Daily Current Affairs Quiz

06 & 07 January, 2026

National Affairs

1. Unlawful Activities (Prevention) Act – UAPA

Source: The Hindu

Context:

The Supreme Court refused bail to Umar Khalid and Sharjeel Imam in the 2020 Delhi riots case.

Unlawful Activities (Prevention) Act – UAPA

The Unlawful Activities (Prevention) Act (UAPA) is India’s main anti-terror law.

Its purpose is to protect the sovereignty, unity, and security of India by preventing activities linked to terrorism, secession, and unlawful organizations.

Why was UAPA made?

- Enacted in 1967

- Strengthened after major security threats (especially post-2004 and 2008)

- To give the government strong legal tools to deal with terrorism and anti-national activities

What does UAPA do?

1. Defines “Unlawful Activities”

Any action that:

- Threatens India’s unity or integrity

- Supports secession or disintegration

- Encourages violence against the state

2. Deals with Terrorist Activities

UAPA covers:

- Planning or committing terrorist acts

- Funding terrorism

- Recruiting or training terrorists

- Possessing weapons or materials for terrorism

3. Bans Organizations

- Government can declare an organization as a terrorist organization

- Membership, support, or funding such groups becomes a crime

4. Individuals Can Be Declared Terrorists

(After 2019 amendment)

- Even individuals, not just organizations, can be notified as terrorists

5. Special Powers to Investigating Agencies

- Longer detention period (up to 180 days without filing a chargesheet)

- Strict bail conditions (bail is very difficult)

- Property linked to terrorism can be seized

Legal basis used

- Section 43D(5), UAPA:

- Courts need only assess whether accusations are prima facie true.

- Considerations like long incarceration or delay in trial carry limited weight.

- Section 15, UAPA (Terrorist Act):

- Interpreted broadly to include acts beyond direct violence, such as threatening disruption of essential services.

2. ICGS Samudra Pratap Commissioned

Source: TH

What is the news?

The Indian Coast Guard (ICG) has commissioned ICGS Samudra Pratap, the first of two indigenously designed Pollution Control Vessels (PCVs), significantly enhancing India’s maritime pollution response and safety capabilities.

Key highlights

Built by Goa Shipyard Limited, it is:

- India’s first indigenously designed Pollution Control Vessel (PCV)

- Largest ship in the Indian Coast Guard (ICG) fleet

- Built with over 60% indigenous content, with a target of 90% indigenisation in future vessels

Capabilities of ICGS Samudra Pratap

- Pollution response

- Advanced pollution detection systems

- Specialised pollution response boats

- Fire-fighting

- Modern onboard fire-fighting equipment

- Maritime safety & security

- Coastal patrol and law enforcement

- Extended surveillance

- Long-range operations across India’s maritime zones

- Aviation facilities

- Helicopter hangar for enhanced reach, even in rough seas

3. India launches e-Production Investment Business Visa (e-B-4) for Chinese nationals

Source: TH

What is the news?

India has introduced a new e-Production Investment Business Visa (e-B-4 Visa) for Chinese nationals, allowing them to travel to India for specific business and investment-related activities.

Key features of the e-B-4 Visa

- Introduced on: January 1

- Eligibility: Chinese businessmen

- Application mode: Fully online, without visiting the embassy or agents

- Processing time: About 45–50 days

- Validity / Stay: Permission to stay in India for up to six months

Permitted activities

The e-B-4 Visa allows travel for:

- Installation and commissioning of equipment

- Production-related business activities

- Investment-linked commercial engagements

The visa is tailored for manufacturing and production ecosystems, rather than general tourism or employment.

4. Aditya-L1 Solar Mission

Source: The Hindu

What is the news?

On the second anniversary of Aditya-L1 reaching the Sun–Earth Lagrange Point-1 (L1), the Indian Space Research Organisation (ISRO) has released an Announcement of Opportunity (AO) inviting Indian scientists to submit proposals for the first AO cycle observations using Aditya-L1 data

About Aditya-L1 mission

- India’s first dedicated solar mission

- Launched: September 2, 2023

- Reached L1: January 6, 2024 (after 127 days)

- Observation point: Sun–Earth L1, ~1.5 million km from Earth

- Enables continuous, uninterrupted observation of the Sun, free from eclipses or occultation

Why is the L1 point important?

