Daily Current Affairs Quiz

20 June, 2025

International Affairs

1. International North-South Transport Corridor (INSTC)

Context:

With tensions escalating between Israel and Iran, India is closely monitoring the potential impact on its strategic infrastructure investments — particularly the Chabahar Port and the International North-South Transport Corridor (INSTC).

International North–South Transport Corridor (INSTC)

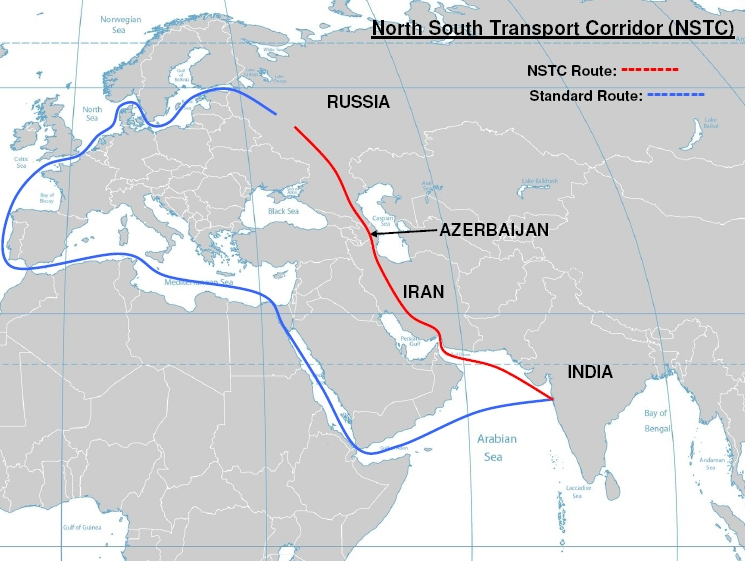

The International North–South Transport Corridor (INSTC) is a 7,200-kilometre multi-modal trade corridor that connects India with Iran, Central Asia, Russia, and Europe through an integrated network of ship, rail, and road routes. It aims to reduce the time and cost of cargo movement between major trade hubs such as Mumbai, Moscow, Tehran, Baku, Bandar Abbas, and Astrakhan.

Originally signed on 16 May 2002 by India, Iran, and Russia, the project has since expanded to include several Eurasian economies.

Key Objectives

- Trade Efficiency: Reduce transportation costs and time compared to traditional sea routes via the Suez Canal.

- Strategic Connectivity: Strengthen trade links between India, Central Asia, the Caucasus, Russia, and European markets.

- Cost & Time Savings: FFFAI estimates the route is 30% cheaper and 40% shorter than existing traditional options.

Synchronisation with Ashgabat Agreement

INSTC aligns with the Ashgabat Agreement, a multilateral pact aimed at facilitating goods transit between Central Asia and the Persian Gulf.

Members (Year of Joining):

- Oman (2011), Iran (2011), Turkmenistan (2011), Uzbekistan (2011), Kazakhstan (2015), India (2018)

INSTC Member Countries

Full Members:

- India

- Iran

- Russia

- Azerbaijan

- Armenia

- Kazakhstan

- Belarus

- Turkey

- Tajikistan

- Kyrgyzstan

- Oman

- Ukraine

- Syria

Observers:

- Bulgaria

Note: Turkmenistan is not a formal member but has been invited to join by India.

Geostrategic and Economic Significance

- Enables India’s outreach to Central Asia and Russia without relying on traditional sea routes via Suez.

- Provides a strategic alternative to China’s Belt and Road Initiative (BRI).

- Facilitates regional integration by building physical and institutional connectivity infrastructure.

- Enhances India’s Act East and Connect Central Asia policies.

National Affairs

1. Rare Earth Minerals and Magnets

Context:

India is finalizing a ₹3,500–5,000 crore incentive scheme to boost the domestic production of rare earth minerals and magnets, critical for electric vehicles (EVs), renewable energy, and defense applications. The scheme is expected to be approved within the next fortnight, according to a senior government official.

Key Highlights

- Incentive Mode: Benefits will be offered through a reverse auction mechanism, encouraging efficient cost discovery and competition.

