Daily Current Affairs

14 December, 2024

National Affairs

1. Funding Problem in ISRO

Context:

The Indian space technology sector is currently valued at $8.4 billion, but accounts for a mere 2 per cent of the global space economy. The growth is expected to be driven by technological advancement, government support, and rising demand for space solutions.

Other Related Projects:

- Pixxel – a constellation satellite of the worlds hyperspectral satellite.

- PierSight has made Varuna a maritime surveillance satellite, expected to be onboard of Isro’s PSLV launcher next year.

- GalaxEye is building the world’s first-ever Hybrid synthetic aperture radar (SAR) and multispectral imaging (MSI) sensor satellite that has the capacity to provided high-resolution, all-weather, multi-sensor data, without the restrictions of time.

- PierSight’s proposed SAR and automatic identification system (AIS) satellite constellation will provide persistent, near-real-time monitoring of all human activity at sea.

Also read: ISRO International Space Research Organization

2. Swiss Takeaway: MFN status to India

Context:

Switzerland has suspended the unilateral application of the most favoured nation (MFN) clause with India under the Double Tax Avoidance Agreement (DTAA). This suspension is based on the October 2023 ruling of the Supreme Court against the MFN’s validity.

Key Highlights:

- This treaty reduced withholding tax careened in India by Indian entities to 5% from previously 10%.

- According to the Federal Department of Finance, income generated on or after January 1, 2025, should be taxable in the source state at the rates prescribed in India-Switzerland Direct Tax Convention.

- The most favoured nation (MFN) clause is a principle found in international treaties, including tax agreements, that ensures equal treatment for all parties involved.

The DTAA between India and Switzerland was signed in 1994 and amended in 2010 to prevent double taxation of income.

What is Double Tax Avoidance Agreement (DTAA)?

It aims to avoid double taxation incidents involving an income through bilateral agreements between two countries.

- Provides tax relief either in co-jurisdictions or both.

- Based on the source of income, taxation incurs.

- Can set low-rate taxes on income derived from cross border.

- It provides a mechanism for the resolution of disputes arising out of the tax-related requirements.

Know more about: DTAA between India and Switzerland

3. Epilepsy Treatment at AIIMS, Delhi

Context:

The Neuroscience Centre at AIIMS, Delhi, has devised a unique treatment method using an advanced neurorobot that can ‘pop’ the brain and provide succour to millions who don’t respond to epilepsy drugs.

Highlights:

- Neuro-robot inserts several electrodes into the brain from where it can begin detecting the triggering area in one’s parts experiencing seizures.

- The electrodes are then stimulated to reproduce the seizure and to reconfirm the point of focus.

- The excision or ablation at that substandard area would give the sensation of popping in the brain so as to inhibit or diminish the seizures.

Epilepsy is a chronic brain disorder that causes seizures, which are episodes of abnormal electrical activity in the brain:

- During a seizure, groups of nerve cells in the brain send signals too fast than usual.

- Cause

- Genetic Factor, Brain Damage

4. Telecom equipment sales rises: PLI Scheme

Context:

Telecom equipment sales have crossed ₹68,700 crore under the Centre’s production linked incentive (PLI) scheme for the telecom sector within three and a half years of its launch, said Neeraj Mittal, secretary, department of telecommunications (DoT).

Key Highlights:

- The total investment under PLI scheme in telecom sector by the Centre has reached ₹3998 crore. Total sales have been ₹68,708 crore.

- The scheme generated employment for 25359 persons and encouraged local manufacturing, exports and investments in telecom and networking products.

Production Linked Incentive (PLI) Scheme

The government launched the Production Linked Incentive (PLI) Scheme that aim boosts the Indian manufacturing sector to become a global hub.

- Ministry

- Ministry of New and Renewable Energy

- Launch Date

- March 21, 2020

5. Globalization of the Billionaires: Billionaires of India

Context:

According to the latest study released by Union Bank of Switzerland, India is home to 185 billionaires, standing in terms of global ranking as the third most populated country concerning billionaires.

Key Highlights:

- Wealth accumulated by billionaires worldwide had increased from being $6.3 trillion in 2015 and it is expected to reach $14 trillion figures in 2024, which constitutes a whopping rise of 121 percent.

- Increased by 52.64 percent globally for all billionaires: from 1,757 to 2,682.

- In 2024, the United States will house the largest number of billionaires among all countries with 835 of them.

The Union Bank of Switzerland (UBS) was a Swiss investment bank and financial services company that merged with the Swiss Bank Corporation in 1998 to form UBS AG:

| Union Bank of Switzerland | UBS AG | |

|---|---|---|

| Founded | 1862 | 1998 |

| Headquarters | Zürich | Zürich and Basel |

| Activities | Investment banking, financial services | Personal and corporate banking, investment banking, wealth management, asset management |

6. Crude Oil Supply

Context:

International markets will likely witness an oil surplus of 950,000 bpd in 2025 even though Opec+ countries extended their supply cut, said the International Energy Agency.

