Daily Current Affairs Quiz

12 March, 2025

International Affairs

1. India-Mauritius Relations

Context:

Prime Minister Narendra Modi, during his visit to Mauritius, emphasized the deep-rooted familial ties between the two nations, highlighting their shared cultural and historical heritage.

Key Highlights

- Girmitiya Struggles

- Modi recalled the hardships of indentured Indian laborers, who were taken to Mauritius by British colonizers. He noted their resilience, drawing strength from Lord Ram and the Ramcharitmanas.

- 1998 Ramayan Conference

- Modi reminisced about his earlier visit to Mauritius for the International Ramayan Conference.

- Ayodhya Ram Mandir

- He appreciated Mauritius’ decision to declare a half-day holiday to mark the Ram Mandir consecration in Ayodhya.

Honors and Diplomatic Engagements

- Highest Civilian Award

- Mauritius PM Navin Ramgoolam announced that Modi would receive the ‘Grand Commander of the Order of the Star and Key of the Indian Ocean (GCSK)’, the nation’s highest civilian honor, during National Day celebrations.

- OCI Card Expansion

- Modi personally handed over OCI (Overseas Citizen of India) cards to Ramgoolam and his spouse Veena Ramgoolam. He also announced a special provision for Mauritius allowing OCI status up to the seventh generation of Indian-origin Mauritians.

Economic and Strategic Cooperation

- Development Partnership

- Modi reiterated India’s commitment to supporting Mauritius’ development projects.

- Agreements Signing

- High-level delegation talks are scheduled, followed by the signing of multiple bilateral agreements.

- India’s SAGAR Vision

- Modi highlighted the India-Mauritius partnership as a key component of India’s Security and Growth for All in the Region (SAGAR) initiative and its broader engagement with the Global South.

Source: TOI

2. US-Canada Trade War

Context:

U.S. President Donald Trump announced massive new tariffs on Canadian steel and aluminium (March 11, 2025), while threatening to “shut down” its auto industry and saying the best way to end the trade war was for Washington’s ally to be absorbed into the United States.

Why is This Happening?

- Ontario imposed a levy on electricity exports to the US.

- Trump retaliates, claiming the move could cripple Canada’s auto sector.

Background

- Previous US Tariffs

- Trump imposed 25% tariffs on all Canadian goods but delayed enforcement.

- Last week, he exempted USMCA-covered goods after markets reacted negatively.

- Upcoming April Tariffs

- US plans to set “reciprocal” tariffs matching Canada’s trade barriers, including its 5% sales tax.

Canada’s Countermeasures

- 25% surcharge on electricity exports to New York & Michigan.

- Tariffs on orange juice, footwear, motorcycles, and more.

- Dairy Tariffs Stand Firm: Canada protects its domestic supply management system.

What This Means

- Strained US-Canada Trade Relations

- Uncertainty in Auto & Manufacturing Sectors

- Potential USMCA Agreement Breakdown

- Market Instability & Investor Worries

- Higher Costs for US Industries Dependent on Canadian Metals

Source: TH

3. Brazil’s COP-30

Context:

Brazil hosts COP30 in Belem (November 10-21, 2025), near the Amazon rainforest. Calls for a shift from negotiations to a decade of action and implementation.

Key Highlights

- COP-30 President-designate Andre Correa do Lago emphasizes urgency, using football analogy of “virada” (turnaround).

- Goal

- Mobilize $1.3 trillion annually by 2035 for developing nations.

- New initiative

- ‘Baku to Belem Roadmap to 1.3T’ to enhance climate finance.

- Brazil proposes an interim stocktake of global climate progress before 2028.

- Formation of ‘Circle of Presidencies’ to integrate biodiversity, land restoration, and climate action.

Brazil’s Climate Leadership & Objectives

- Urgency of Action

- Climate change is an inevitable force—either by choice (proactive policies) or catastrophe (unchecked warming).

- The current trajectory is insufficient, with emissions reductions and financial commitments lagging.

- Mobilizing Climate Finance

- Target: $1.3 trillion annually by 2035 for developing nations.

- Current commitment (COP29 Baku): $300 billion—Brazil seeks alternative financing solutions.

- ‘Baku to Belem Roadmap to 1.3T’ will guide global efforts and secure new funding sources.

- Stocktaking Climate Action Progress

- The first Global Stocktake (GST) occurred at COP28 Dubai (2023).

- The next is scheduled for 2028, but Brazil wants an earlier assessment to identify implementation gaps.

- Creating the ‘Circle of Presidencies’

- Brings together COP hosts from COP21 (Paris) to COP29 (Baku).

- Also includes leaders of Convention on Biological Diversity (CBD) & Convention to Combat Desertification (CCD).

- Focus: Enhance global climate ambition through integrated strategies across climate, biodiversity, and land restoration.

Global Climate Context & Challenges

- U.S. disengagement from climate agreements under Donald Trump raises concerns.

- Shortfall in emissions reductions & insufficient financial support threaten progress.

- Brazil’s COP30 strategy: Move beyond stalled negotiations and drive decisive action.

Brazil’s COP30 vision aims to transform the climate conference into a launchpad for bold, coordinated action. By securing climate finance, tracking progress, and integrating efforts across environmental conventions, Brazil seeks to catalyze a global turnaround in climate policy.

Source: The Indian Express

National Affairs

1. WHO’s Report on Compassion

Context:

On February 7, 2025, the World Health Organization (WHO) released a report, “Compassion and primary health care”, which recognises compassion as a transformative force in primary health care.

WHO’s Stand

- Dr. Tedros Adhanom Ghebreyesus, WHO Director-General, urges a global focus on compassion’s impact on health-care quality.

- Calls for systematic integration of compassion in medical practice.

Why Compassion Matters in Health Care

For Patients

- Faster Recovery: Compassionate care reduces hospital stays (Stanford University study).

- Improved Mental Health: Cancer patients show reduced anxiety with compassionate communication (Johns Hopkins Hospital study).

- The 40-Second Rule: A simple “We are in this together” statement significantly aids patient recovery.

For Health-Care Providers

- Less Burnout: Compassion helps reduce stress and prevent emotional fatigue.

- Job Satisfaction: Stronger doctor-patient relationships lead to better medical outcomes.

