Daily Current Affairs Quiz

22 October, 2025

National Affairs

1. UNFPA Report 2025

Context:

The United Nations Population Fund (UNFPA) in its State of World Population 2025 Report revealed that India’s Total Fertility Rate (TFR) has declined to 1.9, slipping below the replacement level of 2.1. This milestone signals India’s transition into a phase of sub-replacement fertility, raising new concerns over ageing, workforce shrinkage, and demographic sustainability.

Understanding Total Fertility Rate (TFR):

- Definition: TFR measures the average number of children a woman would bear if she experienced current age-specific fertility rates throughout her reproductive life (ages 15–49).

- Computation: Derived from Age-Specific Fertility Rates (ASFRs) for seven age cohorts — 15–19, 20–24, 25–29, 30–34, 35–39, 40–44, and 45–49 years.

- Synthetic Cohort Assumption: The measure assumes current fertility patterns remain constant across generations — a simplification that may not reflect real behavioural shifts.

Limitations of the Current TFR Methodology:

- Synthetic Cohort Bias: Real fertility preferences evolve over time and differ between younger and older women, violating the model’s assumption.

- Tempo Effect: Postponement of childbirth — common among educated and working women — temporarily depresses TFR by excluding delayed births from the current year’s count.

- Age-Cohort Gaps: Births among women below 15 or above 49 are excluded, despite such cases being non-negligible in some rural or traditional communities.

- Survey Underreporting: Social sensitivities and enumerator bias in fertility surveys, especially concerning underage pregnancies, may distort the true fertility picture.

Shifting Fertility Patterns in India:

- Urban Areas: Fertility is increasingly postponed to older cohorts (25–34 years), indicating career and education priorities rather than a true decline in reproductive intent.

- Rural Areas: Fertility is also shifting to the 20–34 age group, though decline in older cohorts (35–39+) suggests emerging preference for smaller families.

- The data points to timing changes, not necessarily fewer children overall.

Implications for India:

- Demographic Transition: India’s declining fertility aligns with global trends but also raises concerns of future population ageing and a shrinking workforce.

- Economic Outlook: Sub-replacement fertility does not inherently hinder growth — many advanced economies prosper with low TFRs.

- Missed Demographic Dividend: Persistent youth unemployment and automation pressures have prevented India from fully leveraging its demographic advantage.

- Elderly Care Challenge: The size of the elderly population today is largely independent of current fertility trends, suggesting policy focus should remain on social protection systems rather than fertility manipulation.

2. UNESCO Global Education Report 2025

Source: The Print

Context:

The UNESCO Global Education Report 2025 highlights that 133 million girls worldwide remain out of school, three decades after the Beijing Declaration (1995), despite significant improvements in enrolment.

Global Snapshot

- Progress: Since 1995, over 91 million more girls attend primary school and 136 million more attend secondary school.

- Persistent Gaps: Despite enrolment gains, major disparities remain in access, quality, and educational outcomes.

Regional Parity Achievements and Challenges

- Central and South Asia: Achieved gender parity in secondary education.

- Sub-Saharan Africa & Oceania: Lagging due to poverty, rural isolation, and conflict.

- Example: In Mali and Guinea, fewer than 20% of girls complete lower secondary education.

Persistent Quality Gaps

- Only two-thirds of countries provide compulsory sexuality education at primary level.

- Gender bias in textbooks and curricula persists, reinforcing stereotypes.

Leadership Inequality

- Women dominate teaching professions, but only 30% of higher education leadership positions globally are held by women.

- Structural barriers exist in academic governance and decision-making.

Economic and Social Significance

- Education of girls is a societal investment: improves poverty reduction, labour participation, and inclusive economic growth.

- The World Bank (2024) estimates closing the global gender education gap could boost global GDP by $15–30 trillion.

3. NITI Aayog’s Roadmap for Climate Action and Energy Transition

Source: Mint

Context:

India is approaching its 2030 target of 500 GW non-fossil electricity capacity and aims to achieve net-zero carbon emissions by 2070 under its Nationally Determined Contributions (NDCs). India also targets a 45% reduction in emission intensity of GDP by 2030 (from 2005 levels). NITI Aayog’s draft roadmap outlines institutional and financial measures to achieve these goals.

