Daily Current Affairs Quiz

4 February, 2025

International Affairs

1. Trump Withdraws U.S. from WHO

Context:

On January 20, 2025, as one of his first executive orders upon his return to the White House, Donald Trump announced that the United States will be leaving the World Health Organization (WHO). His primary reasons included bias towards China and the poor handling of the COVID-19 pandemic.

Major Reasons for This Move

Public Perception of WHO in the U.S.

- Growing Skepticism

- In 2020, 45% of Americans agreed with Trump’s criticism of WHO.

- In 2024, just 40% of American citizens felt their country benefits “not at all” or “not too much” from WHO membership, up from 34% in 2021.

- Partisan Divide

- 80% of Democrats-or Democratic-leaning respondents-believe the U.S. benefits from WHO.

- Only 38% of Republicans agree, and even fewer support from conservative Republicans.

Economic Issues

- The U.S. has been WHO’s largest donor, accounting for 15% of its overall budget since 2016-17.

- During the pandemic (2020-21), funding from the U.S. was reduced to 8.9%, and bounced back in 2022-23 to $1.2 billion.

- The withdrawal ends all future funding and aid, which means WHO will have a significant financial shortfall.

Impact on WHO and Global Health Initiatives

Funding Crisis

- The funds gap is quite enormous with U.S. withdrawing, WHO may find it quite difficult to meet this gap

- Other largest WHO contributors (2024-25)

- Bill & Melinda Gates Foundation (12.9%)

- GAVI Alliance (9.91%)

- European Commission (8.06%)

- World Bank (5.34%)

- China contributes only 3%

WHO Program Disruptions

- The U.S. heavily contributed to WHO programs:

- 26% on enhancing health services worldwide.

- 21% in prompt response to health emergencies.

- 20% on polio eradication.

- 10% on epidemic and pandemic prevention.

Impact on Personnel and Research

- The order references the US personnel working with WHO. Indeed, the number of US collaborating centers is the largest at 79 followed by India and China. Research collaboration and coordinating public health work will be hampered.

Will Others Step Up?

- Germany and UK are the largest donors from Europe and no single country has supplied more than 5 percent of WHO’s financing.

- US dollar contribution cannot easily be replaced because it might probably push WHO into curtailing or raising money on its own private.

2. Panama to Pull out of China’s Belt and Road Initiative

Context:

The country of Panama announced that it has decided to leave China’s Belt and Road Initiative (BRI), which is a mega program involving infrastructure and investments. The latest move comes following pressure from the United States, with US Secretary of State Marco Rubio referring to several concerns over China’s rise in the Panama Canal region.

Key Highlights:

- Panama’s Concessions to the US

- Panama Canal Authority assured US Navy ships of free passage, optimizing the priority for US vessels transiting the canal.

- President Jose Raul Mulino assured the US that Panama would not cede control of the canal, despite mounting tensions with the US.

- Withdrawal from the Belt and Road Initiative

- Panama had agreed to exit the Belt and Road project, with the country’s chief of staff Mulino stating that it would not be renewing participation after the present agreement expires in 2026.

- Panama is now the first Latin American nation to opt out of the program.

- Panama’s Canal Position

- Mulino downplayed fears of US military intervention over the canal, reassuring that the treaty regarding its control remains valid and stable.

- While Trump had criticized Panama for “exorbitant” rates for US ships, Mulino reiterated Panama’s sovereign control over the canal.

- China’s Influence in Latin America

- This is the latest move by a Latin American country to cut diplomatic ties with Taiwan and recognize China. In 2017, Panama had already cut diplomatic relations with Taiwan.

- China has continued to gain ground in the region, especially with the BRI, despite opposition from the US.