Highlights:

- This can work well for India as an enormous oil glut might mean lower oil prices.

- If the Opec+ bloc starts unwinding the voluntary cuts from the end of March 2025, the oil overhang may increase to 1.4 million bpd.

- The level of compliance with agreed targets remains the key uncertainty for the trajectory of Opec+ crude supply.

The Organization of the Petroleum Exporting Countries (OPEC)

The Organization of the Petroleum Exporting Countries (OPEC) is an intergovernmental organization that aims to regulate the price and supply of oil in the world market.

- Headquarter

- Vienna, Austria

- Established

- 14 September 1960

- Secretary General

- Haitham al-Ghais

Banking/Finance

1. SEBI: Regulation for Algorithmic Trading

Context:

Securities and Exchange Board of India Proposes Regulation for Algorithmic Trading.

Highlights:

- Sebi proposes measures to regulate algorithmic trading by retail investors.

- Retail investors are individuals who buy and sell financial securities for personal financial goals, using their own money. They generally invest in smaller quantities, using brokerage accounts, mutual funds, or fintech platforms.

- Proposals aim to introduce checks and balances for stock brokers and exchanges.

- Currently, algo trading is dominated by institutional investors.

- Institutional investors are organizations that pool money to buy securities, real estate, and other assets, or to originate loans. They are large entities that manage large sums of money for their clients or members, and are often considered to be more knowledgeable than retail investors.

Know about: Retail Algorithm Trading Rules?

What is Algorithmic Trading?

- Automated process of trading where the software performs buying and selling activities based on pre-defined norms.

- Examples

- Arbitrage, High-frequency Trading (HFT), and Pairs Trading.

- Arbitrage

- Based on the minute price changes on the same securities which are traded on different exchanges.

- HFT

- large volumes of orders which are executed in very fast speeds, take advantage of price variations of fractions of a cent or less.

- Pairs trading

- It is the simultaneous buying and selling of a related pair of assets.

- Legal in India; regulated by SEBI.

Also read: Securities and Exchange Board of India (SEBI)

2. Forex reserves decline

Context:

India’s foreign exchange reserves dropped by $3.235 billion to $654.857 billion, a five-month low, for the week ended December 6, data released by the Reserve Bank of India (RBI) revealed.

Highlights:

- The reserve bank of India data shows that the foreign exchange reserves have fallen by five months to $654.857 billion.

- Rupee reaches a new low of ₹ 84.88 per dollar on Thursday, but closes at 84.87.

- In the week gone by, reserves increased by $1.51 billion to $658.091 billion.

What is Foreign Exchange Reserve?

3. Capex

Context:

Plan for building India’s logistics towards becoming a developed nation by 2047 is in the works and spending towards capital expenditure (capex) would be decided according to the country’s requirement, Minister of State (MoS) for Finance Pankaj Chaudhary ( pictured )told reporters on Friday.What

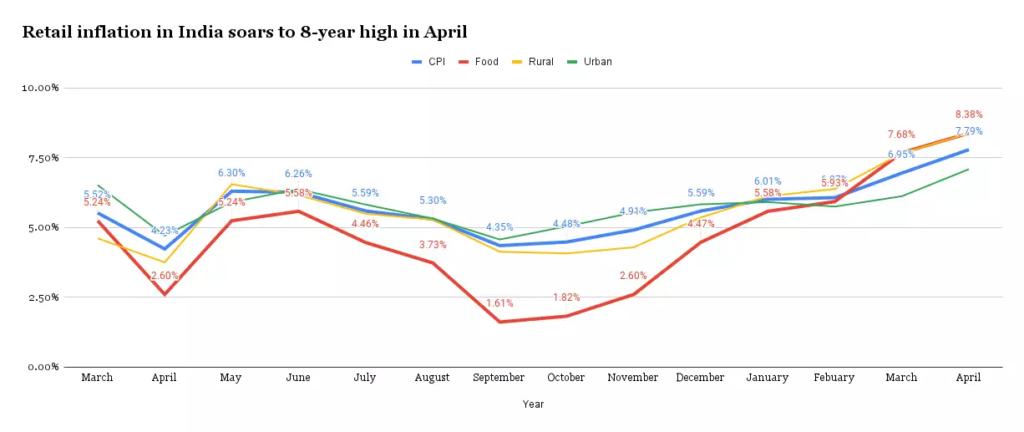

4. Retail Inflation in India Takes a Soft Curve

Context:

Retail inflation dropped to 5.48% in November, after being 6.2% for the previous month.