- Aditya-L1 is placed at Lagrange Point 1, about 1.5 million km from Earth, towards the Sun.

- Provides a stable gravitational location to observe the Sun constantly

- Ideal for studying:

- Solar flares

- Coronal mass ejections (CMEs)

- Solar wind

- Space weather events affecting Earth

What is the Announcement of Opportunity (AO)?

- A formal call inviting researchers to:

- Propose solar observations using Aditya-L1 instruments

- Provide scientific and technical justification

- Analyse data if the proposal is approved

5. Ministry Proposes Doubling Auto PLI Allocation to ₹5,800 Crore

Source: TH

What is the news?

The Ministry of Heavy Industries (MHI) has proposed doubling the allocation for the Production Linked Incentive (PLI) scheme for automobiles and auto components to ₹5,800 crore in the upcoming financial year.

- Allocation in FY 2025–26: ₹2,818.85 crore

- Proposed allocation (next FY): ₹5,800 crore

About the Auto PLI Scheme

- Launched: 2021

- Total outlay: ₹25,938 crore

- Objective:

- Boost domestic manufacturing

- Attract investment

- Promote green mobility

Key features

- Incentives linked to incremental production

- Mandatory Domestic Value Addition (DVA) of 50%

- Focus on Zero Emission Vehicles (ZEVs):

- Battery Electric Vehicles (BEVs)

- Hydrogen Fuel Cell Vehicles

6. Somnath Temple

Context:

The Prime Minister of India highlighted the thousand-year survival of the Somnath Temple, marking 1,000 years since the 1026 CE attack by Mahmud of Ghazni, underscoring the temple’s civilisational resilience and cultural continuity.

About the Somnath Temple

The Somnath Temple is one of the 12 sacred Jyotirlingas of Lord Shiva, revered across Hindu traditions. It is popularly known as the “Eternal Shrine” due to its repeated destruction and reconstruction over centuries.

Location

- Place: Prabhas Patan, near Veraval

- Region: Saurashtra, Gujarat

- Geographical significance:

- Located on the Arabian Sea coast

- Situated at the Triveni Sangam of the Kapila, Hiran, and Saraswati rivers

Historical Evolution

Ancient Origins

- Mentioned in texts such as the Shiva Purana

- Archaeological and epigraphic evidence suggests worship from ancient times

- Indicates the long continuity of Shaivite tradition

1026 CE: Mahmud of Ghazni’s Attack

- The temple was attacked and plundered by Mahmud of Ghazni

- This event is considered the most cited historical rupture in the temple’s history

Medieval Reconstructions

- Rebuilt multiple times by:

- Kumarapala, a Chaulukya ruler (12th century)

- Chudasama dynasty kings

- Destroyed again during Delhi Sultanate invasions

- Historical records indicate the temple was destroyed and rebuilt at least six times

This repeated cycle reinforced Somnath’s image as a symbol of resilience and faith.

Modern Reconstruction

- Rebuilt after Independence under the leadership of:

- Sardar Vallabhbhai Patel

- With strong support from K. M. Munshi

- Reconstructed temple inaugurated in 1951

- Seen as a symbol of cultural revival and national self-confidence

Architectural Features

- Built in the Chaulukya (Solanki) style of temple architecture

- Key elements:

- Lofty shikhara

- Intricate stone carvings

- Spacious garbhagriha housing the Jyotirlinga

- Baan-Stambh inscription:

- States that from the temple’s southern arrow, there is no landmass until the South Pole

- Symbolises cosmic orientation and sacred geography

7. India Inaugurates National Environmental Standard Laboratory (NESL)

Source: PIB

Context:

India has inaugurated the world’s second National Environmental Standard Laboratory (NESL) at CSIR–National Physical Laboratory (NPL), New Delhi, strengthening the country’s environmental monitoring and standards ecosystem. Alongside, India also operationalised the world’s fifth National Primary Standard Facility for Solar Cell Calibration.

About National Environmental Standard Laboratory (NESL)

The National Environmental Standard Laboratory (NESL) is an apex national facility for:

- Testing

- Calibration

- Certification

of air pollution monitoring instruments, specifically validated under Indian climatic and environmental conditions.