Proposed Institutional Mechanisms

a) Low Carbon Development Commission (LCDC):

- Purpose: Guide policy, coordinate multi-ministry climate action, and develop bankable project pipelines for mitigation and adaptation.

- Functions:

- Policy support and data analysis on emissions.

- Mobilize $100 billion annually in climate finance.

- Assist in national communications on climate change and manage national emission inventories.

- Role: Primarily scientific and technical, rather than regulatory; supports states and professional agencies in project execution.

b) National Green Financing Institute (NGFI):

- Purpose: Bridge the financing gap for India’s net-zero targets.

- Functions:

- Focus on blended finance, providing guarantees to reduce Weighted Average Cost of Capital (WACC).

- Develop standardized term sheets and power purchase agreements (PPAs).

- Promote investment in emerging technologies (CCUS, green hydrogen, green ammonia) and renewable infrastructure.

Key Climate Measures Highlighted

- Emission reductions across mobility, industry, energy, and agriculture.

- Promotion of waste management, sustainable construction, mass transit, non-motorized and electric mobility, energy efficiency, and circular economy.

- Net zero approach involves reducing emissions to near-zero levels and offsetting the remainder through carbon capture, afforestation, and other measures.

4. UDAN Scheme

Source: IE

Context:

Civil Aviation Secretary Samir Kumar Sinha announced that the Regional Connectivity Scheme known popularly as UDAN (Ude Desh Ka Aam Nagrik) will be continued beyond 2027 and its nework will extend to 120 new destinations.

Full Form: Ude Desh ka Aam Nagrik

Objective: Make air travel affordable, accessible, and inclusive by connecting remote and regional areas to major cities, promoting regional economic development.

Launch and Milestones

- Launched: 21 October 2016 under the National Civil Aviation Policy (NCAP).

- First Flight: 27 April 2017 (Shimla–Delhi).

- Anniversary: MoCA celebrated the 9th anniversary in 2025.

Key Features

- Viability Gap Funding (VGF):

- Provides financial support to airlines operating on regional routes to maintain affordable fares.

- Airfare Cap:

- Limits ticket prices to keep flights accessible for common citizens.

- Incentivised Framework:

- Waivers on airport charges.

- Tax concessions on Aviation Turbine Fuel (ATF).

- Multi-Stakeholder Governance:

- Collaborative framework involving MoCA, State Governments, AAI, and private operators.

- UDAN 5.5 & Seaplane Guidelines (2024):

- Expanded coverage to water aerodromes and heliports.

- Supports last-mile connectivity in remote regions.

5. India Ranks 9th Globally in Total Forest Area: FAO Report

Source: TOI

Context:

India has achieved a major global environmental milestone by moving up to the 9th position worldwide in total forest area, according to the Global Forest Resources Assessment (GFRA) 2025 released by the Food and Agriculture Organisation (FAO) in Bali, Indonesia.

Key Highlights:

- India’s Improved Global Ranking:

- Current Rank: 9th globally in total forest area (up from 10th in the previous assessment).

- Issued By: Food and Agriculture Organisation (FAO) of the United Nations.

- Report Released: Global Forest Resources Assessment 2025.

- Annual Forest Area Gain:

- India continues to hold the 3rd position globally in annual forest area gain, showcasing its strong reforestation and conservation efforts.

- Reflects steady progress in afforestation, forest restoration, and community-led ecological initiatives.

- Government Initiatives Driving Growth:

- Ek Ped Ma Ke Naam: A national movement launched by Prime Minister Narendra Modi, encouraging citizens to plant trees in honour of their mothers.

- National Afforestation Programme (NAP) and Green India Mission (GIM): Strengthen sustainable forest management and climate resilience.

- Joint Forest Management (JFM): Empowers local communities in forest conservation and livelihood development.

About Global Forest Resources Assessment (GFRA)

- Published by: Food and Agriculture Organisation (FAO) every five years.

- Purpose: Tracks global trends in forest cover, management, biodiversity, and carbon stock.

- Latest Edition (2025): Focused on forest resilience, climate adaptation, and sustainable land-use planning.