Compassion vs. Empathy vs. Sympathy – Key Differences

| Term | Definition | Impact on Health Care |

|---|---|---|

| Sympathy | Feeling pity for someone | A momentary reaction, no real impact. |

| Empathy | Deeply feeling others’ pain | Can cause emotional exhaustion for caregivers. |

| Compassion | Feeling pain but with problem-solving focus | Leads to sustainable caregiving and better patient care. |

Compassion allows doctors to care deeply without getting overwhelmed.

The Urgent Need for Compassion in Mental Health

Depression: The Next Global Pandemic?

- Mental health professionals stress that depression’s impact could rival major global crises.

- A compassion-driven approach is critical for effective intervention.

Case Study: Pradeep’s Story

- Rescued from a superstitious ritual as an infant.

- Labeled a “cursed child”, abandoned, and left with deep emotional scars.

- At Bal Ashram, caregivers used compassion-based rehabilitation.

- Transformation: From a withdrawn child to an expressive, thriving individual.

Lesson: Compassion is not just an emotion, it’s a force for healing.

How to Implement Compassionate Health Care

Step 1: Make Compassion a Priority

- Hospitals & policymakers must integrate compassion into decision-making.

- Compassionate health care should be a core metric of success, not an afterthought.

Step 2: Train Health-Care Professionals

- Introduce compassion training in medical schools.

- Teach the difference between empathy & compassion to prevent burnout.

Step 3: Ensure Equitable & Accessible Care

- Compassion must extend to all, regardless of socioeconomic status, gender, or caste.

- A people-first approach ensures long-term impact on global health care.

The Future: A Compassion-Driven Health System

- Health care goes beyond treating diseases. It’s about nurturing well-being.

- Compassion is the foundation of a fair, effective, and humane medical system.

- Final Call: It’s time to globalize compassionate health care for a healthier, more connected world.

Source: TH

2. The Pitfalls of Toponymous Disease Naming

Understanding Toponymous Diseases

Toponymous diseases derive their names from geographical locations, such as towns, rivers, islands, forests, countries, or continents. Examples include:

- Spanish flu

- Delhi boil

- Madura foot

- West Nile Virus

However, such names often lead to misinformation, stigma, and racial prejudice. They can politicize science and unfairly tarnish entire nations or communities, especially when the true origins of the disease remain unclear.

The Case of the Spanish Flu

- The 1918–1920 influenza pandemic was labeled the Spanish flu, despite not originating in Spain.

- Reason for the misnomer:

- Spain was neutral during World War I and did not censor reports on the outbreak.

- Other countries, involved in the war, suppressed news to avoid lowering morale.

- As a result, the pandemic, which affected 500 million people and caused over 20 million deaths, was inaccurately associated with Spain.

The Shift Towards Scientific Naming

Recognizing the harmful effects of geographical disease names, the World Health Organization (WHO) took action in 2015. It urged scientists to use names based on scientific characteristics rather than location.

Examples of Renaming Diseases

- Congenital Zika Syndrome (2016)

- The Zika virus was named after the Zika Forest in Uganda, where it was first isolated.

- To avoid geographical stigma, the WHO recommended the term Congenital Zika Syndrome to describe the fetal condition caused by the virus.

- Mpox (Monkeypox) – 2022

- The WHO renamed monkeypox as mpox due to concerns over racist and stigmatizing language linked to the disease’s name.

The Controversy Over Trichophyton indotineae

Despite WHO guidelines, misleading disease naming continues. A recent example is the fungal species Trichophyton (T.) indotineae, which causes widespread skin infections resistant to antifungal treatments.

Why the Name is Problematic

- The term ‘indotineae’ unfairly links the disease to India and South Asia, even though its origin remains uncertain.

- The fungus has been reported in over 40 countries.

- The Japanese dermatologists who first identified it in Indian and Nepali patients proposed the name, ignoring WHO recommendations.

- Indian medical experts objected, publishing an article in the Indian Journal of Dermatology, Venereology, and Leprology, arguing that the name is inaccurate and prejudicial.

Scientific Concerns

- The fungus causes ringworm and is resistant to terbinafine, a key antifungal drug.

- Research on the resistance gene was first conducted in India by:

- Dr. Ram Manohar Lohia Hospital, Delhi

- Postgraduate Institute of Medical Education and Research, Chandigarh

- Misleading names do not aid in treatment or research but can fuel discrimination.

The WHO’s Role in Disease Naming

The WHO is responsible for assigning names under the International Classification of Diseases (ICD). Key naming principles include:

- Scientific accuracy

- Ease of pronunciation

- Avoidance of geographical or zoological references

- Consideration of current usage and historical relevance

Correcting Past Mistakes: The Case of Reiter’s Syndrome

- Previously named after Hans Reiter, a German physician who described reactive arthritis in 1916.

- Post-World War II, Reiter was exposed as a Nazi involved in unethical medical experiments.

- The syndrome was renamed reactive arthritis to remove association with his legacy.

The Need for Precision and Unity

Lessons from COVID-19

The SARS-CoV-2 pandemic underscored the global interconnectedness of health crises. It reinforced the need to:

- Focus on scientific accuracy rather than stereotypical labels.

- Promote collaborative global research instead of politicization.

A Call to Action

- The WHO and global scientific communities must prioritize accurate, neutral disease naming.

- Naming should be rooted in science, not assumptions, stigma, or nationalism.

- Microbes do not recognize borders, and disease prevention should unite rather than divide people.

Toponymous disease names mislead, stigmatize, and create unnecessary divisions. The WHO’s push for scientific, neutral naming is crucial in ensuring global cooperation, accurate disease tracking, and effective medical responses. By choosing precision over prejudice, the scientific community can foster a more inclusive and responsible approach to public health.

3. Foreign Aid

What is Foriegn Aid?

The term foreign aid refers to any type of assistance that one country voluntarily transfers to another, which can take the form of a gift, grant, or loan. Most people tend to think of foreign aid as capital, but it can also be food, supplies, and services such as humanitarian aid and military assistance.

Broader definitions of aid include any assistance transferred across borders by religious organizations, non-governmental organizations (NGOs), and foundations. U.S. foreign aid usually refers to military and economic assistance provided by the federal government provides to other countries.

The Role of Foreign Aid

- Foreign aid programs played a major role in the polio fight.