Location

- CSIR–National Physical Laboratory (NPL), New Delhi

Institutions Involved

- Council of Scientific & Industrial Research (CSIR)

- CSIR–National Physical Laboratory

8. PM Inaugurates Grand International Exposition of Sacred Piprahwa Relics

Source: News on Air

Context:

On January 3, 2026, Prime Minister Narendra Modi inaugurated the Grand International Exposition of Sacred Piprahwa Relics titled “The Light and the Lotus: Relics of the Awakened One” in New Delhi.

What are the Piprahwa Relics?

The Piprahwa relics are believed to be mortal remains of Lord Buddha, discovered in 1898 at Piprahwa (present-day Uttar Pradesh).

- Identified as Kapilavastu relics, linked to the Shakya clan

- Among the earliest archaeological evidence of Buddhism

- Regarded as extremely sacred by Buddhists worldwide

9. India Develops 3D-Printed Automatic Weather Stations under Mission Mausam

Context:

In January 2026, Indian scientists led by Indian Institute of Tropical Meteorology (IITM), Pune, developed India’s first 3D-printed Automatic Weather Stations (AWS) under Mission Mausam.

What is Mission Mausam?

Mission Mausam is a national initiative led by the India Meteorological Department (IMD) to:

- Strengthen weather observation infrastructure

- Improve forecast accuracy

- Enhance early warning systems for extreme weather events

What are Automatic Weather Stations (AWS)?

AWS are unmanned systems that automatically measure and transmit:

- Temperature

- Rainfall

- Humidity

- Wind speed & direction

- Atmospheric pressure

They send real-time data to weather centres for forecasting and alerts.

Banking/Finance

1. TMB Partners with TechFini to Strengthen UPI Infrastructure

Context:

On January 5, 2026, Tamilnad Mercantile Bank (TMB) entered into a strategic partnership with TechFini to enhance its UPI acquiring and issuing capabilities.

UPI (Unified Payments Interface)

UPI is a real-time digital payment system developed by the National Payments Corporation of India (NPCI) that allows instant bank-to-bank money transfers using a mobile phone.

Who launched UPI?

- Developed by NPCI

- Launched in 2016

- Operates under the supervision of the Reserve Bank of India (RBI)

UPI Autopay & Lending Automation

- Enables automated EMI and loan repayments

- Supports UPI Autopay mandates

- Expands UPI use cases in credit, collections, and recurring payments

TechFini UPI Platform – Features

- Cloud-native architecture

- Includes:

- TPAP services

- UPI Plugin SDK

- Acquiring & issuing infrastructure

- UPI Autopay

- Capacity: Up to 10,000 transactions per second (TPS)

2. SEBI Proposes New Norm for Sharing Price Data for Educational Use

Source: The Hindu

What is the news?

The Securities and Exchange Board of India (SEBI) has proposed a revised framework for sharing price data for educational purposes, introducing a 30-day time lag to balance data security with academic relevance.

What is the proposed change?

New proposal

- Price data can be shared and used with a 30-day lag

- Applicable only for educational purposes

Current regulation

- Educational institutions can:

- Access price data with one-day lag

- Use the data with a three-month lag

Why is SEBI proposing this change?

SEBI cited stakeholder feedback and internal deliberations:

- One-day lag was considered too short

- Risk of misuse of exchange data

- Three-month lag was considered too long

- Reduces educational relevance

- 30-day lag seen as a balanced approach:

- Minimises misuse risk

- Keeps academic content current and effective

3. RBI Draft Rules to Tighten Dividend Payouts by Banks

Source: TOI

What is the news?

The Reserve Bank of India (RBI) has issued draft rules to tighten dividend payouts by banks, linking distributions to capital adequacy, asset quality, and profit quality. The uniform prudential framework will be effective from FY27.

Why has RBI moved this proposal?

- In the previous financial year, banks paid over ₹75,000 crore in dividends after record profits.

- RBI aims to ensure that capital buffers are preserved, dividends are sustainable, and payouts do not weaken financial stability.

Who will be covered?

Included

- All banking companies

- Corresponding new banks

- State Bank of India (SBI)

- Foreign banks operating in India in branch mode

Excluded

- Small finance banks

- Payments banks

- Local area banks

- Regional rural banks (RRBs)

Key Elements of the Draft Framework

1. Capital Adequacy-Based Restrictions

Capital Adequacy Ratio is a measure of a bank’s financial strength. It shows how much capital a bank has to absorb losses compared to the risk in its assets (mainly loans).

