Introduction

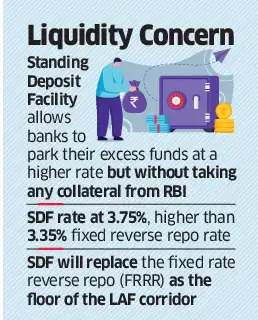

In a country like India, where the economy is as dynamic as its diversity, the role of the Reserve Bank of India (RBI) in maintaining economic stability is crucial. One of the most recent and innovative instruments in its monetary policy arsenal is the Standing Deposit Facility (SDF). Introduced in April 2022, this facility is a non-collateralized liquidity absorption tool, which means it helps the RBI manage excess money in the financial system without giving anything in return, not even government securities.

What is the Standing Deposit Facility (SDF)?

The Standing Deposit Facility (SDF) is a tool introduced by the RBI to absorb surplus liquidity from the banking system without providing any collateral.

Traditionally, when banks had excess funds, they could deposit them with the RBI and earn interest through the reverse repo mechanism, but the RBI had to provide government securities as collateral in exchange. The SDF changes that—it lets banks park their surplus funds securely with the RBI while earning an interest rate, and the RBI doesn’t need to part with any assets in return.

Definition:

“The Standing Deposit Facility (SDF) is a liquidity absorption tool that allows the Reserve Bank of India to mop up surplus liquidity from banks without providing any collateral, thereby enabling more flexible and efficient monetary control.”

Background: Evolution of Liquidity Tools Before SDF

To understand the SDF better, let’s look at how the RBI managed liquidity before its introduction.

Tools Used by RBI Pre-SDF:

| Instrument | Purpose | Collateral? |

|---|---|---|

| Reverse Repo | Absorb liquidity | Yes |

| Open Market Operations (OMOs) | Inject or absorb liquidity | Yes |

| Cash Reserve Ratio (CRR) | Mandatory cash deposit | No (but non-interest bearing) |

| Marginal Standing Facility (MSF) | Liquidity support to banks | Yes |

Although these instruments served their purpose, they had some limitations, especially in a post-pandemic environment where the Indian economy was flooded with surplus liquidity.

Challenges Faced:

- The reverse repo required government securities for each operation.

- OMOs had limitations in terms of flexibility and market impact.

- CRR was a blunt tool and offered no returns to banks.

- The liquidity surplus became persistent and unmanageable with conventional tools.

Recognizing these limitations, the RBI introduced the Standing Deposit Facility based on recommendations from the Urjit Patel Committee (2014) on monetary policy reform.

Introduction of SDF: A Landmark Moment

The RBI Governor Shaktikanta Das formally announced the launch of the SDF on April 8, 2022, during the Monetary Policy Committee (MPC) meeting. It was set as the floor rate of the Liquidity Adjustment Facility (LAF) corridor, replacing the reverse repo in that role.

| Date of Introduction | April 8, 2022 |

|---|---|

| Initial Rate | 3.75% |

| Current Rate (as of April 2025) | 6.25% |

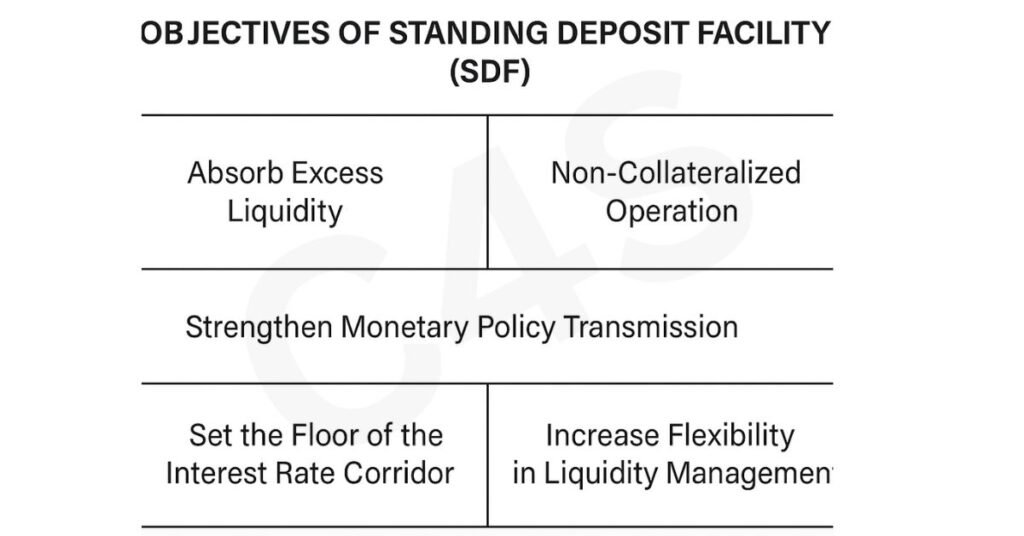

Objectives of the Standing Deposit Facility

The SDF was introduced to achieve multiple goals within India’s evolving monetary and banking framework:

Key Objectives:

- Enhance RBI’s flexibility in managing liquidity

- Control inflationary pressure by absorbing excess funds from the system

- Replace the reverse repo as the floor of the interest rate corridor

- Enable non-collateralized absorption of liquidity, reducing dependency on securities

- Strengthen RBI’s monetary transmission mechanism

How Does the Standing Deposit Facility Work?

