Daily Current Affairs Quiz

14 April, 2025

International Affairs

1. India and Nepal Strengthen Customs Cooperation

Context:

India and Nepal have agreed to enhance their customs cooperation to facilitate smoother trade and combat smuggling across their shared border. The two countries recently held director general-level talks in Kathmandu, where they discussed various measures to improve trade efficiency, upgrade border infrastructure, and address transborder criminal activities.

Key Developments

1. High-Level Talks and Delegations

- Indian Delegation: Led by Abhai Kumar Srivastav, Director General of the Directorate of Revenue Intelligence, Central Board of Indirect Taxes & Customs.

- Nepali Delegation: Led by Mahesh Bhattarai, Director General of the Department of Customs.

- The discussions focused on enhancing customs operations and trade efficiency across the border.

2. Collaborative Efforts for Improved Trade and Security

- Trade Efficiency: Both countries agreed to work on measures that could improve trade operations and strengthen the customs framework, benefiting both economies.

- Technology Implementation: The talks highlighted the importance of introducing new technologies to improve trade facilitation and prevent the smuggling of goods.

- Key Agreements:

- Customs Mutual Assistance Agreement: Finalization of an agreement to improve collaboration.

- Pre-Arrival Exchange of Customs Data: Review progress on the memorandum of understanding (MoU) to exchange customs data before goods arrive at the border.

3. Smuggling and Border Challenges

- Smuggling Prevention: Both nations acknowledged that smuggling has been a shared issue and committed to joint efforts to curb it across the border.

- Economic Benefits: Strengthened customs cooperation is expected to bring significant economic benefits to both India and Nepal.

Strategic Importance for Nepal

- Economic Partnership: India remains a critical trading partner for Nepal under its ‘Neighbourhood First’ policy.

- Exports: India accounts for nearly two-thirds of Nepal’s exports, making the strengthening of trade and customs operations crucial for Nepal’s economic growth.

The India-Nepal customs cooperation agreement marks a significant step in boosting bilateral trade, improving border security, and preventing smuggling. As both nations work towards improving trade efficiency and leveraging technology, this collaboration is set to enhance the economic ties between the two countries.

2. India Unlikely to Challenge US Tariffs at WTO

Context:

India is unlikely to escalate a dispute at the World Trade Organization (WTO) against the United States over the reciprocal 25% tariffs on steel and aluminium, even though it has formally sought consultations under WTO provisions. This strategic restraint comes in light of ongoing bilateral trade negotiations between the two countries.

Key Highlights

1. WTO Consultation

- India invoked Article 12.3 of the Agreement on Safeguards, initiating consultations with the US.

- Officials clarified this move is procedural, not escalatory, and simply reserves India’s right to retaliate later.

- The request seeks dialogue, not litigation, and does not currently signal intent to file a formal trade dispute.

2. India–US Trade Relations

- This is the first WTO case involving India and the US since both agreed to withdraw seven pending cases under the Biden administration to reset trade ties.

- India asserts the US tariffs are essentially safeguard measures, despite the US claiming a national security exception.

3. US Justification

- The US told the WTO Council for Trade in Goods that the tariff action is a matter of essential security, not a breach of WTO commitments.

- It insists it is not altering or abrogating its WTO tariff bindings.

4. WTO’s Appellate Impasse

- India’s cautious approach is shaped by the fact that the WTO’s Appellate Body remains non-functional, with the US blocking judge appointments.

- Any dispute raised may not reach a binding resolution, weakening the WTO as an effective forum for redress.

Political and Strategic Outlook

- India is prioritizing a bilateral solution over multilateral confrontation, especially as trade talks with the US intensify.

- Officials hinted that joining China’s formal WTO case against the US is unlikely, despite similar tariff impacts.

- “Does the solution lie in mechanisms that are themselves under stress?” asked a senior official, highlighting India’s pragmatic stance.

India’s WTO consultation on US tariffs is best viewed as a procedural safeguard, not a prelude to confrontation. As India and the US engage in intensive trade talks, New Delhi appears committed to a diplomatic resolution, signaling maturity in handling trade disputes in a fractured global trade environment.

3. Argentina Secures $20 Billion IMF Deal

Context:

Argentina has signed a $20 billion, 48-month Extended Fund Facility (EFF) agreement with the International Monetary Fund (IMF), marking a significant step in the country’s effort to stabilize its economy. The deal is aimed at supporting Argentina’s fiscal discipline and enhancing its access to international capital markets, while also allowing for reforms in its currency and foreign exchange policies.

Key Aspects of the Deal

- Funding Disbursements:

- The IMF will disburse $12 billion by April 8, 2025, with an additional $2 billion expected by June 2025.

- This funding is part of Argentina’s 23rd agreement with the IMF, which emphasizes economic stabilization, fiscal reforms, and currency flexibility.

- Currency Reform:

- The Argentine central bank will scrap the fixed currency peg and allow the peso to float within a band of 1,000–1,400 pesos per dollar. This move is expected to give the country greater flexibility in its foreign exchange regime.

- Dismantling Capital Controls:

- The capital controls, referred to as the “cepo,” imposed since 2019, will be largely lifted.

- Companies will now be allowed to repatriate profits abroad, which is expected to encourage foreign investment and economic growth.

- Foreign Exchange Flexibility:

- The currency band will be gradually widened by 1% per month, allowing for a controlled devaluation path. This is intended to stabilize the peso without causing market shocks.

The Extended Fund Facility (EFF)

The Extended Fund Facility (EFF) provides financial assistance to countries facing serious medium-term balance of payments problems because of structural weaknesses that require time to address. To help countries implement medium-term structural reforms, the EFF offers longer program engagement and a longer repayment period.

Additional Support and Risks

- Multilateral Support:

- The IMF deal is supplemented by additional financial support from $12 billion from the World Bank and $10 billion from the Inter-American Development Bank.

- Concerns:

- Economist Ricardo Delgado referred to the move as a “devaluation” and expressed concerns over lifting controls amid global economic uncertainties.

- Argentina’s foreign reserves remain negative, and the country risk index continues to rise.

Implications of the Deal

- Economic Stabilization:

- The IMF deal aims to help recapitalizing Argentina’s central bank, fight inflation, and bolster the country’s fiscal position.

- Foreign Investment:

- The easing of currency restrictions and the flexibility provided for repatriating profits is expected to boost foreign investment and improve Argentina’s economic outlook.

- Long-Term Outlook:

- The economic reforms introduced by this agreement are part of a broader effort to restore stability and ensure Argentina’s future access to international financial markets.

About the International Monetary Fund (IMF)

- Founded: 1944

- Headquarters: Washington, D.C., USA

- Managing Director: Kristalina Georgieva

- Members: 191 countries

- Role: The IMF promotes international monetary cooperation, financial stability, economic growth, and provides financial assistance to countries facing balance of payments crises.

National Affairs

1. Parliamentary Panel Review of MGNREGS

Context:

On April 4, 2025, the Parliamentary Standing Committee on Rural Development, led by MP Saptagiri Sankar Ulaka, tabled a report evaluating the Mahatma Gandhi National Rural Employment Guarantee Scheme (MGNREGS). The committee has recommended significant reforms aimed at improving the effectiveness, equity, and efficiency of the scheme.

Key Recommendations

1. Independent Effectiveness Survey

- Purpose: To assess the impact and shortcomings of MGNREGS.

- Focus Areas:

- Worker satisfaction

- Wage payment delays

- Participation trends

- Financial irregularities

- Goal: Use the survey insights to recommend targeted policy reforms.

2. Promoting Equity and Inclusion

- Issue Identified: Uneven participation of women, SC, and ST workers across districts.

- Recommendation:

- Conduct a district-wise participation audit.

- Ensure equal access to work and benefits for marginalized communities.

- Align the scheme more closely with its goal of social and economic inclusion.

3. Expanding Guaranteed Workdays

- Current Provision: 100 days of guaranteed wage employment.

