Daily Current Affairs Quiz

22 January, 2025

International Affairs

1. U.S. Citizenship

Context:

After being sworn in, U.S. President Donald Trump signed an Executive Order cancelling the provision of “citizenship by birth”, which could directly affect thousands of Indian professionals working in the U.S. under H-1B and other temporary visas, who hoped to raise their families there.

Citizenship in U.S.

There are two major modes through which the United States may grant a person the status of citizen.

- Jus Soli (Right of the Soil)

- It grants citizenship to an individual born within the territory of the United States.

- Jus Sanguinis (Right of Blood)

- One gets it if one or more parents were of the status US citizen at birth.

Birthright Citizenship in the United States

Assured by the 14th Amendment The first clause of the 14th Amendment to the US Constitution, which was adopted on July 9, 1868 assures birthright citizenship to people born in US territory, except for American Samoa.

- The Amendment declares

- All persons born or naturalized in the United States and subject to the jurisdiction thereof are citizens of the United States and of the State wherein they reside.

- Historical Context

- The 14th Amendment overruled the Dred Scott v Sandford 1857 decision which denied US citizenship to African Americans both enslaved and free.

Dual Citizenship in India!

2. Tariffs on BRICS Nations!

Context:

US President Donald Trump reiterated to impose 100 per cent import tariffs on the BRICS countries if they took any steps towards cutting the use of the dollar in global trade. The BRICS nations include Brazil, Russia, China, South Africa and India.

India’s Approach and Possible Effects

- Retaliatory Tariffs on U.S.

- India had already imposed retaliatory tariffs in 2018 when the U.S. had taxed Indian steel and aluminum, which affected 29 U.S. products.

- Sectors that might got Affected

- Primary sector: Involves extracting raw materials from nature, such as agriculture and mining.

- Secondary sector: Involves manufacturing and processing raw materials, such as construction and production of goods.

- Tertiary sector: Involves providing services, such as entertainment, financial services, and retail

- Quaternary sector: Involves knowledge-based activities, such as research and development, information technology, and education.

- Make America Great Again

- “Make America Great Again” is a package, and this agenda will definitely attract more tariffs on agriculture and industrial products.

- India-U.S Trade Status

- Indian exports to the U.S. was at CAGR (Compound Annual Growth Rate) of 10.48% over 2001-2023.

- In FY 2023-24, for the first time, the biggest trading partner of India is the U.S. that exported worth $77.51 billion and imported worth $42.2 billion.

- India’s exports to the U.S. raised by 5.57% about $60 billion.

Implications for India

- Immigration

- Stricter immigration policies could displace many Indian professionals and undocumented workers in the US.

- Indian families might face challenges due to changes in citizenship laws.

- Economic Impact

- Proposed tariffs on BRICS nations may affect trade particularly as India seeks to diversify its trade and currency agreements.

- Diplomatic Relations

- Jaishankar’s meeting with Rubio reflects Indias intent to address challenges through dialogue.

- The Quad meeting signals India’s ongoing commitment to IndoPacific stability and its strategic partnerships.

BRICS

- BRICS(named after countries joined firstly) pursued relationships of investment, and later it became an intergovernmental organization comprising nine countries namely Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, UAE.

- Founded in:

- 16 June 2009

- First Summit:

- Russia in 2009

- Chairman

- Vladimir Putin, the President of Russia.

US Lifts Restrictions on Indian Nuclear Entities

3. Trump’s Second Term and International Law Impact

Context:

The second term of Trump represents continued disruptive leadership and challenges to international norms. His policy promotes U.S. Exceptionalism by maintaining its position in making international law, yet demanding other countries comply.

Key Highlights:

Trump 1.0: A Sovereigntist Approach

- Rejection of Multilateralism:

- The policy preferred bilateral agreements so as not to curb the sovereignty of the United States.

- Significant Withdrawals:

- Paris Agreement on Climate Change, Iran nuclear deal, and the nuclear treaty with Russia.

- Trade Protectionism:

- Imposed tariffs on other allied countries and scrapped agreements such as TPP and NAFTA.

- WTO

- Vetoed appointments to the WTO Appellate Body.

Trump 2.0

- New Challenges in Trump 2.0

- Reversion to Unilateralism, Trade Tariffs, and Disengagement from Multilateralism.

- Militaristic Foreign Policy

- To seize Greenland, Panama Canal, and Canada.

- Violation of UN Charter

- Challenging tenets such as no use of force and self-determination.

- Revisionist Impact

- The policy will certainly embolden countries such as China and Russia to further territorial ambitions.

National Affairs

1. The Draft Digital Personal Data Protection (DPDP) Rules, 2025

Context:

The Draft Digital Personal Data Protection (DPDP) Rules, 2025, will take forward the Digital Personal Data Protection Act of 2023.

The Draft Digital Personal Data Protection (DPDP) Rules, 2025

It comes with the objective of improving the legal framework for digital personal data by giving the required intricacies and balancing between the right to privacy of an individual and the requirement to process that personal data lawfully for carrying out those purposes.

- Right to Privacy – Article 21

- Supreme Court of India has Stated that under the Article 21, the right to privacy is a fundamental right too.

- Article 21 of the Indian Constitution speaks about

- Right to life

- Right to personal liberty

Key Findings:

- Based on the Digital Personal Data Protection Act of 2023

- Status

- Open for public consultation until 18 February

- Main Provisions

- Informed Consent:

- Fiduciaries have to provide clear notices to users about the data collected

- Exemptions:

- Data collected for subsidy and benefits purposes is exempt from certain provisions.

- Data Security:

- Data fiduciaries shall have reasonable security safeguards in place.

