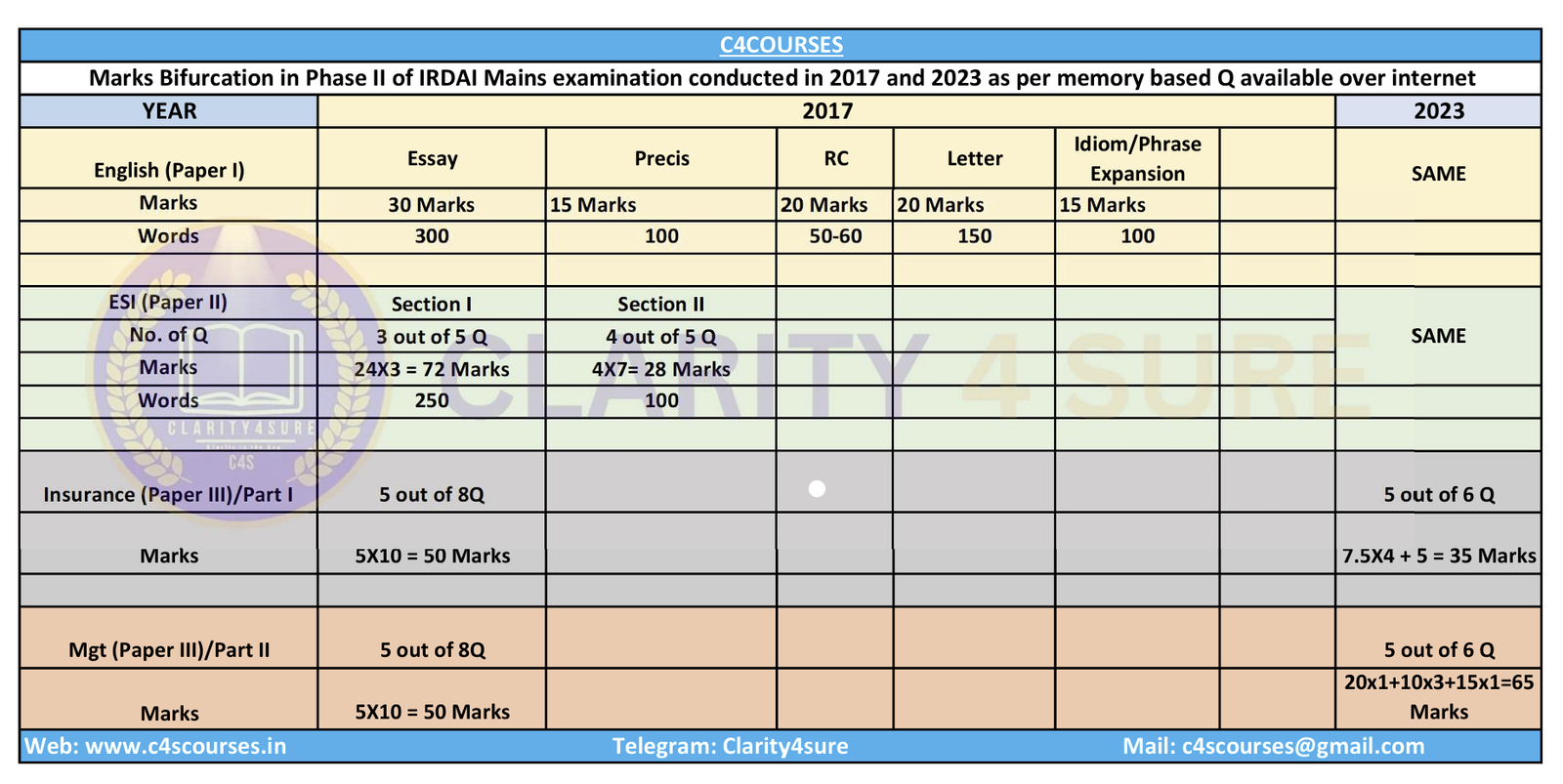

PHASE II MAINS Analysis IRDAI 2017

a) Recently, the Government of India highlighted the success of Direct benefit scheme. Discuss the main objectives of this scheme and the key enabler – JAM for an efficacious implementation of DBT.

b) Evaluate the social and economic impact of the Make in India movement. What are the challenges faced under this movement?

c) What is GST? Compare with earlier tax regime w.r.t any two of the following stakeholders

- Government

- Tax authorities

- Traders

- Corporates

- Customers.

d) Atal Pension Yojana scheme was designed to encourage savings for retirement. Discuss in detail the key features of the Atal Pension Yojana and the role pensions play in an individual’s llfe.

e) What tax benefits do different pension and insurance schemes offer? How can these benefits enhance financial planning?

