Daily Current Affairs Quiz

24 April, 2025

International Affairs

1. India-Saudi Arabia Collaboration on Oil Refining and Energy Market Stability

Context:

India and Saudi Arabia have made significant strides in their collaboration to enhance energy security and market stability. Both countries have agreed to set up two new refineries in India and jointly work toward enhancing global oil market stability. This announcement comes after Prime Minister Narendra Modi’s brief visit to Saudi Arabia, which was cut short due to the Pahalgam terror attack.

Refinery Establishments and Investments

- Two Refineries in India: Saudi Arabia and India have agreed to collaborate on building two refineries in India. These refineries will be part of Saudi Arabia’s broader $100 billion investment commitment to India across sectors like energy, infrastructure, technology, and fintech.

- Saudi Aramco’s West Coast Refinery: While Saudi Aramco was initially focused on establishing a mega West Coast Refinery in Maharashtra with a capacity of 60 MMTPA, progress has been slow. The project plans are now likely to shift toward establishing smaller refineries with capacities of around 20 MMTPA.

Enhancing Energy Supply and Security

- Crude Oil and LPG: In FY2023-24, Saudi Arabia accounted for 14.3% of India’s crude oil imports and 18% of India’s LPG shipments. Both countries are now focused on enhancing cooperation to stabilize global energy markets and ensure secure supply chains for energy sources worldwide.

- Energy Security: Both India and Saudi Arabia emphasized the importance of energy security for all sources of energy globally, particularly in the wake of shifting geopolitical dynamics.

Bilateral High-Level Task Force and Investments

- Task Force Progress: The two nations have made progress in key sectors such as taxation, investment, and supply chain development. The Bilateral Investment Treaty (BIT) is expected to be finalized soon to further strengthen these economic ties.

- Strategic Reserve and Green Hydrogen: Collaboration on India’s Strategic Petroleum Reserve Program and the development of green hydrogen technologies is also a significant focus of their cooperation. The countries plan to explore joint ventures in hydrogen transport and storage technologies as part of a shared effort to stimulate demand.

Labor, Human Resources, and Specialized Industries

- The countries have also agreed to expand cooperation in labor and human resources sectors, with an emphasis on specialized industries and innovative uses of hydrocarbons.

Long-Term Impact of the $100 Billion Investment

- Saudi Arabia’s $100 billion investment commitment to India is a pivotal element in this collaboration. The funds will be directed towards a wide range of sectors, including petrochemicals, infrastructure, and digital infrastructure, strengthening the economic ties between the two nations.

National Affairs

1. Indus Waters Treaty (IWT)

Context:

A brutal terror attack in Pahalgam, Jammu & Kashmir, left 26 people dead, prompting a swift and strong response from India. Following a high-level Cabinet Committee on Security (CCS) meeting chaired by Prime Minister Narendra Modi, a five-point diplomatic and strategic action plan was rolled out.

Indus Waters Treaty Suspended

- What’s new? The 1960 Indus Waters Treaty with Pakistan has been put in abeyance with immediate effect.

- Why now? India cites Pakistan’s continued support for cross-border terrorism as the core reason.

- What’s next? The treaty will remain suspended until Pakistan permanently halts terror sponsorship.

Indus Waters Treaty (IWT)

About the Indus Waters Treaty (IWT):

- Signed on September 19, 1960, between India and Pakistan

- Brokered by the World Bank

- Governs water-sharing and cooperation between the two nations for the Indus River System

- Covers six rivers: Indus, Chenab, Jhelum, Ravi, Beas, and Sutlej

Key Provisions of the Treaty:

1. Water Sharing Arrangement:

- Western Rivers (Indus, Chenab, Jhelum): Allocated to Pakistan for unrestricted use

- India allowed non-consumptive, agricultural, and domestic usage

- Eastern Rivers (Ravi, Beas, Sutlej): Allocated to India for unrestricted use

- Water distribution ratio: ~80% to Pakistan, ~20% to India

2. Permanent Indus Commission:

- Both countries must maintain a Permanent Indus Commission

- Mandated to meet annually

- Facilitates information exchange and cooperation

3. Dispute Resolution Mechanism:

- Step 1: Issues termed “questions” are resolved through the Permanent Commission

- Step 2: Unresolved issues can escalate to the inter-governmental level

- Step 3: Further escalation can involve:

- Neutral Expert appointed by the World Bank

- Court of Arbitration also established under World Bank’s guidance

Important Projects Inspected Under the IWT:

• Pakal Dul Hydroelectric Project:

- Located on Marusudar River (a tributary of the Chenab)

- Pakistan has raised objections regarding potential impact on water flow

• Lower Kalnai Project:

- Also developed on the Chenab River

• Kishanganga Hydroelectric Project:

- Run-of-the-river project in Jammu & Kashmir

- Built on the Kishanganga River (Neelum in Pakistan)

- In 2013, The Hague’s Permanent Court of Arbitration allowed India to divert water with certain conditions

• Ratle Hydroelectric Project:

- Run-of-the-river project on the Chenab River, Jammu & Kashmir

- Subject to objections from Pakistan

Other Key Decisions

Attari Integrated Check Post Shut Down

- Closure: The Attari Integrated Check Post (ICP) has been sealed.

- Deadline: Pakistani nationals currently in India must exit via Attari before May 1, 2025, if they have valid travel endorsements.

End of SAARC Visa Exemption Scheme for Pakistan

- Immediate cancellation of all SAARC Visa Exemption Scheme (SVES) visas issued to Pakistani nationals.

- Exit notice: Any Pakistani citizen in India under SVES has 48 hours to leave.

- New rule: Pakistanis will no longer be eligible for SVES travel to India.

Diplomatic Expulsions and Downsizing

- Persona non grata: Defence advisers at Pakistan’s High Commission in Delhi are to leave within 7 days.

- Reciprocal withdrawal: India will recall its defence personnel and 5 staffers from the High Commission in Islamabad.

- Embassy strength reduced: Both nations will cut mission staff from 55 to 30 by May 1, 2025.

UPSC Civil Services Examination, Previous Year Question (PYQ)

Prelims:

Q. With reference to the Indus river system, of the following four rivers, three of them pour into one of them which joins the Indus directly. Among the following, which one is such a river that joins the Indus direct? (2021)

(a) Chenab

(b) Jhelum

(c) Ravi

(d) Sutle

Ans: (d)

Q. Consider the following pairs (2019)

| Glacier | River |

| 1. Bandarpunch | Yamuna |

| 2. Bara Shigri | Chenab |

| 3. Milam | Mandakini |

| 4. Siachen | Nubra |

| 5. Zemu | Manas |

Which of the pairs given above are correctly matched?

