Introduction

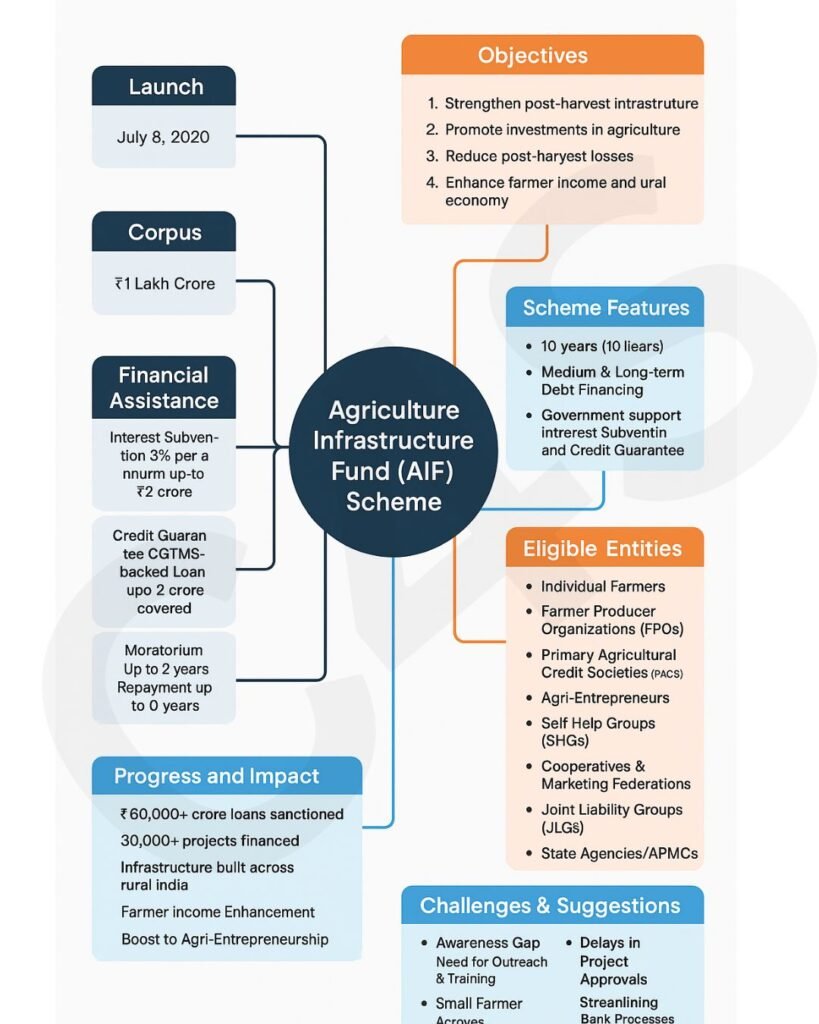

The Agriculture Infrastructure Fund (AIF) is a major initiative launched by the Government of India to drive investment in agriculture and rural infrastructure. Introduced in July 2020, the scheme aims to mobilize medium to long-term debt financing facilities for investment in viable projects across post-harvest management and community farming assets.

By strengthening agricultural infrastructure, the AIF supports farmers, agri-entrepreneurs, and cooperatives in enhancing their productivity, reducing wastage, and improving farmers’ income in line with the goals of Doubling Farmers’ Income.

Key Highlights at a Glance

| Feature | Details |

|---|---|

| Scheme Name | Agriculture Infrastructure Fund (AIF) |

| Launch Date | July 8, 2020 |

| Ministry | Ministry of Agriculture and Farmers’ Welfare |

| Scheme Type | Central Sector Scheme |

| Total Corpus | ₹1 lakh crore |

| Duration | 2020-21 to 2032-33 (10 years) |

| Beneficiaries | Farmers, FPOs, SHGs, PACS, Cooperatives, Startups, APMCs |

| Financial Support | 3% Interest Subvention, Credit Guarantee, Repayment Moratorium |

| Purpose | Building post-harvest management infrastructure and community farming assets |

Objectives of the Agriculture Infrastructure Fund

- To improve agricultural infrastructure across the country, particularly in rural areas.

- To boost supply chain facilities such as warehousing, cold storage, and logistics.

- To reduce post-harvest losses and increase value realization for farmers.

- To enable farmers to access better markets and fair prices.

- To support private investments in agriculture-related infrastructure projects.

Key Features of the AIF Scheme

| Feature | Details |

|---|---|

| Launch Date | 8th July 2020 |

| Tenure of Scheme | FY 2020-21 to FY 2032-33 |

| Corpus Size | ₹1 Lakh Crore |

| Type of Financing | Medium to long-term debt financing |

| Eligible Projects | Post-harvest management infrastructure and community farming assets |

| Interest Subvention | 3% per annum up to a limit of ₹2 crore |

| Credit Guarantee | Coverage under Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE) or through government fund |

| Moratorium Period | Up to 2 years |

Eligible Beneficiaries

The AIF Scheme covers a wide range of stakeholders:

- Individual farmers

- Farmer Producer Organizations (FPOs)

- Primary Agricultural Credit Societies (PACS)

- Agri-entrepreneurs

- Startups

- Central/State agency sponsored Public-Private Partnership (PPP) projects

- Self Help Groups (SHGs)

- Cooperatives and Marketing Cooperatives

- Joint Liability Groups (JLGs)

- State Agencies/APMCs (Agricultural Produce Market Committees)

Types of Infrastructure Supported under AIF

The scheme promotes the creation and modernization of infrastructure such as:

- Warehouses

- Cold chains

- Sorting and grading units

- Primary processing centers

- Collection centers

- Ripening chambers

- Silos

- Packaging units

- Farm mechanization centers

- Supply chain services including e-marketing platforms

Financial Assistance under AIF

- Loan Amount:

- Loans under the AIF have no minimum limit; however, the interest subvention benefit is available for loans up to ₹2 crore.

