Source: PIB

Context:

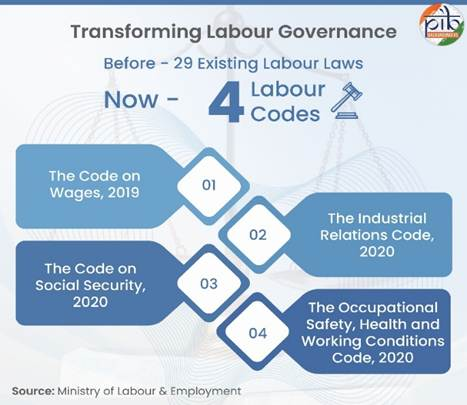

The Central Government has officially notified all four Labour Codes, replacing 29 old labour laws (some from the 1930s–1950s). These Codes are being projected as a big step toward modernising India’s labour market.

The Four Labour Codes

- Code on Wages (2019)

- Industrial Relations Code (2020)

- Code on Social Security (2020)

- Occupational Safety, Health and Working Conditions (OSHWC) Code (2020)

Key Objectives of the Labour Codes

- Simplification & Streamlining: Rationalises 29 labour laws into four comprehensive Codes.

- Enhanced Worker Protection: Covers wages, safety, social security, and welfare.

- Future-Ready Workforce: Supports flexible, formal employment with social protection.

- Inclusive Growth: Promotes gender equality, youth participation, and gig/migrant worker coverage.

- Ease of Compliance for Employers: Single registration, single license, single return.

Labour Codes and Key Features (India, 2025)

Code on Wages, 2019

- Universal Minimum Wage: Ensures minimum wage for all workers across organized & unorganized sectors.

- National Floor Wage: Central minimum benchmark; states cannot fix wages below this level.

- Gender-Neutral Pay: Prohibits wage discrimination across genders, including transgender workers.

- Overtime at 2× Rate: Mandatory for work beyond standard hours.

- Inspector-cum-Facilitator: Shifts focus from penal action to compliance guidance.

- Decriminalized Offences: Minor violations replaced by monetary penalties for compliance-friendly governance.

Industrial Relations Code, 2020

- Fixed-Term Employment (FTE): Time-bound contracts with full benefits, gratuity eligibility after 1 year.

- Re-skilling Fund: 15 days’ wages for retrenched employees for training & employability.

- Trade Union Recognition: Union with ≥51% membership recognized; otherwise, negotiating council formed.

- Higher Layoff Threshold: Approval for layoffs/closures raised from 100 → 300 workers.

- Strike Notice Rule: 14-day notice required to minimize disruption and promote negotiations.

- Expanded Definitions: Includes journalists, sales staff, supervisory employees earning ≤₹18,000.

Code on Social Security, 2020

- Universal Social Security: Life, health, maternity, old-age benefits extended to unorganized, gig, and platform workers.

- ESIC & EPF Expansion: Pan-India coverage; EPF inquiries time-bound & transparent.

- Social Security Fund: Dedicated fund for unorganized/gig workers, financed via aggregator contributions and penalties.

- Self-Assessed Cess: Builders can self-assess construction cess digitally.

- Gratuity for FTEs: Eligible after 1 year, improving project-based worker protections.

- Uniform Wage Definition: Standardizes wage components for correct EPF/ESIC/gratuity calculation.

Occupational Safety, Health & Working Conditions (OSHWC) Code, 2020

- Single Registration/Return: One unified system replaces multiple registrations.

- Migrant Worker Benefits: Includes self-migrated workers; annual travel allowance & portability of entitlements.

- Women’s Night Work: Allowed with consent & safety provisions; promotes equality & inclusion.

- National Worker Database: Digital database for unorganized/migrant workers; enables benefits & skill mapping.

- Working Hours Limit: 8 hours/day, 48 hours/week.

- Safety Committees: Required in establishments with ≥500 workers; joint employer–employee governance.

- Decriminalized Penalties: Minor offences converted into fines/compounding for compliance-oriented approach.

Significance

- Social Security Expansion: Workforce coverage increased from 19% (2015) → 64% (2025); Labour Codes further widen net.

- Pro-Worker & Pro-Employment: Protects informal, gig, migrant, and youth workers while enabling modern, flexible work arrangements.

- Boosts Industrial Growth & Employment: Simplified compliance and flexible frameworks enhance productivity.

- Inclusive & Gender-Sensitive: Equal pay, safety standards, and workforce participation encouraged.