(a) 1, 2 and 4

(b) 1, 3 and 4

(c) 2 and 5

(d) 3 and 5

Ans: (a)

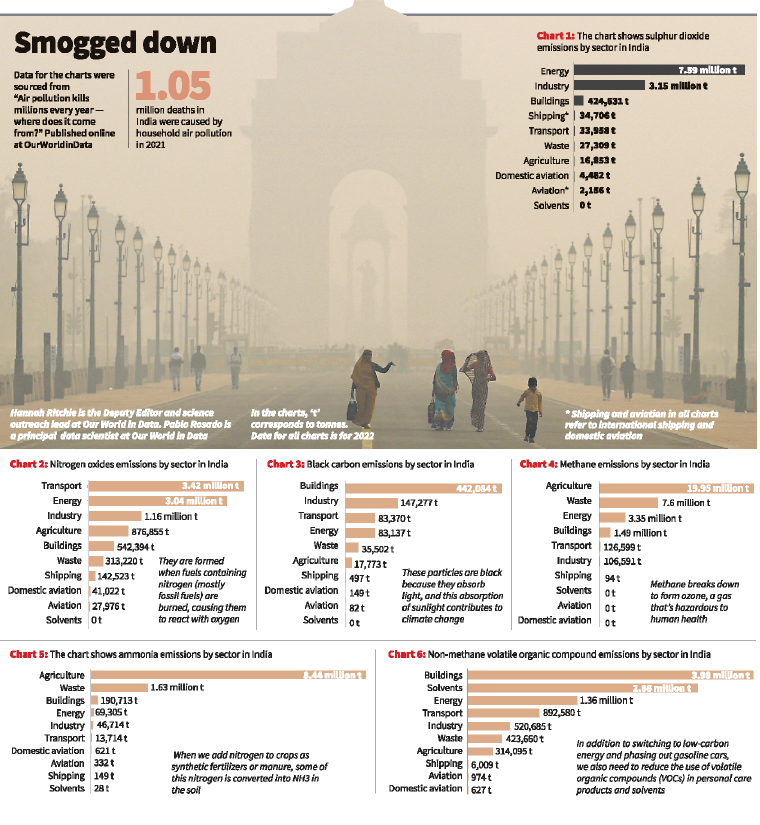

2. Major Sources of Air Pollution in India

Air pollution leads to millions of premature deaths globally each year, with India being one of the worst-affected countries. Understanding where this pollution originates is key to designing effective mitigation strategies. Below is a breakdown of key pollutants and their primary sources based on recent data from 2022.

Sulphur Dioxide (SO₂) – Major Cause of Acid Rain

- Primary Source: Energy production (Chart 1)

- Details:

- Predominantly from coal-based power plants

- Coal combustion releases SO₂ due to sulphur impurities

- Health Impact: Contributes to respiratory problems and acid rain

Nitrogen Oxides (NOₓ) – Toxic to Lungs

- Major Sources (Chart 2):

- Transport sector (cars and trucks exhaust)

- Energy sector (burning coal and gas)

- Health Risk: Causes lung inflammation and exacerbates asthma

Black Carbon – The Deadly Soot

- Leading Sources (Chart 3):

- Biomass and charcoal cooking in low-income households

- Open waste burning

- Impact:

- Contributes to respiratory illnesses

- Major component of PM2.5 air pollution

Methane (CH₄) – Potent Greenhouse Gas

- Top Contributors (Chart 4):

- Agriculture (livestock, rice paddies)

- Waste (rotting organic matter in landfills)

- Environmental Concern: Strong global warming potential

Ammonia (NH₃) – A Hidden Killer

- Almost Entirely From: Agriculture (Chart 5)

- Released from fertilizers and animal waste

- Impact:

- Forms fine particulate matter (PM2.5)

- Linked to 3,85,000 premature deaths annually

Non-Methane Volatile Organic Compounds (NMVOCs) – Silent Threats

- Uncommon Sources (Chart 6):

- Solvents in paints, cleaning agents

- Chemical manufacturing

- Health Risk: Contribute to ozone formation and indoor air toxicity

Sectoral Action Needed

Air pollution in India stems from energy, transport, agriculture, waste, and household sources. Each pollutant has distinct sources and health effects, underlining the need for sector-specific policies such as:

- Clean energy transition from coal

- Vehicle emission standards

- Agricultural reform in fertilizer use

- Better waste management and cooking alternatives

TH

3. Judicial Review and Article 142

Context:

India’s democracy thrives on the delicate balance between the three pillars of governance — Legislature, Executive, and Judiciary. Amidst evolving challenges, the Supreme Court’s role under judicial review and Article 142 has stirred nationwide debate. Here’s an analytical breakdown.

Judicial Review: Constitutional Mandate

- Not explicitly mentioned in the Constitution but implied via Article 13, which invalidates laws contravening fundamental rights.

- Supported by Article 226 (High Courts) and Article 32 (Supreme Court) for rights enforcement.

- Forms part of the basic structure doctrine—ensuring rule of law and constitutional supremacy.

Judicial Activism vs Judicial Review

- Judicial review: Evaluates constitutionality of laws.

- Judicial activism: Proactive role by judiciary in matters where legislative/executive gaps are evident.

- Both are intertwined yet distinct, with activism ideally reserved for extraordinary circumstances.

Public Interest Litigation (PIL)

- Evolved post-Emergency to restore legitimacy and empower marginalized voices.

- Enabled the judiciary to act on behalf of the voiceless, reinforcing rights of prisoners, workers, and victims of custodial violence.

Article 142: Power for Complete Justice

- Allows Supreme Court to go beyond statutory limitations to ensure justice.

- Criticized as a “nuclear missile” but used judiciously in:

- Babri Masjid verdict

- Mob lynching guidelines

- Irretrievable marriage breakdowns

- Judicial restraint is advocated in its use to preserve institutional integrity.

Judicial Accountability and Political Perceptions

- Criticism: Supreme Court perceived as pro-government on:

- Demonetisation, Article 370, Rafale deal, NRC, CAA, EVMs.

- Major pushback: Only a few key rulings went against government positions (e.g., Electoral Bonds, NJAC, Arunachal Pradesh President’s Rule).

- Courts generally defer to elected government, striking down laws only when constitutionally untenable.

The Role of Judges Amid Political and Religious Sensitivities

- Judiciary often prefers peace over conflict, especially in volatile matters like:

- Article 370

- Babri Masjid

- Places of Worship Act

- Allegations of activism must be balanced against judicial prudence and social harmony.