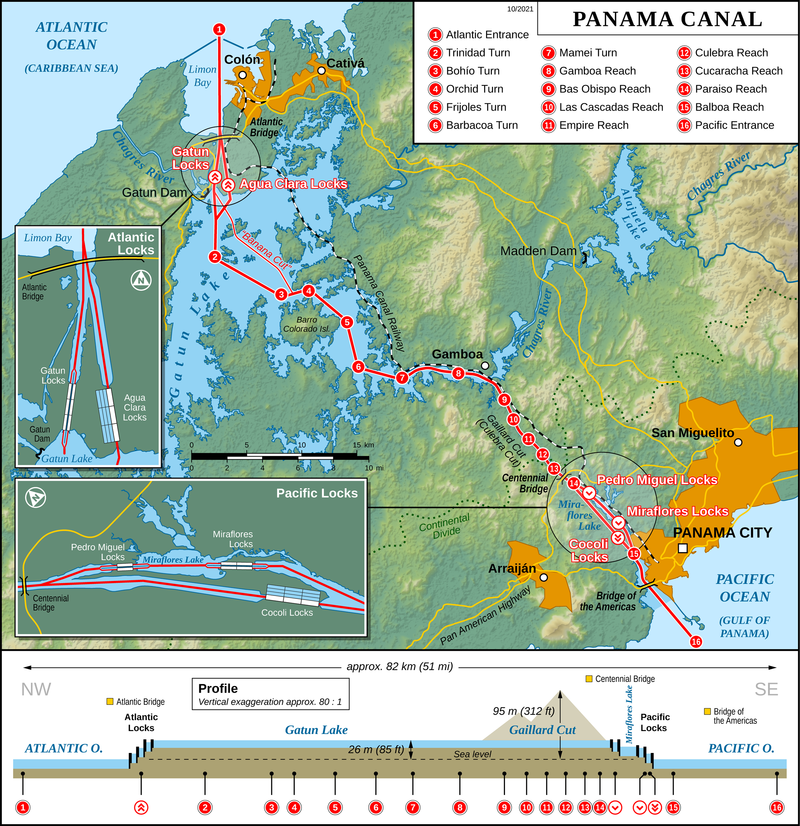

Panama Canal

- This is an artificial 82-kilometer waterway in Panama connecting the Atlantic and Pacific Oceans, cutting across the Isthmus of Panama.

- Significance

- Used for maritime trade and across the Isthmus of Panama.

- Shortens time for ships crossing between Atlantic and Pacific oceans.

- Avoids the hazardous route around southernmost tip of South America.

- One of the biggest and most challenging engineering projects.

3. Trump Pauses Mexico Tariffs

Context:

Mexican President Claudia Sheinbaum said after a conversation with U.S. President Donald Trump that the planned tariffs are on hold for a month, a statement confirmed by the White House.

4. U.S. Tariff

Context:

During his campaign, President Donald Trump often expressed his preference for tariffs, and since taking office, he has swiftly moved on this agenda. Key developments include the imposition of 25% tariffs on imports from Canada and Mexico, and 10% tariffs on goods from China.

Key Highlights:

- Harsher Tariffs on Allies

- Ironically, the 25% tariffs on Canada and Mexico are sharper than the 10% tariff on China, which many felt should have been higher given President Trump’s promises during his presidential campaign.

- This is only part of the larger picture

- Trump has been more harsh on democratic allies than authoritarian regimes, and this has brought international concern to the fore.

Inflation Concerns

- Inflationary effect of tariffs

- This is another consideration of Trump’s administration. For example, Canadian oil, one of the U.S. biggest energy sources, will only incur a 10% tariff to avoid raising energy prices drastically.

- The impact on China is harder to predict but forms part of the broader strategy that Trump has devised to engage in renegotiations with tough trading partners.

- Bargaining Tactic

- Trump uses tariffs as a means of bargaining for better trade deals, particularly with Canada and Mexico, in the hope of concluding agreements quickly that are favorable to U.S. interests.

- More complicated negotiations with China and the European Union may need to escalate tariffs as a bargaining chip.

India’s Takeaways

- India’s Trade Strategy

- India should indicate both strength and willingness to negotiate, maintaining the balance between the possible unilateral tariff reductions without facing U.S. challenges against its interests.

- India needs to find the sectors where the U.S. administration will prefer more access to the Indian market and prepare counter measures in its own interests.

- New Global Trade Dynamics

- The global trade system is undergoing a transformation where it has become much more antagonistic from the United States side under Trump.

- India needs to adjust to this shifting landscape by identifying opportunities for building and strengthening new trade partnerships.

- India needs to focus more on greater integration with other trading partners through both plurilateral agreements such as the Regional Comprehensive Economic Partnership, or RCEP and bilateral trade deals with the European Union.

National Affairs

1. Mission 3000

Context:

Union Railways Minister Ashwini Vaishnaw has assured that despite criticism regarding the slow pace of freight loading, the ministry’s flagship cargo initiative, Mission 3000, remains on track. The mission aims to achieve 3,000 million tonnes (mt) of cargo by 2030.

