Daily Current Affairs Quiz

15 & 16 August, 2025

National Affairs

1. Mission Sudarshan Chakra

Context:

On India’s 79th Independence Day (15th August 2025), the Prime Minister announced the launch of Mission Sudarshan Chakra, a landmark defence initiative to safeguard India’s strategic, civilian, and religious sites from potential enemy attacks.

About Mission Sudarshan Chakra

- What it is?

- A national security mission to build an advanced, multi-layered shield protecting vital installations across India.

- Inspired by the mythological Sudarshan Chakra of Lord Krishna, blending cultural ethos with modern defence technology.

- Nodal Ministry: Ministry of Defence.

- Objectives:

- Develop indigenous, research-based security systems for multi-domain threats (air, land, sea, cyber).

- Promote self-reliance (Aatmanirbhar Bharat) in advanced defence technology.

- Provide integrated protection for critical infrastructure, urban centres, and sacred sites.

- Key Features:

- Multi-Layered Defence: Surveillance, interception, and counter-attack capabilities.

- Comprehensive Coverage: Security shield for strategic, civilian, and religious places.

- Advanced Technology: AI-enabled radar tracking, cyber defence, and physical protection.

- Indigenous Development: Fully designed, developed, and manufactured in India.

- Long-Term Plan: Gradual expansion and upgradation of the system till 2035.

2. National Deep Water Exploration Mission

Context:

On the occasion of the 79th Independence Day, the Prime Minister of India announced the launch of the National Deep Water Exploration Mission to accelerate the discovery of offshore oil and gas reserves. The initiative will focus on areas such as the Andaman Sea and deep waters off the Andhra coast, with the goal of achieving energy self-reliance.

About the Mission

- What it is:

- A flagship energy security initiative to explore untapped oil and gas reserves beneath India’s seabed.

- Designed to operate in mission mode for accelerated offshore exploration.

- Nodal Ministry: Ministry of Petroleum and Natural Gas.

- Supporting Agencies: Directorate General of Hydrocarbons (DGH) and allied research institutions.

Key Features:

- Deep-Water Focus: Targeting unexplored offshore zones like the Andaman-Nicobar basin and Andhra coast.

- Policy Reforms Backing: Linked with the Open Acreage Licensing Policy (OALP) and recent exploration-friendly legislative changes.

- Large-Scale Bidding: Opening over 1 million sq km of erstwhile ‘No-Go’ areas for exploration.

- Advanced Technology: Use of seismic surveys, modern drilling techniques, and AI-enabled exploration tools.

- Public-Private Collaboration: Encouraging both domestic and global players to invest.

3. Next-Generation GST Reform

Context:

On 79th Independence Day, the Prime Minister of India announced a major restructuring of the Goods and Services Tax (GST) to be rolled out by Diwali 2025. The reform is aimed at simplifying tax slabs and reducing the burden on common citizens while enhancing economic growth.

About GST Revamp – Next-Gen Reform

- What It Is?

- A complete restructuring of the GST framework.

- Replaces the current multi-slab system with a simplified two-slab regime (5% & 18%), plus a special 40% rate for select goods.

- Objectives

- Reduce tax burden on essential and standard goods.

- Boost consumption and demand in the economy.

- Simplify compliance for MSMEs and small businesses.

- Stimulate long-term growth by creating a more predictable tax regime.

Proposed Features

- Two Core Rates:

- 5% → Merit goods & essential items.

- 18% → Standard goods & services.

- Special 40% Rate: For 7 items (tobacco, alcohol, pan masala, online betting, etc.).

- Slab Adjustments:

- 99% of current 12% slab items to move to 5%.

- ~90% of current 28% slab items to move to 18%.

- Zero Rate: Continued exemption for essential food items.

- Sectoral Considerations: Labour-intensive exports (e.g., diamonds) to retain present rates.

- GST Council Review: Proposal circulated to states & Group of Ministers (GoM) for final approval before rollout.

Banking/Finance

1. Payment Aggregator (PA) vs. Third-Party Payment Aggregator (TPA)

Context:

The Indian Railway Catering and Tourism Corporation (IRCTC), India’s largest online ticketing platform, is set to expand into the fintech space. Its wholly-owned arm, IRCTC Payments Limited, has received an in-principle approval from the Reserve Bank of India (RBI) to operate as a Payment Aggregator (PA). Currently, IRCTC uses multiple third-party aggregators and its in-house gateway iPay.