Banking/Finance

1. RBI’s Expected Credit Loss (ECL) Model

Context:

The Reserve Bank of India (RBI) has proposed a shift from the current incurred loss model of provisioning to a forward-looking Expected Credit Loss (ECL) framework for scheduled commercial banks. This move aims to enhance the early recognition of credit stress and strengthen the resilience of the banking system.

Current Model – Incurred Loss

- Definition: Banks make provisions for non-performing assets (NPAs) only after a loss event has occurred.

- Limitations:

- Delayed recognition of stress in loans.

- Weakens early warning systems for credit deterioration.

- Can amplify shocks during economic downturns.

Proposed Model – Expected Credit Loss (ECL)

- Definition: Forward-looking approach where banks estimate and provision for potential future losses on loans.

- Key Features:

- Provisions are based on probability of default (PD), exposure at default (EAD), and loss given default (LGD).

- Requires banks to continuously monitor and update credit risk parameters.

- Enhances capital adequacy and financial stability.

Benefits of ECL Framework

- Early Recognition of Stress: Detects potential NPAs before defaults occur.

- Improved Risk Management: Banks adopt proactive measures to mitigate losses.

- Resilient Banking System: Strengthens buffers against economic shocks.

- Alignment with Global Standards: Consistent with IFRS 9 and Basel III guidelines for credit risk provisioning.

Implications for Banks

- Banks will need to upgrade data analytics and risk assessment capabilities.

- May increase short-term provisioning, affecting reported profits initially.

- Encourages prudent lending practices and better credit monitoring.

2. India Records Net FDI Outflow in August 2025

Source: TH

Context:

The Reserve Bank of India (RBI) reported a 159% decline in net Foreign Direct Investment (FDI) in August 2025, indicating that more money left India than entered it. This marks the second time in FY26 that outflows have exceeded inflows, signaling volatility in foreign investment trends.

What is FDI?

Foreign Direct Investment (FDI) refers to long-term capital investment by a foreign entity (company or individual) in another country’s business or assets, typically to gain a controlling interest.

It is different from Foreign Portfolio Investment (FPI), which involves short-term financial assets like stocks or bonds.

Types of FDI:

- Greenfield Investment: Building new facilities or plants (e.g., a new factory).

- Brownfield Investment: Acquiring or merging with existing companies.

FDI Components:

- Gross Inflows: Total money invested by foreign investors in India.

- Repatriation/Disinvestment: Money withdrawn or sent back by foreign firms.

- Net FDI: Gross inflows minus repatriations/outflows.

Possible Causes of FDI Outflow:

- Profit Repatriation: Multinational corporations (MNCs) transferring profits to parent companies abroad.

- Geopolitical and Economic Uncertainty: Investors shifting capital to safer markets.

- High Interest Rates Globally: Developed markets becoming more attractive.

- Corporate Restructuring: Indian firms investing abroad for diversification.

- Regulatory or Policy Concerns: Periodic policy uncertainty or compliance issues.

Consequences of FDI Outflow:

Short-Term Impact:

- Rupee Pressure: Increased demand for foreign currency may depreciate the rupee.

- Reduced Capital Availability: Affects startups, manufacturing, and infrastructure funding.

- Weaker Balance of Payments: Negative FDI flows can widen the current account deficit (CAD).

Long-Term Implications:

- Investor Sentiment: May dent India’s reputation as a stable investment destination.

- Employment & Growth: Lower FDI affects job creation and technology transfer.

- Policy Reforms Pressure: May push the government to liberalize FDI norms and improve the ease of doing business.

- Sectoral Shifts: Outflows may indicate overvaluation or sector-specific saturation in industries like IT or manufacturing.

3. New Tax Rules on Share Buybacks

Source: Mint

Context:

From 1 October 2024, India’s share buyback tax regime underwent a major transformation as per amendments in the Finance Act, 2024. The change aligns the tax treatment of buybacks with dividends, thereby impacting investor returns and corporate payout decisions.

What is a Buyback of Shares?

A buyback (or share repurchase) is a corporate action where a company buys back its own shares from existing shareholders, usually at a price higher than the market value.