Cargo

In transportation, cargo refers to goods transported by land, water or air, while freight refers to its conveyance.

Mission 3000 and Strategic Projects

- The government is targeting 3,000 mt of cargo by 2030 under Mission 3000.

- Key infrastructures

- Will give much-needed boost to volumes.

- The Sonnagar-Andal quadrupling is already showing promise, and this will be a quantum jump in cargo handling by itself.

- The rest also look like it would give its own bargain of growth.

Performance and Revised Targets

- Ministry to cross 1,600 mt for the first time in this fiscal.

- But for the Mission 3000 target, the output will have to almost double in the next five years.

- In the wake of the Budget 2025, freight growth has been considered below par.

- The estimates of freight loading for the current year have been reduced by 15 mt to 1,635 mt.

- For FY25-26, the target is 1,700 mt, a 4% increase over FY25.

Growth Challenges

- Post-COVID, the ministry saw double-digit freight growth and crossed important milestones, such as 1,500 mt.

- However, this year, freight growth is expected to be modest, with a mere 2.9% increase in the current fiscal year.

Government Investments and Long-Term Outlook

- The Indian Railways is investing ₹2.5 trillion annually to revamp the freight sector, addressing past neglect.

- With these continued investments and completion of strategic projects, Mission 3000 is poised to drive major increases in freight volumes in the future.

2. Viksit Bharat 2047

Context:

The vision of a Viksit Bharat 2047 is ambitious, requiring India to adapt quickly to rapidly changing global dynamics. While challenges like geopolitical instability, climate change, and technology disruptions exist, adopting platform-based economic models can provide a pathway to achieve rapid innovation, economic flexibility, and resilience in a volatile environment.

Platform-Based Approach: A Solution to Economic Uncertainty

- Platform Model

- A platform is an elastic system through which a large number of agents, such as buyers, sellers, and service providers, interact in ways that encourage innovation and rapid adaptation.

- Freedom and Flexibility

- Sellers are not tied to one customer, and buyers can find a variety of sellers, so trade is made efficient and inexpensive.

- Innovation and Speed

- Digital technologies will allow real-time information flow so that innovation takes place faster than ever and better responds to changing market demands.

Examples of Successful Platforms

- Digital Payments

- India’s digital payments model is an exemplar of successful platform models where the system rapidly expanded.

- Open Network for Digital Commerce (ONDC)

- The platform that the government is proposing as a tool to create new platforms for startups falls in the pattern of strategies meant to generate new business opportunities and competition.

Platform-Oriented Economic Policy

India requires an overall platform-oriented economic policy aimed at enabling platforms across sectors. These should be constituted by the following elements:

- Enable Participation in Digital Infrastructure

- Integrate all the public and private platforms with Digital India and BharatNet, thus widening the reach and the scope.

- Simplify Regulations

- Unwind unnecessary restrictions, especially FDI, for fostering competition and integration with the global economy.

- The existing limitations on FDI restrict the scope of the market and inhibit innovation and lead Indian firms away from venturing globally.

- Support to Startups

- Platforms should provide marketing support and easy access to small, informal sector-based firms.

- The KYC requirements could be relaxed for small, localized businesses to enable them to make use of digital platforms effectively.

- Mechanisms for Customer Protection

- Set up ombudsmen and transparent customer redressal systems to instill confidence in platforms and ensure customer satisfaction, thus acting as a better growth driver than penalties or controls.

- Eliminate International Transaction Obstacles

- Concentrate on removing barriers to international trade, allowing Indian platforms to be part of international value chains and providing access to new market opportunities.

Union Budget 2025-26

3. India’s Clean Energy Transition

Context:

India has made significant strides in clean energy over the last decade, with increased budgetary allocations and policy initiatives. The challenges are underutilized funds, dependence on fossil fuels, and supply chain constraints.

Key Highlights:

Budgetary Allocations and Utilization

- Sharp increase in funding

- The budgetary provision to the Ministry of New and Renewable Energy increased from ₹1,535 crore (2015 BE) to ₹32,626 crore (2025 BE).

- Underutilization trend

- Except for 2015 and 2023, budgetary provisions have been revised downward due to lower expenditure.