- Moreover, government funding played a mostly dominant role in the late 1990s and early 2000s by covering more than 80% of eradication efforts.

- Recently, private donors have been stepping up and providing a significant share of funding.

The Fight Against Polio: A Success Tale

- In the early 1980s, polio paralyzed almost half a million people a year, mostly children. Fast forward to 2023, and the number of polio cases worldwide translated to just two days’ worth of cases in 1981.

Broader Foreign Aid Effects on Health Across the Globe

- This has been polio and much more regarding how foreign aid has saved millions from death. Other examples include:

- HIV/AIDS

- Over 25 million lives have been saved by the PEPFAR program rolled out by the U.S.

- Malaria

- Just providing bed nets and antimalarial treatments reduced infections and deaths by leaps and bounds.

- Tuberculosis

- Significant reduction in the number of TB deaths has been achieved by the Global Fund and USAID.

The Scale of Foreign Aid

- In 2023, total global foreign aid is about $240 billion.

- This is a small fraction of most rich countries’ economies.

- U.S. aid spending: Just 0.24% of its Gross National Income (GNI).

- Norway is the only country exceeding 1% of GNI in aid spending.

Who Finances Foreign Aid

- Is global aid funded by governments or by billionaire philanthropies? Here are the figures:

- Over 95% of the global foreign aid in 2023 derives from national governments.

- Private philanthropic grants contributed just $11 billion (4.5% of total aid).

Why Government Support Matters

- A tiny decrease in government aid can leave an altogether different mark.

- In 2023, the U.S. contributed $62 billion to foreign aid.

- A reduction of 20% would cut its contribution by $13 billion, more than the entire global private aid sector.

- Building public support for government aid budgets is crucial to increasing global assistance.

The UN’s Target for Aid Spending

- The United Nations (UN) recommends that developed countries allocate 0.7% of their GNI to foreign aid.

- Only five countries met this target in 2023

- Norway, Luxembourg, Sweden, Germany, and Denmark.

- If all developed countries were to meet this target, the additional global aid could easily rise to over $216 billion, almost doubling the current budget.

Public Perception vs. Reality

Despite the relatively low levels of foreign aid spending, public perception is wildly inaccurate:

- A 2015 survey asked Americans how much of the U.S. federal budget went to foreign aid.

- The correct answer was under 1%.

- The average guess was 31%—a massive overestimation.

- When asked how much should be spent, respondents suggested 10%, which is 10 times more than actual spending.

Foreign aid has saved millions of lives at a relatively small cost to donor nations. However, global support remains fragile and misunderstood by the public. If developed countries met the UN’s 0.7% GNI target, the impact on global health, poverty reduction, and crisis response would be transformative.

4. Immigration and Foreigners Bill

Context:

The introduction of the Immigration and Foreigners Bill in the Lok Sabha aims to streamline and strengthen existing immigration laws by consolidating four important pieces of legislations and imposing stricter punishments on violations.

Purpose and Scope of the Bill

- The Bill merges and updates the following laws

- Foreigners Act

- Passport (Entry into India) Act

- Registration of Foreigners Act

- Immigration (Carriers’ Liability) Act

It makes stricter compliance measures for foreigners entering, staying, and exiting India.

Why is Immigration a Problem in India?

Immigration, both internal and international, poses a range of challenges to India, including issues with resource allocation, social stability, and law enforcement, as well as concerns about illegal migration and the exploitation of migrant workers.

Key Provisions

Burden of Proof on Foreigners

- Section 16 states that burden of proof of nationality lies on the individual, while similar laws exist for:

- Prevention of Money Laundering Act (proving assets are untainted)

- Prevention of Corruption Act (proving income legality)

- Customs Act (legal acquisition of goods)

Stronger Registration Requirements

- Presently, foreign tourists need to register with the local FRRO by filling up C form (details of passport, visa, and disembarkation).

- New provision: Hosts, including private homeowners, must also report guest details to the FRRO, probably through an online system.

- New reporting requirements shall now be imposed upon educational institutions, hospitals, and medical centers admitting foreigners.

Carrier Responsibility for Deportation

- Transport carriers (airlines, ships, etc.) should ensure compliance by the foreigners with the Indian immigration laws.

- In case a foreigner is detected violating immigration laws, the carrier must deport the individual at its own cost.

Implications of the Bill

- Heightened monitoring of foreign visitors for enhancing national security.

- Clearly fixing accountability for hosts, institutions, and carriers.

- Stricter punishment for illegal immigration and overstaying.

The Bill promises strengthening of immigration framework in India whilst assuring better enforcements and compliance expediencies. Once passed, the proposed Bill will impose greater accountability, both on foreigners and their hosts.

Source: TOI

5. ASHAs to Receive Higher Remuneration

Context:

Union Health Minister J.P. Nadda announced in the Rajya Sabha that Accredited Social Health Activists (ASHAs) will receive enhanced remuneration, addressing growing demands for better pay.

Introduction

- The Pradhan Mantri Annadata Aay SanraksHan Abhiyan (PM-AASHA) is a flagship initiative launched by the Government of India in September 2018 to ensure that farmers get fair prices for their produce and are protected from market fluctuations.

- The scheme is focused on enhancing farmer incomes and ensuring the government’s commitment to doubling farmers’ income by 2022 (a target proposed earlier by the government).

Origin

- The Pradhan Mantri Annadata Aay SanraksHan Abhiyan (PM-AASHA) was launched in September 2018.

- It is a central sector scheme of the Ministry of Agriculture & Farmers Welfare.

Objective of PM-AASHA

- The primary goal of PM-AASHA is to provide remunerative prices to farmers for their produce and ensure they are safeguarded against distress sales.

- It aims to cover major agricultural crops and ensure that Minimum Support Prices (MSP) are accessible to farmers, thus protecting them from market volatility.

6. Bharti Airtel Alliance with SpaceX’s Starlink

Context:

Bharti Airtel announced a distribution agreement with SpaceX’s Starlink, thus enabling the operator to sell Starlink services in India. The event symbolises a great breakthrough for the satellite Internet firm of Elon Musk in the Indian market.

What is SpacesX’s Starlink?