Democracy vs Judiciary

- Democracy cannot override constitutional limits.

- Judicial review is not anti-democratic—it protects minority rights and federal values.

- The President and Governors, too, are subject to constitutional discipline.

Landmark Judicial Observations

- Krishna Iyer (1981): Constitutional powers must not be misused or driven by vanity.

- Qaiser e Hind (2001): Presidential assent is a constitutional act, not a formality.

- 2025 Tamil Nadu Verdict: Timelines suggested by SC do not amend the Constitution but ensure reasonable constitutional functioning.

Separation of Powers and Respectful Criticism

- All organs must operate within constitutional confines.

- Vice-President’s comments on judiciary undermine constitutional ethos; criticism must be fair, not disparaging.

- Current CJI has taken a cautious path, respecting religious and political sensitivities.

Balancing Justice with Restraint

The Indian judiciary, though unelected, acts as the guardian of the Constitution. Judicial review, far from being undemocratic, is the bulwark against executive overreach. Article 142, while potent, must be exercised with wisdom and restraint to maintain the court’s credibility and constitutional balance.

4. National Adaptation Plan (NAP)

Context:

India is set to present its first comprehensive framework for combating climate change, termed the National Adaptation Plan (NAP), to the United Nations Framework Convention on Climate Change (UNFCCC) by September. This marks a significant step in aligning India’s efforts with global climate commitments, particularly the Paris Agreement.

Key Features of India’s National Adaptation Plan (NAP)

- Broader Scope: Unlike the previous National Action Plan on Climate Change (NAPCC), which focused primarily on mitigation (reducing greenhouse gas emissions), the NAP expands its focus to adaptation strategies, addressing economic, social, and environmental aspects of climate change.

- Spearheaded by MoEFCC: The Ministry of Environment, Forest and Climate Change (MoEFCC) is leading the drafting of the NAP. The plan is being formulated after consultations with various ministries, with sectoral frameworks to be submitted by July.

- Nine Thematic Areas: The NAP will address adaptation in key sectors:

- Agriculture

- Water Resources

- Health

- Gender Issues

- Poverty

- Traditional Knowledge

- Finance

- Resilient Infrastructure

- Biodiversity & Forestry

- Integration with Policies: The NAP seeks to integrate climate change adaptation with existing and upcoming policies, development planning, and strategies.

- Implementation at the Local Level: The plan recognizes that adaptation measures are region-specific and will be implemented by state governments and local bodies, with the support of the private sector.

- Climate Finance Needs: A report estimates that India will need over $1 trillion for climate adaptation between 2015 and 2030, focusing on sectors like agriculture, water resources, and disaster management.

Global Context

- Climate Impact: The global average temperature has already increased by 1.6°C above pre-industrial levels, contributing to extreme weather events that have claimed thousands of lives and caused substantial economic losses in India.

- Future Plans: India will refine its NAP based on future climate assessments, including the Intergovernmental Panel on Climate Change’s (IPCC) next report and the outcomes of COP30, the UN climate conference that is expected to focus heavily on adaptation.

The NAP represents India’s commitment to addressing both the causes and impacts of climate change, with a special focus on adaptation and resilience at the local level, ultimately contributing to the country’s broader goals under the Paris Agreement.

Science & Tech

1. Mystery Behind Dark Matter Deficiency in Galaxy NGC 1052-DF2

Context:

Astronomers at the Indian Institute of Astrophysics (IIA) have found the reason for the strange deficiency of dark matter in the distant galaxy NGC 1052-DF2. Dark matter is a critical component of galaxy formation.

Background: The Cosmic Dark Matter Puzzle

- Dark matter is believed to be essential for galaxy formation and structural integrity.

- Most galaxies, including the Milky Way, contain a vast halo of dark matter that outweighs visible matter.

- However, NGC 1052-DF2, a distant ultra-diffuse galaxy (UDG), appears to defy this norm.

The Indian Breakthrough

- Scientists at the Indian Institute of Astrophysics (IIA) have now offered a fresh perspective on why NGC 1052-DF2 lacks dark matter.

- Their findings aim to resolve contradictions with standard cosmological models that assume dark matter is crucial to galaxy formation.

Key Findings from the Study

- Previous studies estimated a total dynamical mass of less than 340 million solar masses, with stellar mass alone accounting for ~200 million solar masses.

- This unusually low ratio suggests that dark matter plays an insignificant role in this galaxy, unlike in typical spiral galaxies.

Implications for Galaxy Formation Theories

- The results challenge long-standing beliefs about the hierarchical formation of galaxies, which require dark matter scaffolding.

- Dr. K. Aditya, lead researcher, notes the study brings into focus:

- The formation of galaxies with minimal dark matter.

- The astrophysical processes that may allow such anomalies.

- The broader nature and behavior of dark matter.

Innovative Methodology

- The team used stellar density models as a core input and tested various scenarios with and without dark matter.

- Findings show that “cuspy” dark matter halo models (denser centers) were statistically similar to models with no dark matter at all.

Published Research

- The study has been published in the peer-reviewed journal Astronomy & Astrophysics, strengthening its credibility and reach in the global astrophysical community.

2. Lipids and Evolution

Context:

Traditional understanding of evolution emphasizes DNA and proteins, often sidelining lipids as mere structural components. However, a new study from CSIR-CCMB, Hyderabad, challenges this narrow view, suggesting that lipids play a co-evolutionary role with proteins, especially in mitochondrial membranes.

Lipids

Lipids are fatty compounds that perform a variety of functions in your body. They’re part of your cell membranes and help control what goes in and out of your cells. They help with moving and storing energy, absorbing vitamins and making hormones. Having too much of some lipids is harmful.

Key Takeaways

Proteins and Lipids: Partners in Evolution

- Proteins, encoded by DNA, have long been seen as the primary actors in cellular evolution.

- New research suggests lipids—often viewed as passive packing materials—play an active, evolving role alongside proteins.

Study Focus: The Respiratory Complex 1 (RC1)

- RC1 is a vital mitochondrial complex involved in energy production during respiration.

- The study found that parts of RC1 which interface with mitochondrial membrane lipids are mutational hotspots, implicating lipids in disease and evolutionary function.

Lipid-Protein Compatibility

- Using biochemical and computational methods, the team showed that RC1 proteins require specific lipids from the same biological kingdom to maintain structure and function.

- Incompatibility (e.g., inserting plant RC1 into human membranes) led to complex disintegration.

Lipid Diversity and Structural Implications

- Plant lipids are more structurally flexible due to their richness in polyunsaturated fatty acids.