- Recommended Change: Increase to 150 days, considering present-day economic and livelihood challenges.

4. Wage Payment Reforms

- Problem Identified: Chronic delays in wage disbursal.

- Recommendations:

- Enhance compensation rates for delayed payments.

- Ensure timely and predictable disbursement to maintain worker trust and continuity in project execution.

Broader Implications

- The panel’s recommendations highlight the need for modernization of MGNREGS in light of emerging rural challenges.

- A robust survey and improved monitoring can enhance transparency and accountability, making the scheme more responsive and equitable.

- Increasing the number of workdays and ensuring wage reliability can strengthen rural livelihoods, especially for vulnerable populations.

The Standing Committee’s report makes a compelling case for data-driven reforms in MGNREGS, emphasizing inclusive participation, wage security, and program modernization. If implemented, these recommendations could significantly improve rural employment outcomes and reinforce the scheme’s role as a social safety net in India.

2. Africa India Key Maritime Engagement (AIKEYME) 2025

Event: Inaugural edition of the Africa India Key Maritime Engagement (AIKEYME)

Location: Off the coast of Dar-es-Salaam, Tanzania

Dates: April 13 to 18, 2025

Key Highlights

1. Strategic Objective

- Purpose: Foster collaborative maritime solutions to regional challenges and enhance interoperability among participating navies.

- Theme: Strengthen security partnerships under India’s MAHASAGAR initiative (Mutual and Holistic Advancement for Security and Growth Across Regions).

- Scope: Promotes joint maritime operations and cooperation across the Indian Ocean Region (IOR).

2. Participating Nations

- Co-hosts: India and Tanzania

- Other Participants:

- Comoros

- Djibouti

- Kenya

- Madagascar

- Mauritius

- Mozambique

- Seychelles

- South Africa

3. Indian Naval Assets Deployed

- INS Sunayna: Offshore Patrol Vessel sailing under IOS SAGAR, carrying naval personnel from 9 friendly nations.

- INS Chennai: Guided missile destroyer

- INS Kesari: Landing Ship Tank (Large)

Strategic Significance

- Deepening India-Africa Naval Ties: Reflects India’s growing engagement with African coastal nations on maritime security, capacity-building, and naval diplomacy.

- Indian Ocean Region (IOR) Stability: Supports peaceful maritime order and regional preparedness in the face of threats such as piracy, illegal fishing, and maritime terrorism.

- Showcasing Indigenous Naval Capability: Deployment of Indian warships highlights India’s blue-water navy status and technological self-reliance.

The AIKEYME 2025 exercise marks a strategic leap in India’s naval diplomacy and reinforces its commitment to regional maritime security and partnership with Africa. This initiative not only strengthens bilateral and multilateral ties but also aligns with India’s broader vision of a secure and inclusive Indian Ocean Region.

3. DRDO Successfully Tests Mk-II(A) Laser-Directed Energy Weapon

Announced by: Defence Research and Development Organisation (DRDO)

Date & Location: April 13, 2025 | National Open Air Range, Kurnool, Andhra Pradesh

Key Highlights

1. Strategic Significance

- India joins the exclusive group of nations with high-power Laser-DEW capabilities.

- Demonstrates DRDO’s indigenous design and development prowess in next-gen military tech.

2. Operational Capabilities

- Engages and destroys fixed-wing drones at long range.

- Thwarts multiple drone attacks simultaneously.

- Neutralises enemy surveillance assets like sensors and antennae.

- Capable of targeting and disabling missiles, drones, and small projectiles.

3. Performance Features

- Speed: Laser-DEW operates at light speed, ensuring near-instantaneous impact.

- Precision: Targets are engaged with pinpoint accuracy, reducing collateral damage.

- Lethality: Targets suffer structural failure or warhead detonation within seconds.

4. Cost Efficiency

- Extremely low operating cost: A few seconds of firing = cost of a couple of litres of petrol.

- Offers a sustainable, low-cost alternative to conventional ammunition.

5. Technical Overview

- Uses radar or Electro-Optic (EO) systems for target detection.

- Engages targets using intense laser beams to cause damage or destruction.

- Reduces dependence on kinetic weapons and logistics-intensive ordnance.

Broader Implications

- Battlefield Transformation: DEWs could redefine modern warfare with silent, invisible, and precise engagement.

- Counter-Drone Warfare: Positioned as India’s most potent anti-drone solution amid rising drone threats.

- Global Leadership: Reinforces India’s position as a leading innovator in defence technologies.

- Low-Collateral Operations: Ideal for urban combat scenarios, with minimal unintended damage.

The successful demonstration of the Mk-II(A) Laser-DEW system is a landmark achievement in India’s defence modernization journey. It highlights DRDO’s strategic commitment to next-generation warfare and strengthens India’s position as a technological power in high-energy weapons systems.

4. PM Vishwakarma Scheme Faces Implementation Challenges

Context:

The PM Vishwakarma Scheme, launched to empower India’s traditional artisans through financial aid and skill development, is currently grappling with low loan disbursal rates from public sector banks (PSBs). Despite its ambitious scope and ₹13,000 crore budget, implementation challenges have hindered progress.

Key Highlights

Loan Approval Snapshot

- Total loan applications received: 1.39 million

- Loans approved: 390,000 (~28%)

- Applications rejected: 777,000

- Applications deemed ineligible: 157,000

- Loans declined by artisans: 158,000

Scheme Overview

- Launched: September 2023 (PM Modi’s birthday)

- Target Beneficiaries: Artisans in trades such as blacksmithing, goldsmithing, pottery, carpentry, sculpting

- Scheme Duration: FY2023–24 to FY2027–28

- Total Outlay: ₹13,000 crore

Reasons for High Rejection Rate

- Mismatched loan purpose

- Applicants untraceable or lacking basic documentation

- History of non-performing assets (NPAs) or previous loan defaults

- Poor creditworthiness despite need

- High perceived risk by banks

Government Response & Proposed Reforms

- Escalation of rejections: Rejected applications to be reprocessed or reviewed beyond branch level

- Interest subvention processing: Extend deadline for monthly submissions (from 6th to 10th of each month)

- Increased integration with banking systems: Track disbursement, closure, NPA status, etc.

- Better tracking: Introduce ‘withdrawn’ tagging for applicants who decline loans

- Boost engagement: Re-engagement mandate for bank officials with artisan applicants

Implementation Bottlenecks

- Lack of standardized documentation among informal artisans

- Banks’ reluctance to finance high-risk borrowers

- Inconsistent application processing at the branch level

- Limited digital literacy and accessibility for applicants

5. The 16th Finance Commission of India

Context:

The 16th Finance Commission, under Chairman Arvind Panagariya, is navigating a politically and fiscally sensitive landscape as it prepares recommendations for FY2026–2031, with an October 31, 2025 deadline. A central theme of its consultations has been the states’ demand for a higher share in central tax devolution, currently pegged at 41%.

The 16th Finance Commission of India

The 16th Finance Commission of India, led by Dr. Arvind Panagariya, is a constitutional body established under Article 280 of the Constitution. Its primary task is to recommend the distribution of tax revenues between the central and state governments for the period commencing April 1, 2026. The Commission also addresses other matters related to grants-in-aid and augmenting state finances.

Key aspects of the 16th Finance Commission:

- Composition:The 16th Finance Commission is chaired by Dr. Arvind Panagariya, with members including Ajay Narayan Jha, Annie George Mathew, Manoj Panda, and Soumya Kanti Ghosh (part-time).

- Mandate:The Commission is tasked with making recommendations on:

- The distribution of net proceeds of taxes between the Union and the States.

- The principles governing grants-in-aid to the States from the Consolidated Fund of India.

- Measures to augment the Consolidated Fund of a State to support local bodies.

