November 4, 2024

Table of content

- India’s manufacturing growth accelerates in October: PMI

- Deciphering the proposed changes in REIT and InvIT regulations

- RBI warns NBFCs against aggressive business growth, warns of action

- SEBI lens on IPO pricing as more firms tap market

- Revenue Impact: GST Revenue Trends

- Sharing of resources fishermen and the Palk Bay dispute

- Maharashtra’s experiment of using organic farming as tool to tackle agrarian crisis draws attention

- Strengthening the India link in the Indo-Pacific Economic Framework for Prosperity

- Tamarind Water and Buttermilk Saved Bandhavgarh Elephants

- Growth may Have Slipped in Rainy Q2 but Forecast for Fiscal is Sunny

- Centre Rejects Punjab Govt’s Stubble Funding Demand

- India’s manufacturing growth accelerates in October: PMI

Inflation pressures surged due to a three-month high in input costs, primarily attributed to freight, labour, and material costs, according to a survey.

India’s Manufacturing Activity Recovers in October

- Manufacturing activity in India’s priva1te sector recovered in October, breaking a three-month streak of deceleration.

- The HSBC India Manufacturing Purchasing Managers’ Index (PMI) inched up to 57.5 from 56.5 in the previous month.

- A reading of over 50 on the index indicates an expansion in activity.

- 400-odd factories surveyed by S&P Global Market Intelligence reported an acceleration in output growth in October.

- Fresh export orders rebounded in October, with firms reporting new deals from clients in Asia, Europe, Latin America, and the US.

- Production volumes increased, led by robust gains in consumer and investment goods categories.

- Inflation pressures increased as input costs rose at a three-month high pace.

- Business confidence is high due to expectations of continued strong consumer demand, new product releases, and sales pending approval.

2. Deciphering the proposed changes in REIT and InvIT regulations:

SEBI’s Consultation Paper on Regulations for Real Estate Investment Trusts and Infrastructure Investment Trusts

- SEBI proposed changes to regulations for ease of doing business and investor protection.

- Proposal to permit transfer of locked-in units among sponsor and sponsor groups of REITs and InvITs.

- Allows for more flexibility in regulations and parity with corporate regulations.

- Allows all categories of REITs and InvITs to hedge their exposures with interest rate derivatives, forward rate contracts, and interest rate swaps.

- Allows fixed deposits to be part of cash and cash equivalents when computing leverage of REITs, SM REITs, and InvITs.

- Expands the asset base that REITs can add to their portfolio due to overlap and confusion in the definition of infrastructure assets and real estate assets.

- Proposed changes expand the range of assets that can be held by REITs in their portfolio.

3. RBI warns NBFCs against aggressive business growth, warns of action:

RBI Warns Non-Banking Finance Companies

- RBI cautions NBFCs against aggressive growth without sustainable business practices and risk management.

- Governor Shaktikanta Das warns of potential excessive returns on equity.

- NBFCs, including MFIs and HFCs, are driven by capital accretion and investor pressure.

- NBFCs’ Self-correction Desire

- Advocates for sustainable business goals.

- Advocates for a ‘compliance first‘ culture.

- Advocates for strong risk management.

- Stresses on fair practices code adherence.

- Suggests sincere approach to customer grievances.

- Suggests ‘growth at any cost’ approach counterproductive.

- NBFCs’ Usurious Interest Rates and High Processing Fees

- Concerns arise when interest rates are usurious, combined with high processing fees and frivolous penalties.

- ‘Push effect’ exacerbates high-cost and high indebtedness, posing financial stability risks.

- Governor warns of potential financial instability risks if not addressed.

- Post-Policy Conference Report: NBFCs’ Stability and Health

- Das identifies push effect confined to specific NBFCs.

- RBI Deputy Governor Swaminathan J states advisory for high-risk, high growth strategy NBFCs.

- Advisory for segments likely to experience stress.

- Das urges review of compensation practices, variable pay, and incentive structures.