- Data Deletion:

- The data fiduciary will delete the user data within two days of giving notice and may stop the process based on user action during such notice period.

- Parental Consent:

- For personal data related to children.

- Role and Responsibilities of Data Fiduciaries

- Entities collecting and processing personal data are called “Data Fiduciaries”.

- Data retention is only for the period of consent and must be deleted thereafter.

- Security measures include encryption, access control, and monitoring for unauthorized access.

- Consent Management

- The entities managing the consent records have to adhere to stringent verification processes.

- Grievances redressal mechanisms have to be put in place.

- Data Localisation

- Reintroduction of localisation mandates restricting certain personal and traffic data transfer outside India.

- A government-formed committee will determine data restricted from cross-border transfer.

- Data Breach Reporting

- Fiduciaries must inform affected users and the Data Protection Board promptly of a breach.

- All breaches must be reported.

- Government agencies must process citizen data lawfully, with specific safeguards outlined to address concerns over exemptions for national security and public order.

- Informed Consent:

2. Smart Cities Mission

- Launch Date

- June 2015

- Ministry

- Ministry of Housing and Urban Affairs (MoHUA).

- Extension

- The mission has been extended to March 2025 to complete the remaining projects.

- Objective

- Transform 100 cities into clean green and sustainable abodes in support of the citizens quality of life through sustainable and inclusive development.

- Components

- Areabased Development: Focuses on upgrading selected areas in a city.

- Retrofitting: Upgrading existing infrastructure in a city to achieve smart city status.

- Greenfield Projects: Development of new areas with hightech infrastructure from scratch.

- PanCity Solutions: Implementing smart solutions across the entire city.

- Governance Structure

- A Special Purpose Vehicle SPV was created under the Companies Act 2013 to manage and oversee the missions implementation.

- Funding Model

- Primarily based on PublicPrivate Partnership PPP

- Government Initiatives

- Several initiatives are supporting the mission that includes the Atal Mission for Urban Rejuvenation and Urban Transformation AMRUT, Pradhan Mantri Awas Yojana, Urban PMAYU and others such as the Climate Smart Cities Assessment Framework 20 and TULIP.

Challenges

- Lack of Clarity in Definition

- The absence of a clear definition for a smart city has made it difficult to allocate resources effectively and create a uniform development approach.

- TopDown Approach

- The missions centralization limited the involvement of local elected representatives raising concerns over democratic governance and accountability in decision making processes.

- Poor City Selection Process

- Developing less than 1 of a city’s area led to exclusion of many parts causing uneven development.

- Lack of Proper Funding and Scope

- SCM did not go in line with the 74th Constitutional Amendment Act causing conflicts over governance structures and authority distribution.

- Displacement and Social Impact

- Projects under SCM caused the displacement of vulnerable communities in poorer localities and worsened issues like urban flooding.

- Mismatch of Priorities

- The IoT model was deemed unrealistic due to lack of basic amenities in many cities.

- Broader Lessons

- Lack of Governance: Projects exclude public participation and local governance structures lack accountability and effectiveness.

- Neglect of Core Needs: Hightech solutions over fundamental infrastructure result in misaligned outcomes.

- Shimla as a Smart City

- Late Inclusion: Shimla was added to the mission after petitions in Himachal Pradesh High Court.

- Funding Scheme: around 2906 crore through PPP municipal bonds, external borrowings, and government schemes.

- Mishaps and Failures:

- Underutilized Funds: Only 707 crore has been spent with PPP contributions.

- Neglected Redevelopment: Key zones such as Lower Bazar and Krishnanagar have not been touched.

- Unaddressed Traffic Issues: Congestion worsens and nonmotorised mobility plans are sidelined.

Recommendations for Strengthening the Smart City Mission

- Appointment of a Dedicated CEO

- Establish a fixed tenure CEO for better leadership and accountability in managing the mission.

- Inclusion of MPs in Advisory Forums

- Include Members of Parliament in State Level Advisory Forums to strengthen governance and decision making.

- PanCity Projects

- The emphasis on citywide development would be given by pancity projects that provide integrated sustainable solutions to the entire city.

- Capacity Building of Urban Local Bodies

- ULBs Capacitate the Urban Local Bodies ULBs in small cities so that they can make the development process more inclusive.

- Assistance from the Central Government in Building Capacities

- Assist the cities through financial and technical aid to restructure their organizations and build necessary infrastructure for the smart city project.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Mains

Q. With a brief background of quality of urban life in India, introduce the objectives and strategy of the ‘Smart City Programme.’ (2016)

3. Indus Water Treaty

Context:

The World Bank appointed the Neutral Expert NE Michel Lino to announce his competence for adjudicating differences between India and Pakistan about the design of hydroelectric projects on Indus system rivers.