Key Highlights

1. Timeline and Outreach

- First meeting: February 14, 2024 (New Delhi)

- State visits: Since June 2024; all but Haryana, Jharkhand, Uttarakhand, and Uttar Pradesh covered

- Next visit: Maharashtra, May 8–9, 2025

States’ Common Demands

- Vertical Devolution:

- Most states demand an increase to 45–50% of the divisible tax pool

- BJP-ruled states like Madhya Pradesh and Odisha have proposed 48–50%

- Congress-ruled and INDIA bloc states strongly advocate 50%

- Inclusion of Cess and Surcharges:

- Widespread criticism that these central levies are not part of the divisible pool

- Result: Shrinking funds available for state-level development

- Many states seek a cap of 5% of gross tax revenue on such levies

- States like Tamil Nadu and Karnataka demand these be brought under the pool if the cap is exceeded

- Performance-Based Devolution:

- Gujarat urges rewards for fiscal discipline and development metrics

- Focus requested on climate change, renewable energy, and sustainability indicators

Southern States: Strong Push for Equity

- Kerala hosted a conclave with finance ministers of Tamil Nadu, Karnataka, Punjab, and Telangana

- Concerns voiced:

- Imbalance between high-contributing states and returns received

- Call for formulae that account for GDP contribution and economic performance

- Karnataka CM Siddaramaiah:

- State contributes ₹4 trillion annually in gross tax revenue

- Receives just ₹45,000 crore in devolution and ₹15,000 crore in grants

- “Only 15 paise for every rupee” argument highlights horizontal imbalance

Commission’s Challenge: Balancing Act

- Needs to balance equity (support for poorer states) with efficiency (rewarding performance)

- Must address:

- Vertical imbalances (Centre vs. states)

- Horizontal imbalances (between states)

- Trust deficit between Centre and some Opposition-led states

BS

6. India Successfully Tests First High-Energy Laser Weapon System

Context:

India has entered an elite group of nations by successfully testing a high-energy laser-based directed energy weapon (DEW), capable of neutralizing swarm drones, fixed-wing UAVs, and surveillance sensors. The advanced system was developed by the Defence Research and Development Organisation (DRDO) and showcased its precision, lethality, and rapid target engagement at a specialised test range.

Key Features of the DRDO Mk-II(A) Laser Weapon System

- Laser Power: 30 kilowatts, created by combining six 5KW high-energy lasers into a single beam

- Target Range: Demonstrated effective engagement at over 3 km

- Precision Engagement: Destroyed drones and surveillance equipment within seconds

- Speed & Accuracy: Instantaneous lock-on and destruction of multiple drone targets

- Current Form: Land-based system, with plans for future airborne, naval, and satellite-based deployments

Significance of the Test

- Elite Global Status: India is now among four or five nations with operational DEW capabilities, according to DRDO chief Samir V Kamat

- Combat Versatility: Can be used to target combat aircraft, drones, missiles, and surveillance systems

- Future Plans:

- Upgrade to higher power levels for extended range

- Integration with airborne platforms, naval ships, and satellites

- Technology transfer to select private sector partners in the defence industry

Technical Advancements and Past Usage

- Developed by: Centre for High Energy Systems and Sciences, Hyderabad

- Earlier Version: 2KW DEW system already in limited deployment for short-range anti-drone use

- Current Version: Mk-II(A) is the first high-power variant meant for multi-domain operational environments

Strategic and Tactical Implications

- Enhanced National Security: Provides a non-kinetic, cost-effective, and precise defence solution

- Counter-Drone Capability: Ideal for urban warfare and border protection, especially against low-cost UAV swarms

- Space and Naval Defence Ready: Future iterations may offer missile and aircraft defence in space and maritime zones

India’s successful test of its first high-energy laser weapon system marks a pivotal step in indigenous defence capability. With plans for scaling, deployment, and cross-domain adaptability, the DRDO laser DEW could become a cornerstone of India’s future defence strategy.

7. Karnataka Government Proposes Differential Fee on App-Based Aggregators for Gig Workers’ Welfare

Context:

The Karnataka government is working on a differential fee system for app-based aggregators, such as cab-hailing services, to fund the welfare of gig workers. The fee will vary based on the revenue of businesses, with higher revenue-generating platforms expected to pay a higher percentage. This initiative is part of the government’s efforts to enhance gig worker welfare through a proposed bill that seeks to provide social security and other benefits.

Key Points of the Proposal

Differential Fee Structure

- Fee Range: The fee payable by platforms will range from 1% to 5% of the commission paid to gig workers. The exact percentage will depend on the size of the commission earned by the platform.

- Cap on Fee: The Code on Social Security caps the fee at 5% of the amount paid to gig workers.

- Revenue-Based Levy: Higher-revenue businesses, like large cab-hailing services, will pay a higher fee to contribute more towards the welfare fund.

Government Process and Timeline

- Ordinance Route: To implement the bill, the government will take the Ordinance route, with plans to enact the Karnataka Platform-based Gig Workers (Social Security and Welfare) Bill 2024.

- Stakeholder Consultation: After the law is drafted, it will be placed in the public domain for stakeholder feedback for a month. The government will incorporate suggestions before finalizing the rules.

- Implementation Timeline: The levy will likely be rolled out within six months after the rules are framed and the system for payment and welfare verification is developed.

Gig Workers Welfare Board

- The Karnataka government plans to establish a Gig Workers Welfare Board to manage and implement the welfare schemes and oversee the contributions to the fund.

Legislative Context

1. Karnataka’s Bill vs. Rajasthan’s Law

- Rajasthan’s Initiative: Rajasthan passed the first law for platform workers in July 2023, although it is yet to frame rules for its implementation.

- Karnataka’s Leadership: Once passed, Karnataka will be the first southern state to implement such welfare programs for gig workers.

2. Political Support

- Rahul Gandhi’s Advocacy: The idea gained momentum after Rahul Gandhi discussed it with Karnataka Chief Minister Siddaramaiah in April 2024. Gandhi had campaigned for gig worker welfare during his Bharat Jodo Yatra in 2022, adding political weight to the proposal.

3. Future Prospects for Other States

- Telangana’s Interest: Telangana, governed by Congress, has expressed interest in adopting similar legislation, with the state collecting a copy of Karnataka’s draft law for potential implementation.

Karnataka’s initiative to impose a differential fee on app-based platforms for gig workers’ welfare is a significant step towards providing social security benefits to gig workers. By implementing a system of financial contribution from platforms based on their earnings, the state aims to protect the rights and improve the living conditions of gig workers, setting a precedent for other states in India.

Economy

1. Urban and Rural Consumer Sentiment in India (RBI Surveys)

Context:

RBI has released the results of its bi-monthly Rural Consumer Confidence Survey (RCCS) for the first time. This survey is being conducted on regular basis since September 2023. In each round, the survey targets to cover 9,000 rural and semi urban households from all Indian states and three major union territories (UTs).

Urban Job Market Sentiment

- Job Opportunities: 35.5% of urban respondents in March 2025 believed job prospects improved over the past year (Chart 1), consistent with levels from the previous year.

- Income Levels: Only 23.8% reported improved income (Chart 2), showing a 12 percentage point gap between job optimism and income growth.

- Trend Reversal: Optimism about income, which had slowly recovered post-pandemic, began declining in March 2024 and continued to dip through March 2025.

Rural Areas: Greater Income Pessimism

- Income Decline Perception: 29.9% of rural respondents said their income had decreased (Chart 3), compared to 23.3% in urban areas — a consistent trend across all survey months.

- Suggests that rural households face more financial stress, despite job availability.

Price Inflation and Its Effects on Spending

- Commodity Prices: Over 90% of urban respondents reported higher prices than the previous year (Chart 4).

- Consumer Spending: Over 80% of urban respondents also reported higher spending (Chart 5), despite stagnant income levels.

- Inference: Households are likely spending more out of necessity due to inflation, not due to income-driven consumption.

Economic Perception: Dampened Optimism

- Only 34.7% of urban respondents felt the overall economic situation had improved in the past year (Chart 6) — the lowest in more than a year.

- This reflects a disconnect between job availability and financial well-being, likely driven by stagnant incomes and high cost of living.

