Origin

- Currency swaps were originally conceived in the 1970s to circumvent foreign exchange controls in the United Kingdom. At that time, UK companies had to pay a premium to borrow in US Dollars. To avoid this, UK companies set up back-to-back loan agreements with US companies wishing to borrow Sterling.

About

- In today’s interconnected global financial markets, currency swaps have become an essential tool for managing currency risks and accessing foreign currency liquidity.

- Among these, the USD/INR currency swap is one of the most widely utilized, particularly for Indian entities seeking to hedge currency exposure or raise foreign currency capital.

What is a USD/INR Currency Swap?

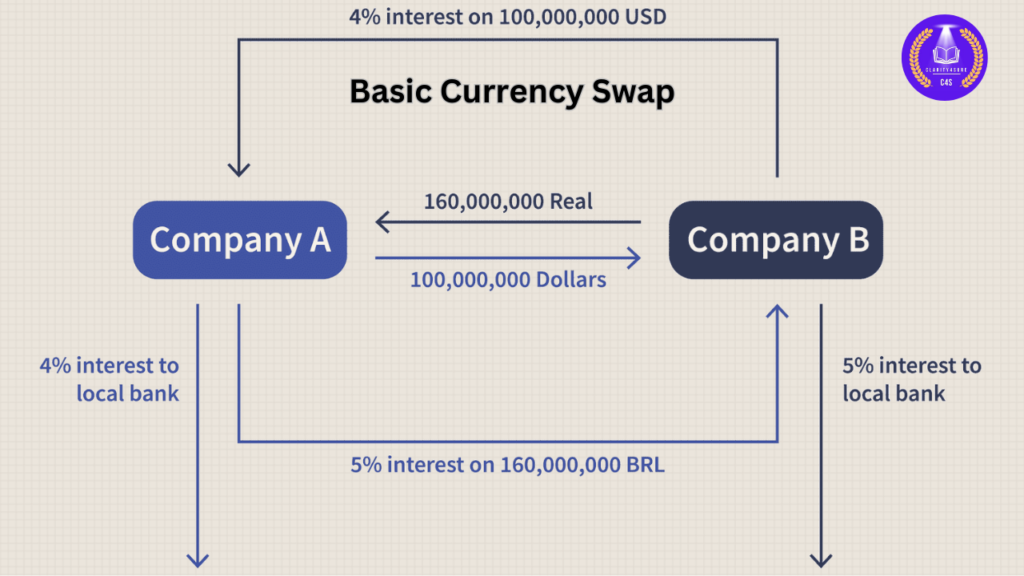

- A currency swap is a financial contract in which two parties agree to exchange principal and interest payments in different currencies for a specified period. Specifically, a USD/INR currency swap involves the exchange of U.S. Dollars (USD) and Indian Rupees (INR).

Here’s a simplified explanation of how it works:

- Principal Exchange:

- The two parties (usually corporations or financial institutions) agree to exchange USD for INR at a predetermined exchange rate. This initial exchange of principal is done at the start of the swap.

- Interest Payments:

- Periodically, the parties will make interest payments in the two currencies. One party may pay a fixed interest rate in INR, while the other may pay a floating rate in USD (or vice versa). The payments depend on the terms agreed upon in the contract.

- Final Exchange of Principal:

- At the end of the swap’s term, the principal amounts are exchanged back. The INR holder gives back USD, and the USD holder returns INR. This exchange may be at the same initial rate or at a rate based on market conditions at that time.

RBI’s Role in Currency Swaps

- The Reserve Bank of India (RBI) plays a significant role in managing the exchange rate stability of the Indian Rupee (INR) through various mechanisms, including currency swaps.

- The RBI uses currency swaps to control the value of the INR and to manage its foreign exchange reserves.

Here are the key reasons why the RBI might use currency swaps:

- Liquidity Management:

- Currency swaps help the RBI manage liquidity in the domestic market, particularly in terms of foreign exchange reserves and market interventions.

- Stabilizing Exchange Rates:

- By engaging in currency swaps, the RBI can smooth out large fluctuations in the exchange rate of INR against the USD, maintaining a more stable market.

- Increasing Foreign Exchange Reserves:

- By swapping INR for USD or vice versa, the RBI can increase its foreign exchange reserves, ensuring that it has sufficient reserves to meet India’s import requirements, external debt obligations, and to maintain investor confidence.