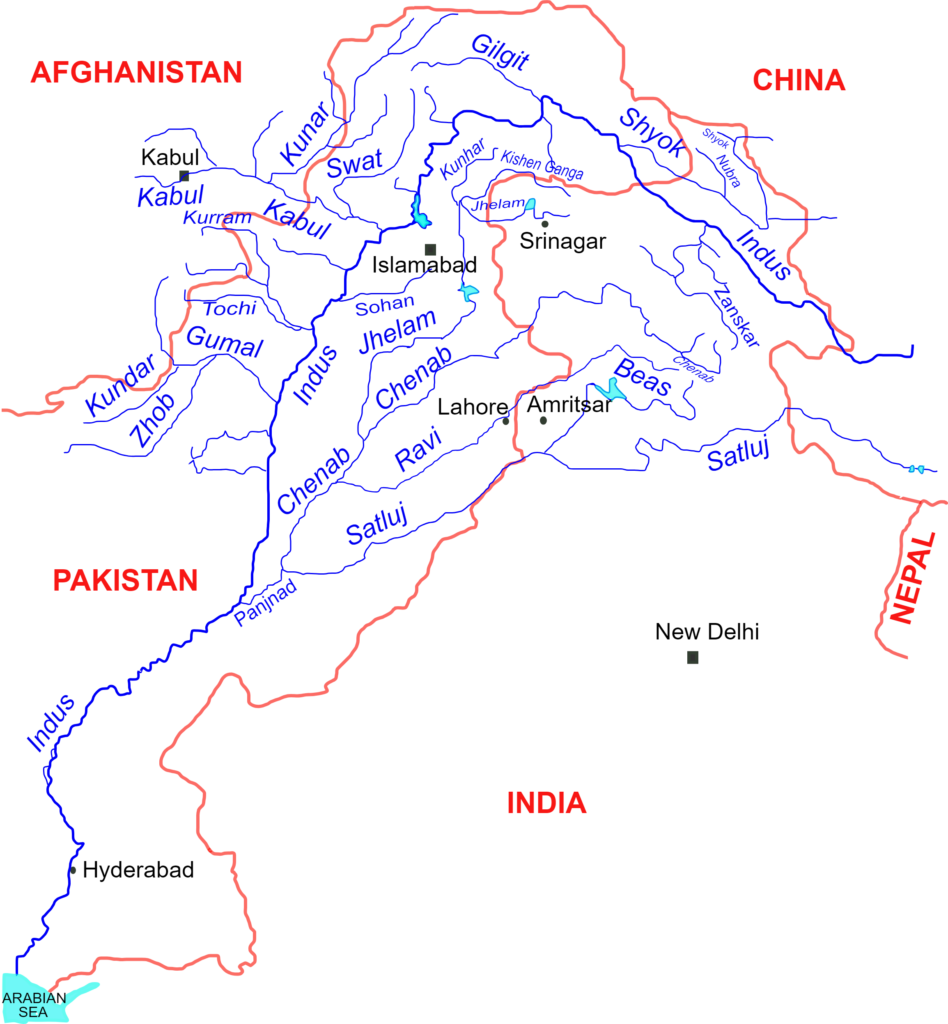

Indus Water Treaty

- Signed

- September 19, 1960 between India and Pakistan brokered by the World Bank.

- Purpose

- The treaty aims to provide a framework for cooperation and information exchange between India and Pakistan regarding the use of the water from the Indus River and its five tributaries Sutlej, Beas, Ravi, Jhelum and Chenab.

Key Provisions

- Water Sharing

- The treaty divides the water of the six rivers in the Indus River System between the two countries.

- Pakistans Share

- The three western rivers Indus Chenab and Jhelum are allocated to Pakistan for unrestricted use with some exceptions for India’s non consumptive agricultural and domestic needs.

- Indias Share

- The three eastern rivers Ravi Beas and Sutlej are allocated to India for unrestricted use.

- Water Distribution

- The river water is divided into 80 to Pakistan and 20 to India.

Permanent Indus Commission

Both countries establish a commission that is required to meet every year for cooperation and resolve any water disputes.

- Dispute Resolution Mechanism: A threestep process in case of a water dispute

- Permanent Indus Commission

- For initial resolution.

- Neutral Expert NE

- If the issue remains unresolved it can be referred to a World Bank appointed NE.

- Court of Arbitration

- If necessary disputes can be appealed to a World Bank established Court of Arbitration.

- Permanent Indus Commission

Projects Inspected Under IWT

- Pakal Dul and Lower Kalnai

- Hydro Electric projects on the Chenab River with concerns raised by Pakistan regarding water flow impacts.

- Kishanganga Hydroelectric Project

- Located in Jammu and Kashmir Pakistan raised concerns over the diversion of the Kishanganga River but The Hagues Permanent Court of Arbitration ruled in favor of India in 2013 with specific conditions.

- Ratle Hydroelectric Project

- Another run of the river hydroelectric power station on the Chenab River in Jammu and Kashmir.

Indus River and Its Tributaries

- Source

- The Indus River originates in Tibet near Mansarovar Lake and flows through India and Pakistan serving a basin that supports about 200 million people.

- Course and Tributaries

- The Indus enters India through Ladakh and flows through Jammu and Kashmir before entering Pakistan‘s Gilgit Baltistan region.

- Major left bank tributaries include the Zaskar Suru Soan Jhelum Chenab Ravi Beas Satluj and Panjnad rivers.

- Major right bank tributaries include Shyok Gilgit Hunza Swat Kunnar Kurram Gomal and Kabul rivers.

- The Indus River empties into the Arabian Sea near Karachi in Pakistan.

| River | Source | Joins |

|---|---|---|

| Jhelum | Spring at Verinag, Kashmir Valley | Chenab at Trimmu, Pakistan |

| Chenab | Chandra and Bhaga streams near Bara Lacha Pass | Satluj after receiving Jhelum and Ravi |

| Ravi | Kullu hills near Rohtang Pass | Chenab near Rangpur, Pakistan |

| Beas | Near Rohtang Pass | Satluj at Harike Barrage, India |

| Satluj | Manasarovar-Rakas Lakes, Tibet | Indus a few kilometers above Mithankot, Pakistan |

Challenges to the IWT Framework

- Indias Position

- Support for the NEs (Neutral Expert) Decision

- India welcomed the NEs assertion of competence to resolve technical disputes under the IWT framework.

