Daily Current Affairs

Table of Content

Banking/Finance

- Macroeconomic ´Stable inflation is foundation of sustained growth´

- Govt looks to cut red tape and unmoor port infra delays

- The “State of the Economy” article in the latest Monthly Bulletin of the Reserve Bank of India (RBI)

- Private Banks seek reduction in Mudra targets

- RBI’s war against inflation is not yet over, says guv Das

- RBI, Maldives Monetary Authority sign pact to promote use of local currencies

- India Unveils AI Data Bank to Propel Innovation and Strengthen National Security

- RBI Governor Shaktikanta Das likely to get extension, announcement expected after Maharashtra Election

- RBI’s FX interventions intended to ensure that the market is liquid and deep, and functioning in an orderly manner, say officials

Agri Business

- Storage in major reservoirs down on 11% post-monsoon deficient rainfall

- SEA President favours adoption of genetically modified crops to improve oilseeds’ productivity

- APEC Climate Center forecasts La Nina emerging during December-February

- Cabinet clears extension of fortified rice scheme until December 2028 to combat anaemia

National Affairs

- Second India-CARICOM Summit’

- Raksha Mantri meets his South Korean, Australian & New Zealand counterparts on the sidelines of 11th ASEAN Defence Ministers’ Meeting-Plus in Lao PDR

- Ministry Directs EPFO to Ensure UAN Activation for Employees through Aadhaar-based OTP

- Cabinet clears extension of fortified rice scheme until December 2028 to combat anaemia

- US indicts Adani for bribing officials in India, misleading investors; issues arrest warrants

- In Ranthambore, tigers and humans struggle for space and survival

Facts to Remember

- High BP, irregular heartbeat up severe stroke risk: Study

Banking/Finance

- Macroeconomic ´Stable inflation is foundation of sustained growth´

Reserve Bank of India Governor Shaktikanta Das Highlights Macroeconomic Stability

- Shaktikanta Das emphasizes the shared responsibility of monetary and fiscal authorities for macroeconomic stability.

- He highlights the importance of effective fiscal-monetary coordination in India’s success amidst adverse shocks.

- Das emphasizes the role of stable inflation in sustained growth, enhancing purchasing power and providing a stable investment environment.

- He emphasizes the role of price stability in enabling economic agents to plan ahead, reduce uncertainty, encourage savings, and investment, all of which boost the potential growth rate of the economy.

- Das also emphasizes that high inflation is disproportionately burdensome on the poor.

- The RBI aims for a sustainable decline towards the target of 4%, emphasizing that stable inflation is in the best interest of both the people and the economy.

- The RBI’s ‘State of the Economy’ report warns that rising prices could undermine the real economy’s prospects and cautions on the spillover effect of rising food prices on headline inflation.

RBI’s 2024 Economic Reports

- Real GDP growth projected to rise to 7.2% in 2024-25, from 7% earlier.

- Inflation projected to remain at 4.5% for FY 2024-25, with lower projections for Q1, Q2, and Q4.

- Domestic growth supported by robust domestic drivers despite geopolitical tensions.

- NBFC sector showing robust growth, with double-digit credit expansion in 2023-24.

- Agricultural sector expected to benefit from above-normal south-west monsoon.

- Provides an analytical overview of macroeconomic and monetary developments.

2. Govt looks to cut red tape and unmoor port infra delays

India’s Ministry of Ports, Shipping and Waterways is expanding the autonomy of major ports in capital expenditure decisions.

- The proposal allows all 12 major ports to undertake capital expenditure at their discretion, using their internal resources.

- The government plans to categorize India’s 12 major ports into four groups based on their size of operations and other various factors.

- The ceiling for capex that can be undertaken without the need for approval will be determined by these groups.

- Under current deliberations, expenditure beyond ₹ 500 crore will still require approval, but it will be submitted to interministerial bodies such as the GatiShakti Network Planning Group, the Public Investment Board, and the Union Cabinet.

- This aims to allow major ports to compete with mega private ports.

- In 2023, major ports handled 721 million tonne of cargo, marking an 11.8% growth yearon-year, while nonmajor ports handled 817 mt, growing by 4.4%.

India’s Major Ports

- Major west coast ports: Mumbai, Kandla, Mangalore, JNPT, Mormugao, Cochin.