Banks will be permitted to distribute dividends only if they meet minimum regulatory capital ratios, including buffers, both before and after dividend payout. This ensures that capital levels are not weakened due to shareholder distributions.

2. Asset Quality Linkage

Dividend eligibility will depend on the health of the loan book, including:

- Levels of NPAs

- Provisioning adequacy

- Overall credit risk profile

Banks with stressed assets will face restrictions or prohibition on dividend payouts.

3. Profit Quality Emphasis

The RBI has stressed that profits should be:

- Sustainable

- Core-business driven

- Adequately provisioned

One-time gains or accounting-driven profits will not justify dividend payments.

4. RBI Proposes to Raise Banks’ Dividend Payout Cap to 75%

Source: ET

What is the news?

The Reserve Bank of India (RBI) has proposed raising the ceiling on dividend payouts by banks to 75% of net profit, up from the earlier 40% cap, while introducing stricter prudential safeguards linked to capital strength, asset quality, and provisioning.

The draft framework is open for public comments till February 5 and will be effective from FY27.

Key proposals by RBI

1. Higher dividend cap

- Maximum dividend payout: 75% of net profit

- Applies to:

- Indian banks

- Foreign banks operating in India in branch mode

2. Graded dividend framework (linked to CET1)

CET1 is the highest-quality and most reliable capital a bank has. It is the first buffer used to absorb losses when a bank faces financial stress.

Dividend payouts will depend on Common Equity Tier 1 (CET1) capital ratios:

- CET1 < 8% → No dividend allowed

- CET1 > 20% → Banks may distribute up to 100% of adjusted net profit,

- Subject to the 75% overall payout cap

Adjusted net profit =

Net profit – Net Non-Performing Assets (NPAs)

3. Higher bar for systemically important banks

Domestic Systemically Important Banks (D-SIBs) such as:

- State Bank of India

- HDFC Bank

- ICICI Bank

will require even higher CET1 ratios to pay maximum dividends:

- SBI: 20.8% CET1

- HDFC Bank: 20.4% CET1

- ICICI Bank: 20.2% CET1

4. Role of bank boards strengthened

Before declaring dividends, bank boards must assess:

- Asset quality and provisioning gaps

- Capital projections

- Long-term growth and sustainability plans

5. Profit quality checks

- Any overstatement of profit must be deducted

- Exceptional/extraordinary income excluded

- Profits flagged in modified audit opinions must be adjusted downward

6. Rules for foreign banks

- Foreign banks in branch mode may remit surplus without prior RBI approval

- If excess remittance is detected during audit:

- Head office must refund the excess

- Make good the capital shortfall

5. India’s Loan-to-Deposit Ratio (LDR) Hits Record 81%

What is the news?

India’s banking system has seen its loan-to-deposit ratio (LDR) rise to an all-time high of 81% in the December quarter, highlighting a widening gap between credit growth and deposit mobilisation. The trend has raised concerns about banks’ funding comfort and may prompt higher deposit rates.

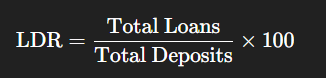

What is Loan-to-Deposit Ratio (LDR)?

LDR measures how much of a bank’s deposits are used for lending.

- Higher LDR → banks are lending aggressively

- Lower LDR → banks have surplus liquidity

What does an 81% LDR indicate?

- Banks have lent out ₹81 for every ₹100 of deposits

- This is historically high for India

- Signals tightening liquidity conditions in the banking system

What is driving the imbalance?

- Strong demand for:

- Retail loans

- MSME credit

- Slower household savings accretion into bank deposits

- Competition from:

- Market-linked instruments

- Small savings schemes

6. RBI Tightens Credit Risk Management: Curbs Related-Party Lending

What is the news?

The Reserve Bank of India (RBI) has notified comprehensive changes to credit risk management rules for commercial banks, prohibiting fresh lending to promoters, large shareholders and related entities, while allowing existing non-compliant related-party loans to continue till maturity.

The new framework will come into force from April 1, 2026.

Key objectives of the new norms

- Prevent conflict of interest and connected lending

- Strengthen governance, transparency and accountability

- Align Indian banking practices with global prudential standards

- Reduce risks of evergreening, crony lending and insider abuse

Who are covered under the restrictions?