- Objective: Reduce dependence on Chinese imports, enhance supply chain resilience, and ensure critical mineral security.

Rare Earth Elements (REEs):

- REEs are a group of 17 metallic elements, including the lanthanides, scandium, and yttrium.

- They are known for their unique magnetic, fluorescent, and conductive properties.

- While not extremely rare in abundance, they are difficult and costly to extract and refine.

Rare Earth Magnets:

- Definition: These are permanent magnets made from alloys of REEs.

- Types: Neodymium (NdFeB) and samarium-cobalt (SmCo) magnets are the most common.

- Strength: They produce much stronger magnetic fields compared to other types of magnets.

- Applications: Widely used in electronics, electric vehicles, wind turbines, and various industrial applications due to their high energy density and ability to generate strong magnetic fields in compact sizes.

- Considerations: Rare earth magnets can be brittle and susceptible to corrosion, so they are often coated or plated.

2. Privacy is a Fundamental Right but is Subject to Reasonable Curbs: HC

Context:

In a significant ruling impacting digital evidence in matrimonial disputes, the Madhya Pradesh High Court has upheld the admissibility of WhatsApp chats obtained without consent. The court emphasized that while privacy is a fundamental right under Article 21, it is not absolute and may yield to the right to a fair trial, also protected under Article 21.

Legal Provisions Referenced

- Article 21: Balancing privacy rights and fair trial guarantees.

- Section 14, Family Courts Act: Empowers courts to accept any material relevant to dispute resolution.

- Section 122, Indian Evidence Act: Marital communication is protected, but not in proceedings between spouses (e.g., divorce).

Right To Privacy

The right to privacy is the fundamental right of individuals to control the dissemination and use of their personal information, maintain personal autonomy, and protect their dignity. It encompasses the right to make personal decisions without unwarranted interference, safeguard personal data, and enjoy private spaces free from surveillance.

Right to Privacy is a Fundamental Right in Which Case?

In India, the right to privacy was recognized as a fundamental right in the case of Justice K.S. Puttaswamy (Retd.) and Anr. v. Union of India and Ors. (2017). This landmark judgment by the Supreme Court affirmed that the right to privacy is an intrinsic part of the right to life and personal liberty under Article 21 of the Constitution.

What are Fundamental Rights?

Fundamental rights are a set of basic human rights that are guaranteed to citizens by Articles 12 to 35 of the Indian Constitution, which are contained in Part III. They serve as a safeguard against potential abuses of power by the government and ensure individuals can enjoy certain freedoms and liberties.

3. Performance Grading Index (PGI) 2.0 Report

Context:

The Ministry of Education has released the Performance Grading Index (PGI) 2.0 report for 2022–23 and 2023–24, evaluating the performance of States and Union Territories (UTs) on school education quality. The report offers an evidence-based analysis of educational outcomes and infrastructure in alignment with NEP 2020 and UN SDGs.

What is PGI 2.0?

- Launched: 2017 (PGI 2.0 introduced to align with NEP 2020).

- Published by: Ministry of Education, Government of India.

- Purpose: To assess school education performance using evidence-based indicators.

- Coverage: 6 domains, 73 indicators.

- Learning Outcomes

- Access

- Infrastructure & Facilities

- Equity

- Governance Processes

- Teacher Education & Training

- Scoring: Out of 1,000 points, classified into 10 performance levels from ‘Daksh’ (951–1000) to ‘Akanshi-3’ (401–460).

Key Findings of PGI 2.0 (2022–24)

- Top Performer: Chandigarh scored 703 points, ranked in ‘Prachesta-1’ (701–760 band), driven by strong governance, infrastructure, and digital adoption.

- Lowest Performer: Meghalaya, with 417 points, placed in the lowest grade — ‘Akanshi-3’, indicating severe gaps in access and learning outcomes.

- No State/UT reached the top four bands (Daksh or Utkarsh), revealing systemic gaps in quality education.

Domain-Specific Performance

- Learning Outcomes:

- No State reached Daksh.

- Chandigarh, Punjab, Puducherry reached ‘Prachesta-2’ — the highest among all.

