Introduction

The Capital Adequacy Ratio (CAR) is one of the most crucial financial metrics used to evaluate a bank’s financial health and ability to withstand financial crises. This ratio plays a pivotal role in ensuring the stability, resilience, and risk management of banks and other financial institutions.

What is Capital Adequacy Ratio (CAR)?

The Capital Adequacy Ratio (CAR), also known as the Capital to Risk-Weighted Assets Ratio (CRAR), is a measure of a bank’s capital in relation to its risk-weighted assets. It ensures that banks have enough capital reserves to cover potential losses and continue their operations during financial downturns.

Regulatory authorities, such as the Reserve Bank of India (RBI), the Federal Reserve (USA), the European Central Bank (ECB), and the Bank for International Settlements (BIS), mandate minimum capital requirements for banks to maintain financial stability and prevent bank failures.

Why is Capital Adequacy Ratio Important?

The CAR is essential for multiple reasons:

Ensures Financial Stability

Banks with a strong CAR are more resilient to economic downturns, financial crises, and unexpected losses. It helps prevent bank failures and financial instability.

Protects Depositors’ Money

A well-capitalized bank has a lower risk of default, ensuring that depositors’ money is safe. If a bank’s CAR is too low, it may struggle to absorb financial shocks.

Compliance with Basel Norms

International banking regulations, particularly the Basel Accords (Basel I, II, III), set CAR requirements to minimize risks in the banking sector. These norms require banks to maintain a certain level of capital to reduce the risk of insolvency.

Improves Investor Confidence

A higher CAR indicates that a bank is financially strong, making it more attractive to investors and stakeholders. Banks with strong CARs generally have higher credit ratings and better access to capital markets.

Reduces Systemic Risk

When banks maintain a healthy CAR, they contribute to the overall stability of the banking system, reducing the risk of widespread financial crises.

Formula for Capital Adequacy Ratio (CAR)

The Capital Adequacy Ratio is calculated using the following formula:

Where:

- Tier 1 Capital includes core capital, such as equity capital, disclosed reserves, and retained earnings. It is considered the most reliable source of capital.

- Tier 2 Capital includes supplementary capital, such as subordinated debt, hybrid instruments, revaluation reserves, and loan-loss reserves.

- Risk-Weighted Assets (RWA) refer to the total value of a bank’s assets, adjusted for risk.

Understanding Risk-Weighted Assets (RWA)

Risk-Weighted Assets (RWA) represent the total assets held by a bank, adjusted for their associated risk levels. Each asset type has a different risk weight assigned by regulators. For example:

| Asset Type | Risk Weight (%) |

|---|---|

| Cash & Government Bonds | 0% |

| Loans to Corporates | 20%-100% |

| Mortgage Loans | 50% |

| Unsecured Personal Loans | 100% |

| Risky Investments | 150% |

Banks with higher-risk assets need more capital to maintain an adequate CAR.

Basel Norms and CAR Requirements

The Basel Committee on Banking Supervision (BCBS) sets global regulatory frameworks for risk management. The Basel Accords define minimum CAR requirements for banks worldwide.

Basel I (1988):

- Introduced the 8% minimum CAR requirement.

- Focused on credit risk and categorized assets based on risk weightings.

Basel II (2004):

- Improved risk assessment by including operational and market risk in CAR calculations.

- Introduced three pillars:

- Minimum Capital Requirements

- Supervisory Review

- Market Discipline

Basel III (2010 – Present):

- Strengthened CAR requirements post the 2008 financial crisis.

- Increased Tier 1 capital requirements.

- Set a minimum CAR of 10.5%, including a 2.5% capital conservation buffer.

CAR Requirements Under Basel III:

- Minimum CAR: 8%

- Minimum CAR (Including Buffer): 10.5%

- Additional Buffer for Systemically Important Banks: Up to 12%

Many countries, including India (RBI guidelines), the US (Federal Reserve), and the UK (FCA & PRA), follow Basel III norms to regulate their banking systems.