PM-KUSUM Scheme (2019)

- Objective: To introduce off-grid solar irrigation pumps and grid-connected solar plants on fallow farmland.

- Financing: ₹34,422 crore.

- Result: Partially successful with less than 0.5 GW of installed capacity due to cold response.

Impact of COVID-19 on Energy Policy

- Break in supply chain of coal, oil, and gas has proved the necessity for energy self-reliance.

- India will source 50% of energy from renewable sources by five years at the COP26 of 2021.

Changes in Policies and Obstacles

Production-linked Incentives (PLIs)

- ₹18,100 Crore for ADVANCED CHEMISTRY CELL STORAGE FOR BATTERY 2021

- ₹4,500 crore for SOLAR PV Modules 2021. Increased further to ₹ 19, 500 crore this year 2022.

Import Duties and Domestic Slowdown of the Solar Industry.

- Implementation of 40% Basic Custom Duty (BCD) on solar modules and 25% duty on solar cells to avoid all dependency on china.

- Negative impact: Higher costs slowed down solar installations nationwide.

Coal Dominance in Power Generation

- As of October 2024, renewables make up 46% of installed capacity, but 70% of power generation still comes from coal.

- Key bottleneck: Lack of grid-scale battery storage to address intermittent renewable energy supply.

Policy Adjustments on Critical Minerals

- Exempt 12 critical minerals and 35 capital goods from BCDs to enhance domestic manufacturing with a focus on lithium-ion batteries.

- Strong Critical Minerals Framework should be established with sustainable and just extraction and sharing.

Global Implications in the Future and India’s Part

- Induction of least dependence on China would require very proactive leadership over sourcing and processing of critical minerals.

- With the US receding from clean energy, India is perfectly placed to take over a highly significant role in the evolution of policies on energy transition globally.

4. Bilateral Investment Treaty (BIT)

Context:

One of the recent strong signals towards more foreign direct investment for the country comes from Union Finance Minister Nirmala Sitharaman as she declared a renewed version of India’s model Bilateral Investment Treaty (BIT). Since India is close to reaching finality on long-pending free trade agreements (FTAs) with the United Kingdom (UK) and the European Union (EU), changes need to be made to the current model BIT to try to make it an investment-friendly framework.

Background and Key Issues in the Current BIT Framework

- Bad Legal Decisions

- The revised BIT is sought due to the adverse legal rulings against India through retrospective taxation in cases of Vodafone and Cairn Energy, which followed the seizure of foreign assets. Consequently, India has terminated the BITs with more than 75 countries between 2016 and 2021.

- Defensive Nature of the 2016 BIT

- The BIT brought into effect in 2016 was meant to safeguard foreign investors but eventually served to shield the Indian government from international arbitration risks. Major concerns were:

- Critical principles like “most favoured nation” and “fair and equitable treatment” are excluded, which are normally incorporated in a BIT.

- Tax disputes were out of the BIT purview, and the government, thereby had a big say on the nature of dispute.

- The BIT brought into effect in 2016 was meant to safeguard foreign investors but eventually served to shield the Indian government from international arbitration risks. Major concerns were:

- Local remedies clause

- The BIT, thereby, required that investors exhaust domestic remedies legally for five years to resort to arbitration, therefore making investors, rather potential ones wary of this highly time-consuming but also insecurely account of the process to be experienced.

The revamped model BIT must move from a defensive posture into one that actively facilitates foreign investment. This would have to consider the following:

- Adopt Global Best Practices

- Flexible terms and fair dispute resolution mechanisms should be incorporated so that foreign investors are enlightened and assured about the clarifications.

- The most favored nation and fair and equitable treatment principles must be reinstated for India to regain its competitiveness edge in attracting global capital.

- Reducing Legal Obstacles

- The five year wait time before arbitration can be reconsidered, considering that with slow judicial action in India, people are not expecting to find an investor.

- Incorporating Investment Areas

- The new BIT should cover a wider range of investments, such as portfolio investments and indirect investments, according to international standards.

- Reduction of Government Discretion

- The government should minimize its discretion in tax disputes and adopt a transparent and equitable procedure to resolve the issue.

Progress and New BIT Agreements

India has already entered into BITs with the UAE, Brazil, and Taiwan under the existing framework. These have been different from the model BIT, with some even:

- Reducing the period for exhausting legal remedies.