- This flexibility may help plants withstand environmental stresses, implying that lipid structures evolved in response to ecological pressures, and proteins adapted accordingly.

Co-Evolution of Membrane Systems

- The study is among the first to offer direct evidence of lipid-protein co-evolution.

- It also reinforces previous findings about lipid-protein interactions in other cellular membranes.

Implications for Human Health and Drug Development

- Understanding lipid roles may refine the use of drugs like statins, which target cholesterol (a lipid).

- Lipids also influence how pathogens enter cells, adding another dimension to disease management.

A Call for Better Tools and Broader Focus

- Studying lipids is challenging due to their chemical complexity and environmental dependence.

- Current tools lag behind, but computational methods are showing promise.

This study marks a paradigm shift, urging a broader view of evolution that includes lipids as dynamic players. From improving our understanding of diseases to inspiring new biomedical innovations, the co-evolution of lipids and proteins could reshape both biology education and healthcare.

3. Global Coral Bleaching Crisis

Overview of the Bleaching Event

- Current Bleaching Crisis: The International Coral Reef Initiative (ICRI) announced that 84% of the world’s coral reefs have been affected by bleaching, marking the most intense global bleaching event ever recorded.

- Record-breaking Impact: This event, which began in 2023, surpasses the previous 2014-2017 bleaching that impacted two-thirds of coral reefs worldwide, making it the fourth global bleaching event since 1998.

Cause and Consequences of Coral Bleaching

- Warming Oceans: The current bleaching event is largely attributed to rising ocean temperatures, exacerbated by global climate change. The 2023-2024 period saw Earth’s hottest year on record, with ocean surface temperatures averaging 20.87°C.

- Impact on Coral: Corals, which rely on colorful algae for nourishment, expel these algae when exposed to prolonged warmth, leading to bleaching. The result is stark white coral skeletons that are vulnerable to death.

Biodiversity Threat

- Vital Ecosystem: Coral reefs, often referred to as the “rainforests of the sea”, are crucial for marine biodiversity, supporting approximately 25% of all marine species. They also play key roles in tourism, seafood production, and coastal protection.

- Threat to Marine Life: The bleaching crisis undermines the foundational biodiversity that coral reefs provide, disrupting ecosystems that depend on these habitats for survival.

Challenges in Ending the Crisis

- Ongoing Warming: Mark Eakin, Executive Secretary of the International Coral Reef Society, warns that the heat stress causing bleaching may never decrease below the threshold needed to end the crisis, signaling a permanent shift in the ocean’s ability to sustain healthy coral ecosystems.

Efforts to Combat the Crisis

- Restoration Initiatives:

- Laboratory-based Coral Restoration: Efforts such as those from a Dutch lab working with coral fragments from the Seychelles aim to propagate corals in controlled environments to repopulate reefs if necessary.

- Florida’s Coral Rescue: Similar projects, like the one off the coast of Florida, focus on rescuing and nurturing corals impacted by heat stress before returning them to the wild.

- Emissions Reduction: Scientists, including Melanie McField from the Global Coral Reef Monitoring Network, emphasize that the most effective long-term solution is to reduce greenhouse gas emissions, particularly carbon dioxide and methane, which are directly contributing to ocean warming and coral bleaching.

The Urgency of Action

- Root Cause: Addressing climate change through emissions reduction is crucial for preserving coral reefs and halting the ongoing crisis.

- Inaction Warning: McField warns that inaction in tackling climate change could be the “kiss of death” for coral reefs, underscoring the need for urgent global policy changes and environmental reforms.

The global coral bleaching event represents an alarming shift in the health of our oceans. While short-term restoration efforts are underway, the long-term survival of coral reefs depends on immediate global action to mitigate climate change and reduce emissions.

BS

Banking/Finance

1. India Issues Fresh Tax Demands on Foreign SaaS Companies

Context:

Major global Software-as-a-Service (SaaS) providers — including Microsoft, Amazon, Google, Oracle, IBM, and Salesforce — are facing new tax assessment orders from the Indian Income Tax Department for the financial years 2021–22 and 2022–23.

- Key Issue: Double taxation arises, with companies facing tax demands under both the equalisation levy and income tax provisions.

Background on Equalisation Levy

- Introduction: India introduced the equalisation levy in 2020 on non-resident e-commerce operators with significant Indian user bases but no physical presence in India.

- Purpose: The levy was intended to serve as a backstop tax, applicable when income tax provisions and tax treaties could not be invoked.

- Phase-Out: The government has committed to phasing out this unilateral levy by August 2024.

Double Taxation Concern

- Voluntary Payment: Many companies voluntarily paid the equalisation levy, even though they are also required to pay tax on Fees for Technical Services (FTS) under the Income Tax Act.

- Resulting Double Taxation: Companies are now facing tax demands on the same income for which they have already paid the levy, with no clear mechanism to claim a credit for the earlier payments.

SaaS Services and Taxability

- SaaS Services: Experts argue that Software as a Service (SaaS) offerings do not qualify as royalty or FTS under Indian law or tax treaties such as the India-US tax treaty.

- Legal Interpretation: Since SaaS services are standardized and automated without human input or transfer of intellectual property, they should not be taxed as FTS.

- Reference: The Supreme Court’s ruling in Engineering Analysis suggested that SaaS companies’ income should not be classified as royalty.

Impact of Tax Treaties

- Narrow FTS Definitions: Countries like the United States, United Kingdom, and Singapore have more restrictive definitions of FTS in their treaties with India, which strengthens the case against taxing SaaS companies as FTS.

Potential Legal Challenges

- Possible Litigation: Given the ambiguity and potential for double taxation, foreign digital businesses may challenge the assessment orders in court.

- Need for Clarification: Experts suggest that unless the Central Board of Direct Taxes (CBDT) provides clear guidance, the matter could lead to fresh litigation, increasing uncertainty for foreign companies operating in India.

Key Points

1. Revenue Reclassified as FTS

- The tax department has classified revenue earned from Indian customers as “Fees for Technical Services” (FTS) under Indian tax law.

- FTS includes technical, managerial, or consultancy services, taxed at 15% under the India–US Double Tax Avoidance Agreement (DTAA).

2. Shift in Tax Interpretation

- Before 2021, similar payments were generally categorized as “royalty”.

- However, a Supreme Court ruling in 2021 (Engineering Analysis Centre of Excellence case) stated that payments for standard, off-the-shelf software are not taxable as royalty under Indian law or most treaties.

3. Continued Scrutiny Post-Ruling

- Despite the Supreme Court judgment, the tax department is now exploring whether payments to foreign SaaS firms can be taxed as FTS.

