Daily Current Affairs

Table of content

National Affairs

- ₹60kcr BPCL Project to Come Up Near AP Port

- PM Modi, Albanese Reaffirm Focus on Defence Cooperation

Banking/Finance

- ‘Inflation Already Biting, if Goes Unchecked, can Hurt Economy’

- Festive spending to boost Q3 no.s after weak Q2: RBI

- Norms to be eased to let more pvt banks collect PF money from companies

- Finance ministry directs major PSBs to fast-track re-KYC verification

- Stable inflation in best interest of economy, Das says

- ULI will be for lending what UPI is for payments: RBI Dy Guv at BFSI Summit

- No systemic risk in banking sector: Jio Financial Services’ KV Kamath

- Indian banks’ microfin loan stress to persist after new regulation: Bankers

Agriculture

- SLCM in pact with Bank of Baroda to help farmers access credit against crops

- Paddy procurement in Punjab going on smoothly, says Centre

Facts to remember

- ‘About 18% of Deaths in 2019 Attributable to Air Pollution’

National Affairs

- ₹60kcr BPCL Project to Come Up Near AP Port

Andhra Pradesh to Build Oil Refinery and Petrochemical Hub

- Andhra Pradesh to invest ₹60,000 crore in an oil refinery and petrochemical hub at Ramayapatnam, Nellore district.

- The project, backed by chief minister N Chandrababu Naidu, will be established on 1,000 acres of land.

- BPCL will have access to a captive jetty at Ramayapatnam port.

- The state government offered three locations to BPCL: Srikakulam, Machilipatnam, and Ramayapatnam.

Ramayapatnam Port

- Deep-sea port in Nellore district of Andhra Pradesh.

- Constructed by Ramayapatnam Port Development Corporation Limited under Andhra Pradesh Maritime Board.

- Maximum depth of 16 metres, accommodating panamax vessels.

Bharat Petroleum Corporation Limited (BPCL)

- India’s second-largest government-owned downstream oil producer.

- Operates refineries in Mumbai, Kochi, Bina, and Numaligarh.

- Markets products through retail outlets, dealers, and distributors.

- Produces light and middle distillates of oil products.

- Markets under brands MAK, Speed, and Bharatgas.

- Government-owned, with 52.98% stake as of 31 March 2023.

- Supports communities through social initiatives like child education and women empowerment.

2. PM Modi, Albanese Reaffirm Focus on Defence Cooperation

India-Australia Launch Renewable Energy Partnership and Strengthen Defence Partnership

- India and Australia launched a Renewable Energy Partnership to boost investments in the renewable energy sector.

- The leaders reaffirmed their commitment to advancing the Comprehensive Strategic Partnership across various areas.

- They expressed intent to strengthen the Joint Declaration on Defence and Security Cooperation in 2025.

- They look forward to a long-term vision of defence, security collaboration to enhance collective strength and contribute to regional peace and security.

- PM Modi emphasized the continued efforts to promote peace, stability, and prosperity in the IndoPacific.

Banking/Finance

- ‘Inflation Already Biting, if Goes Unchecked, can Hurt Economy’

RBI’s State of the Economy Report Highlights Inflation’s Impact on Real Economy

- RBI’s State of the Economy report warns of the potential damage of unchecked inflation on the real economy.

- The report highlights that inflation is impacting urban consumption demand, corporate earnings, and capex.

- The RBI maintains its mandate of maintaining price stability while aiming for growth.

- India’s headline inflation rose to a 14-month high of 6.21% in October, despite expectations of an immediate policy rate cut.

- The report also notes signs of second-order effects or spillovers of high primary food prices.

- Despite the challenges, the RBI projects a bullish medium-term outlook backed by strong macro-fundamentals.

- The report also notes that the Indian economy is resilient, supported by festival-related consumption and a recovering agriculture sector.

- The report notes that domestic financial markets are experiencing corrections due to the hardening of the US dollar and persistent portfolio outflows.