Banks are barred from lending to:

- Their promoters

- Relatives of promoters

- Shareholders holding 10% or more equity

- Entities controlled or significantly influenced by such persons

Exception:

- Non-strategic institutional shareholdings without control or influence

Governance & compliance requirements

Banks must:

- Adopt board-approved policies on related-party lending

- Set aggregate exposure limits and sub-limits

- Establish whistleblower mechanisms for reporting unethical or irregular loans

- Ensure recusal of:

- Directors

- Key managerial personnel

- Specified employees

from decisions involving their own or related-party interests

Approval thresholds for related-party loans

Loans crossing materiality thresholds require board or committee approval:

- ₹25 crore – Large banks

- ₹10 crore – Mid-sized banks

- ₹5 crore – Smaller banks

Additional requirements:

- Maintain updated lists of related parties

- Conduct quarterly compliance reviews

- Report deviations to Audit Committees

- Annual disclosure of loans to specified employees

Treatment of existing related-party transactions

- Existing transactions not compliant with new norms:

- May continue till maturity

- Cannot be:

- Renewed

- Re-priced

- Enhanced

- Modified

unless they fully meet the new rules

RBI clarified that any change in terms will trigger mandatory compliance with the revised framework.

Scope clarifications

- Equity investments → Excluded from the new directions

- Debt instruments of related parties → Covered

- Listed banks must also comply with:

- Securities and Exchange Board of India (SEBI) disclosure norms

- RBI’s intra-group exposure limits

Changes in definition of ‘related parties’

- Removed earlier ₹5 crore monetary threshold for shareholding

- Excluded nominee directors of other banks appointed by statutory bodies

- Restrictions retained on:

- RBI’s own nominee directors

- Independent directors

Special cases

- Agricultural and allied loans to directors of rural cooperative banks will continue to be governed by existing statutory restrictions

Penalties for non-compliance

Violations or circumvention may lead to:

- Monetary penalties

- Higher provisioning requirements

- Forensic audits

- Business restrictions

7. Payments Regulatory Board (PRB)

Context:

The first meeting of the Payments Regulatory Board (PRB) was held in Mumbai under the chairmanship of Sanjay Malhotra, marking the operationalisation of India’s revamped payments governance framework.

About the Payments Regulatory Board (PRB)

The Payments Regulatory Board (PRB) is a statutory authority through which the Reserve Bank of India exercises regulatory, supervisory, and enforcement powers over payment and settlement systems in India, ensuring their safety, efficiency, integrity, and stability.

Legal Basis & Evolution

- Established under: Section 3 of the Payment and Settlement Systems (PSS) Act, 2007

- Operational from: 9 May 2025

- Replaced: Board for Regulation and Supervision of Payment and Settlement Systems (BPSS)

- Rationale: To provide institutional autonomy, transparency, and multi-stakeholder oversight in a rapidly expanding digital payments ecosystem

Composition

The PRB is a multi-stakeholder body, comprising:

- Chairperson: RBI Governor

- Members:

- RBI Deputy Governor (in charge of payments)

- Central Government nominees

- Independent experts in payments, fintech, cybersecurity, and financial markets

- Senior officials associated with digital payment infrastructure (e.g., NPCI, UIDAI)

Key Functions of PRB

1. Authorisation & Oversight

- Grants, regulates, suspends, or cancels authorisation of payment systems such as:

- UPI

- Card networks

- Wallets

- RTGS / NEFT

- Prepaid payment instruments

2. Standards & Interoperability

- Prescribes technical, operational, and cybersecurity standards

- Ensures interoperability, resilience, and fraud prevention

3. Risk Management & Consumer Protection

- Addresses:

- Systemic and settlement risks

- Data security and privacy

- Dispute resolution and grievance redressal

4. Policy Direction

- Reviews performance of payment systems

- Guides long-term digital payments strategy, innovation, and inclusion

5. Supervision & Enforcement

- Conducts inspections and audits

- Issues binding directions under the PSS Act

- Can impose penalties and corrective actions

Agriculture

1. Why India’s fertiliser policy needs a fundamental overhaul

What is the issue?

