Source: ET

Context:

Indian banks are showing stronger profitability and expanding Net Interest Margins (NIMs) as the Reserve Bank of India (RBI) begins its rate-cut cycle, signaling a shift in the monetary policy stance to support growth.

Key Highlights:

- Rate-Cut Impact: The RBI’s move to lower policy rates is easing borrowing costs for banks, allowing them to reprice loans while maintaining higher returns on existing lending portfolios.

- Improved Profitability: Lower funding costs and stable credit demand are enhancing banks’ interest income and overall profitability metrics.

- Changing Lending Dynamics: Banks are shifting towards internal benchmark-based lending, such as the External Benchmark Lending Rate (EBLR) and Marginal Cost of Funds-based Lending Rate (MCLR), improving transparency in loan pricing.

- Credit-Deposit Trends: Slower deposit growth relative to credit expansion has increased competition for deposits, pushing banks to optimize their asset-liability management.

- Sectoral Performance: Private sector banks continue to maintain higher NIMs compared to public sector peers, supported by better credit appraisal systems and diversified loan books.

What is NIM (Net Interest Margin)?

Net Interest Margin (NIM) measures a bank’s profitability from lending operations.

It is the difference between the interest earned on loans and investments and the interest paid on deposits and borrowings, expressed as a percentage of earning assets.

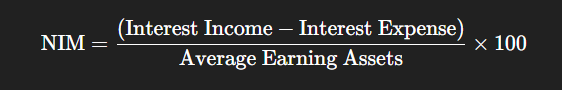

Formula:

Higher NIM = More efficient and profitable bank.