- Demand for Renegotiation

- Since January 2023 India has sought to revise the treaty citing evolving geopolitical and hydrological challenges. However Pakistan has not responded to India’s four formal requests for dialogue.

- Rejection of Parallel Mechanisms

- India opposes the simultaneous operation of the NE and the Court of Arbitration CoA claiming this is not permissible under the IWT.

- Support for the NEs (Neutral Expert) Decision

- Pakistan’s Stance

- Support for Dual Processes

- Pakistan initiated proceedings before the Court of Arbitration in 2016 seeking resolution on hydroelectric project disputes.

- Consistency with IWT

- Pakistan maintains that its actions are within the treaty’s provisions even as India disputes this interpretation.

- Support for Dual Processes

Key Disputes in Interpretation

- Dispute Resolution Sequence

- Indias View

- All disputes must first go through the Permanent Indus Commission PIC followed sequentially by the NE and then if unresolved by the CoA.

- Pakistans View

- Allows for simultaneous activation of dispute resolution mechanisms without exhausting each step.

- Indias View

- Next Steps

- NEs Proceedings

- The NE will review technical aspects of the Kishenganga and Ratle hydroelectric projects to determine compliance with treaty specifications.

- Court of Arbitration

- The CoA continues its deliberations despite India’s boycott.

- NEs Proceedings

Challenges

- India’s Demand for Revision

- India’s push for treaty renegotiation stems from concerns about outdated provisions and its need for greater hydrological security.

- Geopolitical Implications

- The unresolved disputes highlight ongoing tensions between India and Pakistan over water sharing and treaty interpretation.

- Lack of Dialogue

- The absence of formal engagement through the Permanent Indus Commission PIC since May 2022 undermines the treaty’s collaborative mechanisms.

Way Forward

- Focus on Technical Dispute Resolution

- Both countries should prioritize using the existing framework for resolving technical disputes regarding water usage and sharing.

- Transparency and Data Sharing

- Sharing hydrological data can help both nations address mutual concerns and improve trust between the countries.

- Joint Basin Management

- Given the challenges posed by climate change and population growth both India and Pakistan should consider joint management of the Indus basin for water conservation flood control and sustainable water usage.

- Political Commitment and Dialogue

- Long term sustainable solutions depend on both governments willingness to engage in dialogue and cooperation rather than confrontation.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims

Q1. With reference to the Indus river system, of the following four rivers, three of them pour into one of them which joins the Indus directly. Among the following, which one is such a river that joins the Indus direct? (2021)

(a) Chenab

(b) Jhelum

(c) Ravi

(d) Sutlej

Ans: (d)

Q2. Consider the following pairs (2019)

| Glacier | River | |

| 1. | Bandarpunch | Yamuna |

| 2. | Bara Shigri | Chenab |

| 3. | Milam | Mandakini |

| 4. | Siachen | Nubra |

| 5. | Zemu | Manas |

Which of the pairs given above are correctly matched?

(a) 1, 2 and 4

(b) 1, 3 and 4

(c) 2 and 5

(d) 3 and 5

Ans: (a)

Mains

Q. Present an account of the Indus Water Treaty and examine its ecological, economic and political implications in the context of changing bilateral relations. (2016)

Q. The interlinking of rivers can provide viable solutions to the multi-dimensional inter-related problems of droughts, floods, and interrupted navigation. Critically examine. (2020)

4. Jaitapur Nuclear Power Project (JNPP)

Context:

India and France have agreed to boost cooperation in “high-end technology sectors”, as senior officials held Foreign Office consultations in Paris, and talks between the two sides have not resolved issues on the much-delayed Jaitapur Nuclear Power Project in Maharashtra, despite a revised techno-commercial offer being made by French energy company EDF (Electricite De France) in 2022.

Jaitapur Nuclear Power Project (JNPP)

The Jaitapur Nuclear Power Project (JNPP) is a proposed nuclear power plant in Jaitapur, Maharashtra, India. The project is a collaboration between India and France to generate nuclear power for peaceful purposes.

- What is the project about?

- The project involves building six nuclear power plants with a capacity of 1650 MWe each.

- The plant would be the world’s largest nuclear power plant by net generation capacity, at 9,900 MW.

- The plant would supply electricity to 70 million households.

- The plant would avoid over 50 million tons of CO emissions per year.

- Why was the project sanctioned?

- The government of India sanctioned the project in 2005 as the demand for electricity was increasing, fossil resources were scarce, and nuclear power was safe.

- MoEF granted environmental clearance for the project in 2010.

- What are some issues with the project?

- Some say the project is risky and expensive.

- Some say the Civil Liability for Nuclear Damage Bill 2010 is unclear and doesn’t protect victims.

- Some say the project would lead to social, ecological, and public health disasters.

5. Hypersonic Missiles

Context:

In a crucial milestone in the development of next-generation hypersonic munitions, the DRDO has successfully demonstrated a cutting-edge active cooled scramjet combustor ground test for the first time in India. This is the effort to develop a long-duration supersonic combustion scramjet powered hypersonic technology.

Hypersonic Missiles

Hypersonic missiles are those missiles that fly at speeds of Mach 5 or higher, which is over five times the speed of sound. They are very maneuverable and can fly low.

- How they work?

- Hypersonic missiles use aerodynamic lift to maneuver within the atmosphere.

- They can be launched from a rocket and then glide to their target.

- They can also be propelled by air-breathing engines during flight.

- Why they are significant?

- Hypersonic missiles are made to be fast, difficult to detect, and hard to intercept.

- They can be used to strike time-critical or heavily defended targets.

- They can be used to respond to threats when other forces are not available.

