Context:

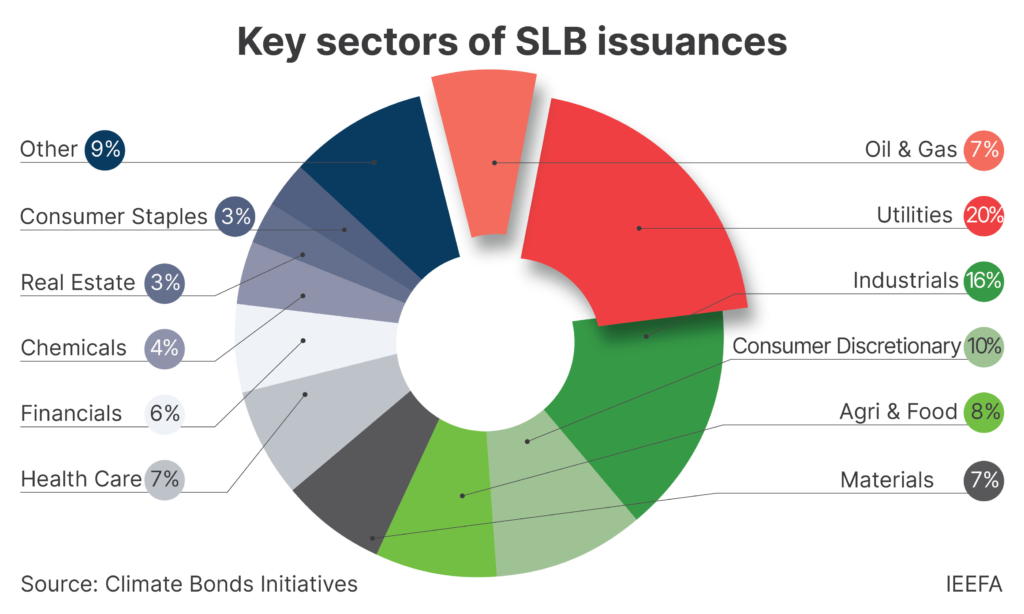

Sustainability-linked bond (SLBs) deals have fall this year, prompting bankers and investors to question whether the $319 billion market will ever regain favour.

Highlights:

- SLB instruments have raised $37.6 billion for companies and government bodies, representing a 46% decline from the entire year of 2023.

- An SLB issuance has fallen about 90% in the Americas and decreased around 30% in the Europe, Middle East, and Africa regions.

Sustainability Linked Bond

- A Sustainability-Linked Bond (SLB) is a type of bond that ties the financial or structural characteristics of the bond to the issuer’s achievement of predetermined sustainability objectives.

- Structured around predetermined key performance indicators (KPIs) and sustainability performance targets (SPTs).

- Independent verification of performed KPIs against SPTs should be obtained at least once a year by the issuers.