4. SEBI lens on IPO pricing as more firms tap market:

SEBI Signs Off on IPO Pricing

- SEBI approves initial public offerings (IPO) pricing.

- Sign-off required for IPOs.

- IPO pricing impacts post-listing performance.

- Market conditions can cause IPO pricing issues.

SEBI’s Approach to IPO Pricing

- The regulator now gives a soft sign-off on the price band of IPO offerings, aiming to align pricing with listed peers.

- The onus is still with the bankers to price the issue the way they want, with the regulator not providing any inputs on the pricing.

- Valuation of an IPO-bound company depends on factors such as past financial performance, future growth potential, demand for shares during roadshows, and market conditions.

- The regulator ensures that key risks are well-articulated in the draft prospectus for investors to make an informed decision.

- SEBI maintains that it will not interfere with the pricing and valuations of an offering, but if there is a wide variance in the IPO price with that of the price quoted in the pre-IPO placement or in an earlier transaction, the issuer must disclose the reasons for the same.

- SEBI was not comfortable with selling shareholders of IPO-bound companies getting involved in pricing the IPO for fear of exerting undue influence on the pricing to the detriment of investors.

- Foreign portfolio investors sold shares worth over ₹1.14 lakh crore in the cash market in October but invested ₹19,842 crore in the primary market.

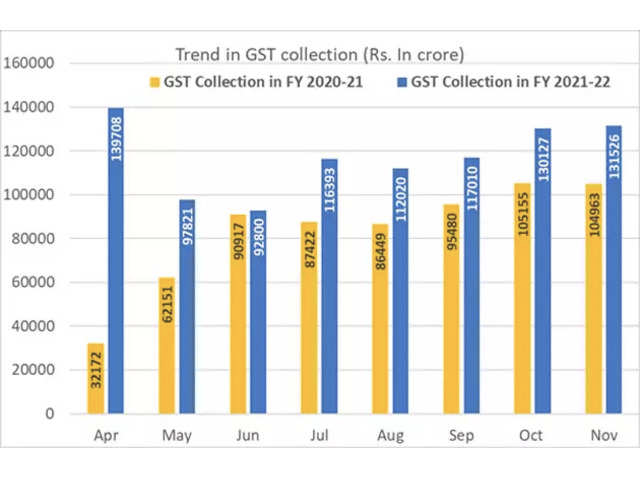

5. Revenue Impact: GST Revenue Trends:

GST Revenue Trends in India

- GST revenue trends have been volatile this fiscal year, with highest collections from indirect tax recorded in three of the seven months.

- Gross and net receipts grew 12.4% and 15.5% respectively, thanks to strong year-end filings.

- July’s gross receipts of over Rs 1.82 lakh crore were the third-highest at 10.3%.

- October’s GST collections were the second-highest in the tax’s seven years.

- Gross revenue growth fell to a three-year low of 7.3% in June and a 40-month low of 6.5% in September.

- October revenues broke a two-month of sequential decline and rose 8.9% year-on-year.

- Net revenues grew at a slower pace of 7.9%, but more than double the 3.9% growth in September.

- Overall growth of net GST revenues this year has slowed to 9% from about 10.2% till August.

- The Reserve Bank of India (RBI) has described GST trends as indicative of a slowdown in the economy, but hopes are pinned on festive demand and improving consumer sentiment.

- Early car sales data point to a K-shaped situation, with sales of expensive SUVs growing rapidly while overall sales remain moderate.

6. Sharing of resources: Fishermen and the Palk Bay dispute:

India-Sri Lanka Fisheries Meeting Highlights

- India renewed its call for a meeting between fishermen of the two countries to resolve the disputed Palk Bay fishing issue.

- The meeting was attended by India’s High Commissioner to Colombo Santosh Jha and Sri Lankan President Anura Kumara Dissanayake.

- The importance of a long-term solution that respects fishermen’s needs and enhances cooperation was emphasized.