- Countries that are developing hypersonic missiles

- United States, China, Russia, Australia, India, France, Germany, South Korea, North Korea, and Japan.

- Potential impact

- Could increase the risk of conflict escalation.

- It will not alter the strategic balance between nuclear powers.

Hypersonic vs Supersonic Missiles

Hypersonic

- Hypersonic missiles are those missiles whose speed is more than five times the speed of sound, while supersonic missiles are those that travel faster than the speed of sound.

- Hypersonic missiles move at a velocity of at least Mach 5, which means five times the speed of sound.

- Hypersonic missiles may be glide vehicles or cruise missiles.

- Hypersonic missiles can use air-breathing engines like scramjets to reach high speeds.

Supersonic

- Supersonic missiles travel at speeds between Mach 1 and Mach 5.

- Supersonic missiles can be cruise missiles.

- Supersonic missiles can travel at speeds of around 2-3 Mach, which is about one kilometer per second.

- Examples

- The Avangard is a hypersonic missile that can travel at Mach 20 and cover ranges of over 3,700 miles.

- BrahMos is a hypersonic missile with an approximate range of about 370 miles.

6. PM EDRIVE Scheme

Context:

With the Union Budget 2025 on the horizon, electric twowheeler (e2W) players are urging the government to introduce critical policy measures and incentives to revitalise the sector. Key demands include relooking at the PM EDRIVE scheme, reduced goods and services tax (GST) rates across the entire EV ecosystem, providing targeted subsidies and innovative financing models.

PM EDRIVE Scheme

PM Electric Drive Revolution in Innovative Vehicle Upgrade (PM EDRIVE Scheme) is India’s latest push toward the promotion of electric mobility as the replacement to the earlier FAME II policy. It has fiscal as well as infrastructural interventions geared toward a hastened take-up of EVs specifically in two/three-wheeler as well as in bus segments but remarkably, this one does not extend direct subsidy benefits to electric cars.

- Launch Date

- October 1, 2024

- Validty

- 31 March 2026

- Ministry

- The Ministry of Heavy Industries (MHI)

- Objective

- To boost electric mobility and transition India toward a greener and more sustainable transport system.

- Financial Outlay

- 10900 crore over two years

- Scope

- Demand incentives for

- Electric twowheelers 25 lakh units

- Electric three wheelers 3 lakh units

- Electric buses 14000 units

- Automakers can claim reimbursements for EV sales similar to the FAME II scheme.

- Demand incentives for

- Charging Infrastructure

- Establishment of public charging stations in selected cities and along highways.

- Modernization of test agencies to handle new green mobility technologies.

- Exclusion of Electric Cars

- No direct subsidies for electric cars due to which the government feels that the proposed lower GST rates 5 and other measures suffice support the segment.

Comparison with the FAME Scheme

- The PM EDRIVE supersedes the FAME Faster Adoption and Manufacturing of Hybrid and Electric Vehicles Scheme which was sanctioned to reduce emissions and boost EVs in all segments.

- The Main Stages of FAME

- FAME I 2015 to 2019

- Focused on incentives for purchasing EVs and developing initial charging infrastructure.

- FAME II 2019 to 2024

- Broader scope emphasizing public transport EVs like ebuses twowheelers and three wheelers.

- Allocated 119 billion for subsidies and charging infrastructure development.

- FAME I 2015 to 2019

Impact of Exclusion of Electric Cars in PM EDRIVE

- Slowing Sales

- Electric car registrations were down 9 for April – August 2024 from the months prior to FAME II.

- Lack of subsidies make them unaffordable, hence limiting their adoption Lack of Charging Stations.

- Charging Station

- There are only 25000 public charging stations in India catering to 46 lakh EVs creating a ratio of 184 EVs per charging station far worse than global averages.

- There is not enough infrastructure for the mass adoption of e cars.

- New Focus

- The focus on taking away subsidies for cars seems to shift toward more emphasis on public transport and smaller EVsas an aid in this aim to decrease vehicular emissions in already overcrowded urban regions.

Support Measures for Electric Mobility beyond Subsidies

- Production Linked Incentive PLI Schemes

- Encourages local production of auto parts and ACC batteries which reduces the cost of production.

- State Level Exemptions

- Most states exempt EVs from road tax and waive the registration fee.

Challenges and Way Forward

- Robust Charging Infrastructure

- In order to fuel the increasing fleet of EVs there is a need for investment in public and private charging networks.

- Electric Car Policy

- For smaller EVs and public transport long term strategies for electric cars are necessary in order to meet climate goals and consumer demand.

- Balanced Incentives

- Adding fiscal support for electric cars would ensure that all segments of EVs grow holistically.

7. Draft Guidelines for Ecommerce Platforms

Context:

The Bureau of Indian Standards (BIS) has proposed draft guidelines under the Food and Consumer Affairs Ministry that will look at enhancing consumer protection and building up trust in this fast growing ecommerce sector. The guidelines will look for self regulation by ecommerce platforms aimed at mitigating fraudulent practices while improving transparency within the digital shopping landscape

Key Features of the Draft Guidelines

PreTransaction Stage

- KYC of Business Partners

- Ecommerce platforms must carry out strict Know Your Customer KYC checks especially for third-party sellers.

- Detailed Product Listings

- Product listings must include: Clear product titles seller contact information and identification numbers.

- Supporting media eg images/videos to help consumers judge product utility and features.

- Product listings must include: Clear product titles seller contact information and identification numbers.

- Importer and Seller Details for Imported Goods

- Platforms must prominently display importer packer and seller information for imported goods to ensure transparency.