After the buyback, the number of outstanding shares decreases, which can increase the earnings per share (EPS) and ownership percentage of remaining shareholders.

Legal Basis in India:

- Governed under Section 68–70 of the Companies Act, 2013 and SEBI (Buyback of Securities) Regulations, 2018 (for listed companies).

- Approval is required from the board or shareholders, depending on the size of the buyback.

- Buyback can be done from:

- Existing shareholders on a proportionate basis,

- Open market,

- Employees holding shares under ESOPs, or

- Odd-lot holders.

Earlier Framework (Before 1 October 2024)

- Buyback Tax: Companies were liable to pay a 20% tax (plus surcharge and cess) on the distributed income from share buybacks under Section 115QA of the Income Tax Act.

- Investor Treatment:

- Shareholders received the buyback proceeds tax-free.

- No further tax liability in the hands of investors.

- Rationale: This system was introduced in 2013 to prevent companies from avoiding Dividend Distribution Tax (DDT) by resorting to buybacks.

New Regime (From 1 October 2024 Onwards)

- Tax Shift:

- The 20% buyback tax on companies has been abolished.

- The entire buyback amount is now taxable as dividend income in the hands of shareholders.

- Investor Taxation:

- Taxed as per the individual’s applicable income tax slab rate.

- For non-resident investors, TDS provisions under Section 195 apply.

- Objective: Simplify taxation and create parity between dividends and buybacks as forms of capital return.

Implications

- For Investors:

- High-tax individuals face lower post-tax returns from buybacks.

- Foreign investors may see withholding tax impacts depending on DTAA (Double Taxation Avoidance Agreement) benefits.

- For Companies:

- May reduce preference for buybacks as a method of returning capital.

- Could increase dividend payouts or share-based incentives instead.

- For Market:

- Short-term dip in buyback announcements post-October 2024.

- Potential rebalancing of corporate capital allocation policies.

4. PFRDA Releases Draft Framework on Pension Wealth Accumulations

Source: PIB

Context:

The Pension Fund Regulatory and Development Authority (PFRDA) has issued a consultation paper proposing a revised framework for valuation and disclosure of pension wealth accumulations. The move aims to enhance transparency for subscribers and ensure the long-term financial stability of India’s pension ecosystem.

Objective of the Consultation Paper

The initiative aims to:

- Enhance governance and transparency in the pension valuation process.

- Protect subscriber interests by reducing NAV volatility.

- Support India’s financial infrastructure development through stable, long-term investments.

Key Proposal: Dual Valuation Framework

The paper proposes a dual valuation approach — combining accrual-based and fair market-based valuation for long-term Government Securities held by pension funds.

Purpose of Dual Valuation Framework

- Stable Wealth Depiction:

- To provide subscribers with a more stable and simplified picture of their pension wealth accumulation during the contribution phase.

- Reduced Interest Rate Impact:

- To minimize the impact of short-term interest rate fluctuations on Net Asset Value (NAV), since such volatility has limited relevance for long-term subscribers.

- Alignment with Long-Term Investments:

- To align pension fund portfolios with nation-building investments like infrastructure and capital formation, strengthening overall economic resilience.

About PFRDA

- Established: 2003 | Statutory Authority: Since 2013 (PFRDA Act, 2013)

- Regulates: National Pension System (NPS) and Atal Pension Yojana (APY)

- Headquarters: New Delhi

- Core Objective: To promote old-age income security and develop India’s pension market.

5. RBI Study Flags Overvaluation Risks in SME IPO Segment

Source: BS

Context:

A recent RBI Bulletin study authored by Bhagyashree Chattopadhyay and Shromona Ganguly has highlighted significant volatility in India’s Small and Medium Enterprises (SME) IPO market, marked by sharp listing gains followed by swift price reversals. The findings point to signs of overvaluation in several SME stocks listed during FY24 and FY25, raising regulatory concerns for the segment.

Key Findings of the RBI Study

- Sharp Listing Gains, Quick Reversals:

- Many SME IPOs witnessed strong listing-day gains, often driven by retail enthusiasm.

- However, these gains were frequently followed by negative returns within weeks or months, indicating unsustainable valuations.

- Retail Investor Frenzy:

- The decline is more pronounced in IPOs that attracted heavy retail participation.