Starlink is a satellite internet constellation operated by Starlink Services, LLC, an international telecommunications provider that is a wholly owned subsidiary of American aerospace company SpaceX, providing coverage to over 100 countries and territories. It also aims to provide global mobile broadband. Starlink has been instrumental to SpaceX’s growth

General Information

- Operator: Starlink Services, LLC (a subsidiary of SpaceX)

- Type: Satellite-based internet service provider

- Coverage: Over 100 countries and territories

- Goal: Global mobile broadband & high-speed internet in remote areas

Service Offerings

- Residential & Business Internet: High-speed broadband with speeds up to 250 Mbps

- Mobile & Maritime Services: Internet access for RVs, ships, and aircraft

- Government & Defense: Used for military and emergency communications in war zones and disaster-struck areas

- Enterprise Solutions: High-speed, low-latency internet for businesses in remote locations

Key Highlights

- Regulatory Approvals Needed

- Starlink needs to secure clearance from the Department of Telecommunications (DoT) and the Ministry of Home Affairs before it can commence its services.

- Cooperation Scope

- Airtel and SpaceX would look at, and possibly pursue sale through Airtel retail:

- Starlink equipment

- Starlink services to enterprises through Airtel

- Connection for communities, schools, and health centers in rural areas.

Once regulatory approvals are in place, this deal could change the face of Internet connectivity in India, especially the rural and underserved areas.

Source: BS

7. PM Surya Ghar Scheme

PM Surya Ghar Muft Bijli Yojana has installed 10.09 lakh rooftop solar system since its launch in February 2024. The Ministry of New and Renewable Energy (MNRE) has received 47.3 lakh applications so far, the government said.

PM Surya Ghar: Muft Bijli Yojana

The Indian government launched the PM Surya Ghar: Muft Bijli Yojana, seeking to enhance the solar rooftop capacity and empower the residential households with the ability to generate their electricity. The program is to be implemented by a National programme Implementation Agency and State Implementation Agencies.

- Launch Date

- 29th February, 2024

- Budget Allocated

- Rs 75,021 crore.

- Ministry

- Ministry of New and Renewable Energy (MNRE)

- Features

- Subsidies 60% of solar unit cost, if the systems capacity is within 2kW.

- 40% subsidy on additional system cost for systems between 2 to 3kW capacity.

- Capacity capped at 3kW.

- Eligibility

- Indian citizens, suitable-roofing houses, valid electricity connection, no other solar panel subsidies.

Banking/Finance

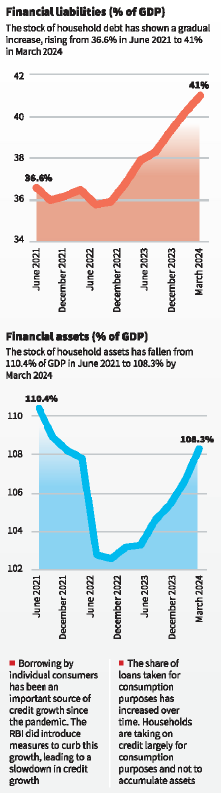

1. Household Debt in India

Context:

The Financial Stability Report (FSR) 2024 released by the Reserve Bank of India (RBI) increasingly expresses concern over household debt and rising consumption loans. The household debt to GDP ratio of India is quite low in comparison with most emerging economies, yet it is steadily increasing from 36.6% in June 2021 to 42.9% in June 2024.

Shift from Asset Creation to Consumption Borrowing

- On one hand, household borrowing is increasing, but on the other hand, household assets are on the decline (110.4% of GDP in 2021→108.3% in 2024).

- This means that most of the borrowing is for consumption rather than asset creation (homes, cars, education, etc.).

- While the RBI states that borrowers are getting healthier, the rising consumption loans might signal weakness in the macroeconomy.

Is Borrowing Becoming Healthier?

- The increase in debt is driven by more borrowers, not increased indebtedness per borrower.

- Sub prime borrowing has declined, while two thirds are now prime or super prime borrowers.

- Super prime borrowers use loans primarily for asset acquisitions, whereas sub prime borrowers are increasingly using loans for consumption.

- Since September 2023, credit control measures introduced by the RBI have had the effect of tightening borrowing among sub prime borrowers.

Growing Concern Over Consumption Loans

- Prime Borrowers

- 64% of their loans are for asset utilization.

- Sub prime borrowers

- Almost half of their loans are taken for consumption purposes.

- Low income households (whose income is <₹5 lakh/year) usually incur borrowings through credit cards and unsecured loans, while rich households borrow for the purchase of houses.

- Delinquencies in personal loans and credit cards rose in September 2024, which indicates financial stress is rising.

- If most of the borrowers usually borrow multiple loans, thus a default on a small loan (credit card debt, etc.) can trigger defaults on bigger loans (housing loans, etc.).

Macroeconomic Risks of Rising Consumer Debt

What’s Driving the Surge?

- Economic Insecurity Post Pandemic: Because of income instability, households are borrowing against consumption, which points to economic weakness.

- Easier Credit Accessibility: Financial innovations may be ensuring that lower income households are taking unsustainable debt.

- Regardless of the cause, more debt for consumption are threats to the stability of economy:

- Low income households have a higher income multiplier, which means they spend more on immediate consumption, thereby stimulating the economy.

- This is not good news because if they are heavily indebted, more of their income will go towards debt repayments, reducing consumption and subsequent economic growth.

- Tax cuts may have limited impact if household debt remains in high territory.

Key Policy Recommendations

- Strengthen credit regulations to prevent excessive debt.

- Encourage asset-based borrowing for financial stability.

Enhance financial literacy programs to help borrowers manage debt. - The RBI’s measures have slowed risky borrowing, but policymakers must remain vigilant about rising consumer debt and its broader economic impact.

2. Alternative Investment Funds (AIFs)

Context:

The new SEBI whole time member, Ananth Narayan, calls for the financial sector to develop a trust based relationship with regulators and to maintain absolute transparency. At a CII event, he spoke about self regulation and proactive reporting of malpractices, especially within the Alternative Investment Funds (AIFs) sector.

- Misuse by Alternative Investment Funds (AIF) faces regulatory concerns

- SEBI has acted against AIF structures set up to evade the regulations.

- Certain funds were reported to have been utilized for bypassing the NPA (Non Performing Asset) recognition norms and thus threatening financial stability.

