Daily Current Affairs Quiz

6 August, 2025

National Affairs

1. Cloudburst

Context:

The recent tragic cloudburst in Uttarkashi (Uttarakhand), which devastated the village of Dharali and surrounding areas, is a stark reminder of how climate change is intensifying natural disasters in India.

What is a Cloudburst?

A cloudburst is an extremely intense rainfall event over a small area within a short duration. As per the India Meteorological Department (IMD), it is defined as rainfall exceeding 100 mm per hour across an area of 20–30 sq km. However, a 2023 study by IIT Jammu and the National Institute of Hydrology (NIH) redefined this as rainfall of 100–250 mm/hour concentrated in just 1 sq km, making it one of the most hyper-local and destructive meteorological phenomena.

Why Are Himalayan Regions More Vulnerable?

- Steep Terrain: Hilly slopes accelerate water runoff, triggering landslides and flash floods.

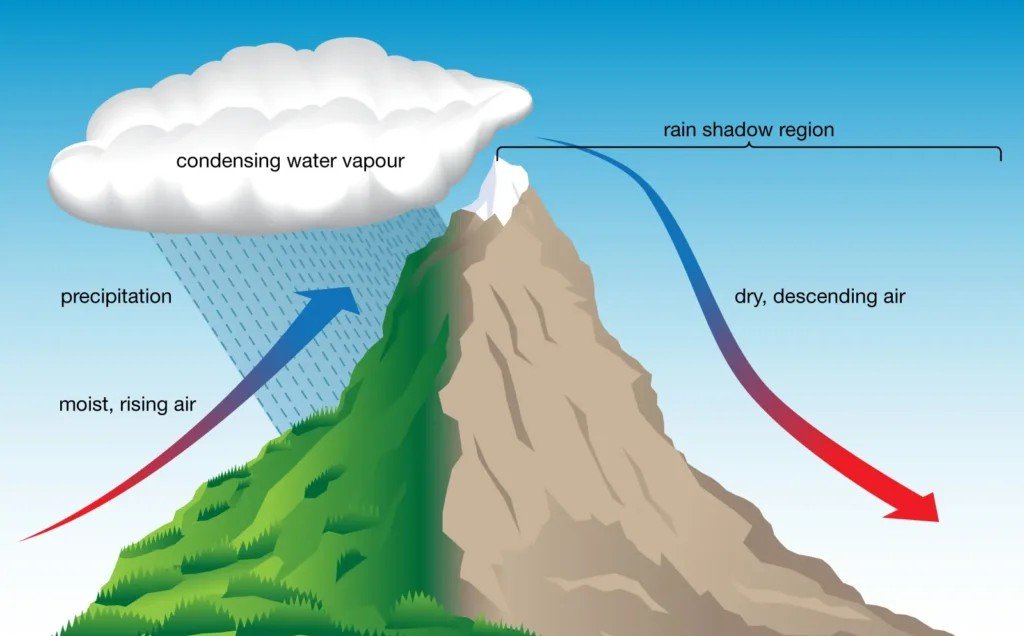

- Orographic Effect: Moist monsoon winds are forced upwards by mountains, leading to rapid condensation and heavy rainfall.

- Poor Soil Absorption: Rocky terrains reduce infiltration, increasing surface water accumulation.

- Fragile Ecosystems: High-altitude settlements (1,000–2,000m) are ecologically sensitive and structurally unprepared for such events.

Scientific Causes and Climate Link

- Moisture Build-Up and Collapse: Towering storm clouds (cumulonimbus) rapidly store moisture due to vertical air currents. A sudden collapse of these currents releases massive rainfall in minutes.

- Climate Change: Warmer air holds more water vapor. For every 1°C temperature rise, the atmosphere retains 7% more moisture, increasing the likelihood of intense short-duration rainfall events.

- Aerosols and Black Carbon: Pollution from forest fires, diesel vehicles, and stubble burning adds cloud condensation nuclei (CCN) to the atmosphere, altering cloud formation and intensifying rainfall episodes.

Impacts of Cloudbursts

- Sudden Flash Floods: Rapid overflow of streams and nullahs, sweeping away people, property, and vehicles.

- Landslides and Mudslides: Water-saturated slopes lose cohesion, causing devastating earth movements.

- Infrastructure Collapse: Roads, bridges, and electricity poles fail under the pressure of debris and water.

- High Casualty Rates: The unpredictable and sudden onset leaves communities with no time to respond.

Challenges in Forecasting Cloudbursts

- Short Duration & Micro-scale: The extremely localized nature makes it nearly impossible to predict using conventional forecasting tools.