Here’s a simplified breakdown of how the SDF operates:

- Banks accumulate excess liquidity when there is more money than needed in the system (for example, due to low credit demand or high government spending).

- RBI opens the SDF window, specifying the interest rate (SDF rate).

- Eligible banks deposit their surplus funds under SDF.

- No collateral is required—

- unlike reverse repo.

- The banks earn interest at the SDF rate on the funds parked.

Real-life Analogy:

Think of SDF as a savings account for banks at the RBI, where they can park their idle money overnight and earn interest—without RBI having to hand over any physical assets.

Structural Details of SDF

| Particular | Details |

|---|---|

| Implemented by | Reserve Bank of India |

| Applicable to | Scheduled Commercial Banks (excluding RRBs) |

| Collateral Requirement | None |

| Tenure | Overnight (Can be changed by RBI) |

| SDF Rate | Usually 25 basis points below the repo rate |

| Position in LAF Corridor | Lower bound/floor |

| Flexibility | High |

| Interest Payment | At a fixed SDF rate |

Comparison: SDF vs Reverse Repo

| Feature | Standing Deposit Facility (SDF) | Reverse Repo |

|---|---|---|

| Collateral | Not required | Required |

| Introduction Year | 2022 | 2000 |

| Liquidity Type | Absorption | Absorption |

| RBI Liability | Deposit | Borrowing |

| Role in LAF Corridor | Floor (current) | Previously floor |

| Usage Frequency | Regular (overnight) | Reduced |

Why is SDF a Game-Changer?

For RBI:

- Provides a more efficient liquidity mop-up tool

- Reduces reliance on government securities and reverse repo

- Helps in maintaining inflation targets with precision

For Banks:

- Offers a risk-free return on idle funds

- Improves liquidity management

- Encourages short-term interest discipline

For the Economy:

- Controls excess money supply, keeping inflation in check

- Enhances transparency and monetary policy efficiency

- Aligns with global best practices

Global Practices: Similar Facilities Around the World

Many major central banks use standing deposit facilities:

| Country | Facility | Purpose |

|---|---|---|

| USA | Overnight Reverse Repo Facility | Liquidity absorption |

| Eurozone | Deposit Facility (ECB) | Overnight liquidity absorption |

| UK | Deposit Facility (BoE) | Short-term monetary control |

India’s SDF aligns with such mechanisms, helping the RBI adopt global standards in liquidity and interest rate management.

Monetary Policy and SDF: How They Interact

The SDF is a vital part of the RBI’s monetary policy toolkit. It helps maintain the interest rate corridor, which consists of:

- Marginal Standing Facility (MSF) –

- Upper bound

- Repo Rate –

- Middle/anchor

- Standing Deposit Facility (SDF) –

- Lower bound

This corridor helps the RBI manage day-to-day interest rates and overall economic liquidity.

Impact of SDF on the Indian Economy

Short-Term Impact:

- Efficient absorption of excess liquidity

- Keeps inflation expectations under control

Long-Term Impact:

- Enhances RBI’s ability to steer interest rates

- Builds investor and market confidence

- Reduces fiscal burden of managing government securities for collateral

Challenges of SDF

Even though SDF is a smart tool, it has some limitations:

| Challenge | Explanation |

|---|---|

| Risk aversion | Banks may prefer parking funds over lending, especially in uncertain times |

| Reduced role of reverse repo | Could lead to liquidity mismatches in times of stress |

| Still evolving | Being new, SDF’s effectiveness is being tested in different market conditions |

| Limited use in tight liquidity | Not useful when the system lacks liquidity |

Conclusion

The Standing Deposit Facility (SDF) is a landmark reform in India’s monetary policy landscape. It reflects the RBI’s strategic shift toward more modern, efficient, and global-standard monetary management practices. As India’s economy grows and integrates deeper into global systems, such tools become essential.

Whether you’re a financial professional or just someone interested in how the economy functions, understanding the SDF gives you a clearer picture of how our central bank maintains financial order and stability.

FAQs: Standing Deposit Facility (SDF)

What is the current SDF rate in India?

As of April 2025, the SDF rate is 6.25%.

How is the SDF rate determined?

It is generally set 25 basis points below the repo rate, forming the floor of the LAF corridor.

Is the SDF applicable to all banks?

No. It is available to Scheduled Commercial Banks, excluding Regional Rural Banks (RRBs).

Can SDF replace all other tools?

No. It complements other tools like repo, reverse repo, CRR, and OMOs, offering greater flexibility.

What makes SDF unique?

It is the first non-collateralized liquidity absorption tool introduced by RBI.