Sub-section – Paper II – Economic and Social Issues Impacting Insurance – Part 2

Attempt any 4 questions. Each question carries 7 marks. Write answer in 80 Words

a) Explain in brief the major highlights and objectives of Pradhan Mantri Fasal Bima Yojana (PMFBY)

b) Inflation is not good for the country; how can the monetary policy decision can tackle the inflationary period?

c) What are the components of household savings and discuss the contribution of insurance in household savings?

d) What is the role of small finance banks in financial inclusion?

e) Explain the role of marine insurance in boosting trade and commerce.

Paper III – Insurance and Management

Sub-section – Paper III – Insurance and Management – Part 1 – Insurance

Attempt any 5 questions. Each question carries 10 marks. Write answer in 100 Words

a) What is reinsurance and what is its importance?

b) What is concentration risk and how to manage and mitigate it?

c) Discuss insurance penetration in India and compare India’s growth with US and China for life and non-life insurance penetration from 2013-2015.

d) Role of brokers and banks in insurance as intermediaries.

e) What is insurance density and does high insurance density mean high insurance inclusion?

f) What is insurable interest?

g) What is co-insurance and Comment on co-insurance from a risk management point of view?

Sub-section – Paper III – Insurance and Management – Part 2 – Management

Attempt any 5 questions. Each question carries 10 marks. Write answer in 100 Words

a) What is a leadership strategy and explain various styles of leadership?

b) Explain the process of effective decision making?

c) What is the importance of digital Marketing?

d) What is the importance of Business ethics?

e) Explain team building process.

f) Case Study based Question on Empathy and Body Language:

A manager at a large retail store observed an increase in customer complaints regarding interactions with staff members. To address this issue, a workshop focusing on empathy and effective body language was conducted to improve customer service.

During the workshop, a role-play scenario was enacted. An employee named Sarah was tasked with handling a customer named John, who was upset about a defective product he had purchased. Initially, Sarah approached John with her arms crossed and avoided eye contact, which seemed to escalate John’s frustration. After a brief pause, Sarah recalled her training. She uncrossed her arms, maintained eye contact, and spoke in a calm voice to acknowledge John’s concerns. She empathized with his situation by stating, “I understand how upsetting it can be to receive a product that doesn’t meet your expectations.” Sarah’s adjustment in her approach visibly calmed John, and they proceeded to resolve the issue amicably.

Questions:

- Analyze how Sarah’s initial body language may have impacted John’s perception and behavior. What changes did she make to improve the interaction?

- Discuss the role of empathy in customer service. How did Sarah demonstrate empathy, and why is it effective in resolving customer complaints?

PHASE II MAINS Analysis IRDAI 2023

Paper II – Economic and Social Issues Impacting Insurance

Sub-section – Paper II – Economic and Social Issues Impacting Insurance – Part 1

Attempt any 3 questions. Each question carries 24 marks. Write answer in 250 Words

- With reference to Pradhan Mantri Fasal Bima Yojana, highlight the main objectives and issues related to this scheme.’

- The Ayushman Bharat scheme was established to provide affordable and accessible healthcare to families, discuss the benefits and challenges faced under this scheme.

- Suppose an insurance company A is a leader in providing life and health insurance products in country X. Country X has recently experienced a significant decline in the young population, that has impacted the insurance company A. Discuss the impact of various age structures on the insurance industry.

- The COVID-19 pandemic significantly disrupted global economies and all industries, including insurance. Explain the positive and negative impact of COVID-19 on the Insurance sector.

- Discuss what is the principle of utmost good faith and the principle of indemnity.

Sub-section – Paper II – Economic and Social Issues Impacting Insurance – Part 2

Attempt any 4 questions. Each question carries 7 marks. Write answer in 80 Words

- Explain the functions of underwriting in insurance.

- Outline the significance of FDI (Foreign Direct Investment) in the insurance sector.

- Bima Sugam is an online marketplace. Briefly explain how customers can benefit from this platform.

- Describe the roles of banks and brokers in the distribution of insurance.

Read the following data and answer the questions below.

“As part of a strategic review, an insurance company conducted an analysis of its operational segments to identify risk factors and profitability potential. The following data was taken from the annual performance reports of four distinct segments within the company:

Segment A: This segment has experienced a high frequency of claims over the past year, but the severity of each claim is relatively low. It covers consumer electronics, which has a high turnover rate but usually involves less costly individual claims.