- east coast ports: Chennai, Tuticorin, Visakhapatnam, Paradip, Kolkata, and Ennore.

- Key commodities handled: coal, iron ore, petroleum products, steel, and fertilizers.

- Major ports: Ennore Port (Kamarajar Port), Visakhapatnam Port, Paradip Port, Kolkata Port (including Haldia), New Mangalore Port.

- Ministry of Shipping manages 12 major ports.

3. The “State of the Economy” article in the latest Monthly Bulletin of the Reserve Bank of India (RBI)

Economic Momentum Slowing in India

- The Reserve Bank of India’s “State of the Economy” article suggests that the economic slowdown in India is over, with private consumption driving domestic demand.

- Real GDP growth is expected to be 6.7% in Q2 and 7.6% in Q3 of this financial year.

- The Monetary Policy Committee (MPC) is being urged to consider food prices in determining policy rates.

- The CPI-based inflation rate increased to 6.2% in October, with food and core rates recording increases of 2.2% and 0.6% respectively.

- RBI economists have identified signs of second-order effects or spillover of high food prices, which could affect wage negotiations.

- High inflation is affecting consumption demand, corporate profits, and capital expenditure, necessitating control for sustainable growth.

- The RBI’s baseline inflation projection for Q4 202526 is 4.1%, close to the target of 4.1%, which may open up space for rate reduction next year.

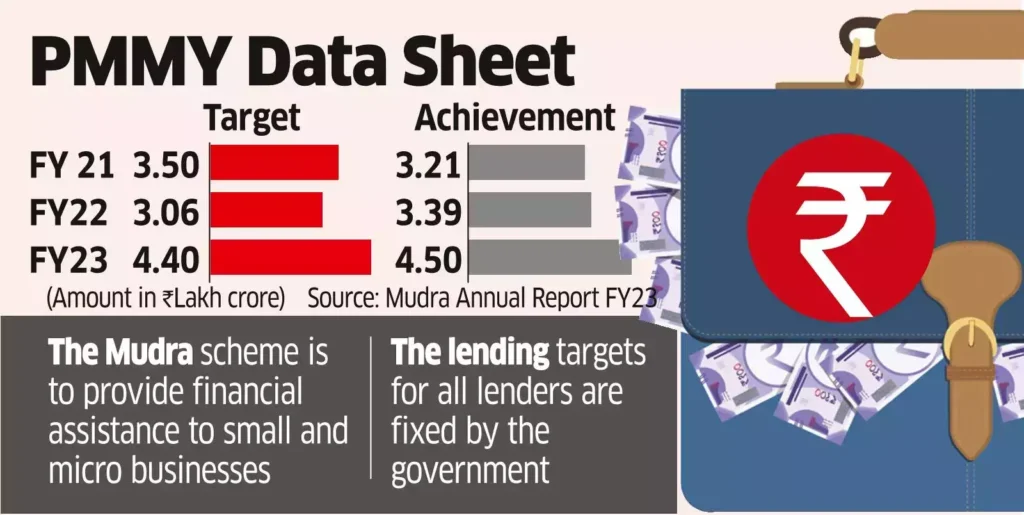

4. Private Banks seek reduction in Mudra target

Private Banks Seek Reduction in Mudra Loan Targets

- Private banks argue for reducing Mudra loan targets due to rising stress in MSMEs’ loans.

- Ficci-Indian Banks’ Association survey predicts a 38% rise in non-performing assets in MSME loans in the next six months.

- Despite low stress in Mudra loans, the sector could face stress due to interest rates and global uncertainty.

- A government official maintains no stress signs in Mudra loans and reports a decrease in bad loans.

Pradhan Mantri Mudra Yojana (PMMY)

- A scheme of the Indian government.

- Provides micro credit/loan up to Rs. 10 lakhs to income-generating micro enterprises in non-farm sectors.

- Provides financial assistance from Member Lending Institutions.

- Supports millions of proprietorship/partnership firms in various sectors.

5. RBI’s war against inflation is not yet over, says guv Das

Reserve Bank of India Governor Shaktikanta Das Reiterates War Against Inflation

- Das emphasizes the need for realigning inflation with the target of 4% on a durable basis.

- He stresses the importance of price stability as a key factor in economic planning, reducing uncertainty, encouraging savings and investment, and supporting sustained growth.

- The speech follows calls from Union commerce minister Piyush Goyal and finance minister Nirmala Sitharaman for lower inflation.