- The rationale: these SaaS products may automate tasks that would otherwise need human input, qualifying them as technical services.

4. Current Status

- Assessment orders have been sent, but none of the companies or the Central Board of Direct Taxes (CBDT) have issued formal responses yet.

Implications

- This move signals renewed tax scrutiny on cross-border digital services.

- It may affect compliance strategies and pricing structures for foreign SaaS providers operating in India.

- Potential tax disputes could emerge over interpretation and classification of software services under Indian law.

2. NPCI’s Netbanking 2.0

Context:

The National Payments Corporation of India (NPCI)’s subsidiary, Bharat BillPay (NBBL), is set to launch a new Netbanking system (switch) aimed at improving customer experiences for online payments. This system, called Netbanking 2.0, is currently being tested and is expected to go live within the next 3–4 months.

Key Features and Benefits

New Payments Switch

- Netbanking 2.0 will not rely on existing payment systems like IMPS but will create an entirely new infrastructure.

- The aim is to provide standardized and interoperable netbanking transactions across banks, payment aggregators, and merchants, enhancing customer experience and improving operational efficiencies.

Stakeholder Involvement

- Multiple ecosystem stakeholders including banks and payment aggregators are currently involved in testing, with four major banks and 6–8 payment aggregators in the pilot phase.

Focus on Standardization

- The system will ensure common connectivity across all banks, addressing current challenges like lack of standardization, chargebacks, and settlement issues in the current network.

Multidevice Flow and Dynamic QR Codes

- One innovative feature of Netbanking 2.0 is the creation of dynamic QR codes that enable a two-device flow, facilitating smoother payment authorizations from larger workstations or laptops with mobile verification.

Enhanced Transparency and Rate Standardization

- The new system aims to bring about rate standardization across the industry, promoting transparency in pricing for payment services. This will benefit stakeholders by offering consistent payment pricing models and simplified integrations.

The Role of NPCI and Regulatory Support

NPCI’s Mandate

- NPCI continues to develop innovative payment solutions like UPI, RuPay, and the National Financial Switch, and plays a pivotal role in improving payment infrastructure in India.

Regulatory Backing

- The Reserve Bank of India (RBI) approved the project in March 2024, aligning with the Payment Vision 2025 to address delays in settlements and enhance interoperability for internet banking transactions.

Related Developments

UPI Circle Feature for BHIM

- In addition to Netbanking 2.0, NPCI has also rolled out the UPI Circle feature on the BHIM app, enabling primary users to delegate financial responsibilities to up to five secondary users.

- This new feature aims to foster a more inclusive and interconnected financial ecosystem, providing secure and flexible ways to share financial tasks.

Implications for the Payment Ecosystem

- The launch of Netbanking 2.0 promises to streamline the payment process, reduce integration complexities for merchants, and improve payment acceptance across a wide variety of sectors such as e-commerce, travel, and digital fashion platforms.

3. RBI MPC Meeting (April 2025)

Context:

In the April 2025 meeting, the Monetary Policy Committee (MPC) of the Reserve Bank of India (RBI) decided to cut the repo rate by 25 basis points (bps), continuing the trend of rate cuts initiated in February. This decision reflects the committee’s accommodative stance, which was adjusted from neutral earlier this month.

- Policy Action: Repo rate cut by 25 bps.

- Policy Stance: Accommodative stance aimed at supporting growth.

Inflation Outlook

- CPI-based Inflation: Governor Sanjay Malhotra highlighted that the inflation outlook is benign, with CPI inflation expected to remain aligned with the 4% target throughout FY2025-26.

- Factors Supporting Inflation Outlook: The favorable factors outweigh any potential negative impacts, driving disinflation in the headline CPI.

- Inflation Target: Expected to stay within the 4% range, creating space for further policy easing.

Growth Projections

- GDP Growth: The RBI projected GDP growth at 6.5% for FY2025-26. Although India remains the fastest-growing major economy, the growth rate is considered below aspirations.

- Policy Rationale: Rate cuts aim to stimulate private consumption and corporate investment to boost economic recovery.

Global Economic Impact

- Global Trade and Economic Disturbances: RBI members expressed concerns about the impact of global trade wars on India’s economy, especially considering US tariffs. However, India’s growth is largely driven by domestic demand, which provides some insulation from external shocks.

- Commodity Prices: A softening of crude oil and other commodity prices may offer positive spillovers to the Indian economy.

BS

4. Moody’s Review of IndusInd Bank and Yes Bank

Context:

Moody’s has initiated a review of IndusInd Bank’s risk management capabilities and its ongoing leadership transition, following revelations of accounting lapses concerning derivatives transactions.

Key Highlights:

- Risk Management Focus:

- Moody’s is primarily focused on evaluating the bank’s risk management capabilities amid these issues.

- Financial Impact:

- Despite the identified issues, the financial impact of the derivatives losses is considered manageable, supported by IndusInd Bank’s strong capital position.

- Discrepancies in Derivatives Transactions:

- An external agency’s report highlighted discrepancies in derivatives deals, estimating a negative financial impact of ₹1,979 crore as of June 30, 2024.

- Credit Rating and Outlook:

- Moody’s placed the baseline credit assessment (BCA) for the bank on review for downgrade in March 2025, citing inadequate internal controls in accounting for these transactions. However, the outlook on IndusInd Bank’s long-term ratings remains stable. The bank’s current long-term credit rating stands at “Ba1” for foreign currency (FC) and local currency (LC) deposits.

Yes Bank: Profitability Concerns

Moody’s also discussed Yes Bank, noting the bank’s progress in cleaning up its books but highlighting ongoing concerns about its low profitability.

- Profitability Comparison: Yes Bank’s Return on Assets (RoA) stands at approximately 70 basis points, significantly lower than the 1.5% RoA observed in comparable private sector banks.

- External Capital Needs: The bank’s profitability is linked to its ability to raise external capital, which will be crucial for future financial health.

- Rehabilitation and Outlook: After a default event, Yes Bank underwent rehabilitation and attracted new shareholders. In July 2024, Moody’s revised its outlook on Yes Bank from stable to positive, anticipating gradual improvements in the bank’s depositor base and lending franchise.

India’s Banking System Outlook

Despite challenges faced by individual banks, Moody’s maintains a stable outlook for India’s banking system. Key drivers for this stability include:

- Government capital expenditure

- Tax cuts

- Monetary easing which could stimulate consumption

5. New Business Premiums (NBPs) Growth in FY25

Context:

In FY25, the life insurance sector witnessed a 5.13% growth in new business premiums (NBPs), reaching ₹3.97 trillion, compared to ₹3.77 trillion in the previous year. This growth rate reflects a slight improvement over the previous year’s 2% increase.