- Including portfolio investments (as in the UAE agreement).

- These agreements point to a degree of flexibility in India’s approach and offer some clues about what the new and improved BIT may look like.

5. Forest Conservation Norms

Context:

The Supreme Court has held that the Centre and States cannot reduce forest cover without providing land for compensatory afforestation. The judgement has been made in the light of legal cases against the 2023 amendment to the Forest (Conservation) Act, 1980.

Key Highlights:

No Reduction of Forest Land without Compensation

- Government cannot divert forest land for linear projects unless equal land is provided for compensatory afforestation.

- Supreme Court Bench of Justices B.R. Gavai and K. Vinod Chandran warned against any efforts to diminish forest cover.

Challenge to 2023 Amendments to the Forest (Conservation) Act

- Petitioners argue

- Section 1A of the amended Act dilutes the definition of forests by limiting it to:

- Declared forests

- Lands recorded as forests in government records post-1980

- Section 1A of the amended Act dilutes the definition of forests by limiting it to:

- Government’s defense

- Amendment does not reduce forest cover and expands ‘government records’ to include lands recognized by local bodies and communities.

Definition of ‘Forest’ and Supreme Court’s Position

Court’s Stand on Forest Definition (1996 TN Godavarman Case)

- Supreme Court reaffirmed the broad, dictionary meaning of ‘forest’ to include:

- All areas which are covered with forests, all types, regardless of status and ownership:

- Undeclared and community forests lands Identified- 1.97 Lakh sq.km

- State/UT Needs Consolidated Records of Forest land.

- Prepare complete record about all forest area land.

- All areas which are covered with forests, all types, regardless of status and ownership:

- Exercise to be completed within one year as per the Environment Ministry’s November 2023 notification.

Implications of the Judgment

- Stronger Protection for Forests

- Any land taken for development must be replaced with compensatory afforestation.

- State Accountability

- States must ensure that all forest-like lands are recorded and cannot escape responsibility through reclassification.

- Infrastructure Project Disruption

- Linear projects such as highways, pipelines, and railways may experience delays and cost overruns on account of land compensation.

6. Manufacturing Purchasing Manager’s Indices (PMI)

Context:

Indian private sector manufacturing activity soared to a six-month high in January, ending a one-year low in December 2024. The record-breaking export performance and strong factory orders were attributed to the rise, as said by the HSBC India Manufacturing PMI.

Key Highlights

The PMI indicates recovery

- HSBC India Manufacturing PMI rose from 56.4 in December to 57.7 in January, breaking a two-month decline.

- This indicates strong expansion in manufacturing activity.

Exports Reach a 14-Year High

- Export growth was the highest since 2011, boosting overall manufacturing output.

Strong Factory Orders & Production

- Factory order books grew at the fastest rate since July 2024, which is a reflection of high demand.

- Production volumes grew at the fastest rate since October 2024.

Easing Cost Pressures & Price Trends

- Input cost pressures eased to an 11-month low, which eased the strain on manufacturers.

- Businesses increased prices, but at the slowest rate in four months.

Manufacturing Sector Sees Record Hiring

- Hiring increased at the fastest pace in nearly 20 years, S&P Global reported.

- Sales were strong, and business growth expectations were bright, leading to more workers hired.

Businesses Feel Hopeful About Future

- 32% of firms anticipate growth, while only 1% expect contraction in output.

- Companies are more optimistic about future expansion than they were in the previous months.

Implications & Outlook

- Improved Manufacturing Growth

- The PMI increase indicates a healthy rebound in India’s manufacturing sector.

- Boost to Job Creation

- Higher hiring is indicative of better employment trends in the sector.

- Inflation Taming

- Lower increases in prices and easier input prices might help to keep inflation within the control level.

- Growth Likely to Be Maintained in Q4 FY25

- Growth will be sustained, as orders, exports, and business confidence are growing.

HSBC Flash Purchasing Manager’s Indices (PMI)

Banking/Finance

1. Financial Sector Reforms under Union Budget 2025-26

Context:

The Union Budget 2025-26 has come with a significant financial sector reforms, with key areas being focused on foreign investment, credit access, corporate bonds, MSME lending, and regulatory coordination.

Key Highlights:

Foreign Direct Investment in the Insurance Sector

- This has been termed the biggest announcement from the Budget.