- Despite global uncertainty and fluctuating foreign portfolio investments, financial conditions are likely to remain accommodative.

- The report also notes that system liquidity remained in surplus during the second half of October and early November.

2. Festive spending to boost Q3 no.s after weak Q2: RBI

RBI’s State of the Economy Report: Q2 FY25 Outlook

- Private consumption is the primary driver of domestic demand, with a rise in festival spending in Q3.

- Private investment remains low due to subdued corporate earnings.

- E-commerce is booming, with marketing strategies targeting Gen Z and increased ad spends by FMCG and auto companies.

- Rural India is emerging as a gold mine for e-commerce companies.

- RBI may not ease rates due to inflationary pressure, which could undermine the real economy’s prospects.

- D2C brands are seeking funds to expand their presence and increase sales through quick-commerce platforms.

- Domestic financial markets are experiencing corrections due to dollar strengthening and portfolio outflows.

- The medium-term outlook for the Indian economy remains bullish, supported by strong macroeconomic fundamentals.

- Private consumption is rebounding, and the agriculture sector is recovering.

- Manufacturing and construction sectors are dynamic, contributing to industrial growth and job creation. India is emerging as a leader in sustainable transportation.

3. Norms to be eased to let more pvt banks collect PF money from companies

Employees’ Provident Fund Organisation (EPFO) to Relax Rules

- The Employees’ Provident Fund Organisation (EPFO) plans to allow more private banks and agent banks to collect provident funds from establishments and deposit them with the retirement fund body.

- The move aims to enhance ease of doing business for companies and ease of living for its subscribers.

- The proposal to nearly double the number of empanelled banks for centralised collection of EPF contribution to 33 from 17 will be considered at the EPFO’s board meeting on November 30.

- The changes include reducing the ceiling on EPFO collection to 0.20% from the current 0.50% to widen the base for EPFO’s direct online collection and reduce the role of aggregators.

- The move will enhance direct banking while minimising aggregator operations at the retirement fund body.

Employees’ Provident Fund Organisation (EPFO) Overview

- Manages India’s retirement plan for employees.

- Administers Provident fund, Pension scheme, and Disability/death insurance schemes.

- Manages social security agreements with other countries.

- Administratively controlled by the Ministry of Labour and Employment, assisted by the Central Board of Trustees.

- Offers benefits like partial withdrawals, tax concessions, and financial backup.

- EPF balance can be checked via missed calls or SMS.

- EPF forms can be used for various purposes like withdrawals, loans, advances, monthly pensions, or claiming benefits.

4. Festive spending to boost Q3 no.s after weak Q2: RBI

Finance Ministry Directs Major Public Sector Banks to Complete pending Re-Know Your Customer (re-KYC/e-KYC)

- The finance ministry has instructed banks to submit action plans by the end of the month to complete the re-KYC process.

- Lead banks are directed to coordinate with gram panchayats to mobilize people for the re-KYC process.

- Senior management of banks is instructed to set up dashboards for regular monitoring of pending re-KYC cases and conduct regular reviews with field staff.

- Out of 539 million Pradhan Mantri Jan-Dhan Yojana (PMJDY) accounts, 112 million are inoperative and 105 million are pending for re-KYC.

- The finance ministry has also instructed banks to explore the possibility of temporary staff deployment and create awareness campaigns about the re-KYC process.

- Periodic updation of KYC will be carried out at least once in every two years for high-risk customers, once in every eight years for medium-risk customers, and once in every 10 years for low-risk customers.

- Banks are encouraged to facilitate re-KYC through any branch and to match their records with Aadhaar in regional languages if English details don’t match.

5. Stable inflation in best interest of economy, Das says

Reserve Bank of India Governor Shaktikanta Das’s Views on Price Stability

- Reserve Bank of India Governor Shaktikanta Das emphasizes the importance of price stability for sustained growth and the economy.

- He highlights the role of stable inflation or price stability in enhancing the purchasing power of the people and providing a stable investment environment.