- Growth in NBP: ₹3.97 trillion (5.13% YoY)

- Previous Year: ₹3.77 trillion (2% YoY growth)

LIC and Private Life Insurers’ Performance

- Life Insurance Corporation of India (LIC):

- NBP Growth: 1.86% YoY growth to ₹2.27 trillion.

- Market Share: LIC held 57% of the market.

- Private Sector Life Insurers:

- NBP Growth: 9.8% YoY growth to ₹1.71 trillion.

- Market Share: Private insurers account for nearly 43% of the market.

Key Players’ Performance

- SBI Life Insurance:

- NBP: ₹35,576.67 crore (7% decline).

- HDFC Life Insurance:

- NBP: ₹33,761.94 crore (12.58% growth).

- ICICI Prudential Life Insurance:

- NBP: ₹22,583.49 crore (24.9% growth).

- Axis Max Life Insurance:

- NBP: ₹12,173.41 crore (10.5% growth).

- Bajaj Allianz Life Insurance:

- NBP: ₹12,292.58 crore (6.7% growth).

Regulatory Impact

- Regulatory Changes: The Insurance Regulatory & Development Authority of India (IRDAI) revised the surrender value norms effective from October 1, 2024, affecting growth across most product categories, particularly in the second half of FY25.

- Group Single Premiums: Growth remained flat amid the current interest rate environment, making insurance products less attractive compared to other investment options.

Individual vs. Group Premiums

- Individual NBP: Grew by 11.3% YoY to ₹1.67 trillion in FY25 (compared to ₹1.5 trillion in FY24).

- Group Business Premium: Rose by 1.07% YoY to ₹1.64 trillion.

The life insurance sector showed positive growth in new business premiums during FY25, with a solid performance by private insurers. However, the impact of regulatory changes and the interest rate environment needs to be closely monitored in the upcoming periods. LIC continues to dominate the market, but private insurers are gaining momentum with stronger growth in individual policies.

6. SEBI Action Against Madhav Stock Vision

Context:

The Securities and Exchange Board of India (SEBI) has debarred Madhav Stock Vision Pvt. Ltd. (MSVPL) and five other individuals from dealing in securities. This action was taken due to allegations of front-running trades on behalf of a major client.

Allegations of Front Running

- What Happened: SEBI’s investigation revealed that MSVPL engaged in front-running—a practice where a broker executes orders for its own account based on advanced knowledge of a large client’s pending trades.

- Insider Information: The perpetrators were found to have eavesdropped on confidential conversations of dealers, gaining access to non-public information about trades being placed by a major client.

SEBI’s Findings

- Proximity of Operations: The perpetrators were operating from the same premises as the brokers handling the big client’s trades. The closeness of trading terminals and dealing desks enabled them to receive confidential details of the client’s trades before they were executed, allowing them to benefit from the information.

- Disgorgement of Illegal Gains: As part of the interim order, SEBI directed the disgorgement of ₹2.73 crore—the amount of illegal gains made by MSVPL and the involved individuals through the front-running activities.

Action Taken

- Trading Restrictions: The broker MSVPL has been restrained from buying, selling, or dealing in securities in its proprietary account as a result of these violations.

7. Letter of Engagement (LoE)

Context:

Under the Securities and Exchange Board of India (SEBI) Investment Advisors Regulations, 2013, all Registered Investment Advisors (RIAs) are required to formalize their relationship with clients through a Letter of Engagement (LoE). This agreement must be in place before providing any financial advice or collecting any fees from clients. The LoE serves as a key document for ensuring transparency and protection for investors.

Definition

- An engagement letter is a written agreement that outlines the business relationship between a client and a service provider.

- It defines the scope of work, terms, costs, and sets clear expectations for both parties.

- While less formal than a contract, it is legally binding and enforceable in a court of law.

Key Takeaways

- Establishes a clear understanding of the engagement between two parties.

- Limits the responsibility and liability of the service provider.

- Used across industries like law, accounting, auditing, consulting, etc.

- Applicable for both individual professionals and large corporations.

- Prevents miscommunication and helps manage scope creep.

How an Engagement Letter Works

- Functions similarly to a contract but is simpler and avoids complex legal jargon.

- Becomes legally valid only when signed by all parties involved.

- Clearly outlines:

- Services to be provided

- Terms and conditions

- Timelines or deadlines

- Compensation and payment terms

- Any limitations or exclusions of service

Example Use Case

- If a contractor hires a lawyer to draft a land purchase agreement, the engagement letter would not permit unrelated services like divorce consultation.

- This limitation may not be explicitly stated but is implied through the defined scope.

Advantages of an Engagement Letter

- Clarity on deliverables, timelines, and pricing for the client.

- Helps the service provider define boundaries and avoid additional unsolicited work.

- May include clauses for:

- Additional costs (e.g., third-party software)

- Optional future services and their estimated costs

- Dispute resolution via mediation or arbitration before legal proceedings

Special Considerations

- Engagement letters for long-term relationships are typically updated annually.

- Helps address changes in:

- Scope of services

- Pricing

- Terms and conditions

- Enhances the legal strength of the document and reinforces mutual understanding.

Who Prepares an Engagement Letter?

- Typically drafted by the service provider (with or without legal assistance).

- Must be signed by both parties to take legal effect.

Is an Engagement Letter the Same As a Contract?

- Not exactly:

- Shorter and less formal than traditional contracts

- Still legally binding and used to reduce liabilities

- Common across small businesses and large firms

When Should It Be Issued?

- At the beginning of the client relationship—before any work begins

- Must be reissued when:

- Services or fees change

- The relationship continues for multiple years

How Often Should It Be Updated?

- Annually, even if there are no major changes

- Ensures clarity, reinforces agreed terms, and minimizes the chance of disputes

8. SEBI Revises NAV Cut-off Timings for Mutual Fund Overnight Schemes (MFOS)

Key Announcement

The Securities and Exchange Board of India (SEBI) has announced revised cut-off timings for determining the Net Asset Value (NAV) applicable to repurchase/redemption of units in Mutual Fund Overnight Schemes (MFOS). The changes aim to accommodate stock brokers (SBs) and clearing members (CMs) by allowing flexible post-market redemption processes.

