multiple accounts in case of multiple daughters.

- It can be opened by the parents or legal guardians of the girl child.

- Minimum and Maximum Investment Limits:

- Minimum Deposit:

- ₹250 per year

- Maximum Deposit:

- ₹1.5 lakh per year

- There is no restriction on the number of deposits that can be made in a year, but the total amount deposited in a year cannot exceed ₹1.5 lakh.

- Minimum Deposit:

- Interest Rate:

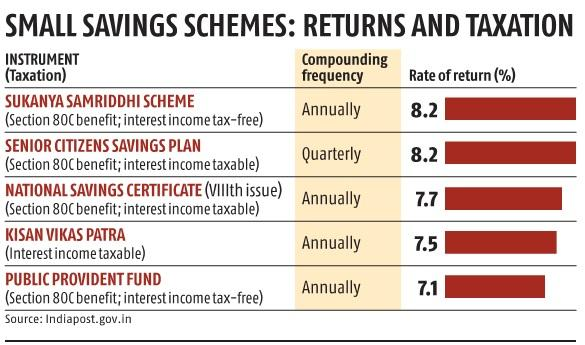

- The interest rate under the SSY scheme is fixed by the government and is revised quarterly. As of now, the interest rate is 8.0% per annum (subject to change by the government).

- The interest is compounded annually, making the returns more attractive.

- Tenure:

- The account can be opened for a minimum of 21 years from the date of opening the account or until the marriage of the girl child, whichever is earlier.

- Contributions must be made for 14 years, after which the account continues to earn interest for a period of 7 years even if no further deposits are made.

- Premature Withdrawal:

- Partial Withdrawal:

- After the girl child turns 18 years old, up to 50% of the balance can be withdrawn for the purpose of education or marriage.

- Account Closure:

- The account can be closed before 21 years under special circumstances like the girl child’s marriage (after the girl turns 18), or death of the account holder, or if the girl child is diagnosed with a terminal illness.

- Partial Withdrawal:

- Tax Benefits:

- Tax-Free Interest:

- The interest earned on the Sukanya Samriddhi account is completely tax-free.

- Tax Deductions:

- The contributions made to the Sukanya Samriddhi Yojana qualify for deduction under Section 80C of the Income Tax Act, 1961, up to a limit of ₹1.5 lakh in a financial year.

- Exempt-Exempt-Exempt (EEE):

- The scheme follows the EEE tax treatment, meaning that the amount invested, interest earned, and the maturity amount are all exempt from tax.

- Tax-Free Interest:

Benefits of Sukanya Samriddhi Yojana

- High-Interest Rates:

- The SSY scheme offers one of the highest interest rates compared to other small saving schemes, making it an attractive option for parents looking to secure their daughters’ future.

- Safety and Government Backed:

- The scheme is backed by the Government of India, ensuring the safety of your investment. Since it is a government initiative, it comes with no risk of capital loss.

- Financial Security for Education and Marriage:

- The primary goal of Sukanya Samriddhi Yojana is to ensure that there are sufficient funds available when your daughter needs them the most—whether for education or marriage. The scheme helps parents save systematically over the years for these key milestones in a girl’s life.

- Flexibility in Deposit:

- The scheme allows parents to make a minimum deposit of ₹250 per year, making it highly flexible for families with varying income levels. The maximum deposit of ₹1.5 lakh ensures that high-income families can also contribute a substantial amount to the future of their daughter.

- Long-Term Savings Tool:

- With a tenure of 21 years, this scheme works as a long-term investment tool, ensuring that the funds grow significantly over time. The compound interest makes it an excellent option for parents who start saving early in their daughter’s life.

- Tax Benefits:

- The scheme provides tax deductions under Section 80C, making it an attractive investment option for tax-conscious individuals.

How to Open a Sukanya Samriddhi Account?

- Visit the Post Office or Bank:

- You can open the Sukanya Samriddhi account at any Post Office or designated bank branches that offer the scheme, such as State Bank of India (SBI), Bank of Baroda, or other public sector banks.

- Required Documents:

- Birth certificate of the girl child

- Aadhar card of the parent/guardian and the girl child

- Address proof and identity proof of the parent/guardian

- Passport-sized photographs of the parent/guardian and the girl child

- Fill the Application Form:

- Complete the SSY application form available at the bank or post office, along with the necessary documents.

- Deposit the Initial Amount:

- Make the initial deposit (minimum ₹250) to open the account.

- Receive Passbook:

- Once the account is opened, you will receive a passbook detailing the account details, deposits, and interest earned.

Things to Keep in Mind

- Account Transfer:

- If you move to a different location, the Sukanya Samriddhi account can be transferred to another branch or post office in the same city or across the country.

- No Joint Account:

- The Sukanya Samriddhi account is a single-account scheme. Joint accounts are not allowed, and only one account can be opened for each girl child.

- Late Payments:

- If you miss a deposit in any year, you can still continue the account by paying a penalty along with the due amount, and the account will become operative again.

- No Premature Closure (Except for Certain Cases):

- The account cannot be closed prematurely unless the girl turns 18 (in case of marriage) or in cases like the death of the account holder or a terminal illness diagnosis.

Conclusion

- The Sukanya Samriddhi Yojana is a powerful tool for parents who want to secure the future of their daughters.

- The scheme offers high returns, tax benefits, and the peace of mind that your daughter will have the financial support she needs for her education and marriage.

- By starting early and making regular contributions, parents can accumulate a significant corpus that will benefit their daughters when they come of age.

- In a country where financial security for daughters is often a concern, the Sukanya Samriddhi Yojana offers an accessible and safe investment option.

So, if you’re looking to ensure a bright and secure future for your daughter, the SSY scheme is definitely worth considering.