- Foundational literacy and numeracy remain a national concern.

- Access:

- Odisha is the only State in ‘Daksh’ (941–1000) — reflecting excellent enrolment and retention.

- Bihar, Telangana, Jharkhand made significant improvements.

- Infrastructure:

- Chandigarh is in ‘Ati Uttam’ (821–880) band.

- Delhi, Dadra & Nagar Haveli-Daman Diu reached ‘Uttam’ level.

- Equity:

- Most States are within the first three bands.

- Gaps in SC/ST and general category learning outcomes are narrowing but still persist.

- Governance & Digital Monitoring:

- Chandigarh led in UDISE+ adoption and transparent fund usage.

- Improvements observed in data-based governance practices.

Overall Trends in PGI 2.0 Report

Positive Developments:

- 24 States/UTs improved scores in 2023–24 over the previous year.

- Equity and gender parity are showing gradual improvement.

- Infrastructure upgrades seen in Delhi, J&K, Telangana—supporting NEP 2020 goals.

- Strong access gains in low-performing states like Bihar and Jharkhand through targeted interventions.

Persistent Challenges:

- No State achieved Daksh or Utkarsh levels—indicating lack of excellence in school education outcomes.

- Foundational learning remains weak, as seen in NAS 2021 outcomes.

- High inter-state disparity — a 286-point difference between Chandigarh and Meghalaya.

- Decline in performance of 12 States/UTs including Bihar, Karnataka, West Bengal, Ladakh—signaling slow recovery post-COVID.

- Critical infrastructure gaps (toilets, libraries, labs) persist in aspirational and low-ranked States.

4. FASTag-Based Annual Pass

Context:

In a bid to enhance seamless highway travel, the Union Minister for Road Transport has announced the rollout of a FASTag-based annual pass starting August 15, 2025. This initiative targets private non-commercial vehicles such as cars, jeeps, and vans, and aims to streamline toll payments and cut congestion across India’s national highway network.

What is FASTag?

- Technology: Radio Frequency Identification (RFID)-based electronic toll collection system.

- Launched: Pilot in 2014 on the Ahmedabad-Mumbai corridor.

- Mandatory Since: February 15, 2021, for all four-wheelers in India.

- Ministry: Ministry of Road Transport and Highways (MoRTH).

- Implementing Body: National Highways Authority of India (NHAI).

- How It Works: A FASTag sticker is affixed to the vehicle’s windshield and linked to a prepaid wallet or bank account. Tolls are auto-deducted as the vehicle crosses a toll plaza.

What is the FASTag-Based Annual Pass?

The annual pass is a prepaid tolling solution for frequent highway travelers using non-commercial private vehicles.

Key Features:

- Prepaid Value: ₹3,000.

- Validity: 1 year from activation or 200 national highway trips — whichever is earlier.

- Activation: Via Rajmarg Yatra app and NHAI/MoRTH official websites.

- Target Users: Private vehicles like cars, jeeps, and vans (non-commercial only).

- Applicability: Especially useful for short trips on stretches with less than 60 km between toll plazas.

Banking/Finance

1. RBI Eases Project Finance Norms

Context:

In a significant move offering relief to lenders, the Reserve Bank of India (RBI) has finalized its project finance norms with a much-lowered general provisioning requirement for new project loans. The revised guidelines will come into effect from October 1, 2025, and mark a substantial easing from the stricter provisioning rules proposed in May 2023.

Key Highlights of RBI’s Final Guidelines

- Lower General Provisioning During Construction Phase

- All projects (excluding CRE): 1% of funded outstanding

- Commercial Real Estate (CRE): 1.25%

- CRE – Residential Housing (CRERH): 1.0%

- (This is significantly lower than the 5% proposed in the earlier draft.)

- Provisioning During Operational Phase (Post Repayment Start)

- CRE: 1.0%

- CRERH: 0.75%

- Other Projects: 0.4% (same as current levels)

- Incentivised Provisioning Reduction Criteria (Earlier Draft)

- The May 2023 draft allowed a phased reduction in provisioning from 5% to 2.5%, and eventually to 1%, subject to:

- Positive net operating cash flow (NOCF) covering current repayment obligations, and

- A minimum 20% reduction in total long-term debt post commencement of commercial operations.