- Das put emphasize on the need for investment in physical and social infrastructure, technology, innovations, and institutional reforms to achieve higher growth.

- He pointed towards the significance of effective coordination between fiscal-monetary policy in the context of low-income countries with large developmental needs.

- Das emphasizes the significance of central bank communication in the Global South as economies transition towards more independent central banks.

6. RBI, Maldives Monetary Authority sign pact to promote use of local currencies

RBI and MVR Sign Agreement

- RBI and MVR establish framework for cross-border transactions.

- Memorandum of Understanding signed by RBI Governor Shaktikanta Das and MVR Governor Ahmed Munawar.

7. India Unveils AI Data Bank to Propel Innovation and Strengthen National Security

“AI for India: Advancing India’s AI Development – Innovation, Ethics, and Governance”

- Union Minister Jitendra Singh emphasizes the importance of responsible AI use in India.

- The government, led by Prime Minister Narendra Modi, has initiated AI-driven programs and launched QuantumMission.

- Singh highlights AI’s role in governance, business, healthcare, education, and space exploration.

- India’s first practical AI Data Bank is introduced to accelerate technological growth and innovation.

- The National Strategy for AI is guided by innovation, ethical governance, and global collaboration.

- India is fostering partnerships for AI applications in critical sectors.

- Singh reaffirms India’s commitment to transparent and fair AI systems.

- He emphasizes the need for India to participate in global platforms like the United Nations and G20.

- Singh envisions India as a global AI leader by 2047, emphasizing responsible and inclusive AI development.

8. RBI Governor Shaktikanta Das likely to get extension, announcement expected after Maharashtra Election

India’s Central Bank Governor Shaktikanta Das Expected to Extend Second Term

- Sources suggest Shaktikanta Das could extend his second term, making him the longest-serving RBI chief since the 1960s.

- Appointed in December 2018, Das has become a trusted figure in Prime Minister Narendra Modi’s administration.

- His current term ends on December 10, but his leadership is expected to continue for at least another year.

Every three years, a selection committee led by the Prime Minister picks the next RBI Governor. There’s no detailed rulebook for eligibility or any fixed checklist. Just that the folks on the committee are experts in economics, banking, finance or public administration

9. RBI’s FX interventions intended to ensure that the market is liquid and deep, and functioning in an orderly manner, say officials

India’s Forex Market Interventions and Export Competitiveness

- Forex market interventions need to be adjusted for the economy’s size.

- India’s GDP averaged US$ 1,186 billion from 1994-2018 and US$ 3,248 billion from 2019-2024.

- RBI’s net interventions to GDP averaged 1.6% from February to October 2022, compared to 1.5% during earlier crises.

- The volatility of the INR has been steadily declining, anchoring financial stability.

- The INR depreciated by 7.8% during 2022-23 and 1.4% for 2023-24, reflecting strengthening of India’s macro-fundamentals.

- The sensitivity of India’s merchandise exports to real exchange rate changes has decreased over the years.

- The emphasis in India’s export effort is shifting towards expanding market share based on quality and technology improvements.

- Central bank governor Shaktikanta Das is likely to get a second term extension, making him the longest-serving Reserve Bank of India (RBI) chief since the 1960s.

Agri Business

- Storage in major reservoirs down on 11% post-monsoon deficient rainfall

India’s Water Storage Levels Drop

- Water storage in India’s 155 major reservoirs dropped by 2 percentage points to 83% of capacity.

- The decrease began after the South-West Monsoon withdrew last month after 8% excess rainfall.

- Post-monsoon rainfall between October 1 and November 21 was deficient in 64% of the 720 districts.

- The IMD reported an 11% deficiency across the nation as of November 21.

- The storage was 150.639 billion cubic metres (BCM) of the 180.852 BCM capacity.

- Punjab, Bihar, and Himachal have the lowest storage at 52%, 36%, and 30% below normal, respectively.

- Despite these developments, the situation is seen favorable for the rabi season with higher storage than last year and better soil moisture.

- 103 of the major reservoirs were filled above 80% of the capacity, with 25 of them full.

- The storage levels in the northern region were lower than last year and below normal.

- The eastern region’s 25 reservoirs had the highest storage at 15.091 BCM or 73% of the 20.798 BCM capacity.