- Expected to have a significant impact on the insurance industry, with capital inflows and sector expansion

One State, One RRB Initiative

- Notification to be issued next week.

- There would be one Regional Rural Bank for one state.

- Goa, which does not currently have an RRB, will probably get one after an assessment of its necessity.

Partial Credit Enhancement for Corporate Bonds

- Aims to boost investor confidence in corporate bonds, particularly those with lower credit ratings.

- The government-backed institutions (like NaBFID) would support reducing borrowing costs and enhancing credit ratings.

- This is part of long-term efforts to deepen India’s corporate bond market.

Grameen Credit Score for Farmers

- Public sector banks will create a rural credit scoring system to assist farmers and rural women in availing loans.

- Understands that most rural borrowers have no formal credit history and require an alternative scoring system.

- Is expected to boost financial inclusion for underprivileged communities.

Increased Kisan Credit Card (KCC) Limits

- No additional burden on banks with the increase in limits.

- Affecting only 8 million of 77.2 million accounts, the loans are mostly for amounts over ₹3 lakh.

- Typically, borrowers in this category have excellent repayment track records.

Credit to MSMEs & NPAs

- MSMEs are an important driver of employment, GDP, and exports.

- In a recent development, the Virtual Credit Guarantee Scheme has been introduced which enables MSMEs to avail loans up to ₹100 crore.

- Plan for an additional credit guarantee scheme for MSMEs soon.

- Government feels confident that it will reduce NPAs and financial risks for banks.

Public Sector Bank Deposit-Credit Ratio

- Banks have been advised to mobilize more deposits to sustain lending growth.

- Recent trends show a slight uptick in deposits, ensuring adequate liquidity.

Expansion of India Post Payments Bank

- Plans to broaden banking services provided by postmen.

- Currently limited to fund reception, but expansion is a priority.

Forum for Regulatory Coordination in Pension Sector

- Designed to improve collaboration between different pension regulators.

- Will create a common platform to facilitate better policy coordination and learning.

Implications & Outlook

- Foreign investment will drive insurance sector growth.

- RRB reforms seek to streamline rural banking.

- The corporate bond market is likely to receive a major fillip.

- MSMEs and farmers will get better access to credit.

- Regulatory coordination in pensions will enhance policy efficiency.

2. RBI’s Sovereign Bond Holding

Context:

It is estimated that the Reserve Bank of India (RBI) holds around ₹1 trillion in sovereign bonds which are maturing over the forthcoming financial year. Traditionally, the government would have swapped those maturing bonds for a longer dated debt, thereby reducing the gross borrowing target.

Important Points:

- So, Bonds Maturity

- RBI has held onto treasury bonds worth ₹1 trillion, maturing for redemptions next year.

- Swap Bemoaned As Undone

- Normally, this maturing paper would have been swapped out with long-term debt well before the Budget to meet the estimated jump in the lower gross borrowing target end.

- Market-Based Approach

- Though, the government does not plan a swap with RBI even this time also, however it plans to manage mature bonds in market-based operation.

- The economic affairs secretary, Ajay Seth mentioned that government wishes to let out these bonds in the market be it is either public institution, or even the RBI.

- The gross borrowing target for 2025-26 has risen from ₹14.01 trillion in the current fiscal year to ₹14.82 trillion due to this move.

Implications

- Gross Borrowing Target

- The decision manifests in the rise in the borrowing target as the maturing bonds will not be swapped for longer-term debt thus reducing the short-term borrowing requirement of the government at present.

- Market Approach

- The process of addressing the maturing bonds under a market-based approach can reveal that the government prefers a more open and competitive process, an implication with broader market effects.

3. Monetary Policy Committee (MPC)

Context:

Monetary Policy Committee (MPC) Meet and Budget In the wake of the 2025-26 budget announced, the Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) meets in the hope that this time, under its new RBI Governor Sanjay Malhotra, there will be a monetary policy ease to be announced to compliment the fiscal one from the Budget.

Key Highlights:

- Monetary vs. Fiscal Policy

- There is a delicate relationship between fiscal policy and monetary policy. Even so, they must not compromise on their mandates.

- Fiscal Policy focuses more on growth and equity.

- Monetary Policy, operating under the inflation-targeting regime, must focus on price stability with a view to achieving an average 4% inflation rate within 2-6% annual bands.