- These conditions have now been relaxed, and the final norms directly mandate lower provisioning across stages, simplifying compliance.

- The May 2023 draft allowed a phased reduction in provisioning from 5% to 2.5%, and eventually to 1%, subject to:

Impact

- Relief to Lenders: Banks and financial institutions will now set aside less capital for provisioning against standard project loans, especially during the high-risk construction phase.

- Support for Infrastructure Financing: By easing the provisioning burden, RBI aims to revive lending appetite in sectors such as infrastructure, manufacturing, and residential real estate.

- Balanced Prudence: While CRE projects still attract a higher provisioning rate (1.25%), the reduction from the proposed 5% ensures continued prudence without stifling credit flow.

2. UNCTAD World Investment Report 2025

Context:

Foreign Direct Investment (FDI) into India remained unchanged year-on-year in 2024 at $28 billion even as global FDI flows dropped 11 per cent, the United Nations Conference on Trade and Development (UNCTAD) said. In 2023, FDI inflows into India had plummeted 43 per cent in 2023 to $28 billion.

What is FDI?

- Foreign Direct Investment (FDI) plays a crucial role in the global economy, facilitating economic growth, creating jobs, and fostering innovation across borders.

- It refers to an investment made by a firm or individual in one country into business interests located in another country.

- FDI is typically characterized by the investor gaining a significant degree of influence or control over the foreign business, often in the form of acquiring a substantial percentage of its shares, establishing new businesses, or purchasing existing assets.

Key Highlights

- FDI Rankings (2024):

- Top Recipients:

- United States: $279 billion (1st)

- Singapore: $143 billion (2nd)

- Hong Kong (China): $126 billion (3rd)

- China: $116 billion (4th)

- India: $27.6 billion (15th, up from 16th)

- Top Recipients:

- Global Trends:

- FDI fell globally by 11% to $1.5 trillion in 2024.

- The headline increase was due to volatile financial flows rather than sustained real investment.

- India’s Sectoral and Strategic Strengths:

- Greenfield Projects: 1,080 in 2024 — 4th highest in the world.

- International Project Finance: 97 deals — among the top five globally.

- FDI Outflows: India ranked 18th, with $23.8 billion in outward investments.

- Digital Services Leadership:

- India led the Global South in greenfield digital services investment (2020–24) with $54 billion, ahead of Singapore ($12B), Brazil, Malaysia, and China.

UNCTAD Insights

- Manufacturing Shift: India, along with Malaysia and Vietnam, is emerging as a preferred manufacturing hub, aided by industrial policy reforms and global supply chain shifts.

- Digital Economy: Cited as a critical driver of global growth, the digital sector is growing 10–12% annually, outpacing global GDP and becoming central to FDI and value creation.

3. SEBI to Boost Transparency in Trading Costs Through Unbundling of Fees

Context:

The Securities and Exchange Board of India (SEBI) is taking steps to improve cost transparency for investors by unbundling trading and clearing charges. This move seeks to provide a clearer cost structure and enhance governance and financial independence of Clearing Corporations (CCs) from stock exchanges.

Key Developments

- Working group formed to examine:

- Separation of trading and clearing fees.

- Measures for ensuring financial self-sufficiency of CCs.

- Enhancing governance standards and transparency in CC operations.

- No structural overhaul:

- SEBI Chairman Tuhin Kanta Pandey clarified that there are no immediate plans to alter the ownership structure of CCs, currently fully owned by stock exchanges.

- Unbundling rationale:

- Ensures clear disclosure of charges to investors.

- Promotes accountability and competition among clearing service providers.

- Does not intend to increase investor costs.

Next Steps

- SEBI may soon issue standardized disclosure norms for clearing-related charges.

- The working group’s recommendations will shape future policy on unbundling and self-sustainability of CCs.