- The western region’s 50 reservoirs had the highest storage at 95% of the 37.357 BCM capacity at 35.330 BCM.

- The central region’s 26 reservoirs were filled to 86% of the 48.227 BCM capacity at 41.667 BCM.

- The storage levels in all southern States were above 75%, with the least being in Kerala.

2. SEA President favours adoption of genetically modified crops to improve oilseeds’ productivity

India’s Solvent Extractors’ Association of India (SEA) advocates for the adoption of GMO crops to boost oilseed productivity.

- SEA President Sanjeev Asthana predicts a growth in India’s oilseed production from 35 million tonnes to 45-50 million tonnes by 2029-30.

- Consumption is expected to reach 28-30 million tonnes at a 3% growth rate, potentially reaching 32 million tonnes with 4% growth.

- The rising demand for convenience foods will increase edible oil consumption, prompting the government to launch initiatives like the National Oilseeds Mission and the Palm Oil Mission.

- Asthana urges the government to grant a 15% export incentive through higher RoDTEP rates, freight subsidies, and interest subvention to boost export competitiveness and increase edible oil availability.

- The association also criticizes the ban on the export of de-oiled ricebran, citing a plummet in milk prices.

- The association urges SEBI and the Finance Ministry to lift the suspension of futures trading in certain commodities.

Solvent Extractors’ Association of India:

- Established in 1963 to promote India’s solvent extraction industry.

- Presently has 875 members, 350 working plants, and an annual processing capacity of 30 million tonnes.

- Premier vegetable oil association in India, representing Rice bran, Oilcakes, Minor Oilseeds, and Soybean processors.

3. APEC Climate Center forecasts La Nina emerging during December-February

APEC Climate Center’s La Nina Forecast

- APEC predicts 62% La Nina conditions between December 2024 and February 2025, with neutral conditions in February-April and March-May 2025.

- The Niño3.4 index is expected to be -0.8℃ for January 2025 and gradually increase to -0.3℃ for May 2025.

- APEC predicts above-normal rainfall for India during December 2024-25, with increased chances of below-normal rainfall in the western Indian Ocean.

- APEC also sees an increased probability for above-normal temperatures over the Indian Ocean and South-East Asia.

Asia-Pacific Economic Cooperation (APEC)

Goals:

- Establish new markets for agricultural products and raw materials.

- Reduce trade tariffs and barriers.

- Facilitate trade and investment liberalization.

- Reduce cross-border trade costs.

APEC Member Economies:

- Includes Australia, Brunei Darussalam, Canada, Chile, China, Hong Kong, Indonesia, Japan, Republic of Korea, Malaysia, Mexico, New Zealand, Papua New Guinea, Peru, Philippines, Russia, Singapore, Chinese Taipei, Thailand, United States, and Vietnam.

- Headquarters: Singapore.

Asia-Pacific Economic Cooperation (APEC) Overview

Goals:

- Establish new markets for agricultural products and raw materials.

- Reduce tariffs and trade barriers.

- Liberalize and facilitate trade and investment.

- Reduce cross-border trade costs.

APEC Structure:

- Based on a “bottom-up” and “top-down” approach.

- Decision-making is consensus-based, commitments are voluntary.

- Four core committees provide strategic policy recommendations.

- Working groups implement initiatives through APEC-funded projects.

Membership:

- Member economies include Australia, Brunei Darussalam, Canada, Chile, China, Hong Kong, Indonesia, Japan, Republic of Korea, Malaysia, Mexico, New Zealand, Papua New Guinea, Peru, the Philippines, the Russian Federation, Singapore, Chinese Taipei, Thailand, the United States, and Vietnam.

La Nina: A Phase of the El Nino-Southern Oscillation (ENSO) Cycle

- La Nina is the cool phase of the ENSO cycle, opposite to El Nino.

- Characterized by cold ocean temperatures, stronger trade winds, and upwelling bringing cold, nutrient-rich water to the surface.

- Impacts global weather patterns, including drier winters in the southern U.S., heavy rains and flooding in the Pacific Northwest and Canada, warmer winters in the South and cooler winters in the North, and a more severe hurricane season.

- Typically lasts 9-12 months, occurs every 3–5 years, and peaks in the spring-summer and winter.