- The greater reprobation for SEBI came from internal reports that did not flag any violation pertaining to the industry as a whole.

What Are Alternative Investment Funds (AIFs)?

Alternative Investment Funds (AIFs) are privately pooled investment vehicles that differ from traditional investment options such as stocks and mutual funds. These funds are typically preferred by High-Net-Worth Individuals (HNIs) and institutional investors due to the high capital requirement.

AIFs operate under the SEBI (Alternative Investment Funds) Regulations, 2012 and can be structured as a company, Limited Liability Partnership (LLP), trust, or other legal entities.

Types of AIFs in India

SEBI classifies AIFs into three categories based on their investment objectives:

Category 1: Growth-Oriented and Impact Investments

These funds primarily invest in start-ups, SMEs, and socially responsible businesses.

- Venture Capital Funds (VCFs)

- Provide financing to new-age startups with high growth potential.

- Suitable for investors with a high-risk, high-return mindset.

- Angel Funds

- Invest in early-stage start-ups that lack access to venture capital.

- Minimum investment per angel investor: ₹25 lakh.

- Infrastructure Funds

- Focus on companies involved in railway, port, and urban development projects.

- Attract investors optimistic about India’s infrastructure growth.

- Social Venture Funds

- Invest in businesses with social impact objectives, such as healthcare and education.

- Offer philanthropic benefits while aiming for moderate returns.

Category 2: Private and Debt-Focused Investments

These funds invest in a range of private and debt instruments without leveraging.

- Private Equity (PE) Funds

- Invest in unlisted private companies with high growth potential.

- Typically have a lock-in period of 4-7 years.

- Debt Funds

- Primarily invest in debt securities of unlisted firms.

- Target companies with strong corporate governance but lower credit ratings.

- SEBI guidelines prohibit the use of funds for direct lending.

- Fund of Funds (FoFs)

- Invest in other AIFs rather than directly into securities.

- Suitable for investors seeking diversified exposure.

Category 3: Market-Driven and High-Risk Investments

These funds employ aggressive strategies and often invest in listed securities.

- Private Investment in Public Equity (PIPE) Funds

- Acquire publicly traded shares at discounted rates.

- Less regulatory burden than traditional secondary issues.

- Hedge Funds

- Invest in both domestic and global equity & debt markets.

- Use complex strategies like derivatives and leverage for high returns.

- Typically charge high fees (e.g., 2% management fee + 20% of profits).

Who Can Invest in AIFs?

AIFs cater to sophisticated investors with substantial capital.

- Eligible investors: Resident Indians, NRIs, and foreign nationals.

- Minimum investment: ₹1 crore (₹25 lakh for fund managers, employees, and directors).

- Lock-in period: Minimum 3 years.

- Investor cap per scheme: Maximum 1,000 investors (except Angel Funds, which allow up to 49).

Benefits of Investing in AIFs

- High Return Potential – AIFs enable fund managers to deploy strategic, high-growth investment models.

- Lower Volatility – These funds are less affected by stock market fluctuations, making them more stable.

- Diversification – AIFs provide exposure to alternative assets, reducing risk during market downturns.

AIFs present a lucrative investment opportunity for HNIs seeking higher returns with controlled risk. However, investors should conduct thorough research and align their financial goals with the right AIF category before investing.

3. IndusInd Bank Stock Crashes 27%

Context:

IndusInd Bank (IIB) stock slipped 27%, at the NSE, to ₹656.80 on March 11 2025, a day after the bank flagged an adverse impact on its net worth due to a discrepancy on accounting for derivatives holdings. IIB estimated the impact to be at 2.35% of the bank’s net worth.

Key Highlights

- Stock Plunge

- IndusInd Bank’s shares crashed by 27%, which meant market value being wiped away worth ₹19,000 crores.

- Regulatory Action

- The RBI asked the bank to disclose its estimated losses, leading to panic among investors.

- Accounting Violation

- There are delays in rectifying discrepancies associated with derivatives. That raised concerns.

- Estimate of Losses

- The bank recorded a 2.35% hit to its net worth as of December 2024 due to derivative losses.

CEO’s Tenure and RBI’s Decision

- Extension of One Year

- An extension of only one year was given to CEO Sumant Kathpalia by RBI instead of the three years recommended by the board.

- In Expectation of New Leadership

- According to sources, RBI wants the bank to submit at least two candidates for CEO succession.

- End of Kathpalia’s Tenure

- March 23, 2026.

Impact on Investor and Market

- Delayed Classifying Loss

- Criticism was over the bank’s eventual classification to a derivative loss.

- Market Downgrades

- Downgrade notices have also flooded in for IndusInd Bank, thus tightening the pressure on its stock.

Next Steps

- Governance Practices

- RBI might review further governmental practices at IndusInd Bank.

- Stock Volatility

- Volatile conditions are cautionary for the investors amidst different political and risk management concerns.

- Findings of Audit by PwC India

- Findings should come before April 2025; results will be crucial for investor sentiment.

Source: BS

4. Unified Lending Interface (ULI)

Context:

Bengaluru-based Namma Yatri auto drivers are participating in pilot projects for small-ticket, unsecured loans on the Unified Lending Interface (ULI). UPI mandates are being explored for automated monthly or bi-monthly collections, ensuring better credit behavior.

About the Unified Lending Interface (ULI)

- Seamless Credit Underwriting

- ULI integrates financial and non-financial data, making lending processes frictionless.

- Standardized APIs

- A “plug-and-play” model allows easy access to borrower data from sources like land records, GSTN, satellite imagery, and other databases.

- Developed by RBI

- Conceptualized by the Reserve Bank of India (RBI) and developed by the Reserve Bank Innovation Hub (RBIH).

Current Progress & Future Potential

- 0.6 million loans worth ₹27,000 crore disbursed via ULI as of December 2024.

- 36 lenders, including banks and NBFCs, onboarded.

- Dynamic Recollection Models

- Exploring variable repayment plans based on weekly/monthly earnings of borrowers.

Industry Impact & Future Outlook

- Transformation of Lending

- Former RBI Governor Shaktikanta Das compared ULI’s potential impact on credit to how UPI revolutionized digital payments.

- Financial Inclusion

- ULI enables faster loan approvals with minimal documentation, making borrowing more accessible and personalized.