Key Takeaways for Policymakers

- Employment vs. Earnings: Availability of jobs does not necessarily translate to better household finances, highlighting the need to focus on wage growth and income quality.

- Rural Vulnerability: Rural households remain more financially vulnerable, requiring targeted income support and rural employment strategies.

- Inflation Woes: High commodity prices are eroding purchasing power, even among the employed. Price stabilization policies are critical.

- Economic Perception: Public confidence in the economy is tied more closely to purchasing power and income growth than to employment statistics alone.

This data signals a complex recovery where employment figures may look stable, but the cost-of-living crisis and wage stagnation continue to weigh heavily on both urban and rural households.

TH

Banking/Finance

1. UPI Downtime

Context:

Unified Payments Interface (UPI), India’s real-time payment system, experienced 995 minutes of downtime from March 2020 to March 2025, spanning over 17 incidents. These outages were attributed to intermittent technical issues by the National Payments Corporation of India (NPCI).

Key Details

1. UPI Downtime Statistics

- The downtime from March 2020 to March 2025 amounted to 995 minutes.

- If April’s outages are included, the downtime is estimated to have exceeded 1,000 minutes.

- The longest outage occurred in July 2024, lasting 207 minutes.

- Despite these incidents, UPI uptime has exceeded 99% each month, indicating high functionality.

2. Causes of Outages

- The recent outages have been linked to network disruptions by internet service providers (ISPs), hardware malfunctions, and overloaded transaction-processing systems of banks.

- An hour-long outage can affect around 40 million UPI transactions.

- The outages have occurred on high-traffic days, such as March 26, where UPI processed 550 million transactions, a 7% decline from the previous day.

3. Market Share of UPI Players

- UPI has seen a duopoly in its market, dominated by PhonePe and Google Pay.

- PhonePe holds 47.25% of the market share, followed by Google Pay with 36.04%.

- Together, these two platforms account for 83% of the UPI transaction volume.

Despite frequent technical glitches, UPI maintains a high level of functionality. The dominance of PhonePe and Google Pay has raised concerns about the market concentration within India’s digital payments ecosystem. These outages, while infrequent, highlight challenges in the scalability and resilience of the infrastructure supporting UPI.

2. Is India’s Personal Income Tax System Truly Progressive?

Context:

Despite long-held assumptions that personal income tax (PIT) in India is progressive meaning the rich pay proportionally more a new research paper by Professor Ram Singh, Director of the Delhi School of Economics, presents compelling evidence that PIT may actually function in a regressive manner for the ultra-wealthy.

Personal Income Tax (PIT) is a levy imposed by the government on an individual’s earnings. It encompasses income from sources like wages, bonuses, interest, and dividends. Tax rates and brackets differ among countries. Typically, individuals with higher incomes are subject to higher tax percentages.

Key Findings from the Paper

Title: Do the Wealthy Underreport Their Income? Using General Election Filings to Study the Income–Wealth Relationship in India

Data Sources: Central Board of Direct Taxes (CBDT), election affidavits of political candidates, Forbes India’s Top 100 Wealthiest List

Severe Underreporting Among the Wealthy

- Top 0.1% of Indian households report income that is only 8% of the national average income-to-wealth ratio

- For Forbes-listed families, reported income is just 1/12th of what a regular household would declare if they held similar wealth

- This creates a class of “income-poor, asset-rich” taxpayers who significantly reduce their tax burden

Effective Tax Rates Fall with Rising Wealth

- The top 0.1% of households pay only 10% of their capital income in PIT (including capital gains and dividend taxes)

- Forbes-listed billionaires pay merely 5% of their capital income as tax

- This means India’s richest individuals pay a lower effective tax rate than many middle-class taxpayers

Implications: PIT System Becomes Regressive

- Wealthier citizens minimize reported income, reducing their tax liabilities

- The PIT system becomes less redistributive, exacerbating income inequality

- It undermines the progressivity of India’s tax regime

Structural Loopholes Exploited

- Underreporting income is facilitated through:

- Unrealized capital gains

- Complex corporate and trust structures

- Offshore assets

- Assets not reflected in annual income declarations

Policy Implications and Recommendations

- Strengthen asset-based taxation, such as:

- Wealth tax or estate duties

- Improved capital gains tracking

- Integrate wealth data from public filings, business ownership records, and financial disclosures

- Use AI and analytics for better profiling and enforcement on high-net-worth individuals

BS

3. Assets Under Management (AUM)

Context:

Launched in August 2009, the Edelweiss Aggressive Hybrid Fund has consistently ranked in the top 30th percentile in the CRISIL Mutual Fund Ranking (CMFR) through Q4 2024. Its assets under management (AUM) surged from ₹143 crore in December 2021 to ₹2,363 crore in December 2024 an annualized growth rate of 155%, far exceeding the category average of 15%.

Assets Under Management (AUM)

Assets Under Management (AUM) refers to the total market value of financial assets managed by an individual, firm, or institution on behalf of clients. AUM is a critical metric in assessing a fund manager’s performance, credibility, and scale of operations.

Key Takeaways

- AUM reflects the market value of all assets a manager controls for investors.

- It is dynamic, fluctuating with capital inflows/outflows and asset performance.

- Management fees are commonly calculated as a percentage of AUM.

- AUM is used to evaluate fund managers and determine eligibility for investment products like hedge funds.

Understanding AUM

- Components: Stocks, bonds, mutual funds, ETFs, cash equivalents, and other securities.

- Management Scope: Includes discretionary capital used by the advisor to make investment decisions without needing investor approval.

- Investor Qualification: Some investments (e.g., hedge funds) require a minimum AUM threshold for investor eligibility.

AUM Calculation

- Calculated by aggregating the market value of all managed assets.

- Influenced by:

- Asset performance (capital appreciation, reinvested dividends)

- Client acquisition (new investors)

- Client withdrawals or asset depreciation

Regulatory Guidelines (SEC and States)

- SEC Registration Requirements:

- $25M–$110M AUM depending on firm size and jurisdiction.

- Mandatory SEC registration at >$110M AUM.

- Firms below $100M AUM must register with their state securities regulator.

- Ensures transparency and investor protection in financial markets.

AUM and Fee Structures

- Management fees are often a percentage of AUM.

- Fee structures vary:

- Higher AUM doesn’t always mean higher income, especially with institutional clients negotiating lower fees.

- Actively managed funds charge more than passively managed funds.

Strategic Relevance of AUM for Firms

- Marketing & Branding: Firms promote high AUM to reflect scale and reliability.

- Client Acquisition: Targeting investors that align with investment strategies boosts AUM.

- Product Innovation: New offerings (e.g., State Street’s “Alpha” platform) help attract capital.

- Growth Leverage: More AUM translates to greater investment power and potential returns.

Investor Psychology and AUM

- Sentiment-driven behavior affects AUM:

- Bull markets = inflows

- Bear markets = withdrawals

- Herd behavior: Investors often choose funds with higher AUM, assuming safety in numbers, which may not always be optimal.

Real-World Example: SPY ETF & State Street

- SPDR S&P 500 ETF (SPY):

- NAV (as of May 31, 2024): $522.58

- AUM: $526.22 billion

- State Street Global Advisors:

- Manages SPY and other funds.

- Total AUM (2023): $4.1 trillion, making it the fourth-largest investment firm globally.

AUM is a powerful metric that reflects a firm’s financial management scale, trustworthiness, and ability to attract clients. However, investors should not view high AUM as the sole indicator of quality, as fee structures, risk/reward dynamics, and strategic fit matter just as much. Whether used by financial advisors, institutions, or investors, AUM remains central to understanding the landscape of investment management.

5. Challenges in Public Sector Bank Promotions

Context:

Public sector banks (PSBs) in India face a critical month as March marks not only the end-of-year scrutiny on key financial metrics but also the promotion season for employees. This is a period where both regulators and investors are closely examining loan growth, deposit portfolios, and other business parameters such as net interest margin and fee income. However, recent controversies have raised questions about the fairness and transparency of the promotion process, especially at higher levels.