4. Sale of listed private non-financial firms rose 7.1% in Q4FY25: RBI Data

Context:

Sales of listed private non-financial companies registered 7.1% growth (y-o-y) during Q4-2024-25 compared with 8% growth in the previous quarter and 6.9% in Q4 2023-24, according to data released by the Reserve Bank of India (RBI).

Overall Sales Growth

- Listed private non-financial companies recorded a 7.1% year-on-year (y-o-y) sales growth in Q4FY25, down from 8% in Q3FY25 and 6.9% in Q4FY24.

- The data is based on financial results of 1,659 listed private firms compiled by the Reserve Bank of India (RBI).

Sector-wise Highlights

- Manufacturing Sector:

- Sales growth slowed to 6.6% in Q4FY25, compared to 7.7% in Q3FY25.

- Double-digit sales growth was observed in:

- Electrical machinery

- Chemicals

- Food products

- Pharmaceuticals

- However, sluggish performance in the petroleum industry dragged overall manufacturing sales growth.

- Information Technology (IT) Sector:

- Sales growth rose to 8.6% in Q4FY25, improving from 6.8% in Q3 and 3.1% a year ago.

- Non-IT Services Sector:

- Continued robust growth at 10% y-o-y, led by:

- Telecommunications

- Transport and storage services

- Continued robust growth at 10% y-o-y, led by:

Input Costs and Profitability

- Input expenses for manufacturing companies increased 8.3% y-o-y in line with sales.

- Raw material to sales ratio remained broadly stable, indicating effective cost management despite rising expenses.

Unlisted Companies Vs Listed Companies

Unlisted Public Company

An unlisted public company is a public company that is not listed on any stock exchange; therefore, it may raise finance through the issue and sale of shares to the public. The jurisdictions vary in criteria for listing. However, for a public company to be registered, it should meet minimum share capital and the number of shareholders.

- Reason For Not Listing?

- Some companies do not list for a variety of reasons, including to avoid costs, not wanting public investors, or having too few shareholders.

Listed Vs Unlisted Companies

- The most significant difference between a listed company and an unlisted company is that shares of a listed company are traded on a stock exchange, while the shares of an unlisted company are not traded on a stock exchange.

5. Bank of Maharashtra Partners with SBI Card to Launch Co-Branded Credit Cards

Context:

In a significant move to deepen financial inclusion and enhance customer engagement, Bank of Maharashtra (BoM) has partnered with SBI Card, one of India’s leading credit card issuers, to launch co-branded credit cards offering a host of consumer benefits.

Key Highlights of the Co-Branded Credit Cards:

- Strategic Collaboration: Combines Bank of Maharashtra’s extensive banking network and customer trust with SBI Card’s digital capabilities and credit card expertise.

- Nationwide Launch: The co-branded cards will be available to eligible customers across India through both online platforms and BoM branches.

- Application Convenience: Customers can apply via digital channels or through branch walk-ins, ensuring accessibility and a hassle-free onboarding experience.

Agriculture

1. Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY)

Source: Mint

Context:

The Union government is confident of maintaining the wheat-rice distribution ratio under the Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) in 2025–26, owing to record wheat procurement, which has already crossed 30 million tonnes (mt) in the current Rabi marketing season. This marks a crucial development ahead of key state elections, particularly in Bihar and West Bengal, where subsidised food aid remains a major political tool.

What is PM-GKAY?

Overview

The Pradhan Mantri Garib Kalyan Anna Yojana (PM-GKAY) is a food security welfare scheme launched in March 2020 as part of the Pradhan Mantri Garib Kalyan Package (PMGKP) to mitigate the impact of the COVID-19 pandemic on the poor.

Key Features

- Objective: To ensure food security during the pandemic by providing free foodgrains to the poor.

- Coverage: All beneficiaries under the National Food Security Act (NFSA), 2013, which includes around 80 crore people.

- Benefit: An additional 5 kg of free wheat or rice per person per month over and above the subsidized NFSA quota.

- Mode of Delivery: Distributed through the Public Distribution System (PDS).

- Portability: Enabled through One Nation One Ration Card (ONORC) allowing migrant workers access across states.

Timeline and Funding

- Initial Phase: April to June 2020.

- Extended Till: September 2022 (in multiple phases).

