Introduction

In an increasingly globalized world, financial services have expanded beyond national borders, creating a need for dedicated regulatory frameworks to govern cross-border financial transactions. Recognizing this necessity, India established the International Financial Services Centres Authority (IFSCA) to regulate and promote financial services within International Financial Services Centres (IFSCs). This move positions India as a major player in the global financial landscape, attracting investors, businesses, and financial institutions to its shores.

What is IFSCA?

The International Financial Services Centres Authority (IFSCA) is a statutory regulatory body established by the IFSCA Act, 2019. It serves as the unified authority to regulate financial services, products, and institutions in India’s International Financial Services Centres (IFSCs), the first and foremost being GIFT City (Gujarat International Finance Tec-City) in Gujarat.

Prior to IFSCA, multiple regulators such as SEBI, RBI, IRDAI, and PFRDA governed different aspects of financial services in IFSCs. With IFSCA in place, there is now a single-window regulatory approach, ensuring efficiency and streamlined governance.

Objectives of IFSCA

IFSCA’s primary goal is to establish a world-class financial ecosystem that fosters international trade, innovation, and economic growth. Its key objectives include:

- Developing a Global Financial Hub –

- Positioning IFSCs as competitive global financial centers akin to Singapore, Dubai, and London.

- Regulating Financial Services in IFSCs –

- Supervising banking, insurance, capital markets, asset management, and other financial activities.

- Enhancing Ease of Doing Business –

- Simplifying regulations, ensuring transparency, and reducing compliance burdens for financial institutions.

- Encouraging Innovation –

- Promoting FinTech, green finance, digital banking, and sustainable investment solutions.

- Integrating with the Global Financial Market –

- Facilitating seamless cross-border transactions and collaborations.

- Promoting Indian Financial Institutions –

- Encouraging Indian banks, insurers, and asset managers to expand their global footprint.

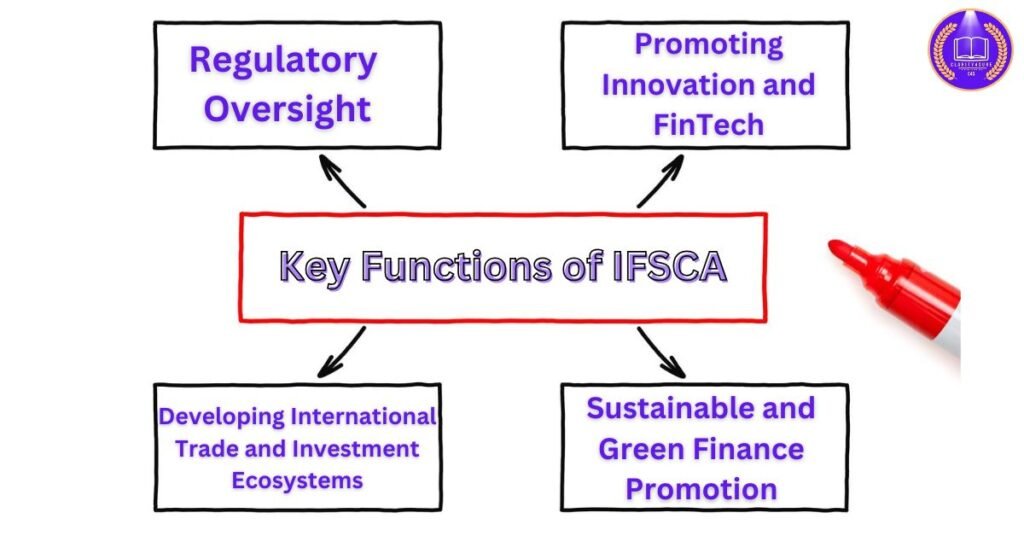

Key Functions of IFSCA

IFSCA is responsible for regulating and promoting financial services within IFSCs. Its key functions include:

1. Regulatory Oversight

- Formulating and implementing regulations for banking, insurance, securities, and fund management in IFSCs.

- Ensuring adherence to global best practices in compliance and governance.

- Issuing licenses to financial institutions operating within IFSCs.

2. Promoting Innovation and FinTech

- Facilitating the development of FinTech and RegTech (Regulatory Technology) solutions.

- Establishing regulatory sandboxes for startups to test new financial products.

- Encouraging the use of blockchain, AI, and big data in financial services.