Segment B: Characterized by a low frequency of claims but high severity when they occur. This segment includes commercial real estate insurance, where incidents are rare but can be very costly due to the high value of the insured assets.

Segment C: Exhibits moderate claim frequency and severity, with significant premium growth. This segment includes health insurance, attracting a diverse range of policyholders, and contributing to balanced risk and growth in premiums.

Segment D: Reported low claim frequency and severity with stable premium rates. This stable segment primarily deals with life insurance for low-risk demographics such as young, healthy individuals without dependents.

Based on the provided data, answer the following questions to help determine the company’s strategic direction for the upcoming fiscal year: - Which of the segments are considered high-risk for the company? Justify your answer.

- Which segments have the highest profit potential for the company? Justify your answer.

Paper III – Insurance and Management

Sub-section – Paper III – Insurance and Management – Part 1 – Insurance (35 Marks)

- Impact of business cycle on insurance (7.5 Marks)

Answer the following questions (2-3) based on the data given in the table below: (10 marks)

Table 1: Expanded Performance Data for 15 Classes of Business Over 10 Years

Here’s the table formatted for clarity:

| Class of Business | Year 1 Premiums ($M) | Year 10 Premiums ($M) | Percentage Growth | Average Annual Growth (%) | Claims Settlement Ratio (%) | Net Profit/Loss Ratio (%) |

|---|---|---|---|---|---|---|

| Auto | 100 | 200 | 100% | 7.2% | 95% | 12% |

| Life | 150 | 300 | 100% | 7.2% | 90% | 15% |

| Health | 120 | 240 | 100% | 7.2% | 88% | 10% |

| Property | 80 | 160 | 100% | 7.2% | 93% | 8% |

| Casualty | 50 | 75 | 50% | 4.1% | 96% | 6% |

| Marine | 70 | 105 | 50% | 4.1% | 85% | 9% |

| Aviation | 200 | 300 | 50% | 4.1% | 80% | 18% |

| Liability | 60 | 90 | 50% | 4.1% | 92% | 5% |

| Reinsurance | 110 | 165 | 50% | 4.1% | 89% | 11% |

| Agricultural | 40 | 60 | 50% | 4.1% | 95% | 3% |

| Export Credit | 130 | 195 | 50% | 4.1% | 82% | 14% |

| Cyber | 90 | 135 | 50% | 4.1% | 87% | 7% |

| Fire | 100 | 150 | 50% | 4.1% | 90% | 4% |

| Travel | 110 | 165 | 50% | 4.1% | 85% | 10% |

| Pet | 95 | 142.5 | 50% | 4.1% | 93% | 2% |

Questions:

- Identify the top three best-performing classes of business based on the provided data. (5 marks)

- Analyze which of the class has the best financial effectiveness out of the classes identified as the top performer in Question 1 based on claims settlement and net profit/loss ratios. (5 marks)

- Read the below passage and answer the following questions (7.5 marks)

Passage:

Person A: I’ve been exploring various policies lately because I want to ensure my family is financially secure if something happens to me. The plan I’m considering offers a payout to my family in the event of my death, which would help cover living expenses and any debts.

Person B: That’s an important safeguard. I’ve been looking at a different type of plan—one that provides coverage for accidents. If I were to get injured and couldn’t work, this policy would cover my medical bills and even replace some of my income while I recover.

Person A: Exactly, it’s all about easing financial stress during difficult times. My plan offers long-term security with a lump sum payout, which is especially crucial since I have young kids.

Person B: Right, and my plan focuses more on immediate needs, protecting against unexpected events that could disrupt my daily life. It’s reassuring to have coverage for those short-term challenges.

Questions:

A. What is the type of insurance Person A is discussing? (2.5 marks)

B. Compare the insurance discussed by Person A with that mentioned by Person B. (5 marks)

- Discuss the role of insurance in mobilizing savings and facilitating financial intermediation. (7.5 marks)

- Discuss the key functions performed by insurers, focusing on product design, claims management, investment, and reinsurance, including relevant examples. (7.5 marks)

Sub-section – Paper III – Insurance and Management – Part 2 – Management (65 marks)

- Explain communication skills (20 marks)

- Write a short note on organizational change. (10 marks)

- A passage was given, you have to read it and answer 3 questions below it. (15 marks)

In a multinational corporation, effective communication is crucial for smooth operations across various global offices. This case study examines XYZ Corp, a leading technology company with offices in more than 30 countries. Despite having advanced communication tools, the company faces significant internal communication challenges.