- Lack of Dense Monitoring Network: Hilly regions lack sufficient Doppler radar and weather stations.

- Limited Local Alert Systems: Remote villages often receive alerts too late, if at all.

- High Cost of Modern Tech: AI-based early warning systems and high-resolution radars remain underfunded.

2. Moldova Becomes 107th Member of International Solar Alliance (ISA)

Context:

The Republic of Moldova has officially joined the International Solar Alliance (ISA), becoming its 107th member country.

Key Highlights:

- Moldova’s Ambassador to India, Ana Taban, handed it over to P. S. Gangadhar, Joint Secretary (Economic Diplomacy) and Head of Depository, ISA.

- Significance: Moldova’s inclusion is expected to boost global cooperation in solar energy adoption and sustainable development efforts.

About the International Solar Alliance (ISA)

- Founded: Joint initiative of India and France at COP-21 (2015).

- Headquarters: Gurugram, India.

- Objective: Promote affordable, reliable, and sustainable solar energy worldwide, especially in:

- Least Developed Countries (LDCs)

- Small Island Developing States (SIDS)

Key Focus Areas of ISA

- Analytics & Advocacy:

- Publishes solar market reports and trends

- Supports member countries in policy and regulation

- Capacity Building:

- Runs STAR-C centres for training and standard-setting

- Develops local solar ecosystems

- Programmatic Support:

- Implements solar projects

- Aggregates demand and enables funding and risk mitigation

3. Ayurveda Aahara Preparations

Context:

The Food Safety and Standards Authority of India (FSSAI), in collaboration with the Ministry of Ayush, has released a detailed list of food items classified under Ayurveda Aahara. This development aligns traditional Ayurvedic wisdom with modern food safety regulations.

What is Ayurveda Aahara?

- Ayurveda Aahara refers to food products prepared in accordance with Ayurvedic principles emphasizing balance, seasonal alignment, natural ingredients, and therapeutic herbs.

- Regulatory Framework: Governed by the Food Safety and Standards (Ayurveda Aahara) Regulations, 2022.

- Objective: To integrate Ayurvedic dietary wisdom with contemporary nutritional standards, promoting preventive health and sustainable lifestyles.

Significance and Impact

- Bridging Tradition and Regulation: Brings structured clarity to Ayurvedic food products, paving the way for innovation and expansion in the nutraceutical and health food market.

- Consumer Confidence: Aids informed dietary choices for health-conscious individuals seeking natural, preventive health approaches.

- Global Positioning: Strengthens India’s positioning as a source of time-tested traditional wellness practices within a regulatory framework.

4. BrahMos Supersonic Cruise Missile

Context:

Following the operational success of Operation Sindoor, the Indian Navy and Air Force are moving ahead with large-scale acquisition of BrahMos supersonic cruise missiles. The move highlights the missile’s exceptional performance, precision strike capabilities, and deterrence value particularly in the context of cross-border engagements.

About BrahMos Supersonic Cruise Missile:

Joint Development

- A joint venture between India’s DRDO and Russia’s NPOM.

- Named after the Brahmaputra (India) and Moskva (Russia) rivers.

Key Features

- Speed: Supersonic (Mach 2.8–3.0) throughout its trajectory.

- Range: ~290 km (with extended versions under development).

- Launch Platforms: Compatible with land-based launchers, ships, submarines, and aircraft.

What is Supersonic? (Mach 1 to Mach 5)

- Speed faster than sound but less than 5 times the speed of sound.

- Speed Range: Mach 1 to Mach 5 (1,235 km/h to ~6,174 km/h).

What is Hypersonic?

- Speeds greater than Mach 5.

- Speed Range: Above 6,174 km/h

Banking/Finance

1. Bank of Baroda Unveils bob FxOne

Context:

Bank of Baroda has launched “bob FxOne”, a digital foreign exchange platform, for its corporate and MSME customers.

Key Features

- Real‑time forex and derivative trading: Live rates, instant deal confirmations, downloadable tickets, and a personalized dashboard with alerts

- One-Click Trade (1CT) and Request‑For‑Quote (RFQ) options enable streamlined execution of bookings across cash, tom, spot, forward, bills, and options

- User-friendly, secure, and branchless interface, eliminating manual intervention and reducing dependency on bank visits

What is a Foreign Exchange Platform?

A foreign exchange platform is:

- An online or electronic interface that facilitates currency trading.

- Used to access real-time exchange rates, execute trades, and analyze market trends.

- Also known as a forex trading platform.

