Context:

The central government is expected to announce an increase in the loan limit on Kisan Credit Card (KCC) scheme from ₹3 lakh to ₹5 lakh in the proposed union budget for FY26.

- Reason

- Increasing costs of farming and escalating demand for greater financial assistance to farmer households.

- Ceiling Limit

- The ceiling of ₹3 lakh, which was fixed almost several years ago, would be increased to limit of maximum ₹5 lakh.

- Current Status of KCC

- According to the latest statistics available on June 30, 2023, there are more than 740 million active accounts with outstanding credit of ₹8.9 trillion.

Budget 2025-26

In the Budget, the loan limit under Kisan Credit Card (KCC) has been enhanced from ₹3 lakh to ₹5 lakh. It will benefit 8 million of 77.7 million KCC accounts only. But it is offered only for farmers with good repayment history and commercial farming, only.

Kisan Credit Card (KCC) Scheme

- Launch

- Launched in 1998 to provide credit support to farmers for cultivation and other needs.

- Extended in 2004 for investment credit requirements of farmers.

- Ministry

- The Ministry of Agriculture and Farmers’ Welfare

- Fisheries and Animal Husbandry

- Reaches fisheries and animal husbandry farmers in Budget-2018-19.

- Implementtion

- Commercial Banks, Regional Rural Banks (RRBs), Small Finance Banks, and Cooperatives implement it.

- Features

- Features include an ATM-enabled RuPay debit card, built-in cost escalation, and any number of drawals within the limit.

- Government initiative

- Government initiative includes farmers under animal husbandry and fisheries no processing fee on loan under KCC and also increasing the ceiling of collateral-free agriculture loan to Rs.1.6 lakh from Rs 1 lakh.

- Objectives

- Objectives include meeting short-term credit requirements for cultivation of crops, post-harvest expenses, produce marketing loan, consumption requirements of farmer households, working capital for maintenance of farm assets and activities allied to agriculture, and investment credit requirement for agriculture and allied activities.

- Financial Provisions

- Financial Provisions include an interest subvention scheme of 2% for short term crop loans up to Rs. 3 lakh and a prompt repayment incentive of 3% to the farmers.

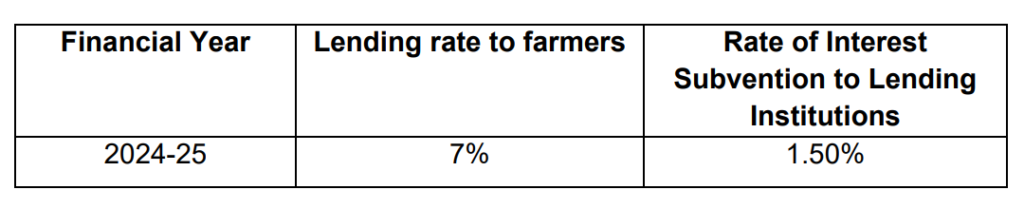

- Recent Update

- Interest Subvention to Lending Institutions has been updated to 1.5% for FY2024-25.

- Drawbacks

- Abuse of KCC are credit transfer towards financially well off people, diverting funds towards non-agricultural use and money laundering

UPSC Civil Services Exam, Previous Year Questions (PYQ)

Q. Under the Kisan Credit Card scheme, short-term credit support is given to farmers for which of the following purposes?

- Working capital for maintenance of farm assets

- Purchase of combine harvesters, tractors and mini trucks

- Consumption requirements of farm households

- Post-harvest expenses

- Construction of family house and setting up of village cold storage facility

Select the correct answer using the code given below:

(a) 1, 2 and 5 only

(b) 1, 3 and 4 only

(c) 2, 3, 4 and 5 only

(d) 1, 2, 3, 4 and 5

Ans: (b)