For example, during the implementation of a new global policy, the U.S. headquarters sent out detailed emails and conducted video conferences to explain the changes. However, employees in the East Asian offices expressed confusion regarding the policy implementation. Feedback revealed issues like unsuitable timing for video conferences across different time zones and inaccurate translations that failed to convey the nuances of the new policy.

Moreover, the company’s heavy reliance on written communication posed difficulties for non-native English-speaking employees, who preferred more direct, verbal instructions. These communication barriers resulted in project delays and a decline in employee satisfaction.

Questions:

A. Identify and discuss the key communication barriers faced by XYZ Corp as described in the passage. (5 marks)

B. What strategies could XYZ Corp implement to overcome the communication challenges highlighted in the case study? (5 marks)

C. How could addressing communication barriers at XYZ Corp impact employee morale and productivity? (5 marks)

- Differentiate between personnel management and human resource management. (10 marks)

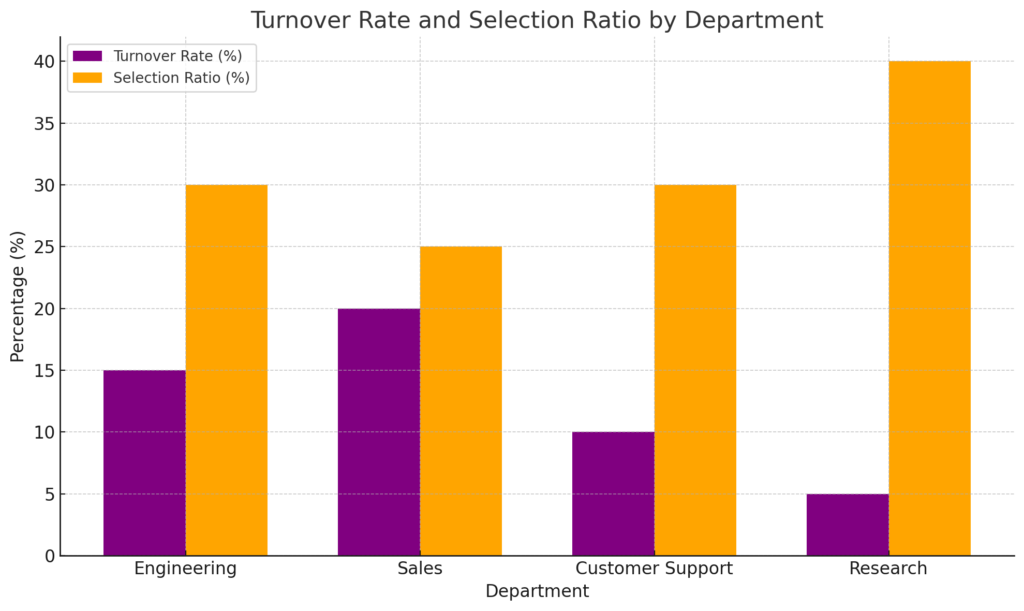

- Analyze the following graph and answer the questions below it: (10 marks)

Questions:

A. Given that 1,000 candidates applied to the Research department this year, use the selection ratio provided in the graph to calculate how many candidates were likely selected. Additionally, based on the selection ratios across departments, identify which department offers the lowest probability of selection for applicants.

B. The graph shows variations in employee departures across departments. Identify the department with the highest departures and propose strategies that managers could implement to enhance employee retention in that department

- Read the below passage and answer the following questions below it (10 marks)

At DEF Logistics, a rapidly growing logistics and supply chain management company, the effective use of core management processes—planning, organizing, staffing, directing, and controlling—is critical for maintaining operational efficiency and fostering growth. To stay competitive in a volatile market, the company recently undertook a strategic review to enhance the effectiveness of these processes.

The initiative began with a detailed planning phase, where strategic goals were redefined to emphasize technological integration and market expansion. During the organizing phase, DEF restructured its teams, forming specialized units focused on technology implementation and market research to better align with the new objectives.

In the staffing phase, the company ramped up recruitment efforts, hiring skilled professionals to lead these new initiatives. During the directing phase, management concentrated on clear communication of the new strategy and boosting employee motivation through targeted training and development programs.

Finally, in the controlling phase, DEF Logistics introduced new performance metrics to track progress toward its strategic goals. These metrics not only measured outcomes but also provided continuous feedback for ongoing improvements.

Questions:

A. How could enhancing the staffing process impact DEF Logistics’ ability to meet its new strategic goals? ( 5 marks)

B. What role might the controlling process play in sustaining improvements at DEF Logistics and how does it support the other management processes? (5 marks)