National Affairs

- Second India-CARICOM Summit

India-CARICOM Summit: 2nd Meeting

- The 2nd India-CARICOM Summit was held in Georgetown on 20 November 2024, chaired by Prime Minister Shri Narendra Modi and Prime Minister of Grenada, H.E. Mr. Dickon Mitchell.

- The summit was attended by various leaders including Presidents of Dominica, Suriname, Trinidad & Tobago, Barbados, Antigua & Barbuda, Grenada, Bahamas, St. Lucia, St. Vincent, Bahamas, Belize, Jamaica, and St. Kitts & Nevis.

- Prime Minister expressed solidarity with CARICOM and ensured India’s commitment to the region.

- India offered major assistance in seven key areas: Capacity Building, Agriculture and Food Security, Renewable Energy and Climate Change, Innovation, Technology and Trade, Cricket and Culture, Ocean Economy and Maritime Security, and Medicine and Healthcare.

- The Prime Minister announced one thousand more ITEC slots for CARICOM countries over the next five years.

- He urged CARICOM members to join global initiatives led by India in renewable energy and climate change.

- India offered its Digital Public Infrastructure, cloud-based Digi locker, and UPI models to CARICOM countries to enhance public service delivery.

- CARICOM and India shared close cultural and cricketing ties, with training for 11 young women cricketers and organizing “Days of Indian Culture” in member countries.

- India was ready to work with CARICOM members on maritime domain mapping and hydrography in the Caribbean Sea.

Caribbean Community

- Political and economic union of 20 Caribbean, Americas, and Atlantic Ocean countries.

- 15 member states: Antigua and Barbuda, Bahamas, Barbados, Belize, Dominica, Jamaica, Grenada, Guyana, Haiti, Monserrat, Saint Kitts and Nevis, Saint Vincent and the Grenadines, Saint Lucia, Suriname, Trinidad and Tobago.

- 5 associated states: Bermuda and Cayman.

- Main objectives: promote economic integration, ensure equitable benefits, coordinate foreign policy.

2. Raksha Mantri meets his South Korean, Australian & New Zealand counterparts on the sidelines of 11th ASEAN Defence Ministers’ Meeting-Plus in Lao PDR

Raksha Mantri’s Meeting with US Secretary of Defense and Defence Ministers

- Raksha Mantri met with Minister of National Defence, Republic of Korea, Australian Minister for Defence Industry & Capability Delivery, and New Zealand Defence Minister.

- Both agreed on positive bilateral defense cooperation and the need for strong relations.

- They agreed to work on the ‘Road map for Defence Industry Corporation’ signed in February 2020.

- Mantri highlighted the potential for growth in co-production and co-development in defence manufacturing ecosystems.

ASEAN

- Political and economic union of 10 Southeast Asian countries.

- Founding members: Indonesia, Malaysia, Philippines, Singapore, Thailand.

- Later members: Brunei Darussalam, Vietnam, Lao PDR, Myanmar, Cambodia.

- East Timor observer status, expected to become full member in 2025.

- Established in 1967 to promote peace, security, and economic growth.

- Aims include economic, social, cultural, technical, educational, regional peace, respect for justice, and adherence to UN Charter principles.

3. Ministry Directs EPFO to Ensure UAN Activation for Employees through Aadhaar-based OTP

Central Government’s Aadhaar Payment Bridge and Employment Linked Incentive Scheme

- Central Government directs Ministries/Departments to ensure Subsidy/Incentive payments through Aadhaar Payment Bridge and 100% Biometric Aadhaar Authentication.

- Employment Linked Incentive (ELI) Scheme announced in Union Budget 2024-25 will benefit maximum employers and employees.

- EPFO to work in a campaign mode with employers to activate Universal Account Number (UAN) of employees.

- Aadhaar-based verification simplifies government delivery processes, enhances transparency, and ensures seamless entitlements.

- Employers must complete UAN activation process through Aadhaar-based One-Time Password (OTP) for all employees joining in the current financial year by 30th November 2024.

- UAN activation provides seamless access to EPFO’s online services, enabling efficient management of Provident Fund (PF) accounts, viewing and downloading PF passbooks, submitting online claims, updating personal details, and tracking claims in real time.

- Next stage will include Biometric authentication through Face-recognition Technology.

4. Cabinet clears extension of fortified rice scheme until December 2028 to combat anaemia

Union Cabinet Approves Extension of Free Fortified Rice Scheme

- The Union cabinet has approved an extension of the free fortified rice scheme under the Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY) from July 2024 to December 2028.

