SIDBI Grade A 2025 Recruitment

The SIDBI Grade A 2025 Recruitment is one of the most awaited opportunities for aspirants aiming to enter India’s premier development financial institution – the Small Industries Development Bank of India (SIDBI). Known for its dynamic role in promoting MSMEs and inclusive growth, SIDBI offers not just a prestigious position but also long-term career security, a high-paying salary structure, and immense learning exposure in the financial sector.

In this comprehensive guide by C4S (Clarity4Sure), we bring you everything you need to know — from notification details, important dates, eligibility criteria, syllabus, exam pattern, selection process, salary structure, to cut-off trends and preparation strategy. Whether you’re a first-time applicant or a serious repeater, this blog is your one-stop solution to crack SIDBI Grade A 2025 with confidence.

SIDBI Grade A 2025 Notification: Important Exam Dates

| Events | Dates |

|---|---|

| SIDBI Grade A Notification Release | 13 July 2025 |

| Online Application Begins | 14 July 2025 |

| Last Date to Apply | 11 August 2025 |

| Tentative Date of Phase 1 Exam | 06 September 2025 |

| Tentative Date of Phase 2 Exam | 04 October 2025 |

| Tentative Schedule of Interview | November 2025 |

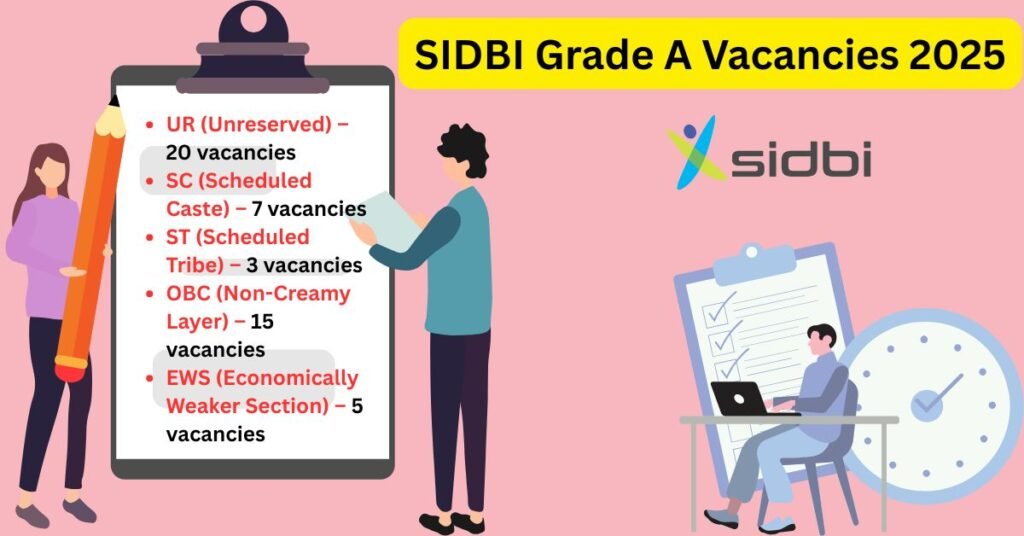

SIDBI Grade A Vacancies 2025

| Category | Vacancies |

|---|---|

| UR (Unreserved) | 20 |

| SC (Scheduled Caste) | 7 |

| ST (Scheduled Tribe) | 3 |

| OBC (Non-Creamy Layer) | 15 |

| EWS (Economically Weaker Section) | 5 |

| PwBD | |

| ▪ HI (Hearing Impaired) | 2 |

| ▪ OC (Orthopedically Challenged) | 1 |

| ▪ MD/ID (Multiple Disabilities / Intellectual Disability) | 2 |

SIDBI Grade A 2025 Eligibility

Age Limit for the SIDBI Assistant Manager Exam

- Minimum Age Requirement: 21 years

- Maximum Age Limit: 30 years

- Date of Birth Range: Applicants must have been born on or after 14th July 1995 and on or before 15th July 2004 (both dates inclusive) to be eligible for the exam.

Age Relaxation

The upper age limit is relaxed for the following categories:

- Scheduled Caste / Scheduled Tribe (SC/ST) – Up to 5 years

- Other Backward Classes (OBC – Non-creamy layer) – Up to 3 years

- Persons with Benchmark Disabilities (PwBD):

- General – Up to 10 years

- OBC – Up to 13 years

- SC/ST – Up to 15 years

- Ex-Servicemen – Up to 5 years

- Candidates affected by the 1984 riots – Up to 5 years

Educational Qualifications for the SIDBI Grade A Exam

To be eligible for the SIDBI Grade A 2025 exam, candidates must possess any one of the following academic qualifications from a recognized university or institution:

1. Bachelor’s Degree (UG) – Minimum 60% (55% for SC/ST/PwBD)

In any of the following disciplines:

- Commerce

- Economics

- Mathematics

- Statistics

- Business Administration

- Engineering (any stream)

2. Professional Qualifications (Any One):

- Company Secretary (CS)

- Certified Management Accountant (CMA/ICWA)

- Chartered Financial Analyst (CFA)

3. Chartered Accountant (CA)

A fully qualified Chartered Accountant is eligible.