Contract Formation Stage

- Consumer Consent

- Platforms must record and ensure consumer consent before proceeding with transactions.

- Review of Transactions

- Consumers should be able to view their transactions before they commit purchases.

- Cancellation Returns and Refunds

- There must be a clear policy on cancellations returns, and refund through transparent timelines and processes.

- Complete Transaction Records

- The platforms must keep transaction records and have them available according to local regulations.

- Secure Payment Systems

- Ecommerce platforms are required to implement secure payment methods using encryption and two factor authentication to protect consumer data.

- Payment Methods

- A variety of payment options including credit debit cards mobile payments ewallets and bank transfers must be made available.

- Disclosure of Processing Charges

- Any processing charges associated with transactions must be fully disclosed to the consumer.

Post Transaction Stage

- Recurring Payments

- Platforms must provide clear disclosures on:

- Duration intervals and amounts for recurring payments.

- Simple optout procedures for consumers who wish to cancel subscriptions.

- Platforms must provide clear disclosures on:

- Cash on Delivery Refunds

- Refunds for cash on delivery orders must be processed according to the consumers preferred method.

Objectives of the Guidelines

- Protecting Consumers

- Address rising concerns over fraud and misinformation in the ecommerce sector.

- Building Consumer Trust

- The guidelines aim to establish transparent and secure transactions ensuring that consumers can make informed choices.

- Regulatory Clarity

- Providing clear rules for ecommerce platforms to govern their operations contributing to a safer digital shopping environment.

8. PM Vishwakarma Scheme

Context:

Public sector banks (PSBs) have raised concerns regarding specific restrictions in the PM Vishwakarma scheme that make individuals ineligible if they had taken government loans in the past five years, such as under the Prime Minister´s Employment Generation Programme (PMEGP).

PM Vishwakarma Scheme

The PM Vishwakarma Scheme targets artisans and craftsmen engaged in areas of blacksmithing goldsmithing pottery carpentry and sculpting many of which comprise traditional Indian crafts. This is more of an activity for preservation of cultural heritage of India but integrates these artisans into the formal economy and global value chains. This is a Central Sector Scheme completely funded by the Government of India.

- Ministry

- Nodal Ministry: Ministry of Micro Small and Medium Enterprises MoMSME.

- Partner Ministries: Departments Ministry of Skill Development and Entrepreneurship Department of Financial Services Ministry of Finance Government of India.

- Launch Date

- 17th September, 2023

- Budget

- Allocations in budget Rs 13000 crore for 5 years 2023 to 2028

- Recognition and Facilitation

- A PM Vishwakarma certificate and an identity card are issued to the artisans.

- Collateralfree credit support up to Rs 1 lakh in the first tranche.

- Till Rs 2 lakh second installment.

- Interest rate on loans 5 concessional.

- Skill Development and Empowerment.

- Features

- Stipend on daily basis for the skill training Rs 500.

- Rs 15000 grant to acquire modern tools.

- Significance

- Empowering Traditional Artisans: Recognizes the critical role that Vishwakarmas traditional artisans play in society.

- Global Supply Chain Integration: Provides support for artisans to be a part of the global supply chain ensuring their survival and growth despite technological advancements.

Banking/Finance

1. SEBIs Proposal for Pre Listing Share Trading

Context:

The Securities and Exchange Board of India (SEBI) is looking into the concept of introducing a controlled mechanism under which investors will be permitted to offer allotted shares even before the exchange-bound formal listing thereof. This step aims to prevent unofficial trading in postIPO grey market and create greater market transparency.

Important Features of the Proposal

- When Listed Facility

- SEBI plans to implement a system enabling trading of IPO shares in the threeday period between allotment and listing.

- This regulated mechanism would replace the need for informal grey market transactions providing a safer and more transparent alternative.

- Objective

- To formalize and monitor prelisting trading, ensuring investor protection and reducing price manipulation in the grey market.

Rationale Behind the Move

- Current Grey Market Practices

- IPO shares are frequently traded informally in the grey market where prices and transactions are unregulated increasing risks for investors.

- By creating a regulated platform SEBI aims to eliminate these risks while allowing investors to benefit from selling their shares prelisting.

- Investor Opportunity

- SEBI Chairperson Madhabi Puri Buch said that the investors who want to sell shares before listing should be given a proper regulated avenue to do so.

- Implementation and Ongoing Discussions

- SEBI is consulting with stock exchanges to design and implement the when listed system.

- Operational guidelines and frameworks including settlement processes and compliance checks will be crucial for ensuring the systems smooth functioning.

Benefits

- Transparency

- Eliminates opaque grey market dealings.

- Liquidity

- Increases opportunities for investors to trade IPO shares.

- Regulation

- Reduces risks of price manipulation and irregularities.

Challenges

- Designing an efficient settlement system for prelisting trades

- Ensuring that the mechanism does not adversely affect the IPO price discovery process.

Grey Market

Grey market goods are goods sold outside the authorized distribution channels by entities which may have no relationship with the producer of the goods. This form of parallel import frequently occurs when the price of an item is significantly higher in one country than another.

Unlisted Companies Vs Listed Companies

Source: The Hindu

2. Payment Aggregator Cross Border (PA-CB)

Context:

Crossborder payments firm Skydo, received an in principle approval from the Reserve Bank of India (RBI) to operate as a payment aggregatorcross border (PACB) entity.

Payment Aggregator Cross Border (PA-CB)

A Payment Aggregator Cross Border (PA-CB) entity is a company that facilitates online cross-border payments for the import and export of goods and services. The Reserve Bank of India (RBI) regulates PA-CBs to ensure accountability and compliance.

- What do PA-CBs do?