- Fishermen from the Northern Province have called for a dialogue with Tamil Nadu fishermen despite complaints of ‘destructive bottom trawling’.

- The issue has led to a rise in arrests of Indian fishermen and their boats, with repeat offenders receiving longer sentences and fines.

- India’s stand on the issue is important, along with conservation of marine ecosystems.

- After Sri Lanka’s parliamentary elections, India should create an enabling environment for reaching an agreement for the northern region’s fishermen.

- India should re-emphasize the deep-sea fishing project for Tamil Nadu fishermen and promote alternative fishing methods.

- New Delhi should provide suitable schemes to help the northern province’s fishermen, who are yet to recover from the civil war.

7. Maharashtra’s experiment of using organic farming as tool to tackle agrarian crisis draws attention:

Since 2020, 9,600 farmers in Vidarbha region have not committed suicide due to agrarian crisis, according to an official.

- The initiative, initiated in six districts of Vidarbha region, aims to combat agrarian crisis.

- The initiative, which started in 2020, has enrolled 9,600 farmers from the region.

- Despite the success, no agrarian crisis-related suicides have been reported among the farmers’ families.

- The initiative has turned farming into a remunerative venture, reducing the risk of suicides among farmers who continue with conventional farming.

- The initiative was conceived in 2018 and began in 2020.

- Dr. Punjabrao Deshmukh Jaivik Kheti Mission, later renamed Dr. Punjabrao Deshmukh Naisraghik Kheti Mission, has successfully grown approximately 12 lakh hectares of land through organic farming.

Organic Farming Project in Maharashtra

- Farmers can choose from various organic farming methods, including composting.

- The government organizes farmers into groups and guides them through capacity building and training programs.

- Farm inspectors and master trainers are provided to farmers, who then train farmers.

- The government supports farmers in input sourcing, management, and marketing through subsidies for market counters and mobile vans.

- Collective measures reduce input costs, improve produce quality, and provide remunerative prices.

- Bulk marketing or retail marketing options are available.

- An organic certification system is introduced to build brand value.

- Farmers produce bio-pesticides in farm labs.

- The project’s scope is planned to expand to 25 lakh hectares by 2028.

8. Strengthening the India link in the Indo-Pacific Economic Framework for Prosperity:

US-India Relations and the Quad Summit

- Prime Minister Narendra Modi’s visit to the Quad Summit in Delaware in 2024 was significant in reshaping the geostrategic view of the Indo-Pacific.

- The Quad Summit underscored shared interests between US President Joe Biden and Modi, but implementation of these understandings is challenging due to the uncertainty of a U.S. presidential election and potential foreign and trade policies.

India’s Acceptance of the Indo-Pacific Economic Framework for Prosperity (IPEF)

- India accepted two landmark agreements under the IPEF, focusing on trade, supply chains, clean economy, and fair economy.

- The IPEF, with its 14 partner countries, represents 40% of global GDP and 28% of global goods and services trade.

Rise in Trade and Clean Economy

- U.S.-India trade has seen a rise, with India’s merchandise exports to the U.S. rising by over 50% from $54.3 billion in 2018 to $83.8 billion in 2023.

- Indian exporters are still aiming to restore the Generalized System of Preferences (GSP), which was withdrew from New Delhi in 2019.

Clean Economy Goal and Benefits

- The U.S.-India clean energy partnership is vital in helping India realize its net zero goals.

- Working towards a clean economy unlocks financial opportunities in climate financing and green bonds.

The Fair Economy Agenda

- The “fair economy” agenda aims to cultivate a transparent, predictable governance environment across the Indo-Pacific.

- The focus is to mitigate hurdles endemic in emerging markets, such as opaque regulatory requirements and tax policies that encourage corrupt behavior.

A Focus on Supply Chains

- The IPEF will create more resilient supply chains, under Pillar II.