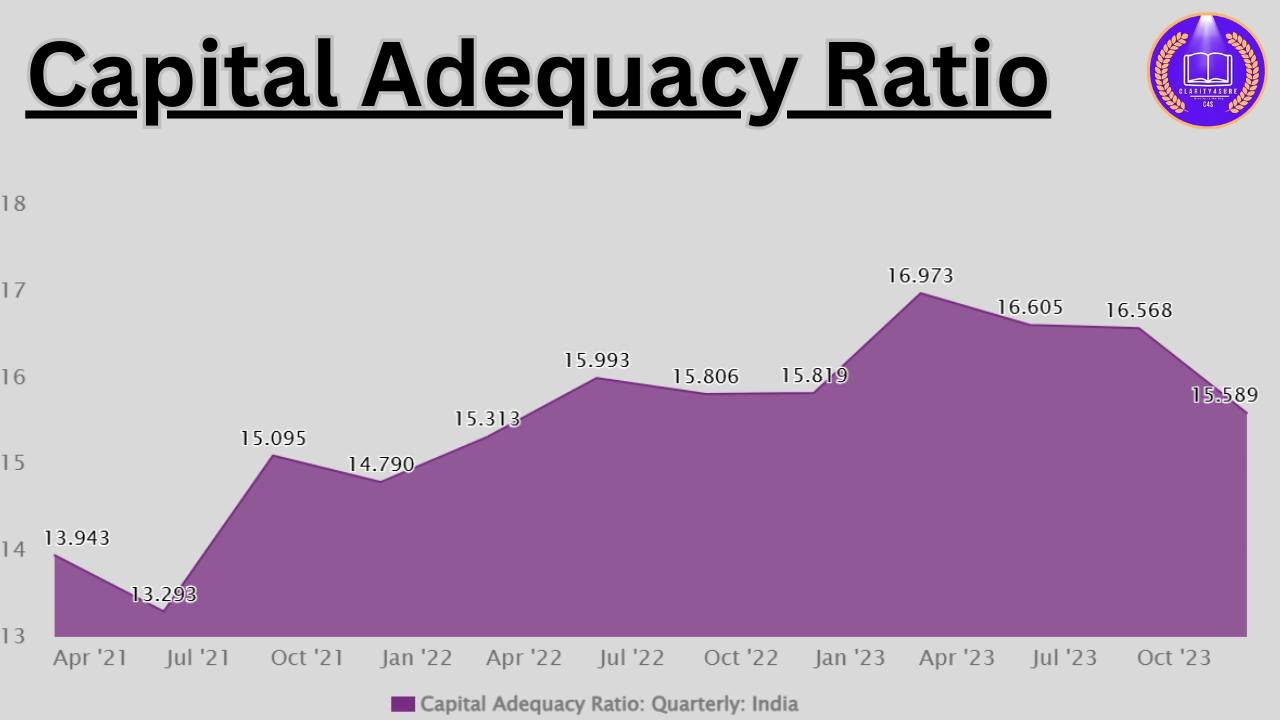

Capital Adequacy Ratio: Global and Indian Perspectives

Capital Adequacy Ratio in India (RBI Guidelines)

The Reserve Bank of India (RBI) follows Basel III guidelines and requires Indian banks to maintain:

- A minimum CAR of 9% (higher than the global Basel III requirement of 8%).

- Additional buffers for large, systemically important banks like SBI, ICICI Bank, and HDFC Bank.

Capital Adequacy Ratio of Major Indian Banks (2024 Data)

| Bank Name | Capital Adequacy Ratio (CAR) % |

|---|---|

| State Bank of India (SBI) | 13.3% |

| HDFC Bank | 18.5% |

| ICICI Bank | 17.2% |

| Axis Bank | 16.8% |

| Punjab National Bank (PNB) | 14.2% |

Indian banks maintain strong CAR levels, ensuring financial stability in the economy.

Implications of a Low Capital Adequacy Ratio

A low CAR indicates that a bank may not have enough capital to absorb potential losses. This can lead to:

- Higher risk of insolvency and failure.

- Regulatory penalties or restrictions from the RBI or central banks.

- Loss of depositor and investor confidence.

- Downgraded credit ratings, affecting the bank’s ability to raise funds.

How Banks Maintain a Strong CAR?

- To strengthen their Capital Adequacy Ratio, banks can:

- Raise additional equity capital through stock issuance.

- Retain more earnings rather than distributing excessive dividends.

- Issue subordinated debt (Tier 2 capital instruments).

- Optimize risk-weighted assets by managing loan portfolios effectively.

Conclusion

- The Capital Adequacy Ratio (CAR) is a vital indicator of a bank’s financial strength and risk management capabilities.

- Maintaining a healthy CAR ensures that banks can:

- Absorb unexpected losses.

- Meet regulatory requirements.

- Protect depositors’ interests.

- Contribute to economic stability.

Regulatory authorities continuously monitor banks to enforce CAR requirements, ensuring the safety of the global financial system.