- The Fiscal Push to Budget

- An attempt to create consumption growth via a ₹1-trillion tax relief. There is a potential for inflation spurt if the growth assumptions turn out to be wrong or there is an abrupt change in the global economic landscape, such as a shift in US policy.

- Economic Growth and Risks

- Even though the Indian economy is going to grow at 6.4% this fiscal year and between 6.3% to 6.8% in the next, experts feel further stimulus is not needed. But inflation risks, which are appearing for the first time, could sway MPC’s decisions in the future.

Inflation and Monetary Policy

- Retail Inflation has eased a bit but is still at 5%, much above the MPC’s target of 4%. This constrains the room for rate cuts.

- External Risks

- Global inflationary pressures, especially with a stronger dollar, could import inflation into India and push up prices.

- Liquidity Measures

- The RBI has already eased liquidity:

- It cut the cash reserve ratio (CRR) by 50 basis points in December to release ₹1.16 trillion.

The latest liquidity measures are worth another ₹1.5 trillion.

- US Federal Reserve Impact

- The US Federal Reserve has maintained its stance on rates and if the RBI lowers its rates, it might make Indian government bonds less appealing than US Treasuries, which might lead to some portfolio outflows.

Implication for MPC

- Warning Advised

- Strong global uncertainty, strong consumer spending pull, and over 5% constant inflation for sure call for the MPC to be careful in what it does next.

- Watching and Waiting for the Game to Unfold

- The MPC needs to see how the budget measures are panning out, but not exacerbated the inflation by presenting more external threats like a high US dollar.

- Cross the River by Feeling the Stones

- The Chinese proverb here means that the MPC should feel the stones, going slowly, and developing conditions as they come along.

RBI and it’s Monetary Policy

Economy

1. Indian Rupee Closes above 87 vs USD

Context:

The Rupee closed at an all time low breaching the ₹87/USD mark amid global economic shifts, trade tensions, and domestic financial vulnerabilities that triggered the decline and exposed the resultant concerns over inflation, foreign investment, and economic stability, while at the same time creating prospective benefits for exporters, remittance inflows, and some economic interests.

Factors Behind The Falling Trend Of Rupee

- Stricter US Dollar

- The dollar index surged to 1.24% high at 109.84, the US labour market data seems robust, increased Treasury yields due to expectations from a prolonged series of high-interest rates.

- Emirating economies’ currencies also the rupee is weaker along with volatility amid the dollar increase.

- Increasing Global Tensions Over a Trade War

- US President Donald Trump’s protectionist policies are increasing global trade uncertainties with fresh tariffs on Canada, Mexico and China.

- It has added yet another pressure line on the other two countries of North America–Canada and Mexico, which are exporting $840 billion worth of goods to US. China now faces a prospective 10 percent tariff, where the Yuan got weakened, adversely affecting the Rupee.

- Constant FII flows out

- FIIs have withdrawn $11 billion from Indian markets since October 2024, which is further intensifying currency pressure.

- Investors are moving their capital to safer US assets, thereby further depreciating the rupee.

- Widening Trade Deficit

- India’s trade deficit has jumped to $188 billion, with an 18% increase from FY24.

- High dependence on crude oil and imported goods has worsened the imbalance, making the rupee more vulnerable.

- RBI’s Response and Policy Outlook

- The Reserve Bank of India (RBI) has sold $3.3 billion in forex reserves over the past seven weeks to curb volatility.

- With inflationary pressures rising, all eyes are on the RBI’s upcoming monetary policy review, which could influence future interventions.

Implications of a Weaker Rupee

The Downside

- Higher Import Costs & Inflation

- Costlier crude oil and imports will increase production costs, impacting businesses and consumers.

- Rising Foreign Debt Burden

- Companies would face higher payout costs in dollar terms, making balance sheets heavy and affecting all investment decisions.

- Capital Flight & FDI Risks

- A bad rupee will trigger capital flights, deter new FDI and raise market volatilities.

- Weaker Consumer Sentiment

- Reduction in purchasing power will slow the demand and affects the overall GDP growth.

The Upside

- Increased Export Competitiveness

- Weaker rupee makes Indian exports more attractive, and thus obviously beneficial for IT, pharmaceuticals, and textiles industries.

- Increased Remittances Inflows

- Specific gains to Indians abroad through better exchange rates; now, there would be higher remittances inflows promoting domestic consumption.