- Reserve Bank Of India kept rates unchanged and reduced the cash reserve ratio in its last policy meeting.

Retail inflation

- It also known as consumer price inflation (CPI), measures the rate at which the prices of goods and services purchased by consumers increase or decrease over time.

Also read: India’s retail inflation and food inflation

5. Increasing Fraud Cases Face Public Sector Banks of India

Context

Borrowal account frauds are responsible for ten percent of the total fraud cases and for 98% of the total fraud value in the period from April 2020 to September 2024.

Key Highlights:

- Non-Borrowal Fraud Forgery, misappropriation of funds, manipulation of books, diversion of funds, and misfeasance are responsible for 90% expense for fraud cases but only 2% expense for total fraud values.

- Digital and cyber frauds have become almost one hundred percent of the non-borrowal frauds, which hold 96% of incidence but only 22% of incidence losses.

- The meeting convened by the ministry of finance to consider a mechanistic approach to speed up.

Borrowal account fraud, also known as loan fraud, is when someone intentionally provides false information to obtain a loan or credit.

Public Sector Banks or PSBs are those banks where the direct holding of the Central/State Government or other PSBs is 51% or more .e.g. BANK OF BARODA, BANK OF INDIA etc.

6. FEMA (Foreign Exchange Management Act)

Context:

Standard Chartered Bank, India, has launched a “FEMA (Foreign Exchange Management Act) Centre of Excellence”

Highlights:

- Introduces a self-service capability for cross-border payments journey optimization.

- It provides a document repository for initiating outward remittances from India on Straight2Bank.

- Aims to help clients in navigating the dynamic regulatory environment.

7. NCLT and NARCL Cases

Context:

The Finance Ministry on Thursday asked banks to closely monitor cases in NARCL and NCLT to minimise procedural delays and adjournments so that bad loan resolution matters are expedited.

Highlights:

- Finance Ministry instructs banks to closely track cases concerning National Company Law Tribunal (NCLT) and National Asset Reconstruction Company Limited (NARCL).

- Aim:

- Avoiding delays in procedures and adjournments for the quick resolution of stressed assets.

- Initiative of the Ministry of Corporate Affairs for the development of a portal which will facilitate easy and transparent information sharing between banks relating to NCLT cases.

- NARCL, which is India’s first bad bank, aims at resolving and liquidating big-value bad loans, through a structured process.

- A bad bank is a financial institution that buys risky assets from other banks or financial organizations to help clean up their balance sheets. Bad banks can be established by banks, governments, or other institutions

- NARCL aggregates and purchases NPAs from banks, while IDRCL deals with the resolution process.

- NARCL has been established as a quasi-judicial body under the Companies Act, 2013 with the main function dealing with corporate disputes of civil nature and is in operation from June 01, 2016.

NCLT is a quasi-judicial authority incorporated for dealing with corporate disputes that are of civil nature arising under the Companies Act. Objectives. Initiated before the Company Law Board under the previous act (the Companies Act 1956)

The National Asset Reconstruction Company Limited (NARCL) is a public sector asset reconstruction company that was established in October 2021. Its role is to acquire, manage, and sell distressed loans from commercial banks to stabilize the banking system and the economy

Agri Business

1. Road Map for Ethanol Production by Indian Sugar Mills Association

Context:

ISMA proposes to hike the subsidy to ₹35,000 crore to increase sugarcane ethanol capacity by 20-25% by 2030-31.

Key Findings:

- The ISMA has requested bringing down the GST on flex-fuel vehicles and differential pricing on ethanol.

- The suggestions include revision of minimum sale price for sugar, fresh pricing of new ethanol for supply year 2024-25, and reduction in falling sugar prices.

What is Ethanol blending?

- It is the process of mixing ethanol with gasoline to reduce the use of fossil fuels.

What is ethanol?

- Ethanol is a renewable biofuel that’s a byproduct of processing sugarcane, rice husk, or maize. It’s also known as ethyl alcohol.

Also read: India shortens down its target for ethanol blending

2. Role of technology in delivering farm-fresh goods

Transforming farm-to-table Supply Chains through Technology

- The farm-to-market supply chains are changing through the advent of Blockchain, IoT, and AI.

- Blockchain opens up possibilities for transparency and tracing to enable consumers trace what they consume back to respective farms.

- IoT devices such as temperature and humidity sensors help to maintain the quality of products during transit.

- AI algorithms optimize logistics seeking short and efficient routes.

Also read: Agriculture Marketing

3. RBI Aggravates Collateral-Free Loan Limit for Farmers

Context:

RBI has updated and scoped the collateral-free loan ceiling for farmers with effect from January 1, 2025: Increased from ₹1.6 lakh to ₹2 lakh.

