NABARD has published the findings from its second All India Rural Financial Inclusion Survey (NAFIS) for 2021-22, which offers primary data based on a survey of 1 lakh rural households, covering various economic and financial indicators in the post-COVID period.

The NAFIS 2021-22 results could help to shed light on how rural economic and financial development indicators have evolved since 2016-17.

1. Income Growth

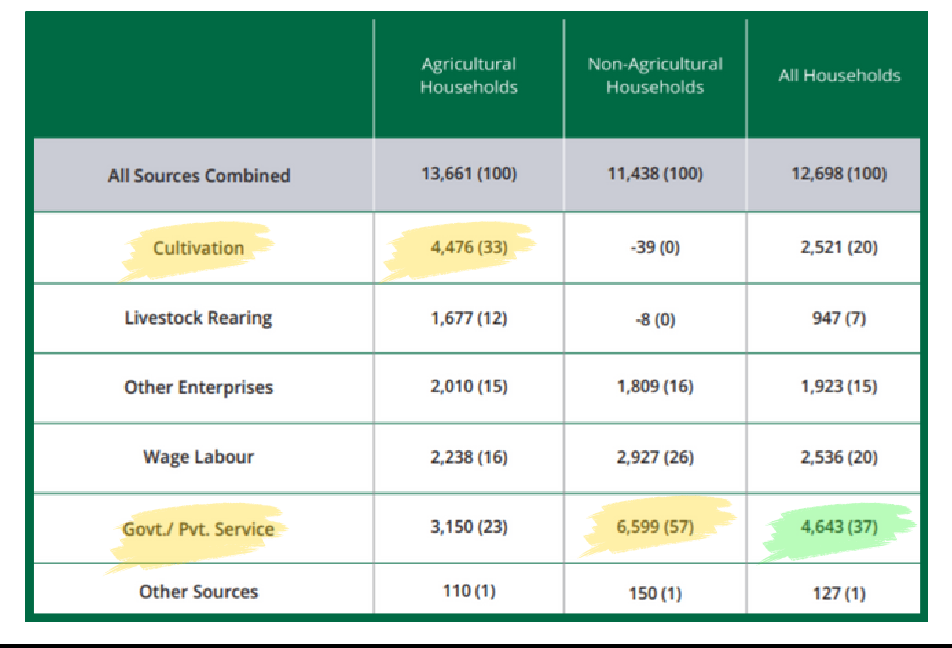

- Average monthly income of all households together, saw a substantial rise of 57.6% over a five-year period, increasing from Rs. 8,059 in 2016-17 to Rs. 12,698 in 2021-22 1 .

- Agricultural households earned slightly more (Rs. 13,661) compared to non-agricultural households (Rs. 11,438).

- For agricultural households, cultivation was the main income source, making up about one-third of their monthly earnings.

AVERAGE MONTHLY HOUSEHOLD INCOME BY SOURCE OF INCOME IN THE AGRICULTURAL YEAR 2021-22 (₹)

2. Expenditure Growth

- The average monthly expenditure of rural households rose significantly from Rs. 6,646 in 2016- 17 to Rs. 11,262 in 2021-22.

- The agricultural households reported a relatively higher consumption expenditure of Rs. 11,710 than Rs. 10,675 for non-agricultural households.

3. Savings

- Annual average financial savings increased to Rs. 13,209 in 2021-22 from Rs. 9,104 in 2016-17.

- 66% of households saved money in 2021-22, up from 50.6% in 2016-17.

4. Kisan Credit Card (KCC)

- 44% of agricultural households possessed a valid KCC.

- Among those with larger land holdings (0.4 ha) or who have taken agriculture loans in past year, 77% had a KCC.

5. Insurance

- 80.3% of households had at least one insured member, a jump from 25.5% in 2016-17.

- This means that 4 out of every 5 households had at least one insured member.

- Vehicle insurance (55%) was the most common type of coverage.

6. Pension Coverage

- 23.5% of households reported at least one member receiving a pension in 2021-22, up from 18.9% in 2016-17.

- Overall, 54% of households with at least one member over 60 years old reported receiving it.

7. Financial Literac

- 51.3% of respondents demonstrated good financial literacy, compared to 33.9% in 2016-17.

CONCLUSION

The NAFIS 2021-22 results highlight the remarkable strides made in rural financial inclusion since the last survey in 2016-17.

Rural households have experienced notable improvements in income, savings, insurance coverage, and financial literacy.

The Government welfare schemes like PM KISAN, Pradhan Mantri Kisan Maan Dhan Yojana, (MGNREGS), (PMAY-G), (PMGSY), (DAY NRLM), Deendayal Upadhyaya Grameen Kaushalya Yojana (DDU-GKY) have significantly contributed to improving the lives of the rural population.

As access to financial services continues to expand, there is a bright outlook for the economic empowerment of these households.

The survey underscores the importance of ongoing support and investment in rural development, paving the way for a more prosperous and financially secure future for India’s rural population.