Introduction

In today’s digital era, India is moving towards a cashless economy, and one of the biggest contributors to this transformation is BHIM (Bharat Interface for Money). BHIM is a revolutionary mobile payment app developed by National Payments Corporation of India (NPCI) to enable fast, secure, and seamless transactions using Unified Payments Interface (UPI).

Whether you’re a business owner, student, or working professional, BHIM makes it incredibly easy to send and receive money instantly using just a mobile number or UPI ID. In this detailed blog, we’ll explore everything about BHIM, its features, benefits, security, and how you can use it to simplify your daily transactions.

What is BHIM?

BHIM is a mobile-based digital payment application launched by Prime Minister Narendra Modi in December 2016. The app is built on UPI (Unified Payments Interface) technology, which allows instant bank-to-bank transfers without needing account details like IFSC codes or lengthy account numbers.

- With BHIM, you can:

- Send and receive money instantly

- Pay bills and make online purchases

- Check your bank balance

- Generate QR codes for easy payments

- Access transaction history and reports

BHIM works on both Android and iOS platforms and is available for download on the Google Play Store and Apple App Store.

Key Features of BHIM

1. Instant Money Transfer

You can send and receive money instantly using mobile numbers, UPI IDs, or scanning QR codes. No need to enter long bank details!

2. No Need for a Wallet

Unlike mobile wallets like Paytm or PhonePe, BHIM directly connects with your bank account. This eliminates the need for adding money to a separate wallet.

3. Secure Transactions

BHIM is backed by NPCI and follows two-factor authentication (UPI PIN and device binding), ensuring complete security.

4. Supports Multiple Banks

BHIM supports all major banks in India, allowing transactions from any bank that supports UPI.

5. 24/7 Availability

The app works 24/7, including bank holidays and weekends, making it convenient for users to make payments anytime.

6. QR Code Payments

Merchants and individuals can generate and share QR codes for easy and fast payments.

7. Multi-Language Support

BHIM is available in multiple Indian languages, making it easy to use for people across different regions.

8. Bill Payments and Recharges

Users can pay utility bills like electricity, water, gas, and mobile recharges directly from the BHIM app.

How to Set Up and Use BHIM?

Step 1: Download and Install

- Visit the Google Play Store or Apple App Store.

- Search for BHIM App and install it.

Step 2: Registration

- Open the app and select your preferred language.

- Verify your mobile number linked to your bank account via SMS OTP.

- Set up a 4-digit passcode for security.

Step 3: Link Your Bank Account

- Choose your bank from the given list.

- The app will automatically fetch account details linked to your mobile number.

- Set a UPI PIN by entering your debit card details.

Step 4: Start Transacting

- Send Money:

- Enter UPI ID or mobile number → Enter the amount → Authenticate with UPI PIN → Money is transferred instantly!

- Receive Money:

- Share your UPI ID or QR code with the sender.

- Check Balance:

- Tap on your bank account to view balance details.

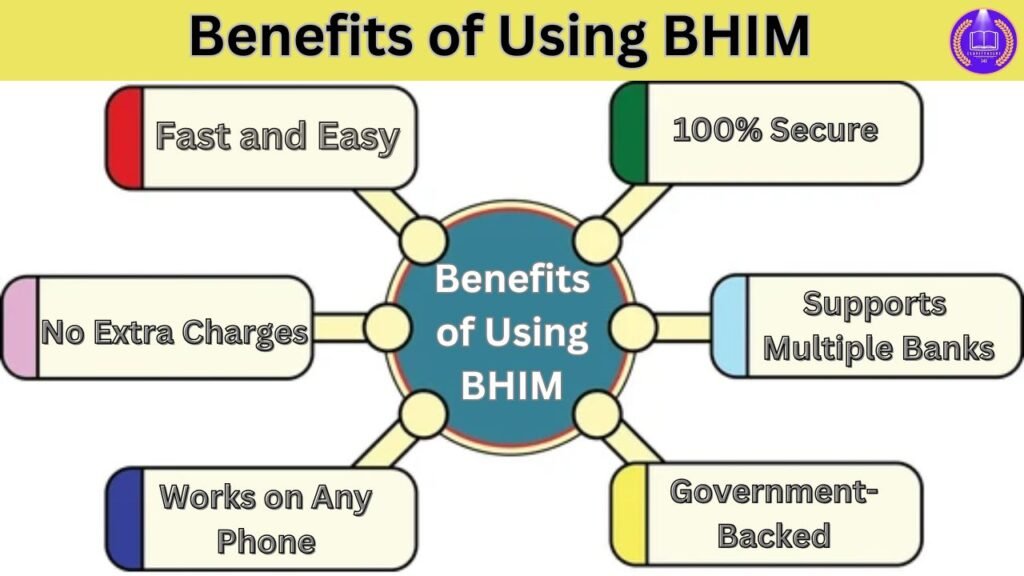

Benefits of Using BHIM

- Fast and Easy –

- No need for bank details, just use UPI ID or mobile number.

- 100% Secure –

- End-to-end encryption and NPCI-backed security.

- No Extra Charges –

- Transactions are free or have minimal charges.

- Works on Any Phone –

- No need for a high-end smartphone, works on basic Android devices too.

- Supports Multiple Banks –

- One app for all your banking transactions.

- Government-Backed –

- Developed by NPCI under the Digital India Initiative.

Is BHIM Safe?

Yes! BHIM follows high-level encryption and security measures to protect users from fraud. Here are a few security tips:

- Never share your UPI PIN with anyone.

- Always verify the receiver’s details before transferring money.

- Enable app lock to prevent unauthorized access.

- Regularly check your transaction history for any suspicious activity.

If you ever face fraud or issues, you can contact BHIM customer support or your bank for help.

BHIM vs Other UPI Apps (PhonePe, Google Pay, Paytm)

| Feature | BHIM | Google Pay | PhonePe | Paytm |

|---|---|---|---|---|

| Direct Bank Transfer | ✅ | ✅ | ✅ | ✅ |

| Requires Wallet? | ❌ | ❌ | ❌ | ✅ |

| UPI QR Code Payments | ✅ | ✅ | ✅ | ✅ |

| Cashback & Rewards | Limited | Yes | Yes | Yes |

| Government-Backed | ✅ | ❌ | ❌ | ❌ |

BHIM is a simple and secure choice for direct bank transfers, while apps like Google Pay, PhonePe, and Paytm offer additional rewards and cashback programs.

Conclusion

The BHIM app is a game-changer in India’s digital payment revolution. Its simplicity, security, and government backing make it one of the most reliable UPI payment apps. Whether you need to pay bills, transfer money, or check balances, BHIM does it all with ease.

If you haven’t used BHIM yet, download it today and experience a fast and secure way to manage your transactions.

Frequently Asked Questions (FAQs)

- Is BHIM free to use?

- Yes, BHIM is free to download and use. However, some banks may charge nominal fees for UPI transactions.

- Can I use BHIM without the internet?

- Yes! You can use *USSD Code 99# to make transactions without the internet.

- What is the maximum transaction limit in BHIM?

- BHIM allows up to ₹1,00,000 per transaction (may vary by bank).

- Is BHIM available in multiple languages?

- Yes, BHIM supports 20+ Indian languages, making it user-friendly for all.

- Can I link multiple bank accounts to BHIM?

- Yes, but you can only use one primary account at a time. You can switch accounts as needed.