4. Master’s Degree (Post-Graduation)

- A two-year full-time MBA or PGDM in any discipline from a UGC/AICTE/Government-recognised institute.

5. Bachelor’s Degree after 10+2 (3-year program)

- Graduation of minimum 3 years duration after Class 12th

- Should have obtained at least 60% marks (or 55% for SC/ST/PwBD)

- Must be from a UGC/Government-approved institute.

6. Post-Graduation after Graduation

- At least 2 years of full-time post-graduate studies following a bachelor’s degree.

Nationality for the SIDBI Grade A Exam

To be eligible for the SIDBI Grade A (Assistant Manager) recruitment, a candidate must belong to any one of the following categories:

- A citizen of India, or

- A subject of Nepal, or

- A subject of Bhutan, or

- A Tibetan refugee who came to India before 1st January 1962 with the intention of permanently settling in India, or

- A person of Indian origin who has migrated from the following countries with the aim of permanent settlement in India:

- Pakistan, Burma, Sri Lanka

- East African countries: Kenya, Uganda, Tanzania (formerly Tanganyika and Zanzibar), Zambia, Malawi, Zaire, Ethiopia, and Vietnam

Important Note:

- Candidates who fall under categories (2), (3), (4), and (5) must have a certificate of eligibility issued by the Government of India.

- They are allowed to appear for the SIDBI exam and interview provisionally, but their final appointment will only be confirmed after they submit this eligibility certificate.

Attempts Allowed for the SIDBI Grade A Exam

SIDBI puts no restriction on the number of attempts. As long as you meet the age criteria, you are eligible to apply for the SIDBI Grade A 2025 Assistant Manager exam.

SIDBI Grade A Pattern 2025

The selection process will be conducted in three phases:

- Phase 1: Online Objective Test

- Phase 2: Online Descriptive (Answers to be typed using Keyboard) and Objective Test

- Phase 3: Interview

SIDBI Grade A Phase 1 Pattern

- The SIDBI Grade A Phase 1 exam is a fully objective-type test and is meant only for qualifying purposes. This means that the marks scored in Phase 1 will not be counted towards the final selection.

- The exam is bilingual, so you can choose to attempt it in either English or Hindi, based on your preference. However, please note that the English Language section will only be available in English.

| Sr. No. | Name of the Test | No. of Questions | Maximum Marks | Time |

|---|---|---|---|---|

| 1 | English Language | 30 | 30 | |

| 2 | Reasoning Aptitude | 25 | 25 | |

| 3 | Quantitative Aptitude | 25 | 25 | |

| 4 | Computer Knowledge | 20 | 20 | |

| 5 | General Awareness (with special reference to Banking & Financial Sector and Economic & Social Issues) | 20 | 20 | |

| 6 | MSMEs: Policy, Regulatory & Legal Framework; Finance and Management (with focus on MSMEs) | 30 | 30 | |

| 7 | Stream-Specific Test: MSME Financing (Due Diligence, KYC, Financial Ratios, Term Loan/Working Capital Assessment, Documentary Credit, NPA & Recovery, IRAC Norms, NBFC Financing, Credit Risk Assessment, etc.) | 50 | 50 | |

| TOTAL | 200 | 200 | 120 Minutes |

- The sections on English Language, Reasoning Aptitude, Quantitative Aptitude, and Computer Knowledge are qualifying in nature. This means you just need to clear the minimum cut-off in these sections — their marks won’t count towards your final score for shortlisting.

The actual merit will be based on your performance in the following sections:

- General Awareness (with focus on Banking, Finance, and Economic & Social Issues)

- MSME-related topics

- Stream-Specific Test

- So, your shortlisting for Phase 2 (the next stage) will depend only on the marks scored in these merit sections.

SIDBI Grade A Phase 2 Pattern

- Once you clear Phase 1, you’ll move on to Phase 2, which is a combination of both objective and descriptive tests.

- Phase 2 consists of two papers:

- Paper I – English Descriptive (75 marks):

You’ll be asked to write essays, letters, or precise writing to test your communication and writing skills. - Paper II – MSME/Finance Knowledge (Total 125 marks):

- Objective Section: 75 marks

- Descriptive Section: 50 marks

This paper checks your understanding of MSME-related topics, finance, credit appraisal, and banking knowledge.