- Hedging Against External Shocks:

- A currency swap can help hedge against sudden shocks in the foreign exchange market, such as external geopolitical or economic crises that may cause significant depreciation of the INR.

Why Do Companies and Governments Use USD/INR Currency Swaps?

Currency swaps serve a wide range of strategic purposes. Here are some common reasons why entities engage in USD/INR currency swaps:

- Hedging Currency Risk

- Currency risk, also known as exchange rate risk, is the potential for fluctuations in the value of one currency relative to another. For Indian companies with overseas operations or foreign debt in USD, currency swaps are a way to hedge against unfavorable fluctuations in the USD/INR exchange rate.

- For instance, if an Indian company is earning revenues in USD but has costs in INR, a sudden depreciation of the INR against the USD could hurt its profitability. A USD/INR swap could help stabilize the financial impact of such fluctuations by locking in exchange rates and interest rates for the duration of the swap.

- Access to Foreign Currency Liquidity

- In cases where Indian companies or the Indian government need to raise funds in USD, a currency swap can be a more cost-effective option than borrowing in the open market. Instead of going through the complexities of issuing USD-denominated bonds or loans, companies can access USD liquidity by swapping INR with a counterparty, which is often a bank or another financial institution.

- Lower Borrowing Costs

- A currency swap can be an attractive way to lower borrowing costs. Often, borrowing directly in foreign markets (such as through bonds or loans) can be expensive due to the high interest rates charged by international lenders. Currency swaps can be structured to offer better rates, especially when one party has access to cheaper financing in its own domestic market.

- Capitalizing on Market Differences

- Sometimes, interest rate differences between two countries (in this case, the U.S. and India) can make it more favorable for companies to swap currencies rather than borrowing directly. For example, if interest rates are lower in the U.S. than in India, an Indian company may enter into a USD/INR swap to take advantage of the lower cost of financing in the U.S.

RBI’s Strategic Use of Currency Swaps

The RBI utilizes currency swaps as part of a larger strategy to maintain the INR’s stability. This includes:

- Interventions in Forex Markets:

- The RBI steps into the currency markets to stabilize the INR against extreme fluctuations, typically through buying or selling foreign currencies.

- Maturity Management:

- The RBI actively manages the maturity of its foreign currency swaps to avoid liquidity crunches and ensure that foreign currency obligations are met.

- For example, in 2018, the RBI launched a Dollar-Rupee Swap Scheme that enabled the RBI to inject more liquidity into the system.

- This scheme was especially important during times of high demand for USD when the rupee was under pressure.

How Does a USD/INR Currency Swap Work?

- Initiating the Swap:

- Parties Involved:

- The swap typically involves two parties—let’s say an Indian company and a U.S. bank.

- Initial Exchange:

- At the start of the swap, the Indian company provides INR, and the U.S. bank provides an equivalent amount in USD, based on the agreed-upon exchange rate.

- Parties Involved:

- Interest Payments:

- Fixed vs Floating:

- The parties then agree to interest payments that are either fixed or floating. For example, the Indian company may agree to pay a fixed interest rate in INR to the U.S. bank, while the U.S. bank may pay a floating rate in USD to the Indian company (or vice versa).

- Frequency of Payments:

- Interest payments are usually made periodically, such as every 6 months or annually.

- Fixed vs Floating:

- Reversal of Principal Exchange:

- At the maturity of the swap, the initial exchange of currencies is reversed. The Indian company gives back USD to the U.S. bank, and the U.S. bank returns the agreed-upon INR to the Indian company.

- Settlement of Swap:

- If the swap is structured as a “non-deliverable” swap, the principal exchange might not be physically made but instead settled in cash based on the market exchange rate at the time of settlement.

Types of USD/INR Currency Swaps

- Foreign Currency Swap with the Central Bank:

- The RBI might engage in direct swaps with other central banks, such as the Federal Reserve, in order to ensure liquidity. For example, during times of crisis, central banks may swap currencies to ensure that both countries have access to the necessary foreign currency reserves.

- Foreign Currency Swap Auctions:

- The RBI occasionally conducts foreign currency swap auctions to inject dollars into the market. This can help meet the demand for USD in the market without causing significant depreciation of INR.