3. Developing International Trade and Investment Ecosystems

- Creating a favorable tax regime for global investors.

- Enhancing cross-border investment flows by reducing capital restrictions.

- Collaborating with international financial regulators to enhance global integration.

4. Sustainable and Green Finance Promotion

- Encouraging green bonds and ESG (Environmental, Social, and Governance) investments.

- Supporting renewable energy and climate finance projects.

- Partnering with global financial institutions to drive sustainable economic growth.

GIFT City: India’s First IFSC

GIFT City (Gujarat International Finance Tec-City) is India’s first operational IFSC and serves as a hub for offshore banking, capital markets, insurance, and asset management services. IFSCA governs all financial activities within GIFT City, making it a strategic destination for global investors.

Advantages of GIFT City IFSC

- 100% foreign ownership permitted for financial institutions.

- Liberalized currency regulations, allowing transactions in foreign currencies.

- Tax incentives, including exemptions from GST, MAT (Minimum Alternate Tax), and dividend distribution tax.

- State-of-the-art infrastructure with advanced digital connectivity and smart city features.

- Strategic location, offering connectivity to global financial hubs.

Key Sectors Regulated by IFSCA

IFSCA regulates multiple financial segments, ensuring a comprehensive financial ecosystem within IFSCs. The key sectors include:

1. Banking

- Permits foreign and domestic banks to set up offshore banking units.

- Allows financial transactions in foreign currencies without restrictions.

- Enables trade financing, treasury operations, and global banking services.

2. Capital Markets

- Oversees stock exchanges, brokerage firms, and commodity trading.

- Regulates derivative trading, debt markets, and alternative investment funds (AIFs).

- Facilitates international investment in equity and debt securities.

3. Insurance and Reinsurance

- Encourages global insurance companies to establish reinsurance businesses.

- Offers tax and regulatory incentives for offshore insurance operations.

- Develops a specialized framework for captive insurance companies.

4. Asset and Wealth Management

- Provides a regulatory framework for mutual funds, portfolio management, and wealth advisory services.

- Supports the setup of offshore investment funds and alternative investment vehicles.

- Promotes cross-border investment opportunities.

5. FinTech and Digital Banking

- Establishes a sandbox environment for testing new financial technologies.

- Encourages blockchain-based trade finance and digital asset management.

- Regulates digital banks and neo-banking platforms.

Recent Developments and Initiatives by IFSCA

IFSCA has introduced several initiatives to boost IFSCs in India:

1. IFSCA (Banking) Regulations, 2020

- Allows Indian and foreign banks to set up International Banking Units (IBUs) in IFSCs.

- Provides operational flexibility for offshore banking activities.

2. IFSCA FinTech Regulatory Sandbox

- Enables startups and financial firms to test new FinTech solutions under relaxed regulations.

- Encourages AI-driven financial services, digital lending, and blockchain adoption.

3. Aircraft Leasing and Financing

- Promotes aircraft leasing from IFSCs, reducing dependency on global leasing hubs like Ireland and Dubai.

- Provides tax incentives for aviation finance companies.

4. Unified Regulator for IFSC Capital Markets

- Consolidates regulatory functions for capital markets under one authority.

- Ensures seamless market operations and investor protection.

Challenges and Future Prospects

Despite its rapid growth, IFSCA faces certain challenges:

- Limited Awareness –

- Global investors and financial institutions need more awareness about India’s IFSC framework.

- Competition from Global IFSCs –

- Singapore, Dubai, and Hong Kong offer established financial ecosystems.

- Regulatory Harmonization –

- Need for stronger coordination with global financial regulators.

Future Roadmap

- IFSCA aims to:

- Expand IFSCs beyond GIFT City to other regions.

- Enhance tax incentives and ease of business policies.

- Strengthen international collaborations with leading financial centers.

- Promote sustainable finance and digital asset management.

Conclusion

The International Financial Services Centres Authority (IFSCA) plays a pivotal role in shaping India’s financial landscape, making the country a global hub for offshore banking, investment, and FinTech innovation. With progressive regulations, state-of-the-art infrastructure, and government support, IFSCA is poised to drive India’s emergence as a key player in the international financial sector.

As India continues to position itself as a preferred destination for global financial services, IFSCA will be instrumental in bridging domestic financial markets with international investors, ensuring long-term economic growth and stability.