So, the total marks for Phase 2 come to 200 marks, and you’ll have a combined time of 210 minutes to complete both papers.

| Paper | Name of the Test | Type of Paper | No. of Questions | Maximum Marks | Time |

|---|---|---|---|---|---|

| Paper I | English Language | Online Descriptive | 3 | 75 | 75 minutes |

| Paper II | MSME / Finance | Online Objective (Bilingual – Hindi & English) | 50 questions (Mix of 1-mark and 2-mark questions) | 75 | 60 minutes |

| Online Descriptive | 10 questions (Attempt any 4):2 questions of 15 marks each + 2 of 10 marks each | 50 | 75 minutes |

- Note on Negative Marking:

- There’s a ¼ mark deduction for each wrong answer in the objective sections (Phase 1 and Paper II objective portion).

SIDBI Grade A Final Selection

The final selection will be based on the combined marks in Phase 2 + Interview. A psychometric test shall be conducted before the interview.

SIDBI Grade A Syllabus

- SIDBI has only mentioned the subject name in Phase 1 and has given no syllabus.

- The following section-wise topics are possible to come in the SIDBI Grade A Phase 1 paper, similar to what we see in other regulatory bodies’ exams.

1. English Language

Focuses on grammar, comprehension, and vocabulary skills:

- Reading Comprehension

- Cloze Test

- Para Jumbles

- Error Spotting

- Sentence Improvement

- Vocabulary (Synonyms, Antonyms, Fill in the blanks)

2. Reasoning Aptitude

Designed to test logical thinking and problem-solving:

- Seating Arrangements (Linear, Circular, Floor-based)

- Puzzles (Box-based, Scheduling, etc.)

- Syllogism

- Inequality

- Blood Relations

- Coding-Decoding

- Direction Sense

- Input-Output

- Logical Reasoning

3. Quantitative Aptitude

Mathematical and data interpretation abilities are tested:

- Arithmetic Topics:

- Profit & Loss, SI & CI, Time & Work, Time-Speed-Distance, Ratios

- Data Interpretation:

- Pie Charts, Bar Graphs, Line Graphs, and Tables

- Number Series

- Simplification & Approximation

- Quadratic Equations

- Data Sufficiency

4. Computer Knowledge

Covers fundamental computer literacy:

- Basics of Computer Hardware and Software

- Operating Systems

- Internet and Networking

- MS Office Tools (Word, Excel, PowerPoint)

- Keyboard Shortcuts

- Cyber Security & Digital Banking

5. General Awareness (Banking, Finance & ESI Focus)

Focuses on current and financial affairs:

- Current Affairs (past 4–6 months): Economy, MSMEs, Finance

- Union Budget 2025 & Economic Survey Highlights

- RBI Reports & Circulars (e.g., Financial Stability Report, Monetary Policy)

- Government Schemes for MSMEs: CGTMSE, PMEGP, MUDRA, SFURTI

- Banking Awareness: CRR/SLR, Basel Norms, NBFCs, Types of Accounts

- Financial Institutions: SIDBI, NABARD, NHB, EXIM Bank, NaBFID

- Static GK: Committees, Headquarters, Economic Indices

6. Finance & Management (MSME-focused)

Tests your understanding of financial systems and management practices:

Finance Topics:

- Overview of Financial System (RBI, SEBI, SIDBI)

- Types of Capital: Working, Fixed, Equity, Venture, Debt

- Time Value of Money, NPV, IRR

Management Topics:

- Principles of Management (Planning, Organising, Controlling, Delegation)

- HRD Concepts: Training, Appraisal, Recruitment

- Motivation Theories (Maslow, Herzberg, McGregor)

- Leadership Styles and Conflict Management

- Basics of Organisational Behaviour

7. Stream-Specific Topics (MSME & Banking-Focused)

- MSME Lending & Financing: Due Diligence, KYC, Document Verification

- Financial Ratios & Their Analysis

- Working Capital & Term Loan Assessment

- Documentary Credit: Concepts & Instruments

- NPA Classification and Recovery Processes

- IRAC Norms: Income Recognition, Asset Classification, Provisioning

- Credit Risk Analysis & Assessment Tools

- NBFCs & Their Role in MSME Lending

- Functions of ARCs (Asset Reconstruction Companies)

- Basics of Investment and Merchant Banking

- Overview of Alternative Investment Funds (AIFs)

- India’s MSME Policy Framework & Government Support Initiatives

SIDBI Grade A Phase 2 Syllabus

For Phase 2, the syllabus has only been provided for Paper II by SIDBI, which is merely indicative. Here is the syllabus for both Paper 1 and Paper 2.

Paper I – Descriptive English

In this section, candidates will be evaluated on their written communication skills. You will be asked to attempt the following:

- One Essay – Write on a given topic, usually related to economics, finance, or social issues.

- One Precis – Summarize a given passage concisely and accurately.

- One Reading Comprehension – Read a passage and answer multiple questions based on it.

This paper is designed to assess your clarity of thought, articulation, and command over the English language.