1. Payment Aggregator (PA)

- An entity that facilitates e-commerce sites and merchants to accept payment instruments (credit cards, debit cards, UPI, wallets, etc.) from customers.

- Role:

- Collects funds from customers.

- Pools the money into an escrow/nodal account.

- Settles it to the respective merchants after a set time.

- Regulation:

- Must obtain RBI authorisation under the Payment and Settlement Systems Act, 2007 (PSS Act).

- Example: Razorpay, PayU, Cashfree, BillDesk.

- Direct Handling of Funds: Yes, they directly handle customer funds before settlement.

2. Third-Party Payment Aggregator (TPA / Third-Party PA)

- An intermediary that provides technology infrastructure to connect merchants with banks/payment gateways but does not handle funds directly.

- Role:

- Acts as a technology service provider.

- Payment flow is routed directly to the bank/authorised PA’s nodal account.

- Does not pool or settle funds.

- Regulation:

- Since they don’t handle funds, RBI does not mandate separate PA authorisation.

- They must, however, comply with outsourcing & IT security guidelines issued by RBI.

- Examples: Some fintech companies that only provide APIs/SDKs to merchants without touching the money.

Key Difference

| Feature | Payment Aggregator (PA) | Third-Party PA (TPA) |

|---|---|---|

| Handles Funds? | Yes, collects & settles merchant payments | No, only provides tech platform |

| RBI Authorisation | Mandatory under PSS Act | Not required (but subject to IT/outsourcing norms) |

| Nodal/Escrow Account | Must maintain | Not applicable |

| Examples | Razorpay, PayU, BillDesk | Juspay (tech layer), Pine Labs (when acting only as API) |

2. Participating (Par) Products in Insurance

Context:

Indian life insurers are rebalancing their product mix towards participating (par) insurance products, moving away from unit-linked (ULIPs) and aggressively priced non-participating (non-par) products. This comes in response to volatile equity markets, falling interest rates, and pricing competition, which have increased balance sheet risks.

What are Par Products?

- Par Products (Participating Policies) are life insurance policies where the policyholder is eligible to receive a share in the profits (surplus) of the insurer, in the form of bonuses or dividends.

- These are called “with-profit policies”.

- Surplus depends on investment returns, expenses, and claims experience.

- Unlike non-par products (which offer fixed guaranteed returns but expose insurers to risk in low-rate environments) or ULIPs (where the policyholder bears full market risk), par products balance security with growth potential.

Key Features

- Profit Sharing

- Policyholders share in the insurer’s distributable surplus, usually declared annually.

- Bonuses are not guaranteed and depend on the insurer’s financial performance.

- Types of Bonuses

- Reversionary Bonus: Declared annually, added to the sum assured.

- Cash Bonus: Paid out immediately.

- Terminal Bonus: Paid at maturity or death.

- Premium

- Slightly higher than non-par products, since part of the premium funds the bonus pool.

- Returns

- Combines guaranteed benefits (like sum assured) with non-guaranteed bonuses.

- Provides long-term savings + protection.

3. Peer-to-Peer (P2P) Collect in Payments

Context:

The National Payments Corporation of India (NPCI) has announced that it will discontinue the peer-to-peer (P2P) collect request feature on UPI starting October 1, 2025. The decision comes amid rising cases of fraud and misuse linked to this feature.

What is Changing?

- Collect Request Feature:

- Allowed a UPI user to send a payment request to another user (e.g., to split bills or remind someone to repay money).

- The recipient could accept or decline the request.

- Problem: Fraudsters increasingly misused this feature by tricking unsuspecting users into approving bogus payment requests.

Peer-to-Peer (P2P) Collect

- P2P Collect is a feature in UPI (Unified Payments Interface) that allows a user to request money from another user, instead of sending it.

- Unlike a normal transfer (where the payer initiates), here the receiver initiates a “collect request” and the payer just needs to approve it.

Peer-to-Peer (P2P) in Payments

- Peer-to-Peer (P2P) payments are digital money transfers between two individuals without involving cash or physical instruments.

- Transactions happen using mobile apps, UPI IDs, QR codes, phone numbers, or bank accounts.

4. Credit-to-Deposit Ratio Remains Below 80%: CareEdge Ratings

Context:

According to CareEdge Ratings, the credit-to-deposit (CD) ratio in Indian banks remains below 80% as credit offtake continues to lag deposit growth.