- Total Expenditure: Approx. ₹3.91 lakh crore for all phases.

- Nodal Ministry: Initially under Ministry of Finance, now executed by Ministry of Consumer Affairs, Food & Public Distribution.

Challenges and Concerns

- Outdated Census Base: Beneficiaries determined based on 2011 Census, leaving many food-insecure individuals uncovered.

- Fiscal Burden:

- High cost raises concerns about fiscal deficit (aimed to be reduced to 6.4% of GDP).

- Inflationary Pressures:

- Program impacts food inflation, especially in rice and wheat, which constitute about 10% of retail inflation.

- In 2022, India restricted wheat and rice exports due to erratic monsoons and falling yields.

- Sustainability:

- Logistics and grain procurement challenges increase as the scheme scales.

Related Government Initiatives

- National Food Security Mission (NFSM)

- Rashtriya Krishi Vikas Yojana (RKVY)

- Pradhan Mantri Fasal Bima Yojana (PMFBY)

- Integrated Scheme on Oilseeds, Pulses, Palm oil & Maize (ISOPOM)

- National Food Security Act (NFSA), 2013

UPSC Civil Services Examination Previous Year Question (PYQ)

Mains

Q. What are the salient features of the National Food Security Act, 2013? How has the Food Security Bill helped in eliminating hunger and malnutrition in India? (2021)

2. Assam’s Solar Pump Initiative

Context:

Over 70% of Assam’s population depends on agriculture, with 85% of farmers holding small or marginal land. Only 21.54% of net sown area is irrigated (2022), compared to the national average of 49.92%. Erratic monsoons, droughts, and expensive diesel pumps create high uncertainty for rain-fed farming. Farmers lack access to affordable irrigation and awareness of income diversification options like horticulture.

A Multi-Stakeholder Partnership

Lead Organisations:

- Gramya Vikash Mancha (GVM) – Grassroots implementer

- NABARD – Financial support via Tribal Development Fund (TDF)

- WRI India – Knowledge partner for sustainable energy and monitoring systems

Key Intervention Sites:

- Khatarbari and Kalcheni villages, Tamulpur district, Assam

Intervention Design: Clean Energy Meets Livelihoods

- Adapted ‘Wadi’ homestead model to promote horticulture (mango, guava, Assam lemon).

- Installed:

- 2 units of 2HP and 3 units of 1HP submersible solar pumps for 48 acres

- 3 portable solar pumps with custom trolleys, co-designed with women farmers

- Conducted energy needs assessment, technology training, and performance monitoring.

Key Outcomes

- Improved Irrigation Access: Enabled year-round water supply, reducing dry-season losses.

- Diversified Crops: Farmers now intercrop potatoes, tomatoes, papaya, chillies, leafy greens, and more.

- Women Empowerment: Reduced manual labour, greater participation in technology decisions.

- Reduced Emissions: Shift from diesel to solar supports India’s clean energy transition.

- Shared Infrastructure: Portable pumps allow collaborative use across adjacent plots.

Monitoring and Scalability

- Real-time flow meters and remote systems for pump performance tracking.

- Farmers are exploring value-addition technologies like cold storage and food processing.

- NABARD and GVM aim to promote local entrepreneurship and replicable rural models.

Why This Matters

- Reduces vulnerability of small farmers in one of India’s most climate-sensitive states.

- Demonstrates alignment with SDGs 2, 7, and 13.

- Offers a replicable framework for other rain-fed, low-income farming regions in India.

Facts To Remember

1. HDB Financial Services IPO: HDFC Bank Accepts Lower Valuation Amid RBI Overhang

HDFC Bank, India’s largest private-sector lender, is set to launch a ₹12,500 crore initial public offering (IPO) for its non-banking financial arm, HDB Financial Services, on June 25–27, 2025. The IPO is expected to be the largest ever by an NBFC in the Indian market.

2. Russia Warns U.S. Against Military Action on Iran Amid Escalating Israel-Iran Tensions

Russia issued a stern warning to the United States against any military intervention targeting Iran, amid rising fears of wider conflict following recent Israel-Iran hostilities.