- Interest Subvention:

- 3% per annum for a maximum period of 7 years.

- Credit Guarantee:

- Loans up to ₹2 crore are eligible for credit guarantee coverage.

- Moratorium Period:

- Up to 2 years depending on the type of project and revenue generation capacity.

Application Process

Here is the step-by-step process to apply for financial assistance under AIF:

- Prepare a Project Report:

- Clearly outline the project, cost, expected outcomes, and infrastructure to be created.

- Apply via AIF Portal:

- Applicants must submit their proposals online through the AIF official portal.

- Loan Processing:

- Banks and lending institutions will process the loan applications based on project viability.

- Approval and Disbursement:

- After approval, loans are disbursed along with interest subvention benefits.

- Monitoring and Reporting:

- Regular project monitoring and reporting are mandatory as per scheme guidelines.

Progress and Achievements (As of Early 2025)

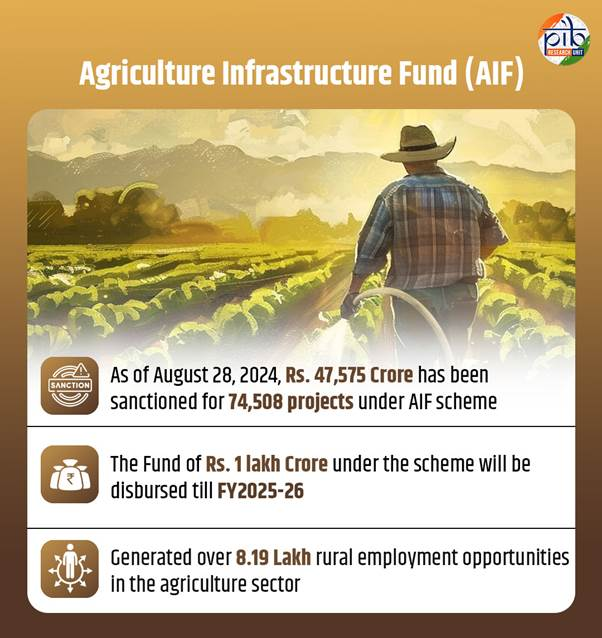

- Over ₹60,000 crore worth of loans sanctioned.

- More than 30,000 projects across India have benefited.

- Significant growth in storage capacity and cold chain development.

- Positive push towards modernization and mechanization in farming practices.

Benefits of Agriculture Infrastructure Fund

- Strengthens rural economy through asset creation.

- Reduces post-harvest losses and improves price realization.

- Encourages private sector participation and entrepreneurship in agriculture.

- Improves food security through better storage and supply chain facilities.

- Generates rural employment opportunities.

- Boosts exports by facilitating global market standards in produce handling.

Challenges and Way Forward

| Challenges | Suggested Solutions |

|---|---|

| Limited awareness among farmers | Stronger awareness campaigns at grassroots level |

| Delays in project approvals | Simplification and digitization of approval processes |

| Land and operational issues | Facilitating easy land leasing and farmer agreements |

| Financing constraints | Wider banking participation and financial literacy programs |

Going forward, stronger synergy between government agencies, financial institutions, and the private sector will be crucial to realize the full potential of the AIF scheme.

- Enhanced Awareness Campaigns:

- Special drives, field demonstrations, and localized campaigns are needed.

- Simplified Application Procedures:

- More user-friendly portal and hand-holding support at district levels.

- Involvement of Technology:

- Using satellite imagery, mobile apps, and AI to monitor projects.

- Special Focus on Smallholders:

- Tailored schemes to enable small farmers and FPOs to access funds.

Conclusion

The Agriculture Infrastructure Fund (AIF) is a visionary step toward building a self-reliant and sustainable agricultural ecosystem in India. By promoting investment, innovation, and rural employment, AIF is poised to be a game-changer in reshaping the agricultural landscape and enhancing farmers’ income.

Farmers, cooperatives, and agri-entrepreneurs must leverage the AIF to unlock opportunities and contribute toward Atmanirbhar Bharat (Self-Reliant India).

FAQs on Agriculture Infrastructure Fund

Q1. What is the maximum loan amount eligible for interest subvention under AIF?

→ Up to ₹2 crore per project.

Q2. Who can apply for the AIF Scheme?

→ Farmers, FPOs, PACS, cooperatives, SHGs, startups, and agri-entrepreneurs.

Q3. How long will the AIF Scheme be operational?

→ It will be operational till FY 2032-33.