Credit-to-Deposit (CD) Ratio

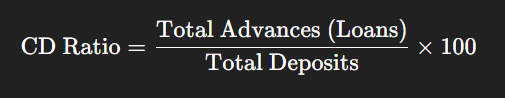

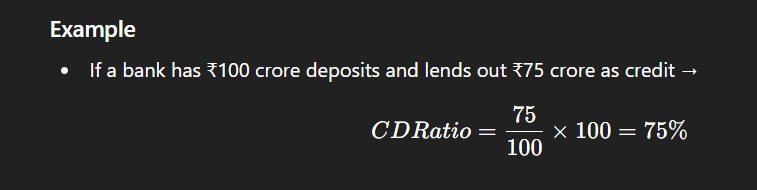

- The Credit-to-Deposit (CD) Ratio shows the proportion of a bank’s deposits that have been lent out as credit.

- Formula:

Purpose / Importance

- Measures how efficiently a bank is using its deposits.

- Indicates the health and liquidity of the banking system.

- Used by RBI as a key financial stability indicator.

5. RBI to Introduce Continuous Cheque Clearing System

Context:

The Reserve Bank of India (RBI) has announced a major reform in cheque processing by shifting from batch-based Cheque Truncation System (CTS) to continuous cheque clearing, aimed at faster settlements and enhanced customer convenience.

Current Process:

- Cheques are cleared in batches with a T+1 day cycle (up to 2 working days).

- Banks collect, scan, and process cheques in scheduled clearing sessions.

New System – Continuous Clearing:

- Cheques will be scanned, presented, and processed throughout business hours (10 AM – 4 PM).

- Clearing time: reduced to a few hours within the same day.

- Drawee bank will give positive/negative confirmation in real time.

Post-Settlement Rules:

- Clearing house shares results with presenting bank.

- Funds to be released to customers immediately, max within 1 hour after settlement.

Objectives:

- Faster cheque clearance (closer to digital payments).

- Lower settlement risks.

- Enhanced operational efficiency for banks.

- Improved customer convenience.

6. SBI Life Launches “Smart Shield Plus” Term Insurance

Context:

SBI Life Insurance has launched a new term insurance product—Smart Shield Plus—to meet the evolving protection needs of modern consumers.

Key Features

- Type of Plan: Individual, non-linked, non-participating, pure risk life insurance offering life cover without an investment component.

- Plan Options (3 Choices):

- Level Cover: Fixed sum assured throughout.

- Increasing Cover: Sum assured increases annually by 5%, up to a maximum of 200%.

- Level Cover with Future Proofing: Option to increase cover at key life stages (marriage, childbirth, etc.) without medical underwriting.

- Flexibility & Coverage:

- Whole-life protection (coverage up to age 100) and limited-term options.

- Multiple premium payment term options.

- Flexible payouts: lump sum, installments, or a combination.

- Accessibility & Innovation:

- Available through both digital and offline channels with simplified documentation.

- Affordable premiums with discounted rates for female lives.

- Objective: To provide a future-ready plan that adapts to changing responsibilities across life stages.

7. Punjab & Sind Bank Launches ‘PSB Naari Shakti’ Savings Account

Context:

Punjab & Sind Bank (PSB) has launched a special savings account named “PSB Naari Shakti” to empower women by offering financial as well as health-related benefits.

Key Features:

- Variants: Two options – PSB Pink and PSB Smile.

- Health Coverage:

- Cancer cover

- Group accidental insurance

- Free annual preventive health check-ups

- Financial Benefits:

- Complimentary Platinum RuPay debit card for seamless digital transactions

- Exclusive savings account privileges tailored for women customers

- Objective: To strengthen women’s financial independence while addressing their healthcare needs.

About Punjab & Sind Bank

- Founded: 24 June 1908

- Headquarters: New Delhi, India

- MD & CEO: Swarup Kumar Saha

Facts To Remember

1. Nagaland Governor L. Ganesan no more

L. Ganesan, 80, Governor of Nagaland and former senior BJP leader from Tamil Nadu, passed away in Chennai.

2. Keymer remains undefeated; Pranesh wins Challengers crown

German Vincent Keymer capped a memorable triumph in the Quantbox Chennai Grandmasters chess tournament 2025 with a convincing win in the final round of the Masters section over American GM Ray Robson.

3. AU Small Finance Bank to open 51 branches on Independence Day ahead of universal bank transition

AU Small Finance Bank is expanding its branch network in preparation for its conversion into a Universal Bank. It will launch 51 branches across the country on August 15, 2025, coinciding with India’s 79th Independence Day.