- Rupee-Dollar Swap Scheme:

- In 2018, the RBI introduced a special scheme to swap INR with USD to enhance the supply of foreign currency. The scheme was aimed at addressing liquidity problems faced by banks and boosting the rupee’s value.

- Fixed-for-Fixed Swap

- Both parties agree to pay fixed interest rates for the duration of the swap. This is a straightforward structure, where the INR holder pays a fixed rate in INR, and the USD holder pays a fixed rate in USD.

- Fixed-for-Floating Swap

- In this structure, one party pays a fixed interest rate, while the other pays a floating rate (often tied to a benchmark like LIBOR). For example, an Indian company might pay a fixed INR rate, while the U.S. bank pays a floating USD rate.

- Floating-for-Floating Swap

- Both parties agree to exchange floating interest rates. The floating rate in INR could be tied to a benchmark like the MIBOR (Mumbai Interbank Offer Rate), while the floating rate in USD could be based on LIBOR or SOFR.

Mechanics of the USD/INR Currency Swap

- Initial Swap:

- In a USD/INR currency swap, the RBI (or any participating financial institution) exchanges a predetermined amount of USD for INR at the current exchange rate.

- Interest Payments:

- Throughout the term of the swap, each party makes periodic interest payments based on the agreed-upon interest rate in the respective currencies.

- Final Settlement:

- At the end of the swap agreement, the currencies are exchanged back at a predetermined rate, which could differ from the original rate depending on the terms of the contract.

For example:

- If an Indian bank or institution needs USD liquidity, the RBI could enter into a swap where it provides INR to the bank in exchange for USD.

- After the term of the swap expires, the bank returns the USD and gets back INR, including the agreed-upon interest payments.

Benefits of Currency Swaps

- Stable Exchange Rates:

- The currency swap reduces the pressure on the INR by increasing liquidity and can lead to more predictable exchange rate fluctuations.

- Enhanced Foreign Exchange Reserves:

- This helps in building and maintaining India’s foreign exchange reserves, which is essential for external stability.

- Low-Cost Access to Foreign Currency:

- Financial institutions and the RBI can access foreign currency (USD) at a relatively low cost without going through the international forex markets.

Risks Associated with USD/INR Currency Swaps

Although currency swaps offer various advantages, they also come with inherent risks:

- Exchange Rate Risk:

- If the INR depreciates significantly against the USD, the Indian company could face higher costs when the principal is exchanged back at the end of the swap. The agreement might include clauses to manage this risk, but it remains a factor.

- Interest Rate Risk:

- The floating interest rates in currency swaps are usually based on global benchmarks. Fluctuations in these rates, like a rise in LIBOR, can increase the cost of borrowing for either party.

- Credit Risk:

- In the event of a default by either party, the swap could fail to deliver the intended benefits, causing financial loss. Parties usually mitigate this risk by involving a highly rated counterparty or using collateral.

- Liquidity Risk:

- Currency swaps are usually long-term contracts, and if either party wants to exit before maturity, they may face difficulties in finding a willing counterparty or may have to pay a premium to break the swap.

Recent Developments and Measures by the RBI

In recent years, especially during periods of economic stress or global uncertainty, the RBI has become more proactive in using currency swaps as part of its monetary policy toolkit. For instance:

- The COVID-19 pandemic brought a significant focus on liquidity and the need for effective forex interventions. The RBI used currency swaps to manage the INR’s depreciation during uncertain times.

- In recent months, the RBI has been involved in setting up mechanisms to manage the flow of USD and INR to reduce volatility and strengthen its foreign exchange reserves.

Conclusion

- A USD/INR currency swap is a vital financial tool that allows Indian companies and financial institutions to access USD liquidity, hedge against currency risk, and lower borrowing costs.

- USD/INR currency swaps are a vital tool used by the Reserve Bank of India (RBI) to manage India’s foreign exchange reserves, maintain liquidity in the market, and stabilize the exchange rate of the Indian rupee.

- By using these swaps strategically, the RBI ensures that India’s foreign exchange market remains resilient to external shocks while safeguarding the value of the INR.

- However, these swaps also carry risks, such as exchange rate fluctuations, and must be managed carefully to avoid unintended consequences.

By understanding the structure, benefits, and risks of USD/INR currency swaps, entities can use them strategically to improve their financial positions, reduce costs, and manage currency exposure effectively.