India’s fertiliser subsidy regime has become fiscally costly, economically inefficient, environmentally damaging, and harmful to public health. Despite spending close to ₹1.9 trillion in FY25 on fertiliser subsidies (with FY26 allocations at ~₹1.6 trillion, likely to overshoot), outcomes in crop productivity and nutrient efficiency continue to deteriorate.

Key problems with the current fertiliser policy

1. Massive fiscal burden with poor returns

- Fertiliser subsidy (FY25): ₹1.9 trillion+

- Additional hidden subsidy:

- Natural gas supplied to fertiliser plants at ~50% of market price

- Imports rising:

- 10 million tonnes → 12 million tonnes next year

- Result: Escalating costs without commensurate gains in output

2. Falling nutrient use efficiency

- Share of applied fertiliser actually absorbed by crops:

- Nitrogen (urea): <35%

- Phosphorus: ~20%

- Potassium: 50–80%

- Large quantities are:

- Diverted for resale

- Lost to air and water systems

3. Declining fertiliser productivity

- Fertiliser-to-grain response ratio:

- 1970s: ~1:10

- 2015 (irrigated areas): ~1:2.7

- Indicates diminishing marginal returns from fertiliser use

4. Distorted nutrient balance (NPK imbalance)

- Ideal NPK ratio: 4 : 2 : 1

- India’s current ratio: 10.9 : 4.4 : 4

- Cause:

- Heavily subsidised urea encourages overuse

- Effects of excess urea:

- Nitrous oxide emissions → climate warming

- Nitrate leaching → groundwater contamination & health risks

- More vegetative growth without proportional grain yield

5. Global comparison highlights inefficiency

- Farm value addition per unit land:

- India: 38% of China

- China uses:

- More fertiliser

- But with balanced NPK use and better technology

- Outcome: higher productivity per unit input

What reforms are suggested?

1. Shift to Direct Cash Transfers (DCT)

- Replace subsidies to fertiliser companies with:

- Direct cash support to farmers

- Transfers linked to:

- Cultivated area (not ownership)

- Benefits:

- Reduces leakage and diversion

- Empowers farmers to choose optimal fertiliser mix

- Reveals true demand and shortages

2. Move to market-determined fertiliser prices

- Allow fertiliser firms to:

- Price products freely

- Innovate (nano fertilisers, complex fertilisers)

- Farmers, supported by cash transfers and extension services, can:

- Optimise nutrient use by soil type

3. Promote coal gasification

- Reduce dependence on imported LNG

- Use abundant domestic coal as fertiliser feedstock

- Co-benefits:

- Energy security

- Support for climate transition by stabilising power supply alongside renewables

Facts To Remember

1. Former World billiards champion Manoj Kothari passes away

Former World billiards champion and Indian cue sports chief coach Manoj Kothari passed away, according to his family sources. Kothari was 67 and is survived by his wife and son Sourav. He was not keeping well and was being treated in Tamil Nadu.

2. Former Kerala Minister V.K. Ebrahim Kunju passes away

V.K. Ebrahim Kunju, senior leader of the Indian Union Muslim League (IUML) and former Minister for Public Works, died in Kochi.

3. National Siddha Day 2026 – January 6

About National Siddha Day

- Observed on: January 6

- Occasion: Birth anniversary of Sage Agathiyar, regarded as the father of the Siddha system of medicine

- Astronomical link: Coincides with the Ayilyam star in the Tamil month of Margazhi

- 2026 marks: 9th National Siddha Day

- Theme 2026: “Siddha for Global Health”

4. World Day of War Orphans 2026 – January 6

About World Day of War Orphans

- Observed on: January 6

- First observed: January 6, 1995

- Proposed by: French NGO SOS Enfants en Détresse (1994)

5. Sports

- Andre De Grasse Named International Ambassador for Tata Mumbai Marathon 2026

- Sjoerd Marijne Reappointed Chief Coach of Indian Women’s Hockey Team

- PM Modi Virtually Inaugurates 72nd National Volleyball Championship

6. PM Inaugurates 72nd National Volleyball Tournament

On January 4, 2026, Prime Minister Narendra Modi virtually inaugurated the 72nd National Volleyball Tournament (Senior National Championship).

- Venue: Dr. Sampurnanand Sports Stadium

- Location: Varanasi, Uttar Pradesh

- Mode: Video conferencing

- Present: UP CM Yogi Adityanath