Highlights:

- Intended to provide relief assistance to small and marginal farmers on account of the increased input costs.

- This order mandates every bank operating throughout the country to instead prescribe no collateral and margin obligations on loans up to ₹2 lakh per borrower, based on agricultural and allied activity.

- Small and marginal land-holdingers would benefit through this decision, according to figures of the agriculture ministry, by 86%.

- The measure is intended to simplify access among the individuals to Kisan Credit Card (KCC) loans and to support the government in the realization of its Revised Interest Subvention Scheme.

KCC could refer to the Kisan Credit Card scheme or the Kisan Call Centre:

- Kisan Credit Card (KCC) scheme: This scheme is implemented by the Ministry of Agriculture and Farmers’ Welfare, Government of India. It provides farmers with credit for production, post-harvest expenses, marketing, consumption, and working capital. Farmers who can be eligible for the KCC.

4. Crop Diversification

Context:

Emphasising crop diversification as one of the strategies to revitalize the plantation sector, the agri experts has underlined the need for considering scientific approach in crop selection.

Crop Diversification

Crop diversification is the practice of adding new crops or cropping systems to a farm’s agricultural production.

- Crop Diversification Incorporates new crops or cropping systems in agricultural production.

- Enhances soil health, biodiversity, and crop yields.

- Increases income, mitigates climate change effects, and reduces pest and disease risk.

Economy

1. India’s Income Inequality and Growth

Context:

According to WIL, the income inequality in present India is worse than that during colonial rule, which does not imply that the poor are worse off.

Key Highlights:

- Now India’s become the greatest unequal country in the world, whereby the top 10% share in 55-60% of the aggregate income and the bottom 50%-approximately receives about 15%.

- The income scale and inequality argument of the government only persuades the rich entrepreneurs were not convincing.

- The right amount of inequality for India would be 30-40% and not the present figure of 55-60%.

- The caste system, which is the strongest influence on inequality, is largely policy-driven.

- India has innovated to overcome inequality through reservations for scheduled castes, scheduled tribes, and women in elections, referring to the inequality issue.

What is Income Inequality

Income inequality is the uneven distribution of income across a population. It’s a concern in many countries around the world, and it’s often accompanied by wealth inequality, which is the uneven distribution of wealth.

Gini Coefficient

The Gini coefficient is a number between 0 and 1 or 100.

- 0 signifies perfect equality.

- 1 or 100 implies perfect inequality.

- India’s Point:

- 37.06 (2022)

Also Read: Editorial Analysis

2. Fitch Ratings and CareEdge Ratings: India’s GDP Growth Outlook

Context:

Fitch Ratings reduced India’s GDP growth for 2024-25 to 6.4% from 7.2% but does not expect the slump to be extended.

Key Highlights:

- CareEdge also revised downwards its GDP growth forecast for the country to 6.5% from 6.8% considering the slow GDP growth during the July-September period as well as a deeper fall in corporate profit.

- In 1993, CareEdge Ratings (CARE Ratings Ltd) has established itself as one of India’s leading credit rating agencies.

- CareEdge expects that the slowdown is temporary and forecasts a 6.8% GDP growth for the second half of the fiscal year.

- Fitch saw household consumption as the major engine of India’s economic growth in a possible trade war scenario and a slowdown in global trade.

- Fitch Ratings Inc. is one of the three nationally recognized statistical rating organizations (NRSRO).

- Established

- 1914

- Headquarter

- New York City

Other Institution Forecast:

- Asian Development Bank downgraded GDP to 6.5 percent instead of the earlier 7 percentage point estimate, considering the lower growth prospects of private investment and housing demand.

- The RBI has reduced its earlier projection for GDP growth in 2010-11 from 7.2 percent to 6.6 percent.

Also read: Comparing GVA and GDP

Facts to Remember

1. 5G Phone Transition Between India and China

- When it comes to the percentage difference in smartphone shipments moving from 4G to 5G last year, India and China are pretty level.

- The share of 5G phones in India increased from a mere 57% in Q2 2023-24 to 83.4% in Q2 2024-25.

2. Microfinance Organization of the Year Award

Satin Creditcare Network, the premier microfinance firm in the area, has won the highly coveted ‘Microfinance Organization of the Year Award’ at the Global Inclusive Finance Summit.

- Recognized for making microfinance inclusive.

- Empowers millions of households to build sustainable livelihoods.

Global Inclusive Finance Summit held in New Delhi.

3. 30 people drowned per hour in 2021, says WHO

The report, released at an event in Geneva, reveals that three lakh people died by drowning in 2021 around the world.

About: WHO

4. French President: Emmanuel Macron

French President Emmanuel Macron on Friday appointed Francois Bayrou as his third prime minister of 2024.