Revised NAV Cut-off Timings

- Offline Applications

- Up to 3:00 PM: Previous business day’s closing NAV

- After 3:00 PM: Next business day’s closing NAV

- Online Applications

- Cut-off time: 7:00 PM

- Effective Date: June 1, 2025

Objective & Rationale

- Facilitate after-market hour un-pledging and redemption by brokers and clearing members

- Avoid premature selling of underlying securities by mutual funds

- Align redemption flexibility with the nature of overnight securities, which have one-day maturity

About MFOS

- Invest in low-risk instruments:

- Overnight government securities

- TREPS (Tri-party Repo Dealing and Settlement)

- Suitable for short-term parking of surplus funds

- Units held in demat form and are mandatorily pledged with clearing corporations

- Designed to offer liquidity with minimal risk

Recent SEBI Financial Update (FY 2023-24)

- Total Income: ₹2,075 crore

- YoY Growth: 48%

- Revenue Source: Primarily from fees and subscriptions

About SEBI

- Established: April 12, 1988 (Statutory powers from Jan 30, 1992)

- Headquarters: Mumbai, Maharashtra

- Chairman: Tuhin Kanta Pandey

- Mandate: Regulates securities and commodities markets in India

- Under: Ministry of Finance, Government of India

9. RBI Cancels Licence of Ajantha Urban Co-operative Bank, Aurangabad

Context:

The Reserve Bank of India (RBI) has cancelled the banking licence of Ajantha Urban Co-operative Bank Maryadit, based in Aurangabad, Maharashtra, citing inadequate capital and poor earning prospects.

Effective From

- Date of Cancellation: April 22, 2025

- The bank has ceased all banking operations from this date.

Winding-up Process

- RBI has requested the Registrar of Cooperative Societies, Maharashtra, to:

- Initiate liquidation proceedings

- Appoint a liquidator

Depositor Protection under DICGC

- Depositors will be eligible for reimbursement up to ₹5 lakh per depositor via the Deposit Insurance and Credit Guarantee Corporation (DICGC).

- 91.55% of depositors will receive their entire deposits under this coverage.

- As of April 3, 2025:

- DICGC has already paid ₹275.22 crore to insured depositors.

RBI’s Justification

- The bank:

- Cannot fully repay its depositors

- Has no viable recovery path

- Continuing operations would be:

- Against public interest

- Detrimental to depositors

Post-Cancellation Restrictions

The bank is prohibited from all banking activities, including:

- Accepting new deposits

- Repaying existing deposits

Recent RBI Development

- April 2025: RBI updated norms to allow minors aged 10 and above to independently operate savings and term deposit accounts, promoting early financial literacy.

About the RBI

- Established: April 1, 1935

- Headquarters: Mumbai, Maharashtra

- Governor: Sanjay Malhotra

- RBI is India’s central banking authority, regulating monetary policy and financial stability.

10. AU Small Finance Bank Rolls Out Elite Concierge Services for AU ivy and AU Eternity Program Members

Context:

AU Small Finance Bank (AU SFB), India’s largest small finance bank, has introduced concierge services for its premium banking programs, AU ivy and AU Eternity.

Key Highlights:

- Target Audience: The services are designed for Ultra High Net Worth Individuals (UHNI) and go beyond traditional banking by offering bespoke lifestyle privileges.

- Service Offerings:

- Travel: Partnerships for domestic and international luxury travel, hotels, and villas.

- Education Support: Assistance for students planning to study abroad, from pre-departure to post-arrival.

- Dining: Exclusive culinary experiences and premium offers through partner networks.

- Airport Services: Complimentary cab transfers, premium lounge access, and meet & greet services.

- Golf Access: Access to elite golf courses through service providers.

- Shopping Perks: Deals with luxury brands, invitations to exclusive events, and access to limited-edition items.

- Luxury Experiences: Limousine pickups, yacht charters, private events with celebrity chefs and mixologists.

- Event Invitations: Private screenings, sit-down dinners, and cookout evenings.

- Digital Banking: Advanced digital banking solutions tailored for premium clients.

About AU SFB:

- Founding and Growth: AU Small Finance Bank was founded in 1996 by Sanjay Agarwal and became a scheduled commercial bank in April 2017.

- Credit Ratings: The bank holds strong credit ratings: ‘AA/Stable’ from CRISIL, ICRA, CARE, and India Ratings, and ‘AA+/Stable’ for Fixed Deposits from CRISIL.

- Leadership: Executive Director & Deputy CEO: Uttam Tibrewal.

Economy

1. World Bank Cuts India’s FY25 Growth Forecast to 6.3%

Context:

The World Bank has revised India’s GDP growth forecast downward for FY2025, citing a mix of global economic weakness and domestic policy uncertainty. The downgrade aligns with similar projections by the International Monetary Fund (IMF), indicating growing caution about India’s short-term economic trajectory.

Key Highlights

- Revised GDP Forecast for FY25: Lowered to 6.3%, down 40 basis points from the previous estimate of 6.7%

- Growth in FY24: Estimated at 6.5%, impacted by sluggish private investment and underperforming public capital expenditure

- FY26 Outlook: Projected to remain stagnant at 6.3%, suggesting limited recovery momentum

Primary Drivers of the Downward Revision

- Private Investment Slowdown: Despite monetary easing and regulatory reforms, private sector response remains tepid

- Public Capex Misses Targets: Government’s capital expenditure did not meet planned levels, affecting overall investment climate

- Global Economic Weakness: Continued global headwinds, including geopolitical instability and slowing trade, are weighing on export-driven sectors

- Policy Uncertainty: Ambiguity surrounding policy continuity and regulatory clarity is deterring long-term investment

IMF Also Revises India’s Growth Outlook

The IMF cut its FY25 GDP forecast to 6.2% from its earlier estimate of 6.5%, echoing the World Bank’s concerns

Outlook and Implications

While India remains one of the fastest-growing major economies, persistent external challenges and internal inefficiencies could constrain potential output

Policymakers may need to accelerate structural reforms, stimulate private investment, and ensure execution of public infrastructure projects to revive momentum

Agriculture

1. Nabard Invests in eKisanCredit Agri-Fintech Startup to Digitize Rural Credit

Context:

The National Bank for Agriculture and Rural Development (Nabard) has made its first-ever investment in a bootstrapped startup, acquiring a 10% equity stake in 24×7 Moneyworks Consulting Pvt Ltd. The startup operates eKisanCredit (eKCC), a digital loan origination and automation platform for cooperative banks, PACS, and regional rural banks (RRBs).

About eKisanCredit (eKCC)

- A fully digital loan origination system, enabling end-to-end automation of the rural credit process.

- Seamlessly integrates with:

- Land records

- Aadhaar & eKYC

- Core banking systems

- ePACS platforms

- Piloted by Nabard across banks for over 2.5 years, and now ready for nationwide rollout.