Promotion Process in Public Sector Banks

Promotion Scrutiny and Lack of Transparency

- The promotion process for Assistant General Managers to Deputy General Managers has recently come under scrutiny, with some officials being elevated despite underperformance allegations.

- An RTI (Right to Information) filing revealed cracks in the promotion system, pointing to issues such as legal cases, reputational damage, and poor performance histories among individuals who were still promoted.

This situation has led to concerns regarding the integrity of the promotion process and the standards followed by decision-making panels.

Case Study: Mr. X and the Vigilance Inquiry

Mr. X’s Promotion Struggles

- Mr. X, a General Manager in a large PSB, faced a roadblock in his career despite delivering significant results at his assignment as Chairman of a Regional Rural Bank (RRB) in northern India.

- His RRB made a 21% increase in profits and improved key metrics such as loan growth and non-performing assets during his tenure.

However, despite these achievements, Mr. X was overlooked for promotion due to a vigilance inquiry related to the video production costs for a G20 presentation. Despite receiving appreciation from both NABARD (National Bank for Agriculture and Rural Development) and the Finance Ministry for the high-quality video, the failure to follow tender norms led to questions about the spending and process.

The Vigilance Challenge: Innovation Stifled by Rules

Vigilance Inquiries and Innovation Risks

- The primary reason Mr. X was passed over for promotion was that he bypassed the tender process in a time-sensitive situation, where the video had to be completed within 10 days.

- Despite justifying the need for the urgency and the reasonable cost, the vigilance department refused to clear the case, citing non-compliance with tender norms.

This incident highlights a significant dilemma for employees in public sector banks— innovation and initiative are often stifled by rigid bureaucratic procedures. The fear of vigilance inquiries and penalties discourages employees from taking risks or exploring innovative solutions, potentially limiting the ability of PSBs to compete with more flexible and dynamic private-sector banks.

Implications for Public Sector Banks: Can They Compete?

Systemic Challenges to Competing with Private Sector Banks

- With promotion processes that are seen as opaque and influenced by vigilance concerns, public sector banks face an uphill battle in attracting and retaining top talent.

- The stringent regulatory oversight often discourages risk-taking, while private sector banks, with more autonomy and less regulatory red tape, can adopt more agile and innovative strategies to meet customer needs.

The story of Mr. X serves as a cautionary tale about how public sector banks’ promotion practices and bureaucratic hurdles may hinder their competitiveness in the evolving banking landscape.

The Need for Reform

To enable public sector banks to effectively compete with their private-sector counterparts, a reform of promotion processes and vigilance mechanisms is needed. More transparency, coupled with a balance between compliance and innovation, could allow employees to thrive and contribute to the bank’s growth without the fear of retrospective scrutiny.

6. Centre Plans Major KYC Reforms Under PMLA

Context:

The Indian government is preparing to overhaul the Know Your Customer (KYC) rules by introducing a risk-based framework through amendments to the Prevention of Money Laundering Act (PMLA). The reforms aim to simplify processes for low-risk customers while introducing stricter checks for high-risk accounts, enhancing efficiency, customer experience, and regulatory compliance.

Key Highlights

1. Shift to Risk-Based KYC Framework

- Current KYC norms require uniform compliance across all customer types.

- Proposed changes will allow differentiated KYC processes based on the customer’s risk profile.

- Expected to reduce repetitive documentation and improve efficiency.

2. PMLA Amendments and Alignment with RBI Guidelines

- The amendment will bring PMLA and RBI KYC regulations into alignment.

- Aims to streamline the onboarding process and remove redundancies in documentation across financial institutions.

3. Revamped Central KYC Records Registry (CKYCRR)

- A major pillar of reform is the upgradation of the CKYCRR, which stores digital KYC data.

- Key improvements include:

- Verification of data/documents with issuing authorities

- Use of AI and facial recognition to remove duplicate entries and maintain a “golden record”

- View-only access for customers with correction request options

- Integration with DigiLocker for seamless onboarding

4. Improved Customer Experience and Lower Compliance Costs

- Reforms aim to extend KYC update intervals for low-risk accounts.

- Reduces costs for institutions and enhances convenience for customers.

- OTP/face authentication ensures data usage is consent-based, bolstering trust.

5. Technological Integration and Metadata Sharing

- Financial institutions will benefit from shared metadata, enhancing the interoperability of records.

- The no-fee model for using CKYCRR encourages widespread adoption and digitization.

6. Digitization Milestones and Future Impact

- CKYCRR has already digitized 990 million records, with 1,360 million records accessible across institutions.

- Turnaround time for KYC updates has significantly decreased and will improve further post-revamp.

- The system minimizes manual data collection, allowing faster and more accurate verifications.

The proposed KYC reforms represent a critical step towards smarter, more adaptive regulation that balances financial integrity with ease of doing business. With the revamped CKYCRR at its core, the initiative promises to usher in a new era of digitized, interoperable, and customer-friendly KYC processes, setting the foundation for more inclusive and secure financial access in India.

Mint

7. Short-Term Market Borrowings Surge Amid Tight Liquidity in FY25

Context:

Despite a record year for long-term fundraising, both banks and non-banking financial companies (NBFCs) heavily relied on short-term borrowings in FY25 to address acute liquidity pressures, particularly in the latter half of the year. Issuances of commercial papers (CPs) and certificates of deposit (CDs) hit multi-year highs as institutions grappled with high-cost retail deposits and a persistent liquidity deficit.

Key Highlights

1. Record Issuances of CPs and CDs

- CDs (by banks): ₹13.2 trillion in FY25 vs ₹9.6 trillion in FY24 – highest in five years

- CPs (by corporates/NBFCs): ₹10.6 trillion in FY25 vs ₹9.3 trillion in FY24 – highest in three years

- NBFCs’ CPs alone: ₹7.5 trillion in FY25 vs ₹6.3 trillion in FY24

2. Reasons for Elevated Short-Term Borrowing

- High cost of retail deposits made CDs a preferred funding option

- Liquidity was persistently tight between November 2024 and March 2025

- CDs and CPs offer ease of access and faster turnaround than traditional CASA (Current Account Savings Account) deposits

3. Systemic Liquidity Deficit and March Peak

- Liquidity deficit in Q4 FY25 ranged between ₹1.5–3 trillion

- Record CP issuance of ₹1.1 trillion each in fortnights ending 15 Feb and 15 Jun 2024

- Record CD issuance of ₹1.2 trillion in fortnight ending 21 Mar 2025

- Outstanding CPs fell to ₹4.4 trillion by March 2025 after peaking at ₹4.8 trillion in mid-February

- Outstanding CDs ended FY25 at an all-time high of ₹5.3 trillion

4. March 2025 Funding Crunch

- CP maturities (as of 6 March 2025):

- March: ₹1.65 trillion

- April: ₹36,000 crore

- May: ₹85,000 crore

- Non-banks issued 48% of the aggregate ₹2.85 trillion CPs, public finance entities 17%

- Top 10 issuers accounted for 43% of total CPs (₹1.2 trillion)

5. RBI Measures and Liquidity Outlook

- Liquidity has shifted back to surplus as of April 2025

- RBI steps taken:

- Open market operations

- FX swaps

- Dividend payouts to government

- Kotak Institutional Equities expects durable liquidity to rise to ₹3 trillion by June 2025

- Repo rate has been cut by 50 basis points (bps) this year (25 bps each in Feb and Apr)

- Another 25 bps rate cut expected in June to support liquidity

6. Broader Fundraising Context

- Despite strong short-term borrowing, FY25 also saw record long-term fundraising through debt and equity markets

- Reflects a dual-track strategy: tap long-term funding for growth and short-term markets for liquidity mismatches, especially in H2 FY25

The surge in short-term market borrowings in FY25 highlights how financial institutions adapted to a tight liquidity environment. While RBI interventions have now eased liquidity pressures, the elevated use of CPs and CDs underscores the importance of flexible funding strategies in navigating systemic shocks. As conditions stabilize, focus is likely to shift back to sustainable long-term capital planning alongside prudent asset-liability management.