- Retail investors, lured by potential for “quick profits,” often ignored business fundamentals, leading to price inflation at listing.

- Overvaluation Signals:

- The study compared price-to-earnings (P/E) ratios of 100 SMEs listed in FY24–FY25 with their respective industry averages.

- Around 20% of these stocks had excessive P/E multiples, suggesting overvaluation relative to peers.

- Dominance of Fresh Capital Issues:

- In FY24, fresh capital accounted for 94.8% of total issue size.

- In FY25, it was 91.5%, showing that companies are raising funds for expansion rather than providing exits to existing shareholders.

- Regulatory Response:

- The Securities and Exchange Board of India (SEBI) has initiated steps to tighten SME IPO norms, including stricter disclosure requirements and monitoring mechanisms to curb speculative activity.

Background: SME IPO Boom in India

- The SME platform was introduced by SEBI and stock exchanges (NSE Emerge, BSE SME) to help smaller firms raise capital efficiently.

- Over the past two years, record SME IPO activity has been observed — over 250 listings in FY25 — with massive retail participation.

- However, valuation discipline and post-listing governance have emerged as key challenges.

About SME IPOs

- Definition: IPOs issued by Small and Medium Enterprises to raise equity on specialized SME exchanges.

- Eligibility: As per SEBI, post-issue paid-up capital should be below ₹25 crore.

- Platform: Listed on BSE SME and NSE Emerge.

- Objective: To provide smaller businesses access to equity financing and visibility in capital markets.

6. Indian Banks’ Profitability and NIM Improvement Amid RBI Rate-Cut Cycle

Source: ET

Context:

Indian banks are showing stronger profitability and expanding Net Interest Margins (NIMs) as the Reserve Bank of India (RBI) begins its rate-cut cycle, signaling a shift in the monetary policy stance to support growth.

Key Highlights:

- Rate-Cut Impact: The RBI’s move to lower policy rates is easing borrowing costs for banks, allowing them to reprice loans while maintaining higher returns on existing lending portfolios.

- Improved Profitability: Lower funding costs and stable credit demand are enhancing banks’ interest income and overall profitability metrics.

- Changing Lending Dynamics: Banks are shifting towards internal benchmark-based lending, such as the External Benchmark Lending Rate (EBLR) and Marginal Cost of Funds-based Lending Rate (MCLR), improving transparency in loan pricing.

- Credit-Deposit Trends: Slower deposit growth relative to credit expansion has increased competition for deposits, pushing banks to optimize their asset-liability management.

- Sectoral Performance: Private sector banks continue to maintain higher NIMs compared to public sector peers, supported by better credit appraisal systems and diversified loan books.

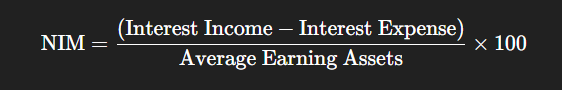

What is NIM (Net Interest Margin)?

Net Interest Margin (NIM) measures a bank’s profitability from lending operations.

It is the difference between the interest earned on loans and investments and the interest paid on deposits and borrowings, expressed as a percentage of earning assets.

Formula:

Higher NIM = More efficient and profitable bank.

7. SEBI Tightens Insider Trading Oversight as Unlawful Gains Surge

Source: Mint

Context:

The Securities and Exchange Board of India (SEBI) has intensified its crackdown on insider trading after detecting a surge in illicit stock market gains. The move follows a major case involving a Central Electricity Regulatory Commission (CERC) official and trades in Indian Energy Exchange Ltd (IEX) shares, where SEBI ordered the impounding of over ₹173 crore in unlawful gains — one of the largest such actions in recent years.

Key Highlights:

- Case Overview: SEBI uncovered large-scale insider trading linked to unpublished price-sensitive information (UPSI) concerning the Indian Energy Exchange (IEX).

- Key Action: The regulator impounded over ₹173 crore of unlawful gains, marking one of the largest insider trading crackdowns in recent years.

- Entities Involved: A CERC official allegedly leaked confidential information to certain individuals, who then used it to profit through timely trades in IEX shares.