Source: BS

5. IRDAI Allows Bond Forwards for Insurers

Context:

Insurance companies can now trade in bond forwards for hedging interest rate risks, as per a new IRDAI circular. Move aligns with the Reserve Bank of India’s (RBI) directive, expanding hedging options beyond forward-rate agreements (FRAs), interest rate swaps, and exchange-traded futures.

Bond Forwards vs. Forward-Rate Agreements (FRAs)

| Feature | Bond Forwards | Forward-Rate Agreements (FRAs) |

|---|---|---|

| Settlement Type | Actual bond delivery at maturity | Cash settlement based on yield difference |

| Market Availability Risk | Lower risk (bond is pre-contracted) | Higher risk (insurers must procure bond separately) |

| Preferred By Insurers? | Yes, due to reduced settlement risks | Becoming less attractive |

Industry Reactions

- Experts believe bond forwards could replace FRAs, making them redundant for insurers.

- Banks’ eligibility for FRAs in the future remains uncertain.

- Insurers can only take long positions in bond forwards and must report transactions quarterly.

Restrictions

- Bond forwards not permitted for unit-linked insurance plans (ULIPs).

Implications for the Insurance Sector

- More efficient risk management: Direct bond delivery ensures better liquidity planning.

- Regulatory compliance: Quarterly reporting increases transparency.

- Potential market shifts: Increased adoption of bond forwards may lead to phasing out of FRAs.

Source: BS

6. SEBI Reduces Rights Issue Processing Time

Context:

Markets regulator Sebi reduced the processing time for a rights issue of equity shares to 23 days in a bid to make it a preferred route of fundraising.

- Faster Rights Issue Timeline

- Reduced from an average of 317 days to just 23 working days.

- Faster than preferential allotment, which takes 40 working days.

- Ease of Doing Business

- No need to file a draft offer with SEBI for its observation.

- Instead, filing will be done with stock exchanges for in-principle approval.

- Flexibility in Allotment

- Companies now have more freedom to allot shares to specific investors in a rights issue.

Impact on Fundraising

- Makes rights issues a more attractive route for companies looking to raise capital.

- Enhances market efficiency by streamlining regulatory processes.

- Encourages more listed entities to opt for rights issues over other fundraising options.

7. RBI Investigates Unhedged Forex Liabilities in Banking System

Context:

RBI is assessing whether lapses in unhedged forex liabilities extend beyond IndusInd Bank to the broader banking system.

- Banks asked to provide details on:

- Foreign currency liabilities (including FCBR(B) deposits and foreign currency bonds).

- Hedging effectiveness and positions in forex derivative markets.

- Quarterly testing of hedging strategies for compliance.

- Regulator seeks assurances that banks adhere to hedging guidelines in both letter and spirit.

IndusInd Bank’s Net Worth Erosion

- Internal review uncovered discrepancies in derivative portfolio, potentially impacting 2.35% of net worth (~₹1,600 crore loss in Q4 FY24).

- Issues stemmed from internal trades using low-liquidity forex instruments:

- 3 to 6-year yen borrowings and 8 to 10-year dollar borrowings.

- Instead of hedging directly with external counterparties, the bank used internal desks.

- Discrepancies arose due to differences between swap valuations and mark-to-market pricing.

- Review triggered by an RBI circular (Sept 2023), prompting scrutiny of derivative practices.

Potential Industry-Wide Implications

- If systemic gaps are found, RBI may tighten forex hedging regulations.

- Greater scrutiny on risk management practices in banks’ derivative portfolios.

- Banks may face higher compliance costs and stricter monitoring.

RBI’s investigation could uncover systemic risks related to unhedged forex liabilities. IndusInd Bank’s case highlights risks of internal hedging mechanisms without external counterparties. Tighter oversight and possible regulatory interventions could reshape forex risk management practices in the banking sector.

8. The Credit-Deposit (CD) Ratio

Context:

HDFC Bank repurchased nearly ₹7,000 crore worth of its high-cost bonds in the last six months. Move aimed at lowering its credit-deposit (CD) ratio, which surged to 110% post-merger with Housing Development Finance Corp (HDFC) in July 2023. Bond buyback represents a small fraction of HDFC Bank’s ₹4 lakh crore outstanding borrowings (March 2024).

The Credit-Deposit (CD) Ratio

The Credit-Deposit (CD) ratio measures the proportion of a bank’s total deposits that have been disbursed as loans, reflecting how efficiently a bank uses its deposits to generate income and indicating its liquidity and credit risk.

The credit-deposit ratio (CD ratio) is a measure of how much a bank lends out of its total deposits. It’s calculated by dividing the total loans by the total deposits and multiplying by 100.

What does the CD ratio indicate?

- High CD ratioIndicates that the bank is lending out a large portion of its deposits, which could be due to high demand for loans

- Low CD ratioIndicates that the bank is lending out a smaller portion of its deposits, which could be due to low demand for loans

How does the CD ratio affect the bank?

- A high CD ratio could indicate that the bank may not be able to mobilize enough deposits to meet the demand for credit

- A low CD ratio could indicate that the bank has conservative lending practices

How does the Reserve Bank of India (RBI) encourage banks?

- The RBI has encouraged banks to adopt innovative strategies to get more funds and narrow the gap between credit and deposit growth

What is an ideal CD ratio?

Some experts say that an ideal CD ratio would be between 65% and 75%

- Definition:The CD ratio is calculated by dividing the total loans outstanding by the total deposits, expressed as a percentage.

- Significance:

- Bank Health: It’s a crucial indicator of a bank’s liquidity and ability to cover loan losses and withdrawals.

- Liquidity & Risk: A high CD ratio might mean a bank is lending a significant portion of its deposits, potentially increasing liquidity and credit risks.

- Profitability: A low CD ratio may suggest the bank is not fully utilizing its resources, potentially impacting profitability.

- Factors Influencing the Ratio:

- Credit Demand: Strong demand for loans can raise the CD ratio.

- Deposit Mobilization: Higher deposit growth can lower the CD ratio, especially if lending doesn’t keep pace.

- Economic Conditions: Booms or recessions can affect both loan demand and deposit growth, influencing the CD ratio.

- Example: A bank with a CD ratio of 75% means that three-fourths of its deposits have been used for lending.