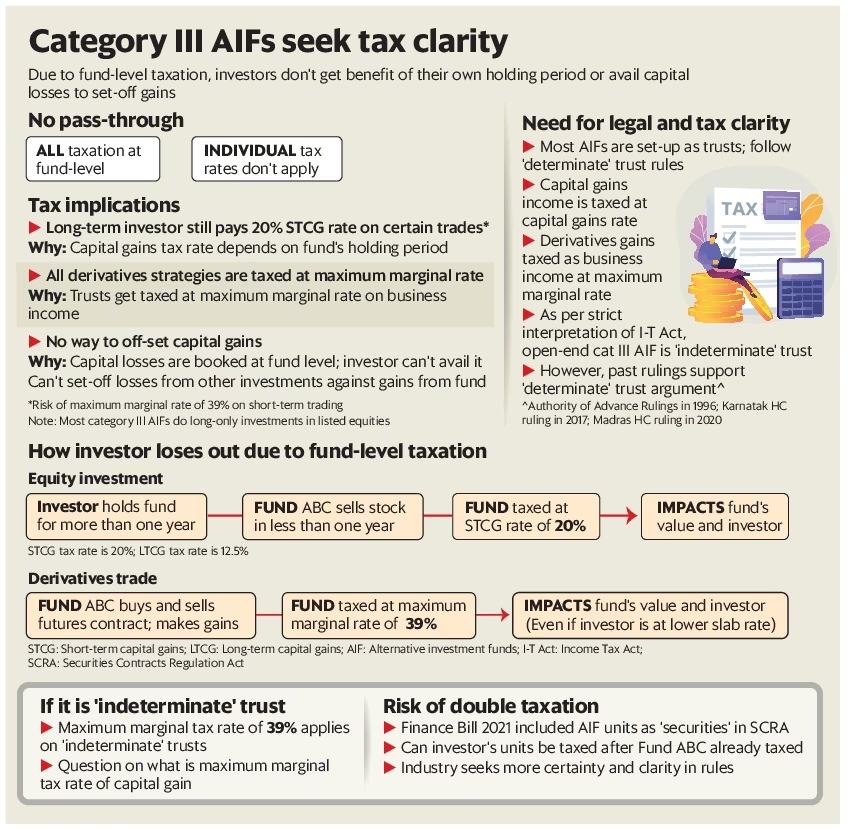

8. Category III AIFs and Tax Challenges

Context:

Since their introduction in 2012, Category III Alternative Investment Funds (AIFs) have become a significant part of India’s investment landscape, raising over ₹1.29 trillion. However, they continue to operate in a tax grey zone, lacking a dedicated tax regime — a problem that directly impacts investor returns and fund efficiency.

Current Tax Landscape and Structural Challenges

1. No Pass-Through Tax Status

- Category III AIFs are not treated as pass-through vehicles under current tax laws.

- All taxes are paid at the fund level, not the investor level, irrespective of how long an investor holds their units.

- Impact: Investors are taxed on the fund’s asset holding period, not their own, losing out on lower long-term capital gains (LTCG) rates.

2. Taxation on Capital Gains

- If a fund sells assets within a year, the gains are taxed at short-term capital gains (STCG) rate of 20%, even if the investor holds units for over a year.

- No tax deferral or long-term benefits apply at the investor level.

3. Derivatives Taxed as Business Income

- Gains from futures and options (F&O) are treated as business income and taxed at the maximum marginal rate of 39%.

- Investors, even those in lower tax slabs, bear the brunt of this high tax rate.

4. No Loss Set-Off or Carry-Forward Benefits

- Capital losses at the fund level cannot be passed on to investors.

- Investors cannot offset fund losses against other gains or carry forward losses for tax purposes.

Legal Ambiguity: Determinate vs. Indeterminate Trusts

Category III AIFs are structured as trusts, but taxation hinges on whether they are treated as:

1. Determinate Trusts

- Beneficiaries and their shares are identifiable.

- Taxed at the same rate as applicable to the beneficiary (e.g., capital gains rate for capital income).

2. Indeterminate Trusts

- No fixed identification of beneficiaries/shares.

- Entire income taxed at maximum marginal rate (39%).

Conflicting Interpretations

- CBDT (2014) upheld a strict definition requiring named beneficiaries with fixed shares.

- Court Rulings (AAR 1996, Karnataka HC 2017, Madras HC 2020) allowed broader interpretation—identifiability at any point is enough.

Current Practice: Industry follows judicial precedents, treating Category III AIFs as determinate trusts, though this lacks codified certainty.

Double Taxation Risk

- In 2021, AIF units were reclassified as ‘securities’ under the SCRA.

- This raises the risk of double taxation:

- Once on gains made by the fund

- Again on gains made by the investor upon redemption of AIF units

Industry Demand: Clarity, Not Concessions

Key Clarifications Sought:

- Pass-through tax treatment for Category III AIFs

- Definitive recognition as determinate trusts

- Avoidance of double taxation on fund-level and investor-level gains

- Clear application of special tax rates (e.g., 12.5% LTCG, 20% STCG)

Need for a Defined Tax Regime

Despite its scale and growth potential, Category III AIFs suffer from an outdated tax framework that fails to align with the modern investment ecosystem.

What’s Needed:

- A specific tax framework for Category III AIFs, akin to mutual funds

- Investor-level taxation to allow holding period-based tax treatment

- Legal alignment on trust classification and elimination of double taxation risks

Outcome Expected: With regulatory clarity, India can unlock the full potential of AIFs, enabling capital market depth, financial innovation, and investor confidence.

9. SEBI Signals Regulatory Reboot Under New Leadership

Context:

The Securities and Exchange Board of India (SEBI), under its new chairperson Tuhin Kanta Pandey, is charting a path toward simplified compliance, smarter regulation, and increased market participation. The first board meeting under his stewardship on March 24 delivered policy tweaks that balance market transparency and investor protection with a pragmatic approach to regulation.

Key Regulatory Changes & Implications

1. Enhanced Governance for SEBI Board Members

- New Committee Formed: To review conflict of interest, disclosure norms, and ethical standards for board members.

- Why It Matters: Senior officials, previously exempt from SEBI’s internal code of conduct, will now be subject to scrutiny—bolstering institutional credibility.

2. FPI Disclosure Norms Relaxed

- Disclosure Threshold Raised: From ₹25,000 crore to ₹50,000 crore AUM for ultimate beneficial ownership in equity.

- Impact:

- Fewer Foreign Portfolio Investors (FPIs) will need to disclose underlying investors.

- Signals regulatory trust but warns against misuse.

- Suggestion: Introduce de minimis exemptions for small investors to avoid penalizing compliant FPIs.

3. Category II AIF Rule Tweaked

- Problem: Mandate to invest 50% in unlisted securities clashed with a shrinking unlisted debt market.

- Solution: Listed debt securities rated ‘A’ or below to be treated as unlisted for compliance.

- Effect: Adds flexibility for fund managers and deepens the bond market.

4. Fee Collection Norms Eased for Advisors

- Change:

- Investment Advisers (IAs) can now collect fees annually (from two quarters).

- Research Analysts (RAs) also enjoy a longer fee window.

- Challenge: Despite reforms, compliance burdens are driving advisors out—registered IAs dropped to 932.

- Need: Regulatory decluttering to support professionals and contain the rise of unregulated finfluencers.

5. Rollback on Legal Entity Segregation

- Deferred Rule: Requirement for merchant bankers, debenture trustees, and custodians to operate via separate legal entities.

- Reason: A logistical nightmare without clear evidence of conflict.

- Significance: Reflects a willingness to course-correct and avoid overregulation.

Strategic Direction: From Hyper-Regulation to Smart Regulation

- Tone Shift: SEBI is transitioning from a “strict enforcer” to a pragmatic mentor—one who trusts but verifies.

