Context:

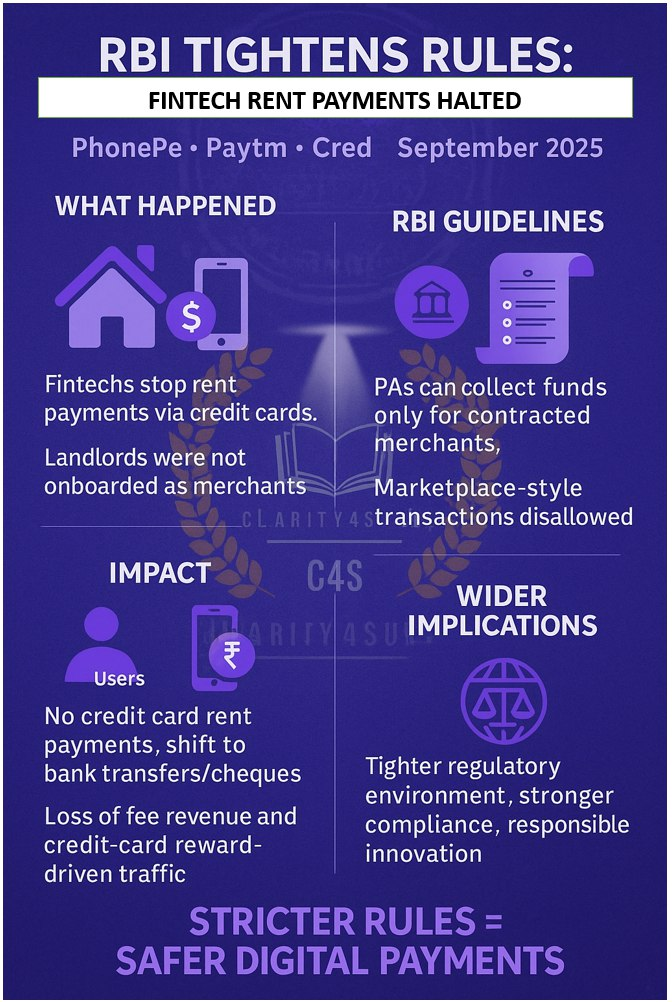

On September 2025, RBI issued a revised Master Direction for PAs. Major fintechs like PhonePe, Paytm, and Cred have stopped offering rent payment via credit cards as a result.

What Changed?

- Merchant-only aggregation

- A PA can aggregate funds only for merchants with whom it has a direct contractual relationship.

- Rent payments to landlords not registered as merchants with full KYC are now disallowed.

- Ban on Marketplace-style PA Business

- PAs cannot act as a marketplace themselves.

- Their role is limited to providing payment facilitation for onboarded merchants.

- Merchant Due Diligence

- PAs, not acquiring banks, are now directly responsible for verifying merchant KYC.

- Funds must be settled only into the onboarded merchant’s bank account.

Why RBI Did This?

- Prevent misuse of credit cards: Rent payments were functioning like disguised peer-to-peer (P2P) transfers.

- Curb fraud and money laundering: Fake “rent” payments were sometimes used for cash flow management or illicit transfers.

- Strengthen accountability: Ensures traceability of funds and merchant legitimacy.

- Regulatory simplification: Moves from multiple licenses and micro-rules → one unified PA licence, principle-based framework.

Impact

On Fintechs

- Loss of a high-volume, fast-growing use case (rent payments via cards).

- Reduced fee income and lower credit card transaction volumes.

- Need to re-onboard landlords as merchants → high cost, less attractive for casual landlords.

On Users

- No more earning credit card reward points / cashback on rent.

- Limited ability to convert rent into EMIs via fintech apps.

- Must switch back to bank transfers, UPI, cheques, or BBPS for rent payments.

Exam Relevance

- Payment Aggregator (PA): Entity that facilitates digital payments between merchants and customers without requiring merchants to set up their own payment infrastructure.

- Marketplace ban: PAs cannot run e-commerce-like setups; they only process payments for contracted merchants.

- KYC mandate: Full merchant verification required, strengthening AML (Anti-Money Laundering) safeguards.