- Help businesses engage in international transactions securely and efficiently.

- Enable customers to make recurring cross-border payments and manage subscriptions.

- Provide virtual account management services to customers.

- What are the types of PA-CBs?

- Export-only PA-CB: A PA-CB that only allows exports.

- Import-only PA-CB: A PA-CB that only allows imports.

- Export and import PA-CB: A PA-CB that allows both exports and imports.

- What are the requirements for PA-CBs?

- Non-bank entities must apply for authorization from the RBI.

- They must maintain a minimum net worth.

- They must comply with the KYC norms mentioned in the Master Direction on KYC.

- They must undertake due diligence of the buyer if the per unit value of goods/services imported exceeds INR 2.5 lakhs.

Source: Business Standard

3. Business Correspondents (BCs)

Context:

A fresh review of the remuneration and penalties for business correspondents BCs is to be held after 12 years in a meeting called by the Department of Financial Services (DFS).

Business Correspondents (BCs)

4. World Economic Forum Annual Summit

Context:

The India Pavilion at the World Economic Forum (WEF) Annual Summit in Davos was inaugurated jointly by Chief Ministers Union Ministers and state ministers.

World Economic Forum (WEF)

5. Bank Liquidity Deficit and RBI Intervention

Context:

Liquidity Position Trend Since the second half of December 2024 Indian banks have faced a liquidity deficit that touched a level of 236 trillion as on January 20 2025.

This liquidity deficit was partly caused by an accumulation of government cash balances with the Reserve Bank of India and RBI interventions in the forex market which drained rupee liquidity.

- RBIs Policy Response

- The liquidity deficit reduced CRR to banks by RBI in December 2024 as much as it 50bps downline was reduced to as low as to 40 to NDTL.

- The resultant effect is expected around 116 trillion liberated into the banks coffers to address concerns that a liquidity deficit creates.

- Current Status on CRR Issue

- Bankers have pointed out that reducing the CRR further can supply yet more durable liquidity.

Role of CRR in Liquidity Management

- The role of the CRR in management of liquidity can be seen from the following two viewpoints:

- Smoothing short term interest rates by absorbing sudden inflows or outflows of funds in settlement balances helps manage intraday liquidity needs and relieves pressure on overnight interbank call money rates.

- Managing large or sudden capital inflow/outflow In emerging markets, like India, providing a cushion in managing large or sudden capital inflow/outflows is important.

Historical Evolution and Effectiveness of CRR Changes

- In times of crisis such as the 2008 North Atlantic Financial Crisis and the 2020 COVID19 crisis the RBI reduced the CRR significantly to inject liquidity quickly into the system.

- 2008 CRR was cut by 4 percentage points to 5 to provide liquidity.

- 2020 The CRR was reduced sharply to 3 to respond to pandemic related disruptions.

- However CRR has been permitted to fall below 4 only during crisis times The March 2020 reduction was an exception.

Risks of Further CRR Cut

- Limitations on Further CRR Cuts

- CRR is currently at 4 the current level of CRR is at a critical point CRR cuts cannot be made at this point in time unless the circumstances are dire enough to call for such extreme action.

- Transitory liquidity factors

- The current deficit is partly because of temporary factors and the liquidity adjustment facility by the RBI can cater to such needs without any further cuts in CRR.

- Alternative measures

- The RBI has other instruments like OMOs and targeted liquidity operations to handle liquidity effectively without any further cuts in CRR.

- Challenges of Other Instruments

- OMOs Although effective OMOs are relatively slower and may not offer quick liquidity They do involve participation constraint and could thus distort government bond yields.

- CRR Flexibility

- Reducing the CRR enables the RBI to inject liquidity more quickly and uniformly across all banks compared with OMOs which take their time and are much less flexible.

RBI’s Liquidity Management Tools

6. Open Market Operations (OMOs)

Open Market Operations (OMOs) are a tool used by the Reserve Bank of India (RBI) to manage liquidity in the economy. OMOs involve buying and selling government securities (G-Secs) in the open market. The RBI uses OMOs to control inflation, boost economic growth, and keep bond yields at desired levels.

How OMOs work?

- Selling G-SecsWhen there is excess liquidity, the RBI sells G-Secs to remove it from the system.

- Buying G-SecsWhen there is a liquidity shortage, the RBI buys G-Secs to inject liquidity into the system.

Why OMOs are important?

- OMOs help the RBI manage the rupee liquidity in the market.

- OMOs help the RBI keep bond yields low, which lowers the government’s borrowing cost.

- OMOs help the RBI control inflation and money supply.

- OMOs help the RBI smoothen liquidity conditions throughout the year.

7. RBI’s New Regulations for Non-Resident Indians (NRIs)

- Streamlined Cross-Border Transactions:

- The NRIs are now allowed to open rupee accounts with banks abroad, making current and capital account transactions relatively easier.

- Application of Rupee for Business and Personal Transactions:

- NRI can make use of the rupee proceeds in various transactions like export payments, business dealings, and investments in India.

- Greater Flexibility for NRIs:

- NRIs can retain rupees earned from exports to India and utilize the balance for business payments to Indian residents.

- Increased Ease of Foreign Investment:

- NRIs can invest abroad in rupee-denominated assets, which will increase their investment choices and facilitate repatriation.

- Export-Import Facilities:

- NRIs can retain their rupee accounts for the receipt of export earnings, managing advance remittances, and payment of import bills to India.

Banker’s View: Limited Transactions Anticipated

- Bankers anticipate limited transactions due to the non-convertible status of the rupee.

- The accounts are primarily open for trade transactions in the UAE, Indonesia, and the Maldives, but could eventually extend to all countries.