Key Functions

- Currency Conversion: Instantly convert one currency to another.

- Trading & Speculation: Allows traders to profit from currency price movements.

- Hedging: Helps businesses or investors protect against currency risk.

- Real-Time Market Access: Live price feeds, analytics, and charting tools.

2. RBI Removes Prior Approval Requirement for Special Rupee Vostro Accounts (SRVAs)

Context:

The Reserve Bank of India has amended the procedure for opening Special Rupee Vostro Accounts (SRVAs), aiming to promote trade settlement in INR and ease compliance for banks.

Key Highlights:

- RBI has eliminated the requirement for prior approval to open SRVAs.

- Authorised Dealer (AD) banks can now open SRVAs for foreign correspondent banks without seeking RBI’s permission.

- This move is part of India’s strategy to promote rupee-based international trade settlements.

About Special Rupee Vostro Accounts (SRVAs)

- SRVAs are INR-denominated accounts held by overseas banks with Indian AD banks.

- These accounts facilitate invoicing, payment, and settlement of exports/imports in Indian Rupees.

- Introduced as part of the RBI’s 2022 framework for international trade settlement in INR.

Significance

- Enhances ease of doing business in cross-border trade.

- Boosts internationalisation of the Indian Rupee.

- Strengthens India’s bilateral trade relationships, especially with nations facing dollar liquidity issues.

3. PFRDA Launches Modernized Website Under ‘PFRDA CONNECT’ Initiative

Context:

The Pension Fund Regulatory and Development Authority (PFRDA) unveiled its revamped and modernized website under the PFRDA CONNECT initiative.

Key Highlights:

- Launched by: Shri S. Ramann, Chairperson, PFRDA

- Objective: Enhance transparency, accessibility, and efficiency in pension sector governance through digital transformation.

Features of the New Website

- Design Features:

- Fully responsive design with improved navigation and content structure.

- Centralised access to pension schemes, regulatory updates, and announcements.

- Incorporates a modern Content Management System (CMS) for streamlined updates.

- Compliance:

- Adheres to GIGW (Guidelines for Indian Government Websites).

- Follows WCAG (Web Content Accessibility Guidelines) for global accessibility standards.

- Integration & Functionality:

- Enhanced search capabilities and system integration.

- Aligned with other regulatory digital platforms for seamless service delivery.

Significance

- Aligns with Digital India goals and inclusive governance

- Reinforces PFRDA’s commitment to a proactive, tech-driven pension administration model

4. IDFC FIRST Bank and IndiGo Launch Dual Credit Card with Shared Limit

Context:

IDFC FIRST Bank and IndiGo Airlines have jointly launched the IndiGo IDFC FIRST Dual Credit Card, featuring two cards (Mastercard and RuPay) under one shared credit limit.

Key Highlights:

- Dual Card Format: Two physical cards Mastercard and RuPay issued together with a single credit limit and a single statement.

- Application Options:

- With credit eligibility (standard)

- Without credit checks via FD-backed option

- PIN and transaction preferences must be set separately for each card.

- All spends contribute to IndiGo BluChips and milestone benefits.

Significance

- India’s first dual-network credit card combining Mastercard and RuPay

- Integrates fintech innovation with loyalty

5. Promoting Financial Literacy and Borrower Protection in Rural India: Initiatives by NABARD and RBI

Context:

To foster financial inclusion and literacy among rural populations, including microfinance borrowers, the Reserve Bank of India (RBI) and the National Bank for Agriculture and Rural Development (NABARD) have launched several targeted initiatives. These efforts aim to improve digital and financial awareness, ensure borrower protection, and streamline access to credit, especially in underserved areas.

Key Financial Literacy Initiatives

1. Financial & Digital Literacy Camps (NABARD):

- NABARD supports financial literacy camps across rural areas through rural bank branches and Financial Literacy Centres (FLCs).

- Focus areas include:

- Digital banking

- Government social security schemes

- Cyber security

- Mobile banking awareness

2. Centre for Financial Literacy (CFL) Project (RBI):

- Launched in 2017, CFLs use community-led and participatory methods for financial literacy.

- As of March 2025, 2,421 CFLs have been established, with one CFL serving three blocks on average.

3. Village Level Programmes (VLPs):

- NABARD organizes VLPs with the support of banks and State Rural Livelihood Missions (SRLMs).

- Objectives:

- Facilitate SHG account openings

- Strengthen credit linkage

- Encourage regular loan repayment

- Boost financial inclusion in villages

Microfinance Sector Reforms and Credit Access

1. Revised Definition of Microfinance Loan (RBI):

- Loans to households with annual income ≤ ₹3 lakh are now classified as microfinance loans.