Paper II – MSME and Finance (Domain-Specific Test)

This is a specialized section that tests your knowledge and understanding of MSME and financial concepts. The topics broadly cover:

MSME Sector – Policies and Frameworks

- Legal, regulatory, and policy environment concerning Micro, Small, and Medium Enterprises (MSMEs) in India.

Finance and Management with MSME Emphasis

- Fundamentals of financial systems, particularly relevant to MSME development.

- Basic management principles and their practical applications in the MSME sector.

MSME Lending and Financial Operations

- Due Diligence Procedures

- Know Your Customer (KYC) Norms

- Financial Ratio Analysis

- Credit Appraisal of Term Loans and Working Capital

- Documentary Credit, Collateral, and Legal Documentation

- Classification and Recovery of NPAs

- IRAC Norms (Income Recognition, Asset Classification & Provisioning)

- Non-Banking Financial Company (NBFC) Lending Practices

- Credit Risk Analysis & Evaluation Techniques

Capital Markets and Investment Basics

- Introduction to Investment Banking and Merchant Banking

- Understanding Equity Markets

- Alternative Investment Funds (AIFs)

- Role and functions of Asset Reconstruction Companies (ARCs)

Government Schemes and Support for MSMEs

- In-depth awareness of current government initiatives and policies aimed at promoting and supporting MSME growth in India.

SIDBI Grade A Phase 2 Syllabus

For Phase 2, the syllabus has only been provided for Paper II by SIDBI, which is merely indicative. Here is the syllabus for both Paper 1 and Paper 2.

Paper I – Descriptive English

In this section, candidates will be required to complete the following tasks:

- One Essay – Write a well-structured essay on a given topic, typically related to finance, economy, or social relevance.

- One Precis – Summarize a provided passage in a concise and clear format.

- One Reading Comprehension – Read a given passage and answer questions based on the content.

Paper II – MSME & Finance

This is a subject-specific paper aimed at evaluating your domain knowledge. The indicative and officially prescribed syllabus includes the following key areas:

MSME Sector

- Policies, legal and regulatory frameworks governing Micro, Small, and Medium Enterprises in India.

Finance & Management (with emphasis on MSMEs)

- Foundational management principles and financial concepts relevant to MSME operations and development.

MSME Lending & Credit Operations

- Due Diligence Procedures

- Know Your Customer (KYC) Compliance

- Financial Ratio Analysis

- Assessment Techniques for Term Loans and Working Capital Needs

- Documentary Credit, Required Security, and Legal Documentation

- Handling Non-Performing Assets (NPAs) and Recovery Methods

- IRAC Norms – Guidelines for Income Recognition, Asset Classification, and Provisioning

- Lending by NBFCs to MSMEs

- Credit Risk Assessment and Mitigation

Capital Markets & Banking

- Basics of Investment Banking and Merchant Banking

- Introduction to Equity Markets

- Overview of Alternative Investment Funds (AIFs)

- Role and structure of Asset Reconstruction Companies (ARCs)

Government Support for MSMEs

- Key schemes, policies, and incentives launched by the Government of India to promote the MSME sector.

SIDBI Grade A Salary

As per the official SIDBI Grade A 2025 notification, here’s a detailed breakdown of the salary, allowances, and benefits you can expect as a Grade A officer (Assistant Manager) at SIDBI:

Basic Pay

- ₹44,500 per month (starting basic)

Gross Monthly Emoluments

As a SIDBI Assistant Manager, your gross salary will be approximately ₹1,00,000 per month, which includes various allowances such as:

- Dearness Allowance (DA)

- Grade Allowance

- Special Allowance

- Local Compensatory Allowance

- Bank’s contribution to National Pension System (NPS)

Additional Perks and Benefits

SIDBI Grade A officers also enjoy a wide range of perks, including:

- Leased flat or SIDBI-provided accommodation

- Medical reimbursement for self and family

- Leave Fare Concession (LFC) – Travel reimbursement every 2 years

- Education and Furnishing Allowance

- Interest-free Festival Advance

- Reimbursement for telephone bills, newspaper, vehicle maintenance

- Low-interest/concessional loans for:

- Car

- Home

- Travel

- Consumer goods (laptops, mobile phones, etc.)

Annual CTC (Cost to Company)

- Approximately ₹19 to ₹21 lakhs per annum (LPA)

SIDBI Grade A Application Fee

Here is the non-refundable application cum processing fee to apply for the SIDBI Grade A exam:

| Category | Application Fee | Intimation Charges | Total Charges |

|---|---|---|---|

| SC / ST / PwBD | Nil | ₹175 | ₹175 |

| Others (General / OBC / EWS) | ₹925 | ₹175 | ₹1100 |

| Staff Candidates (Regular employees of SIDBI) | Nil | Nil | Nil |