Economy

1. India Plans New Export Promotion Schemes to Counter US Tariffs

Context:

New support measures are being finalised by the government for exporters against proposed US tariffs and reciprocal duties. The schemes will be finalised within a month’s period under the Rs 2,250 crore Export Promotion Mission announced in the Budget.

Objectives of the Schemes

- Support for Small Exporters: Special focus on MSMEs.

- Collateral Free Loans: Access to finance has become easier for exporters.

- Compliance Assistance: Exporters shall be assisted in compliance with non tariff regulations of developed countries.

- Alternative Financing Instruments: Encouraging cross border factoring.

- Support on Risky Markets: Aid for exports to volatile areas.

Concerns Among Exporters

- Orders On Hold: Buyers are waiting and watching due to uncertainty over the US tariffs.

- Timid Procurement: Export volumes have fallen, with buyers reluctant to put down their commitment.

- Effect of Tariff in the US: This has set in motion US tariffs on steel, aluminium, and other goods coming from March 12.

Global Trade Dynamics

- Some Exporters Benefit from China Tariffs:

- Indian exporters in labor intensive sectors have benefited from US tariffs on China.

- But it is clear, too early to put a number on benefits.

2. GDP Revisions in India

NSO’s Statistical Reform: Reducing GDP Revisions

- Change Implemented:

- The National Statistical Office (NSO) reduced GDP estimation cycles from six to five iterations.

- The final GDP estimate is now available in two years instead of three.

- Objective:

- Streamline economic data reporting.

- Improve timeliness of GDP estimates.

Persistent Challenges in GDP Estimations

- Significant Variations in GDP Estimates:

- Final GDP figures differ sharply from First Advance Estimates (FAE).

- Example:

- 2020-21 (COVID year): Final GDP grew 1.9 percentage points higher than initial estimates.

- 2016-17 (Demonetization year): GDP revised up from 7.1% to 8.3%.

- 2018-19 (Election year): Revised down from 7.2% to 6.5%.

- Possible Causes of Divergences:

- Delayed data updates from government agencies and state-owned enterprises.

- Overestimation in weak economic years and underestimation in stronger years.

- Political considerations—FAEs often appear more optimistic before elections.

Latest GDP Data (2023-24 & 2024-25)

- 2023-24

- First Revised Estimate (FRE) pegged GDP growth at 9.2%, up from 7.3% in the FAE (a 1.9 percentage point increase).

- Manufacturing sector growth doubled, alongside higher government and private consumption expenditures.

- 2024-25

- Second Advance Estimate revised GDP up from 6.4% to 6.5%.

- Fiscal deficit revised downward, improving government’s fiscal consolidation performance.

Implications of Large GDP Revisions

- Impact on Fiscal Deficit

- Fiscal deficit for 2023-24 revised from 5.6% to 5.5% of GDP.

- 2024-25 target lowered to 4.7%, improving fiscal outlook.

- Political and Economic Consequences

- Modi government’s second-term GDP growth now looks stronger at 5% vs. earlier 4.6%.

- Raises concerns about data reliability and transparency.

The Need for Further Statistical Reforms

- Reduce the extent of GDP revisions.

- Shorten the timeline for final GDP estimates (align with global best practices).

- Improve data collection efficiency from government agencies and enterprises.

- Enhance transparency to prevent political influence on economic data.

While recent reforms have improved GDP reporting timelines, large and frequent revisions remain a concern. Strengthening statistical integrity is crucial for credible economic policymaking and investor confidence.

Agriculture

1. Turning Waste into Wealth

Context:

In the 17th century, German alchemist Hennig Brand believed urine contained gold. While he was mistaken about the metal, his experiments led to the discovery of phosphorus, an essential nutrient for plants.

Today, scientists refer to urine as “liquid gold” because it contains nitrogen, phosphorus, and potassium, the key ingredients of commercial fertilizers. However, the challenge has always been efficiently extracting these nutrients from wastewater.

A recent study published in Nature Catalysis has introduced a revolutionary technique to address this issue. Researchers have developed an electrochemical method to convert urea—a nitrogen-rich compound in urine—into percarbamide, a crystalline peroxide derivative with practical applications.

This innovation achieves two major goals:

- Sustainable urine treatment in urban wastewater

- Efficient recovery of nitrogen for use as fertilizer

The Science Behind Urea Extraction: Why Is Urea Important?

Humans consume nitrogen through food, convert it into urea, and excrete it via urine. In theory, if we could extract urea efficiently, we could recycle it as a natural fertilizer, completing the nitrogen cycle. However, extracting pure urea from urine has been a longstanding challenge due to interference from salts and other compounds.

How Does the New Process Work?

The research team overcame this challenge by leveraging hydrogen bonding properties in urea.

- Urea reacts with hydrogen peroxide to form percarbamide, a white crystalline solid that can be easily separated from urine.

- Percarbamide has two major advantages:

- It releases active oxygen, making it valuable for chemical reactions.

- It facilitates the recovery of urea from urine with high purity.

- The researchers developed a graphitic carbon-based catalyst that enables an electrochemical process to convert urine into percarbamide with nearly 100% purity.

A Win-Win Discovery

Initially, the researchers were focused on stabilizing hydrogen peroxide in liquid form. They then realized that urea could be used within urine itself, solving multiple challenges at once.

The Role of Activated Graphitic Carbon

The team designed a specialized catalyst to enhance two chemical pathways:

- Pathway I: Urea reacts directly with hydrogen peroxide.

- Pathway II: Urea binds to a reactive hydroperoxyl intermediate before forming percarbamide.

This approach allows efficient extraction of percarbamide while simultaneously treating wastewater.

Potential Impact and Future Applications

- Sustainable Fertilizer Production: Percarbamide combines the nitrogen benefits of urea with the oxidative power of hydrogen peroxide, making it ideal for slow-release fertilizers.

- Eco-Friendly Wastewater Treatment: This method could transform how urban wastewater is managed, turning waste into a resource.

- Resource Recovery and Circular Economy: The process aligns with global efforts toward sustainable recycling and nitrogen cycle restoration.

Lead researcher Xinjian Shi emphasized the significance of this discovery:

This breakthrough technology turns human waste into a valuable resource, paving the way for sustainable agriculture and innovative wastewater management. By harnessing natural cycles, scientists are closing the loop on nitrogen use, making our world a little greener—one flush at a time.