- Balancing Act:

- Investor protection remains paramount.

- But overreach and red tape are being reconsidered in favor of innovation and market growth.

Under Tuhin Kanta Pandey, SEBI appears poised to modernize its regulatory philosophy—aiming for a system that is efficient, flexible, and rooted in evidence-based policymaking. If this momentum sustains, SEBI may finally strike the delicate balance of being respected, feared, and occasionally applauded—a hallmark of mature, forward-looking regulators.

10. HDFC Bank Lowers Savings Account Interest Rate

Context:

HDFC Bank, India’s second-largest private sector bank, has reduced its savings account interest rate by 25 basis points to 2.75%—the lowest among its major peers. The new rate, effective from April 12, reflects ongoing shifts in India’s banking environment, particularly in response to changes in the Reserve Bank of India’s (RBI) repo rate.

Key Developments

Interest Rate Reduction

- New Rate: 2.75% on savings accounts.

- Effective Date: April 12, 2025.

- Comparison:

- ICICI Bank and Axis Bank offer a minimum interest rate of 3% for savings balances below ₹50 lakh.

- HDFC Bank’s new rate places it below its large private sector competitors in terms of savings account interest.

Strategic Focus Post HDFC Merger

- Objective: HDFC Bank, which merged with HDFC in July 2023, is now focusing on increasing its term deposits to bolster its liquidity position.

- Impact: The reduced savings rate is likely to encourage depositors to shift funds to higher-yielding term deposits or recurring deposits.

Market Context and Challenges

1. Impact of RBI’s Repo Rate Cuts

- Recent RBI Policy: The RBI implemented its second consecutive repo rate cut in 2025, prompting a corresponding reduction in lending rates.

- Banking System Dynamics: The reduction in repo rates puts pressure on banks to adjust their funding costs and preserve net interest margins. Lower savings account rates are one way to achieve this.

2. Competition for Retail Deposits

- Deposit Flows: With depositors seeking higher returns from mutual funds and other capital market instruments, the demand for traditional savings accounts is waning.

- Industry Insights: Anil Gupta from ICRA highlights that retail term deposit rates may decline over time as banks adjust to higher credit-to-deposit ratios and liquidity challenges.

HDFC Bank’s Post-Merger Liquidity Management

- Credit-Deposit (CD) Ratio: After its merger with HDFC, HDFC Bank’s CD ratio surged beyond 100% due to the large mortgage loan portfolio it inherited.

- Correction in CD Ratio: The ratio has now corrected to 98%, though it remains higher than the pre-merger levels of 85%-87%.

- Liquidity Pressures: The bank is managing a challenging liquidity situation, prompting a strategic focus on increasing term deposits and adjusting savings rates.

HDFC Bank’s interest rate cut reflects the broader banking landscape shaped by repo rate changes, competitive pressures, and liquidity management following its merger with HDFC. While the bank’s savings rate is now the lowest among major private sector banks, this move could serve as a strategy to drive more term deposits, which are critical for its post-merger financial stability.

11. Banks Propose Common Insurance Repository to Combat Loan Fraud

Context:

Banks in India have proposed the creation of a common insurance repository and shared access to key customer data to address rising concerns over fraud in loans backed by life insurance policies. The proposal, which was discussed with the government earlier this month, aims to strengthen KYC norms and enhance fraud prevention mechanisms.

Key Issues and Challenges

Rising Cases of Fraud

- Fake Surrender Value Certificates: Banks have reported a surge in cases where fraudulent surrender value certificates were used to secure higher loan amounts against life insurance policies.

- Fraudulent Loans: Instances of individuals using policies with existing loans or assigned to other parties to take out new loans have also been increasing.

Need for a Common Repository

- Proposal for a Common Insurance Repository: Banks have recommended the establishment of a centralized insurance repository to enable verification of policy details such as surrender values and assignments.

- Access to Key Data: The repository would allow lenders to verify policy information directly, reducing the risk of fraudulent loans.

Existing Infrastructure

- Current Repositories: India currently has four insurance repositories. However, a shared, common repository accessible to banks would simplify the process and improve verification.

- Digital Insurance Shift: Over 90% of insurance policies in India are now issued in electronic format, making it easier for repositories to manage policy data digitally.

Regulatory Discussion

Insurance Regulatory and Development Authority of India (IRDAI)

- Collaboration with IRDAI: The Insurance Regulatory and Development Authority of India (IRDAI) is set to be involved in discussions about how to operationalize the shared repository and which regulator should oversee it.

- Policy Loans: IRDAI had made policy loans mandatory for all life insurance savings products, which has made it easier for policyholders to access liquidity but has also increased the risk of fraud.

KYC Enhancements

- Central KYC Records Registry (CKYCR): The proposal also comes as part of a broader push for modernizing the Central KYC Records Registry (CKYCR) and streamlining the KYC process, with key meetings held by financial regulators and institutions earlier this month.

Benefits for Banks and Borrowers

Lower Interest Rates on Policy Loans

- Attractive Loan Terms: Loans against life insurance policies often come with lower interest rates (around 9-10%) compared to personal loans, which typically carry higher rates (15% and above). This has made such loans an attractive option for borrowers.

Reducing Fraud Risk

- Verification of Surrender Values: By having a centralized, accessible insurance repository, banks can better verify the surrender value of insurance policies, which is the basis for most loans against life insurance.

The creation of a common insurance repository would significantly streamline the loan approval process and reduce fraud risks in loans backed by life insurance policies. By improving data transparency and KYC procedures, this move could also enhance the overall integrity of the financial system, benefiting both lenders and borrowers.

12. Karnataka’s Micro Loan and Small Loan Bill

Context:

Microfinance involves providing small loans, savings, insurance, and remittance services to low-income and unbanked populations. It began in the 1980s with the SHG-Bank Linkage Programme, institutionalized by NABARD, and later regulated by the Reserve Bank of India (RBI). By FY25 Q3, India’s microfinance loan portfolio reached ₹3.91 lakh crore (CRIF Report).

The Importance of Microfinance Institutions (MFIs) in India

1. Financial Inclusion

- MFIs are critical in reaching rural populations, particularly women, who are often excluded from formal banking systems.

- Example: Karnataka alone has 63 lakh unique microfinance borrowers (MFIN data).

2. Empowering Women

- Many MFIs focus on lending to women, promoting financial independence and social mobility.

- Example: Microloans support sectors such as agriculture, dairy, petty trade, and MSMEs, directly benefiting women entrepreneurs.

3. Supporting Livelihoods

- Microloans provide access to credit for small-scale farmers, traders, and micro-businesses, enabling them to expand and thrive.

- Example: The SHG-Bank Linkage Model has mobilized over 1 crore SHGs across India, with ₹100,000 crore in credit disbursed via SHGs in FY24 (NABARD).

4. Reducing Informal Borrowing

- MFIs provide loans at 18-26% interest rates, a sharp contrast to the exorbitant 60-120% charged by informal moneylenders, reducing reliance on informal credit.

Issues Faced by Microfinance Institutions

1. Coercive Recovery Practices

- Unregulated microfinance institutions often engage in aggressive recovery practices that lead to harassment and suicides.

- Example: In Karnataka, 22-38 deaths were reported in 6 months due to loan stress (The Hindu).

2. Presence of Unregulated Players

- There are fly-by-night operators who offer microloans without RBI registration, leading to significant risks for borrowers.

3. Political Interference and Waivers

- Election-linked loan waiver promises disrupt the repayment culture and lead to crisis situations, as seen in the Assam MFI crisis of 2021.

4. Over-Indebtedness and Multiple Loans

- The lack of a centralized credit tracking system results in debt spirals, where borrowers take out loans from multiple MFIs without awareness of their total debt.

5. Lack of Data Transparency

- Poor credit assessment models and rising NPAs (Non-Performing Assets) have been a concern in the sector.

- Example: Karnataka’s MFI loan book dropped from ₹42,000 crore to ₹34,000 crore in 2024.