- The four member-democracies (Australia, India, Japan, and the U.S.) are committed to rejigging and rebuilding supply chains.

- India’s participation in the IPEF supply chain agreement is pivotal, solidifying its commitment to minimising vulnerabilities.

Consensus Building and the IPEF

- The pillars of supply chains, a clean economy, and a fair economy may reshape economic relations in the region.

9. Tamarind Water and Buttermilk Saved Bandhavgarh Elephants:

- A 90-year-old report by RC Morris, FZS, reveals 14 elephant deaths in Tamil Nadu in 1933 due to Kodo millet poisoning.

- The report, found in the Biodiversity Heritage Library archives, is gaining renewed attention as forest officers investigate the recent fatalities.

- The report suggests that tamarind water and buttermilk could neutralize the effects of Kodo millet poisoning, which is now linked to the deaths of 10 elephants in Bandhavgarh.

10. Growth may Have Slipped in Rainy Q2 but Forecast for Fiscal is Sunny:

The median GDP forecast for July-Sept is 6.8%, lower than the RBI’s 7% forecast, with FY25 projections at 6.8-7.1%.

India’s Economic Growth Moderates in July-September due to Slowdown in Consumption and Investment

- An ETpoll of 10 economists predicts moderated economic growth in India in July-September due to a slowdown in consumption and investment.

- The median estimate for GDP growth in the second quarter is 6.8%, year on year, with estimates ranging from 6.5% to 7%.

- The Reserve Bank of India revised its growth projections for the September quarter to 7%, from 7.2% in its monetary policy meeting last month.

- The economy expanded a robust 8.1% in the corresponding period last year and 6.7% in the first quarter of this financial year.

- The Reserve Bank of India has revised its growth projections for the September quarter to 7%, from 7.2% in its monetary policy meeting last month.

- Early corporate results suggest a softness in the economy, with revenue and net profit rising by 7.2% and 2.5%, respectively.

- External triggers include the global slowdown, increasing bilateral tensions with Canada, the escalating conflict in West Asia, and the continuing Russia-Ukraine war.

- The manufacturing and services Purchasing Managers Index (PMI) for September by HSBC indicated a slowing momentum.

- The economy is projected to grow between 6.8% and 7.1% in FY25, with a double-digit growth in consumption and 8-10% growth in investment.

- The World Bank and International Monetary Fund have projected 7% growth for India for FY25.

11. Centre Rejects Punjab Govt’s Stubble Funding Demand:

The Punjab government, led by AAP, has proposed a ₹2,000 crore farmer incentive scheme, with the Centre funding the majority, prompting the central government to follow Haryana’s lead.

Punjab and Union Agriculture Ministry Battle Over Stubbling Incentives

- The BJP-led central government and the AAP-led Punjab government are battling over who should fund a bill to discourage stubble burning among farmers.

- Union agriculture ministry has rejected Punjab’s proposal, citing existing government funding measures and the example of the BJP-led Haryana government.

- The AAP-ruled Delhi government has also not embraced the idea.

- Punjab proposed an incentive scheme to the Centre to give ₹2,500 per acre to farmers to cover the operational cost of stubble management.

- The state has proposed that the cost of the scheme be shared between Punjab, Delhi, and the Indian government, with each paying ₹400 crore each and the Centre footing the bulk with ₹1,200 crore.

- The agriculture ministry has cited Haryana’s efforts to implement actions under the Central government subsidy scheme for Crop Residue Management and Sub-Mission on Agricultural Mechanisation.

- The Centre has claimed to have released funds worth ₹1,681.45 crore for the scheme from 2018-19 to 2024-25, enabling the distribution of 1.46 lakh machines and setting up more than 25,500 CHCs in the state.

- The Punjab government has underlined its commitment to the cause, detailing the decrease in stubble burning over the years and ground-level action.

- The Centre is expected to bring in new rulebooks to ensure ‘appropriate’ Environmental Compensation and enable CAQM to exercise its power under the Act.