- Regulatory Response: SEBI has intensified surveillance and data analytics mechanisms to detect coordinated or pattern-based insider activity across the capital markets.

- Wider Crackdown: This move is part of SEBI’s broader efforts to ensure market integrity, transparency, and investor confidence, especially amid rising retail participation in equities.

About Insider Trading

Insider trading refers to buying or selling securities of a listed company by individuals who have access to unpublished price-sensitive information (UPSI).

- Example:

- If an employee or regulator learns about an upcoming merger, results, or policy decision before it becomes public and trades on that knowledge, it constitutes insider trading.

Legal Framework:

- Governed under SEBI (Prohibition of Insider Trading) Regulations, 2015.

- Punishable with penalties, disgorgement (return of unlawful gains), and market bans.

8. PFRDA Proposes Dual Valuation Framework for NPS and APY Portfolios

Source: ET

Context:

The Pension Fund Regulatory and Development Authority (PFRDA) has issued a discussion paper proposing a dual valuation approach for securities held in the portfolios of the National Pension System (NPS) and the Atal Pension Yojana (APY). The move aims to make pension wealth accumulation more transparent and stable while strengthening the long-term investment character of pension funds.

Key Highlights:

- Dual Valuation Proposal:

- The regulator has proposed valuing a portion of the government securities (G-Secs) portfolio on an accrual basis (based on interest earned over time).

- The remaining portion would be valued on a mark-to-market (MTM) basis (reflecting current market prices).

- This “dual valuation” method is expected to balance prudence and realism by providing both stability and economic relevance in fund valuation.

- Objective of the Framework:

- To present pension wealth accumulation more clearly to subscribers.

- To ensure long-term financial stability and reflect the true economic purpose of pension investments.

- To align pension fund investments with long-term capital formation—especially in funding productive infrastructure assets with long gestation periods.

9. RBI Launches Offline Digital Rupee (e₹) at Global Fintech Fest 2025

Context:

The Reserve Bank of India (RBI) launched the offline digital rupee (e₹) at the Global Fintech Fest 2025, marking a significant step in the digital finance ecosystem of India. The e₹ is a form of Central Bank Digital Currency (CBDC), combining the convenience of digital payments with the characteristics of physical cash.

Key Highlights:

- Nature of e₹:

- Official CBDC issued by RBI.

- Functions like physical cash in digital form.

- Stored in bank wallets provided by SBI, ICICI, HDFC, and Union Bank.

- Availability:

- Wallet apps available on Google Play and Apple App Store.

- Supports instant person-to-person (P2P) and person-to-merchant (P2M) transactions.

- Offline Capability:

- Supports offline payments using minimal network connectivity or NFC tap technology.

- Ensures usability in rural and remote areas, expanding financial inclusion.

- Programmability & Pilots:

- Being tested in government schemes:

- GSAFAL in Gujarat

- DEEPAM 2.0 in Andhra Pradesh

- Enables efficient subsidy delivery, transparency, and traceability of funds.

- Being tested in government schemes:

- Pilot & Adoption:

- India’s first retail e-rupee pilot started on December 1, 2022.

- Over 7 million users have participated so far.

Significance for India:

- Strengthens digital payment infrastructure.

- Promotes financial inclusion, especially in underserved regions.

- Reduces dependency on cash handling.

- Facilitates transparent, traceable, and programmable payments for government schemes.

Economy

1. Post-Diwali Farm Challenge: From Consumer Inflation to Farmer Woes

Source: The Indian Express

Context:

After months of food inflation being a primary concern for policymakers, India now faces a reverse challenge — many crops are selling below Minimum Support Prices (MSPs) despite a strong monsoon and rising sowing, shifting the policy focus from consumer prices to farmer viability.

Key Highlights:

- Food Inflation Eased: Retail food inflation has been in negative territory for four consecutive months ending September 2025, compared to an average of 8.5% annual rise during July 2023–Dec 2024.

- Crop Glut & High Stocks:

- Wheat stocks stood at 320.3 lakh tonnes on October 1, 2025 — highest in four years and about 1.5 times required buffer.

- Rice stocks held by government agencies were 4.4 times the PDS plus strategic reserve requirement.