- The total cost of the scheme is estimated to be ₹17,082 crore.

- The extension aligns with the government’s Anaemia Mukt Bharat plan, which aims to combat anaemia and micronutrient deficiencies.

- The supply of fortified rice will be extended through the Targeted Public Distribution System (TPDS), the Integrated Child Development Service (ICDS), and the PM POSHAN scheme in all states and union territories.

- The government’s Anaemia Mukt Bharat plan, which aims to combat anaemia and other micronutrient deficiencies.

- The National Family Health Survey (NFHS-5) which was conducted between 2019 and 2021 shows anaemia remains prevalent across India.

Anemia

- A blood disorder causing insufficient red blood cells or hemoglobin for oxygen transport.

- Symptoms include fatigue, weakness, dizziness, shortness of breath, headaches, pale skin, chest pain, and irregular heartbeat.

- Causes include nutrient deficiencies, including iron deficiency, folate, vitamins B12, and A.

- Blood loss can occur due to gastrointestinal conditions, NSAIDs, heavy menstruation, post-trauma, post-surgery, and postpartum period.

Pradhan Mantri Garib Kalyan Anna Yojana (PMGKAY)

- Launched to provide free food grains to the poor and migrants during the Covid-19 pandemic.

- The central government provides 5 kg of free food grains monthly.

- Supplements the subsidized ration under the National Food Security Act (NFSA).

- Beneficiaries can collect food grains from fair price shop dealers with their ration card or Aadhaar number.

- Application requires opening a Jan Dhan account in a bank authorized by the Reserve Bank of India and submitting income documents.

5. US indicts Adani for bribing officials in India, misleading investors; issues arrest warrants

US Prosecutors Indict Gautam and Sagar Adani for Bribery in India

- US prosecutors indict billionaire Gautam Adani and his nephew, Sagar Adani, for alleged $265 million bribery to secure solar power supply contracts in India.

- The case follows allegations by Hindenburg Research.

- Arrest warrants have been issued for Adani and Adani, with plans to hand them to foreign law enforcement.

- The US Department of Justice and the US Securities Exchange Commission have also charged Adani and others with FCPA violations.

- The SEC accuses Adani and others of raising money from US investors on false and misleading statements about their involvement in bribery.

- The bribe, reportedly worth Rs 1,750 crore, was allegedly paid for contracts in Andhra.

6. In Ranthambore, tigers and humans struggle for space and survival

Tiger Attacks in Rajasthan

- On November 2, a tiger was found in a village near Rajasthan’s Sawai Madhopur district.

- The tiger was identified as Chirico, or T-86, and was found next to the mauled body of a villager.

- From 2019 to 2024, five people lost their lives in tiger attacks, and over 2,000 cattle were killed by tigers.

- Reports suggested 25 out of Ranthambore’s 75 tigers were “missing,” with 14 missing for less than a year and 11 for over a year.

- The National Tiger Conservation Authority has requested the Wildlife Crime Control Bureau to investigate the matter.

Ranthambore National Park

- 1,334 km2 (515 sq mi) national park in Rajasthan, India.

- Bound by Banas and Chambal Rivers.

- Named after Ranthambore Fort.

- Established as Sawai Madhopur Game Sanctuary in 1955.

- Declared Project Tiger reserve in 1974.

Facts to Remember

- High BP, irregular heartbeat up severe stroke risk: Study

High Blood Pressure and Stroke Risk Factors

- High blood pressure, irregular heartbeat, and smoking may increase the risk of severe stroke.

- Other risk factors like diabetes, physical inactivity, stress, and alcohol use have a lower risk of severe symptoms.

- Stroke occurs when blood supply to a part of the brain is cut off, leading to complications like difficulty swallowing, paralysis, memory loss, confusion, and vision loss.

- The World Stroke Organisation (WSO) emphasizes the importance of hypertension control in stroke prevention, especially in lower and middle-income nations.

- High blood pressure and smoking may cause severe stroke compared to other factors like diabetes, as they affect large and medium-sized arteries.

- A survey in Delhi revealed nearly 70% of people over 50 years old have high blood pressure, with smoking prevalence in 20%.

- Timely administration of drugs to dissolve blood clots can save many patients, and some may benefit from minimally invasive surgery to remove the blood clot.