- Economic self reliance by the government India is attempting to improve domestic competitiveness through policy reforms and trade strategies rather than depending on currency devaluation.

2. Impact of 100% FDI in Insurance Sector

Context:

The Indian Government is working to relax the FDI limit in the insurance sector up to 100% with an intention of providing global companies an entry into the country and increasing the inflow of capital.

Key Highlights:

- Benefits of 100% FDI in Insurance:

- The step is likely to promote an increase in the number of players in the insurance sector bridging the Indian under-penetrated market.

- Such a move could attract foreign capital in the sector by increasing competition resulting in technological transfer, and hopefully that would bring a reduction in long-term premia.

- The target of Insurance for All by 2047 by Insurance Regulatory and Development Authority of India (IRDAI) also aligns with the need for more capital in the sector.

Concerns for Foreign Insurers

- Distribution Complexity

- Foreign insurers would have to adjust to India’s bancassurance model, where the bank is leading in distribution for life insurance, and agency-led model for non-life insurance. This is a huge deviation from the distribution models of most other countries.

- Reconfiguring Partnerships

- Most foreign insurers are currently operating in joint ventures (JVs) with Indian partners. Full ownership might require restructuring of existing relationships and navigating mergers and acquisitions.

Industry Perspective

- Foreign Insurers’ Adaptation

- Foreign firms would find it challenging to adapt in India’s peculiar distribution system. According to Pallavi Malani, a partner with Boston Consulting Group, “the market setup is a little different, especially life and health insurance, compared to any other market across the world”.

- Capital Flow

- The step will raise FDI, but past experiences are a cautious one regarding the immediate capital inflows. FDI trends show that capital flow has been fluctuating with an inflow of 27,379 crore since FY21 even after raising the FDI cap to 74%.

Market Penetration and Growth

- Under-penetration

- India’s insurance market is under-penetrated, and 100% FDI will be able to bridge this gap. Higher foreign involvement will be bringing global best practices, innovative products, and improved customer service to the market.

- Local Impact

- According to Bajaj Allianz Life Insurance’s Tarun Chugh and IndiaFirst Life Insurance’s Rushabh Gandhi, foreign investment would be good for India, but the distribution-driven market will not show any changes.

Distribution Challenges

- Banks and Agencies

- Foreign insurers will find it difficult to operate in India’s bank-led distribution model for life insurance and agency-led distribution for other insurance products without local partnerships.

- M&As

- Smaller insurers may consider mergers and acquisitions to restructure their presence and adapt to the market dynamics.

Facts To Remember

1. Bhutan PM Tobgay to attend West Bengal business summit

Bhutan’s Prime Minister Dasho Tshering Tobgay is scheduled to visit Kolkata for two days to attend the State’s business summit on February 5 and 6, an official from the Royal Bhutanese Consulate in the city said .

2. OpenAI announces new ‘deep research’ tool for ChatGPT

U.S. tech giant OpenAI on Monday unveiled a ChatGPT tool called “deep research” that can produce detailed reports.

3. Khazima — the remarkable journey of India’s carrom World champion

M.B. Khazima, who recently bagged three titles — women’s singles, women’s doubles (with V. Mithra), and women’s team championship — in the Carrom World Cup in the San Francisco Bay Area (USA), has a no-nonsense approach to life and sport.

4. Govt Disburses Over ₹3 Lakh Crore Under PM Kisan Yojana

Over 3 lakh crore rupees have been disbursed to the farmers across the country by the government under PM Kisan Yojana.

5. World Cancer Day 2025: ‘United by Unique’

Today is World Cancer Day. The day is observed on 4th February to raise awareness of cancer and to encourage its prevention, detection, and treatment.

6. Govt offers 1.27 lakh opportunities under PM Internship Scheme

The government today said that under the Pradhan Mantri Internship Scheme, it is receiving an overwhelming response from across the country

7. Govt plans to increase power generation capacity to 874 GW by 2031-32

The Government has said that it is planning to increase installed power generation capacity to 874 GW by 2031-32.

8. India contributes $37.64 million to UN regular budget for 2025

India has contributed 37.64 million US Dollars to the United Nation’s Regular Budget for this year, securing its place among the 35 member states honoured for timely and full payment of their dues. This contribution was made on the 31st of last month.