Path Forward: A Balanced Approach

1. Legal Framework and Licensing

- Strengthen the RBI’s Fair Practices Code and restrict operations of unregistered lenders to ensure ethical lending practices.

2. Grievance Redressal Mechanism

- Establish a local ombudsman system to resolve borrower complaints swiftly and fairly.

3. Credit Information Integration

- Implement credit bureaus to centralize borrower data, preventing over-lending and excessive borrower exposure to risk.

4. Financial Literacy Campaigns

- Educate borrowers on their debt limits, repayment obligations, and legal rights to avoid falling into debt traps.

5. Ethical Lending and Monitoring

- Promote social performance ratings for MFIs and encourage community-based monitoring to ensure fair practices.

- Example: Post-2011 reforms in Andhra Pradesh improved transparency and borrower protection.

Microfinance has a pivotal role in driving financial inclusion and women’s empowerment. However, the recent crisis in Karnataka highlights the urgent need for stronger regulation and borrower protection. A balanced approach that fosters access to credit while ensuring ethical lending practices, institutional accountability, and borrower dignity is essential for the sustainable growth of the microfinance sector.

Science & Tech

1. India’s First Automated Bat Monitoring System ‘BatEchoMon’

Innovation: Launch of BatEchoMon – India’s first automated bat echolocation monitoring system

Developed by: Kadambari Deshpande and Vedant Barje

Key Highlights

1. Research Breakthrough

- Developed to autonomously record, process, and analyse bat echolocation calls in real-time.

- Transforms months of manual data processing into a task completed within hours.

2. System Design & Functionality

- Hardware: Built around a Raspberry Pi microprocessor with Audiomoth as an ultrasonic detector.

- Process:

- Activates automatically at sunset.

- Filters out non-bat ultrasounds (e.g., insects, human-made noise).

- Uses a convolutional neural network (CNN) to match call patterns to known species.

- Outputs:

- Spectrograms and audio clips of bat calls.

- Species-wise activity reports throughout the night.

3. Compact & Customisable

- Device size: 200 mm × 80 mm × 80 mm

- Solar-powered with up to 8 days backup.

- Modular design allows customization of power and data transfer systems.

Research and Ecological Impact

Accelerating Bat Studies

- Cuts down massive processing time: 20 nights of data once took 11 months to analyse, now possible in a few hours.

- Encourages broader deployment across urban and forest ecosystems.

Global Significance

- May be the first globally to combine inbuilt recording and species classification in a single field-ready unit.

- Low-cost alternative: One-third the price of advanced global bat detectors.

Expanding Ecological Knowledge

- Expected to advance research on:

- Bat species distribution

- Nocturnal behaviour patterns

- Ecosystem health monitoring

Current Limitations & Future Goals

1. Limited Species Identification

- Currently detects 6–7 common Indian species.

- Needs robust reference libraries for broader classification.

2. Need for Expanded Datasets

- Greater collaboration needed to create training datasets for under-recorded species.

- Indian contributions to global databases (e.g., ChiroVox, Xeno-Canto) remain sparse.

3. Next Steps

- Extended field testing across diverse environments.

- Beta testing with selected researchers.

- Scaling to support real-time ecological insights and conservation interventions.

BatEchoMon signals a paradigm shift in how Indian bat researchers can monitor, understand, and conserve vital nocturnal species. By blending machine learning, automation, and affordability, it paves the way for wider adoption and richer ecological insights into one of the least-studied mammalian groups in the country.

Agriculture

1. Saving India’s Traditional Seed Varieties

Context:

India’s agricultural biodiversity is facing an alarming crisis. While hybrid crops like wheat and rice dominate the market, traditional seed varieties that have sustained the country’s food security for centuries are disappearing. This loss threatens the very foundation of India’s agricultural and cultural heritage.

- Traditional Seed Benefits: Indigenous varieties are more resilient to climate shocks, such as droughts and floods, and can restore soil health. These crops are crucial in the face of increasing extreme weather events.

- The Problem: Modern farming practices, which emphasize high-yielding hybrid varieties, have led to the decline of these climate-resilient, nutrient-rich crops.

Structural Issues in India’s Food System

Several systemic factors contribute to the erosion of traditional seeds:

- Market Demand and Consumer Preferences: Consumers, influenced by supermarket trends and government food programs, prefer high-yield crops, reducing the demand for traditional grains like millets and indigenous rice.

- Lack of Community Seed Banks: Unlike hybrid seeds, which are mass-produced, traditional seeds depend on local exchange and conservation efforts. India lacks adequate community seed banks to preserve these varieties.

- Agricultural Policies: Government policies have historically focused on increasing food production through high-yield varieties, sidelining the conservation of biodiversity and the development of climate-resilient crops.

Conservation Efforts and Potential Solutions

Despite the challenges, significant strides are being made in the conservation of traditional seed varieties:

- MSSRF Initiatives: The M.S. Swaminathan Research Foundation (MSSRF) has led efforts to conserve indigenous crops, such as through the Tribal Agrobiodiversity Centre in Odisha, where national consultations are held to foster collaboration on building climate-resilient seed systems.

- Key Actions for Revival:

- Farmer Involvement: Involving farmers in participatory plant breeding programs, where they collaborate with scientists to improve traditional seeds.

- Community Seed Banks: Expanding well-funded and accessible seed banks to ensure that valuable varieties are preserved.

- Policy and Market Support: Providing government incentives and support for growing traditional crops, including expanding Minimum Support Prices (MSPs) and procurement programs.

Creating a Sustainable and Resilient Food System

India must embrace a comprehensive approach to restore its traditional seed varieties and ensure food security and sustainability:

- Strengthening Local Markets: Governments should support systems for processing and marketing traditional crops, ensuring farmers can sell them at profitable prices.

- Public Awareness Campaigns: Promoting the environmental and health benefits of traditional crops will drive consumer demand, stimulating market response.

- National Coordination: A coordinated national effort is necessary to balance food security, climate resilience, and nutritional benefits, leveraging the wisdom of local farmers and modern scientific research.

A Call for National Action

India’s reliance on high-yielding crops is unsustainable in the long run, given the mounting challenges of climate change and soil degradation. Investing in traditional seeds offers a solution that combines productivity with resilience and sustainability. A coordinated national effort, involving farmers, scientists, and policymakers, is essential to safeguard India’s agricultural heritage and ensure a balanced, sustainable food system for future generations.

UPSC Mains PYQ

How does e-Technology help farmers in production and marketing of agricultural produce? Explain it. (UPSC-2023)

Facts To Remember

1. Ganguly remains chairperson, Laxman a panel member again

Sourav Ganguly was re-appointed chairperson of the ICC men’s cricket committee while V.V.S. Laxman was picked again as a panel member.

2. India clinches silver in men’s recurve team event

India clinched a silver in the men’s recurve team event at the Archery World Cup Stage 1 after the trio of Dhiraj Bommadevara, Tarundeep Rai, and Atanu Das lost 5-1 to China in the final, in Auburndale, USA.

3. Archery World Cup: Dhiraj Bommadevara clinches individual Bronze for India

In Archery, India’s Dhiraj Bommadevara clinched a bronze medal at the Archery World Cup 2025 in Florida, USA, this morning. Dhiraj defeated Andres Temino Mediel in the Men’s Individual Recurve event with a scoreline of 6-4.

4. FPIs Withdraw ₹38,535 Crore from Indian Markets in First Half of April Amid Global Volatility

Foreign investors pulled out 31,575 crore rupees from Indian equity markets in the first two weeks of April, amid rising global market volatility triggered by the ongoing tariff war.

5. Global Gold Prices Hit Record High Amid Trade War Tensions and Weakening US Dollar

Global gold prices surged to another record high last week following the escalating trade war tension and a weakening US dollar.

6. India’s forex reserves surge by 10.8 billion US dollars to 676.26 billion dollars

India’s foreign exchange reserves surged by 10.8 billion dollars, reaching over 676.2 billion dollars in the week ending April 4.