- Weak Crop Prices Despite Sub-optimal Output:

- Example: Soyabean area and yield fell in 2025, yet market prices in places like Latur were around ₹4,100/quintal, well below MSP of ₹5,328.

- Export prices for soyabean meal fell from ~$490/tonne (Sept 2024) to ~$398/tonne (Sept 2025), reflecting global oversupply.

- Policy Shift Required:

- With crops such as maize, cotton, pulses and millets selling below MSP, the government may shift from a pro-consumer to a pro-farmer orientation — e.g., by restoring import duties on cotton and peas, or stepping up MSP procurement.

Food Inflation

Food inflation refers to the rise in the prices of food items such as cereals, pulses, vegetables, fruits, milk, meat, and edible oils over a period of time. It measures how much more consumers have to pay for food compared to previous months or years.

Measured By:

In India, food inflation is captured as part of the Consumer Price Index (CPI) — specifically under the CPI-Combined (CPI-C) and CPI-Rural/Urban categories. The National Statistical Office (NSO) compiles and publishes CPI data every month.

Formula:

Food Inflation (%)=Current Food Price Index−Previous Food Price Index×100/Previous Food Price Index

Causes of Food Inflation:

- Supply-Side Factors:

- Poor monsoon or drought → lower crop yields.

- Crop damage due to floods or heatwaves.

- Higher input costs (fertilisers, fuel, electricity).

- Disruption in logistics or storage losses.

- Demand-Side Factors:

- Rising household incomes → higher demand for protein-rich foods (milk, meat, pulses).

- Festive season demand or export surges.

- Government and Policy Factors:

- Export bans, minimum support price (MSP) hikes.

- Hoarding or stock limits on essential items.

- Import restrictions or global supply shocks (e.g., due to wars or trade bans).

Implications

- Rural distress risk: Low crop prices may reduce farm incomes and dampen rural consumption, which has knock-on effects for the broader economy.

- Food inflation paradox: While easing food inflation is welcomed by consumers, persistently low crop prices create structural risks for agriculture.

- Need for calibrated policy: The twin goals of moderating consumer prices and ensuring farmer profitability are now in tension — requiring calibrated interventions such as targeted MSP support, export regulation and crop diversification.

- Global linkages matter: Indian crop prices are affected by global trends — e.g., soyabean price drop tied to large harvests in Brazil, USA, Argentina. Domestic policy must respond in sync with external dynamics.

Agriculture

1. Kapas Kranti Mission

Source: TH

Context:

The Central Government has launched the ₹600 crore “Kapas Kranti Mission” to enhance cotton productivity and promote sustainable cultivation practices across India. The initiative focuses on long-staple, high-yield cotton through scientific innovation and farmer-oriented extension services.

About the Kapas Kranti Mission

To promote high-yield, long-staple cotton varieties through scientific innovation, modern agronomy, and farmer-focused support systems.

Key Goals:

- Enhance Productivity: Increase yield per hectare through improved seed varieties and better agronomic practices.

- Sustainable Cultivation: Encourage water-efficient irrigation, integrated pest management, and reduced chemical dependence.

- Farmer Empowerment: Build capacity through training, extension services, and market linkages.

- Technology Integration: Deploy AI-driven pest surveillance, drone-based nutrient mapping, and satellite-based crop monitoring.

- Climate Resilience: Promote climate-smart cotton farming models to adapt to changing weather patterns.

Implementation Framework

- Nodal Ministry: Ministry of Agriculture and Farmers’ Welfare

- Budget Allocation: ₹600 crore over multiple years.

- Focus States: Maharashtra, Gujarat, Telangana, Madhya Pradesh, and Punjab — India’s leading cotton-producing states.

- Collaborating Agencies:

- ICAR–Central Institute for Cotton Research (CICR)

- Cotton Corporation of India (CCI)

- Krishi Vigyan Kendras (KVKs)

- State agriculture departments and FPOs (Farmer Producer Organisations).

2. Per Drop More Crop Scheme

Source: News on Air

Context:

The Union Agriculture Ministry has introduced greater flexibility under the Per Drop More Crop (PDMC) scheme to promote micro-level water storage and conservation. The move aims to empower states and Union Territories (UTs) to design localised water management projects that enhance irrigation efficiency and ensure sustainable water availability.