- Despite India’s retail inflation rising to a 14-month high of 6.21 per cent in October, the RBI has remained unchanged at 6.5%, easing the policy tightening cycle.

- Das suggests that countries in the global south need to increase their per capita income and productivity, but growth should not come at the cost of price stability.

- He emphasizes the need for congenial public policies, including monetary policies, to be growth supportive while maintaining balance with inflation.

- Das stresses the importance of fiscal and monetary coordination in maintaining the balance between growth and inflation.

- He warns of the challenges of maintaining overall stability including sustained growth, price stability, and financial stability for the countries of the global south.

6. ULI will be for lending what UPI is for payments: RBI Dy Guv at BFSI Summit

RBI Introduces Unified Lending Interface (ULI)

- RBI Deputy Governor, T Rabi Sankar, introduces the Unified Lending Interface (ULI), a public-sector infrastructure project aimed at democratizing private sector lending.

- ULI provides a universal lending platform for private entities to innovate within a structured regulatory framework.

- Sankar emphasizes the role of UPI in enhancing economic efficiency and aims to expand its reach to offline and feature phone users.

- The RBI is working to link UPI with other countries for global acceptance, allowing Indians abroad to make payments using UPI.

- Sankar warns that while UPI’s growth has not reduced currency circulation, it has slowed the growth rate of physical currency.

Business Standard BFSI Insight Summit 2024:

- Gathers industry leaders for discussions, knowledge exchange, and expo.

- Session on technology and AI’s impact on financial sector.

- Key speakers: RBI Governor, SBI Chairman, industry leaders.

- Participants: Leading banks, NBFCs, mutual funds, insurance companies, regulators.

- Format: Panel discussions, fireside chats, keynote speeches.

7. No systemic risk in banking sector: Jio Financial Services’ KV Kamath

Indian Banking Sector Health and Risks

- KV Kamath, independent director and non-executive chairman of Jio Financial Services, stated that there is no systemic risk in the Indian banking sector.

- He cited the top-four banks reporting returns on equity of 16-20% in the last quarter, indicating a stronger banking system than in the past 50 years.

- Kamath noted that lending activity cycles and pain are inevitable, but no such pain is reflected in the current quarter’s numbers.

- He noted signs of a “pyramid” forming in the non-banking financial company (NBFC) sector, with many borrowers taking multiple loans while still seeking additional credit.

- Kamath praised the RBI’s proactive stance in raising risk weights for unsecured loans and urged lenders to scrutinize the borrower’s end-use of funds.

- Kamath expressed concern about the flow of funds raised through personal and unsecured loans entering the markets, citing RBI Governor Shaktikanta Das’s warning about the risks of retail participation in the Futures and Options (F&O) market.

8. Indian banks’ microfin loan stress to persist after new regulation: Bankers

Indian Microfinance Lenders Prepare for Defaults

- Indian lenders are expecting another wave of defaults in their microfinance portfolios due to tightened rules by the Reserve Bank of India (RBI).

- Default rates in microfinance loans, collateral-free loans to those with annual income up to Rs 300,000 ($3,556), have already increased.

- The RBI has previously flagged unfair practices in the sector, including “usurious” interest rates and “unreasonably high” processing fees.

- The RBI has asked lenders to stop issuing new microfinance loans to borrowers unless they have cleared previous loans.

- This informally conveyed instruction could lead to cascading defaults as some borrowers fail to repay dues without fresh credit.

- The impact of stricter regulations could last even longer, with stress expected to creep up and be prolonged.

- The total outstanding of microfinance loans jumped by 18.3% on-year as of June-end.

Agriculture

- SLCM in pact with Bank of Baroda to help farmers access credit against crops

Sohan Lal Commodity Management (SLCM) Partners with Bank of Baroda for Credit Access

- SLCM, a post-harvest logistics and agri-solutions company, has partnered with Bank of Baroda to provide credit to farmers and the agriculture fraternity.

- The partnership will offer competitive post-harvest credit rates and secure storage and risk management solutions.