Source: TH

2. MSP: Balancing Farmer Support & Market Efficiency

The Role of MSP in India’s Agriculture

- MSP ensures food security and protects farmers from price fluctuations.

- However, it leads to crop overproduction, environmental concerns, and low market diversification.

- Some farm groups demand a legally enforced MSP, but this could disrupt market price discovery.

Challenges with MSP Implementation

- Limited Outreach

- Only 15% of paddy farmers and 9.6% of wheat farmers benefit from MSP procurement.

- Mostly large farmers benefit, while small & marginal farmers (producing 53.6% of paddy and 45% of wheat) face low participation.

- High Fiscal Cost

- MSP leads to excess government spending on procurement & storage.

- Environmental Issues

- Overproduction of water-intensive crops (e.g., paddy & wheat) in water-stressed regions.

- Market Distortions

- Price-deficiency payments (compensating farmers for MSP-market price gaps) could lead to manipulated market prices, increasing fiscal pressure.

- Example: Madhya Pradesh’s Bhavantar Bhugtan Yojana was abandoned after one season due to inefficiencies.

The Way Forward: Strengthening Market Mechanisms

- Invest in Infrastructure: Build efficient value chains to reduce price gaps between farmers and consumers.

- Encourage Private Procurement: Reduce dependence on government intervention.

- Promote Crop Diversification: Shift focus from MSP-dependent crops to high-value and climate-resilient crops.

- Expand Agri-Derivatives Markets: Help farmers hedge against price risks.

- Enhance Agri-Research & Technology: Improve farm productivity beyond MSP-backed crops.

India needs competitive agricultural markets where farmers earn a larger share of consumer spending. MSP is not a permanent solution; alternative income support & market-driven policies are required. Growth in agriculture is driven by non-MSP crops—aligning production with changing demand patterns is key.

Source: BS

3. Pradhan Mantri Matsya Kisan Samridhi Sah-Yojana (PM-MKSSY) Launched Under PMMSY

Key Highlights

- New Central Sector Sub-scheme under Pradhan Mantri Matsya Sampada Yojana (PMMSY).

- Implemented for four years (FY 2023-24 to FY 2026-27).

- Total outlay: ₹6,000 crore (₹3,000 crore public finance + ₹3,000 crore private investment).

Major Components of PM-MKSSY

- Component 1-A: Formalization of fisheries sector & access to Government programs.

- Component 1-B: Promotion of aquaculture insurance.

- Component 2: Support for fisheries microenterprises to enhance value chain efficiency.

- Component 3: Expansion of fish and fishery product safety & quality assurance systems.

- Component 4: Project management, monitoring, and reporting.

Launch of National Fisheries Digital Platform (NFDP)

- Launched on 11th September 2024 under PM-MKSSY.

- Aims to formalize the Indian fisheries sector by creating a digital identity and database.

- Key Features:

- One-stop solution for institutional credit access.

- Strengthening of fisheries cooperatives.

- Incentives for aquaculture insurance.

- Performance-based incentives for farmers.

- Fisheries traceability systems.

- Training and capacity building.

Aquaculture Insurance Under PM-MKSSY (Component 1-B)

Types of Insurance

- Basic Insurance

- Covers yield losses due to natural calamities, pollution, riots, malicious acts, farm structural damage, etc.

- Comprehensive Insurance

- Covers all Basic Insurance perils + losses due to diseases.

Incentive Structure

- 40% of premium paid with a ceiling of ₹25,000 per hectare or ₹1 lakh per farmer (for 4 hectares WSA).

- Intensive Aquaculture Systems (RAS, bio-floc, cage culture, raceways, etc.): 40% incentive with a ceiling of ₹1 lakh per farmer (for 1,800 m³ system).

- Additional 10% incentive for SC/ST and women beneficiaries.

Current Status of NFDP Implementation

- Aquaculture module is live on the NFDP portal.

- 262 lead applications submitted, covering 710 hectares of farms.

- Applications forwarded to insurance companies via the portal.

Official Announcement

- Union Minister of State, Shri George Kurian, provided this information in Rajya Sabha on 12th March 2025.

PM-MKSSY aims to boost the fisheries sector through digitalization, insurance incentives, and value chain improvements. The NFDP portal will play a crucial role in formalizing the sector and improving financial accessibility. The success of aquaculture insurance implementation will determine the effectiveness of risk mitigation for fish farmers.

Source: PIB

Facts To Remember

1. PM Modi Honoured with Mauritius’ Highest Award

Prime Minister Narendra Modi has been conferred Mauritius’ highest honour, the Grand Commander of the Order of the Star and Key of the Indian Ocean, as announced by Mauritian PM Navinchandra Ramgoolam on Tuesday.

2. EU chief calls for defence ‘surge’, says the ‘time of illusions’ is over

EU chief Ursula von der Leyen called for a “surge” in European defence spending, as the 27-nation bloc faces an aggressive Russia and faltering U.S. support.

3. Ex-Philippine President held for ‘crimes against humanity’

Former Philippines President Rodrigo Duterte was arrested on Tuesday in Manila by police acting on an International Criminal Court warrant tied to his deadly war on drugs.

4. RBI ex dy guv M K Jain to join RIL as advisor

MK Jain, former deputy governorr of the Reserve Bank of India (RBI), is set to join Reliance Industries (RIL) as advisor.

5. Abhinav sets a new heptathlon record

Kerala’s Abhinav Sreeram broke the boys’ heptathlon record in the 20th National youth athletics championships at the Patliputra Sports Complex in Patna.

6. India, Qatar sign MoU for economic cooperation

India and Qatar have signed an agreement to promote and develop mutual collaboration in publicprivate partnership framework and investment, use of financing tools, as well as economic policies, the finance ministry said.

7. Fitch upgrades viability rating for PNB, Union Bank

Global rating agency Fitch upgraded the viability ratings (VR) for two public sector lenders, Punjab National Bank and Union Bank of India, from “b+” to “bb-”, on the back of improvement in their risk profile. It also affirmed longterm issuer rating of “BBB-” for New Delhibased PNB and Mumbaibased Union Bank. Fitch said that there isa supportive operating environment for Indian lenders in the country, which has strong mediumterm growth potential witha large and diversified economy.