RBI’s Efforts to Promote Rupee Usage

- In 2023, an RBI committee recommended expanding the use of the rupee in international trade, including inclusion in the IMF’s Special Drawing Rights basket.

- Bilateral and multilateral trade arrangements have been proposed for invoicing, settlement, and payments in INR and local currencies.

Existing Attempts to Rupee Settlement

- July 2022:

- Opening of special rupee Vostro account with AD banks in India, opened the door for rupee settlement in international trade.

Economy

1. Rashtriya Ispat Nigam Limited (RINL)

Context:

The Union Cabinet Committee on Economic Affairs approved a 11,440 crore financial package for RINL aimed at reviving the struggling state owned enterprise operating the Visakhapatnam Steel Plant.

Rashtriya Ispat Nigam Ltd (RINL)

- Full Name

- Rashtriya Ispat Nigam Ltd RINL commonly known as Vizag Steel.

- Chairman

- Ajit Kumar Saxena

- Established

- 18 February 1982

- Ownership

- A Central Public Sector Undertaking CPSU under the Ministry of Steel Government of India.

- Location

- Based in Visakhapatnam, Andhra Pradesh, India.

Key Features and Background

Integrated Steel Plant RINL operates Visakhapatnam Steel Plant VSP which is India’s first shore based integrated steel plant built with state of theart technology.

- Commissioning

- The steel plant was commissioned in 1992 with an initial capacity of 30 MTPA Million Tonnes Per Annum of liquid steel

- Expansion

- Reached 63 MTPA in April 2015

- Increased capacity to 73 MTPA in December 2017

Captive Mines and Resources

- Limestone

- Captive Mine Located at Jaggayyapeta Krishna District Andhra Pradesh

- Dolomite

- Captive Mine Situated at Madharam Khammam District Andhra Pradesh

- Manganese

- Ore Captive Mine Located at Cheepurupalli Vizianagaram District Andhra Pradesh

- Sand Mining

- Lease RINL holds a mining lease for river sand on the Champavathi River

Agriculture

1. Buyofuel Launches Buyo Inventory App

Context:

Buyofuel Launches Buyo Inventory App for Biofuel Inventory Management.

About Buyofuel

- Specialization: Biofuel marketplace connecting producers, suppliers, and consumers.

- Mission: Streamline biofuel trade and management with innovative and sustainable solutions.

Challenges in Biofuel Inventory Management

- Difficulty managing raw material inflow and finished product outflow.

- Issues with stock mismanagement, overproduction, and material wastage during processes like fermentation.

- Unplanned machinery downtime disrupting production schedules.

Features of the Buyo Inventory App

- Real-Time Tracking:

- Monitors raw material inflow and finished product outflow.

- Sends alerts to prevent overstocking or shortages, ensuring smooth operations.

- Integration Capabilities:

- Aligns with machinery maintenance schedules and production capacity.

- Ensures timely availability of spare parts to minimize downtime.

- User-Friendly Interface:

- Facilitates rapid adoption across operational teams at different levels.

- Promotes seamless integration into existing processes.

Benefits for the Biofuel Sector

- Operational Efficiency: Reduces material wastage and prevents production delays.

- Cost Optimization: Streamlines inventory management to improve profitability.

- Sustainability Focus: Supports environmentally-friendly practices in biofuel production.

Leadership Insights

- Kishan Karunakaran, CEO of Buyofuel:

- Describes the app as a “key milestone” for the biofuel industry.

- Highlights its role in enabling cost-efficiency, waste reduction, and overall profitability.

Impact and Vision

- The app’s launch reflects Buyofuel’s commitment to innovation and sustainability.

- Promotes a greener future by enabling biofuel companies to adopt intelligent technologies for growth.

- Aims to build a seamless ecosystem for biofuel trade and management.

India’s Ethanol Program

Facts To Remember

1. India outplays England to clinch PD Champions Trophy

Aided by Yogendra Bhadoria’s quick-fire 73 (40b, 4×4, 5×6) Radhika Prasad’s four for 19 in 3.2 overs, India thrashed England by 79 runs to lift the Physically Disabled Champions Trophy in Colombo.

2. Mixed trends of Asian & European markets

Major Asian indices displayed mixed trends today. Hong Kong’s Hang Seng Index dropped over 1.6 percent, China’s Shanghai Composite Index shed 0.9 percent, and Singapore’s Straits Times Index ended down by 0.37 percent.

3. Govt decides to increase MSP by Rs 314 for raw jute; 4decision will benefit 40 lakh farm families

The government has decided to increase the Minimum Support Price for raw Jute for marketing season 2025-26. Briefing media in New Delhi today about the Cabinet decisions, Union Commerce and Industry Minister Piyush Goyal said, MSP of five thousand 650 rupees per quintal for raw jute will be provided which is 315 rupees more in comparison to the previous marketing season 2024-25.

4. EPFO adds 14.63 lakh new members in Nov 2024

The Employees’ Provident Fund Organisation (EPFO) added 14 lakh 63 thousand members during November last year.

5. World Bank appointed neutral expert backs India’s stand on dispute with Pakistan regarding Indus Water Treaty

The World Bank-appointed Neutral Expert has announced that it is competent to decide on the differences between India and Pakistan over two hydropower projects in Jammu and Kashmir, under the Indus Water Treaty

6. Govt celebrates 10th anniversary of ‘Beti Bachao Beti Padhao’ scheme

Government is celebrating the 10th anniversary of Beti Bachao Beti Padhao scheme today, marking a decade of relentless efforts to protect, educate, and empower the girl child.