About the Per Drop More Crop (PDMC) Scheme

Part of the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) – launched in 2015 to achieve “Har Khet Ko Pani” (Water for Every Field) and improve water-use efficiency in agriculture.

- Nodal Ministry:

- Ministry of Agriculture and Farmers’ Welfare

- Primary Objective:

- To promote micro-irrigation technologies (drip and sprinkler systems) and efficient on-farm water management practices to achieve “more crop per drop.”

Revised Guidelines:

- The “other interventions” section of PDMC has been expanded to include micro-level water management activities, such as:

- Diggi (small reservoir) construction

- Water harvesting systems

- States and UTs can now plan projects based on local needs—for both individual farmers and community-level systems.

- Increased Funding Flexibility:

- Earlier, funding for such activities was capped at 20% of total allocation for each state/UT.

- For Northeastern and Himalayan states, as well as UTs of J&K and Ladakh, the cap was 40%.

- Now, states/UTs can exceed these limits depending on their regional water requirements.

- Objective:

- Promote micro-irrigation and water-use efficiency.

- Support localized, sustainable water storage to strengthen irrigation reliability.

- Enhance farm productivity and income by optimizing water resources.

About the Scheme:

- Launched: 2015

- Part of: Pradhan Mantri Krishi Sinchayee Yojana (PMKSY)

- Focus: “More Crop Per Drop” – promoting efficient irrigation technologies such as drip and sprinkler systems.

Facts To Remember

1. Vanasamrakshana Samiti (forest protection committee)

In a touching display of humanity, three Kani tribal women from the Vanasamrakshana Samiti (forest protection committee) in Thiruvananthapuram, Kerala, revived a baby macaque that had suffered an electric shock near the Kallar Golden Valley forest check-post.

About the Vanasamrakshana Samiti (VSS):

- Members often assist forest officials in fire prevention, wildlife rescue, and ecological monitoring.

- VSSs are community-based forest protection groups functioning under the Kerala Forest Department.

- They involve local and tribal communities in forest conservation, wildlife protection, and sustainable resource use.

2. Defence Minister Rajnath Singh Releases Book on Civil-Military Fusion by Lt Gen Raj Shukla

Defence Minister Rajnath Singh has said that Operation Sindoor witnessed extraordinary jointness and integration among the three Services.

3. Centre Notifies Amendments to IT Rules, 2025 to Boost Content Moderation Transparency

Ministry of Electronics and Information Technology has notified the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Amendment Rules, 2025 to amend the Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules – IT Rules, 2021.

4. Earth Sciences Ministry Conducts 54 Cleanliness Campaigns, Clears 192 Files Under SCDPM 5.0

The Ministry of Earth Sciences has conducted 54 impactful cleanliness campaigns and has weeded out 192 files after a thorough review of more than 500 files and records under the Special Campaign for Disposal of Pending Matters (SCDPM) 5.0.

5. NHAI to Deploy 3D Survey Vehicles in 23 States for AI-Based Highway Monitoring

National Highways Authority of India (NHAI) will deploy Network Survey Vehicles in 23 states covering 20 thousand 933 km for the collection, processing and analysis of Road inventory and Pavement condition data of National Highway stretches.

6. PSA Launches AI Playbooks for Agriculture, SMEs & White Paper to Boost Responsible AI Adoption

Principal Scientific Adviser (PSA) Prof. Ajay Kumar Sood has launched ‘AI Playbooks for Agriculture and SMEs’ and ‘AI Sandbox White Paper’ to accelerate Responsible AI Adoption across the country.

7. Neeraj Chopra Conferred Honorary Lt Colonel Rank in Territorial Army

Two time Olympic medallist javelin thrower Neeraj Chopra has been conferred the honorary rank of Lieutenant Colonel in the Territorial Army.

8. Gujaratis Across the World Celebrate ‘Bestu Varsh’ Today

The Gujarati community across the world is celebrating New Year today. In Gujarat, the new year, which is popularly known as ‘Bestu Varsh’, is celebrated on the first day of the Kartik month of the Hindu calendar Vikram Samvat.