Strategic Importance of the Investment

- Shaji KV, Chairman of Nabard, emphasized that eKCC:

- Enhances access to agricultural credit

- Improves transparency and efficiency

- Promotes inclusive banking services for small and marginal farmers

- GS Rawat, Deputy Managing Director, added:

- The move highlights the need to empower last-mile financial institutions through scalable digital innovation.

Other Innovations by 24×7 Moneyworks

- Developed AIFIS (Agriculture Infrastructure Fund Information System):

- Manages interest subvention claims

- Enables real-time validation and disbursement of funds

2. eNAM Integration Empowering Farmers with Better Prices

Context:

Integration of APMC mandis with the National Agriculture Market (eNAM) is enhancing price realization for farmers, says R Leshma Manogna, Assistant Professor at BITS Goa. Her NABARD-sponsored research focuses on price gaps, the role of middlemen, and market forecasting using AI and machine learning.

Key Benefits of eNAM Integration

- Real-time price visibility on eNAM helps farmers negotiate better and avoid exploitation by middlemen.

- Eliminates 60–70% of middlemen, allowing direct buyer-seller interaction via smartphone notifications.

- Standardized quality procedures for agricultural commodities are now in place.

- Farmers refuse low offers using market data from eNAM, including MSP awareness.

Ground Realities and Farmer Concerns

- Despite superior quality, farmers often don’t get desired prices.

- Initial implementation lagged, but significant improvement over the last five years.

- Smartphone access and digital literacy among farmers are key enablers.

BITS Goa & NABARD Study Highlights

- Draft report submitted to NABARD; focuses on price realization across 23 commodities in India’s western coastal region.

- 40+ survey questions covered farmers’ experiences with mandi-eNAM integration.

- Study aims to streamline direct market access and further cut out intermediaries.

Forecasting Price Trends Using AI & ML

- Prof. Manogna’s team compares traditional econometric models with:

- Machine Learning (ML)

- Deep Learning (DL)

- Recurrent Neural Networks (RNN) – which outperform Artificial Neural Networks (ANN) in price prediction accuracy.

- 15 years of wholesale price data analyzed using a 70:30 training/testing ratio.

Incorporating Ground-Level Variables

- Models now factor in:

- Climate change

- Soil quality

- Trade tariffs

- Purpose: To enhance climate-resilient agricultural productivity and accurate price forecasts.

eNAM is transforming agri-markets by enabling transparency, better prices, and predictive insights. The integration of tech and policy must continue for inclusive and sustainable agricultural growth. AI-powered price forecasting offers a future-ready tool for both policy planners and farmers.

3. Samunnati Launches FPO Partnership Model for Market-Led Agri Value Chain Empowerment

Context:

Agri-value chain enabler Samunnati has launched a pioneering FPO Partnership Model to transform the way Farmer Producer Organisations (FPOs) engage with the market. Unlike conventional credit-centric approaches, the model fosters shared value creation, making FPOs equal partners in procurement, processing, and sales across the agri value chain.

First Implementation: Maathota Tribal FPC, Andhra Pradesh

- Location: Visakhapatnam district, Andhra Pradesh

- Key Crops: Coffee, turmeric, black pepper

- Economic Impact:

- Procurement and sales worth ₹4–4.5 crore

- Farmers witnessed 10–15% higher profit per acre

- Drivers of Value:

- Transparent pricing

- Reduced distress selling

- Daily, timely payments facilitated by Samunnati

Core Features of the FPO Partnership Model

- Joint Value Creation: Co-ownership of downstream marketing and profit-sharing based on pre-agreed ratios

- Working Capital Support: For procurement and processing via FPCs

- Market Access: Samunnati brings networks, tools, and digital market linkages

- Capacity Building: Institutional strengthening and operational professionalization of FPOs

Advantages Over Traditional Models

- Replaces transactional finance models with collaborative engagement

- Delivers 2–3x higher value creation than conventional revolving credit structures

- Focuses on trust, traceability, and transparency

- De-risks operations and promotes equitable profit distribution

Nationwide Expansion Plans

- The model is being scaled to FPOs across India’s key agricultural geographies

- Each partnership is customized by:

- Crop type

- Regional ecosystem

- FPO maturity level

- Samunnati’s outreach spans 30,000+ FPOs nationwide

The Samunnati FPO Partnership Model represents a significant shift in India’s agri-finance landscape—positioning FPOs not just as producers, but as empowered partners in the national market. By integrating finance, advisory, and market access, Samunnati is unlocking sustainable prosperity for India’s farmer collectives.

Facts Top Remember

1. Odisha raises minimum qualification requirement for anganwadi workers

In a bid to strengthen childcare and maternal services, the Odisha Cabinet decided to raise the minimum qualification requirement for anganwadi workers from matriculation to graduation.

2. SBI General Insurance net increases twofold to ₹ 509 crore in FY25

SBI General Insurance reported a more than twofold jump in net profit to ₹ 509 crore for the financial year 202425 (FY25).

3. National Campaign launched to eliminate Measles-Rubella by 2026

The National Zero Measles-Rubella Elimination campaign 2025-26 was launched in New Delhi today on the first day of the World Immunisation Week.

4. India’s steel industry brimming with confidence, aims 300 MT production by 2030: PM Modi

Prime Minister Narendra Modi today stated that India’s steel industry is brimming with renewed confidence about its future. Speaking virtually at the inauguration of the INDIA STEEL – 6th International Exhibition and Conference being held in Mumbai, he highlighted the ambitious goals set under the National Steel Policy, which aims to increase the country’s steel production to 300 million tonnes by 2030.

5. Govt implements transformative policy measures to promote underground coal mining

The government has taken a series of transformative policy measures aimed at promoting underground coal mining.

6. World Immunization Week 2025 begins with theme “Immunization for All is Humanly Possible”

World Immunization Week 2025 by the World Health Organisation (WHO) will begin from today across the globe. The week-long campaign will last till the 30th of this month.

7. Indian Chess Grandmaster Koneru Humpy wins Pune FIDE Women’s Grand Prix

Indian Chess Grandmaster Koneru Humpy won the Pune FIDE Women’s Grand Prix yesterday. Humpy won the final round with White pieces against Bulgarian International Master Nurgyul Salimova by a score of 7/9 points.

8. Vithya, Yashas win 400 m hurdles titles in National Federation Senior Athletics Competition 2025

Olympian Vithya Ramraj won gold in the women’s 400-meter hurdles at the National Federation Senior Athletics Competition in Kochi yesterday, clocking 56.04 seconds to qualify for the Asian Championships 2025.