ABOUT

- The Fund of Funds for Startups (FFS) is a government initiative launched in 2016 under the Startup India program to boost the Indian startup ecosystem.

- Instead of directly investing in startups, the FFS provides capital to SEBI-registered Venture Capital (VC) and Alternative Investment Funds (AIFs), which in turn invest in promising startups.

- This approach ensures that professional fund managers with industry expertise allocate capital efficiently, thereby fostering innovation and entrepreneurship in India.

Budget Allocation 2025

- The Budget 2025, has doubled its commitment to the fund of funds for startups, adding another ₹10,000 crore to fuel high-potential ventures.

- So far, AIFs for startups have received investment commitments of over ₹91,000 crore, and this latest injection aims to sustain the momentum.

Objectives of the Fund of Funds for Startups (FFS)

- Facilitate Startup Funding

- Increase the availability of domestic venture capital for startups.

- Encourage Innovation

- Support technology-driven and high-growth potential startups.

- Reduce Dependence on Foreign Capital

- Create a strong homegrown funding ecosystem.

- Promote Employment and Economic Growth

- Boost job creation through startup development.

Key Features of FFS

| Feature | Description |

|---|---|

| Launched | 2016 |

| Managed by | Small Industries Development Bank of India (SIDBI) |

| Total Corpus | ₹10,000 Crore |

| Investment Period | 14 years (Till 2025, extendable by 2 years) |

| Investment Mode | Through SEBI-registered AIFs |

| Fund Allocation | Maximum 10% of the AIF’s total fund size |

| Direct Investment in Startups? | No, only through VC Funds/AIFs |

The fund operates as a fund of funds, meaning it does not directly invest in startups. Instead, it supports Venture Capital (VC) and Alternative Investment Funds (AIFs), which then provide funding to startups.

How Does FFS Work?

- The Government Allocates Funds

- The Department for Promotion of Industry and Internal Trade (DPIIT) allocates funds to SIDBI, which manages FFS.

- Selection of Venture Capital (VC) and AIFs

- SIDBI identifies and invests in SEBI-registered Alternative Investment Funds (AIFs).

- VC Funds Invest in Startups

- These AIFs then provide funding to DPIIT-recognized startups in various sectors.

- Startup Growth & Returns

- As startups grow, they generate returns, which benefit the funds and indirectly support further investments.

Eligibility Criteria for Funds Seeking FFS Support

To receive funding from FFS, VC firms and AIFs must meet the following criteria:

- Registered with SEBI under AIF Category I & II.

- Focus on Early-Stage Startups and growth-stage companies.

- Attract Co-Investment

- The FFS can contribute up to 10% of the corpus; the rest must be raised from other investors.

- No Investment in Real Estate, NBFCs, or Debt Instruments

- Funds must focus on startups only.

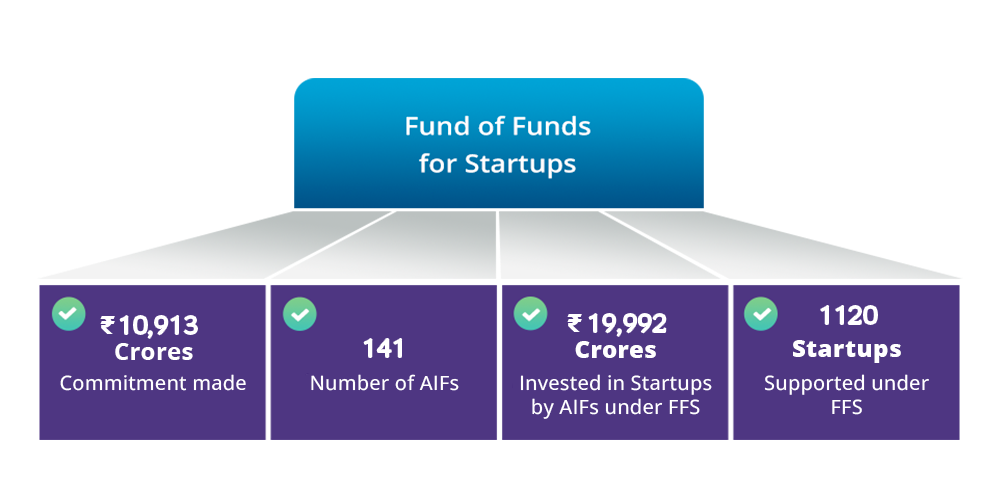

Impact of FFS on the Indian Startup Ecosystem

- Boost in Domestic Capital

- Since its launch, FFS has infused over ₹9,000 crore into AIFs, which have further invested in 900+ startups, reducing dependency on foreign investors.

- Encouragement of Early-Stage Investments

- Many Indian startups struggle to get funding in their early stages. The FFS encourages Venture Capital firms to invest in promising early-stage companies.

- Sectoral Growth & Employment

- The FFS has helped high-potential sectors like fintech, healthcare, agritech, AI, and deep tech grow, generating thousands of jobs.

- Strengthening the AIF Market in India

- By channeling funds through SEBI-registered Alternative Investment Funds (AIFs), FFS has improved India’s venture capital landscape.

Challenges in the FFS Implementation

- Slow Deployment of Funds

- Bureaucratic processes have slowed down fund disbursement.

- Limited Risk-Taking by AIFs

- Some VCs prefer investing in established startups rather than early-stage ventures.

- Complex Compliance & Regulatory Hurdles

- Many small VC firms struggle with government compliance requirements.

Future Prospects of FFS

- Faster Fund Deployment

- The government is working on simplifying procedures for quicker fund disbursement.

- Increased Corpus Allocation

- There are discussions about increasing the corpus beyond ₹10,000 crore due to strong demand.

- More Support for Deep-Tech & AI Startups

- Future investments may focus more on sectors like AI, robotics, biotech, and clean energy.

Conclusion

- The Fund of Funds for Startups (FFS) is a significant initiative to boost Indian startups by ensuring better access to capital.

- While there are challenges in implementation, its impact on fostering innovation, entrepreneurship, and employment is undeniable.

As India’s startup ecosystem grows, FFS will continue to play a crucial role in making India a global startup powerhouse.