- SLCM’s patented technology platform, Agri Reach, aims to simplify collateral management and create financial inclusivity for farmers, agribusinesses, and stakeholders.

- SLCM’s assets under management (AUM) increased by 73% to ₹11,952 crore in the first half of the current fiscal from ₹6,911 crore in the same period in the previous financial year.

- The collaboration is part of SLCM’s strategy to provide Warehouse Receipt Financing and collateral management services across territories.

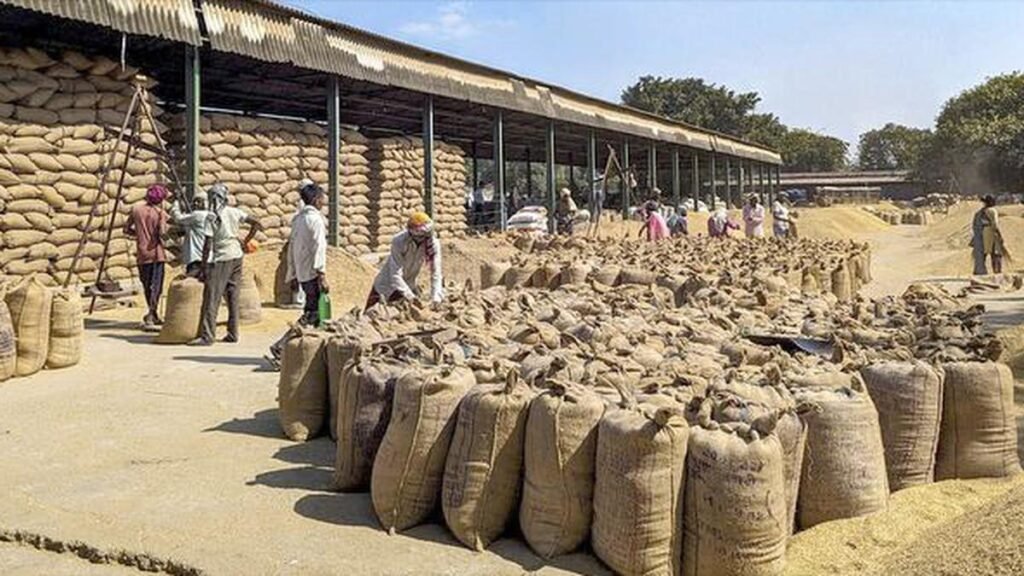

2. Paddy procurement in Punjab going on smoothly, says Centre

Paddy Procurement in Punjab Amid Delays

- The Food Corporation of India (FCI) and State agencies procured 120.67 lakh metric tonnes (LMT) of paddy from the State.

- 6.58 lakh farmers in the State have received benefits of procurement with a minimum support price (MSP) worth ₹27,995 crore.

- A total quantity of 126.67 LMT of paddy has arrived in the Punjab mandis as of November 8, 2024.

- ‘A’ Grade paddy is being purchased at MSP at the rate of ₹2,320 per quintal.

- The total paddy purchased till date in the ongoing kharif marketing season (KMS) amounts to ₹27,995 crore.

- 4,839 millers have applied for shelling of paddy and 4,743 millers have been allotted work by the Punjab State Government.

Facts to remember

- ‘About 18% of Deaths in 2019 Attributable to Air Pollution’

India’s Air Pollution Impact and Health Concerns

- India’s health research body reported that 18% of total deaths in 2019 were due to air pollution.

- COPD was the leading cause, accounting for 32.5% of deaths.

- Ischaemic heart disease, stroke, and lower respiratory infections were the other leading causes.

- Air pollution caused 11.5% of the total Disability Adjusted Life Years (DALYs) in India.

- Delhi and the National Capital Region are experiencing severe air pollution, leading to health and safety concerns.

- Dr Harsh Mahajan warns of acute problems and long-term lung diseases due to severe pollution.

- Major sources of air pollution include industrial emissions, vehicular exhaust, road dust resuspension, construction activities, refuge burning, and solid fuel use.

- Indoor pollution is mainly caused by burning biomass.