- Removed:

- Loan amount caps per cycle

- Minimum tenure requirements

2. Greater Flexibility in Loan Usage:

- Borrowers can now use microfinance loans for:

- Health expenses

- Education

- Income smoothing

- Earlier restriction of 50% loan usage for income-generating purposes has been lifted.

Borrower Protection Measures

1. Repayment Cap to Prevent Over-Indebtedness:

- Monthly loan repayments are capped at 50% of household income.

2. Recovery Safeguards:

- RBI-mandated ethical recovery guidelines for Regulated Entities (REs).

- REs must have dedicated grievance redressal mechanisms for recovery-related complaints.

3. Interest Rate Regulation and Transparency:

- On March 14, 2022, RBI:

- Deregulated microfinance interest rates.

- Mandated board-approved policies to ensure non-usurious lending.

- Encouraged market-driven competitive rates.

Role of Industry SROs and Credit Information Systems

1. Self-Regulatory Organizations (SROs):

- Sa-Dhan and Microfinance Institutions Network (MFIN) ensure:

- Regulatory compliance among MFIs and NBFC-MFIs.

- Policy consultation with RBI.

- Monitoring of borrower indebtedness and lender caps.

2. Credit Information Reporting:

- Credit Institutions (CIs) are required to submit:

- Household income data

- Loan information

- This helps Credit Information Companies (CICs) assess borrower exposure and prevent over-indebtedness by enforcing the 50% repayment ceiling.

Agriculture

1. Farmers’ Library Inaugurated in Ludhiana

Context:

In a significant step to empower farmers with scientific knowledge and improve farm productivity, a Farmers’ Library was inaugurated at Mushkabad FAM Dairy Producer Company Limited in Ludhiana, Punjab. The initiative is part of a NABARD-funded research project aimed at promoting Farmer Producer Organizations (FPOs) in the dairy sector.

Key Highlights:

- Inaugurated by Dr J P S Gill, Vice-Chancellor of Guru Angad Dev Veterinary and Animal Sciences University (GADVASU).

- The library aims to disseminate the latest scientific farming practices, bridging the knowledge gap among farmers.

- Visitors can access farm literature aligned with university recommendations to boost livestock productivity and sustainable farming.

Project Details

- Implemented under the project: “Promotion of FPO on Dairy Farming in Ludhiana”.

- NABARD provides financial and technical support, enhancing market linkages and improving farmers’ economic status.

What is a Farmer Producer Organization (FPO)?

A Farmer Producer Organization (FPO) is a legal entity formed by farmers to collectively engage in agricultural and allied activities, aiming to improve their income, market access, and bargaining power.

Key Features of FPOs

- An FPO is a registered collective of farmers (usually small and marginal) who come together to improve production, processing, and marketing of their agricultural produce.

- FPOs are generally set up under:

- Companies Act, 2013 as Producer Companies

- Cooperative Societies Act

- Societies Registration Act, etc.

Objective

- To enhance farmers’ income by leveraging economies of scale, value addition, and better market access.

- To act as a bridge between farmers and buyers, including processors, exporters, and retailers.

2. TraceX Technologies Launches Agentic AI Tool

Context:

With the European Union’s Deforestation Regulation (EUDR) set to come into effect from December 2025, TraceX Technologies, a Bengaluru-based agrifood and climate tech start-up, has launched an Agentic AI-powered tool to automate compliance processes for exporters.

What is the EU Deforestation Regulation (EUDR)?

- Applies to products such as coffee, cocoa, palm oil, soy, rubber, cattle products, wood, and wood-based items.

- Mandates that all such products exported to the EU must be legally sourced and deforestation-free.

Core Features of TraceX’s Agentic AI Tool

- Automated Supplier Onboarding & KYC

- Captures supplier credentials, land ownership documents, and verifies plots using AI-based document and email parsing.

- Plot-Level Geolocation & GeoJSON Validation

- Maps exact farm locations and verifies spatial data (GeoJSON) to ensure plot-level traceability.

- Satellite-Based Risk Assessment

- Uses global satellite datasets (like Hansen and JRC) to check if land was deforested after the 2020 cut-off date under EUDR.

- AI-Driven Risk Scoring

- Provides dynamic risk scoring of suppliers and plots and recommends corrective actions before shipment.

- One-Click DDS Generation & TRACES Integration

- Automates the creation of Due Diligence Statements (DDS) and prepares them in formats compatible with the EU’s TRACES platform.

- Audit-Ready Dashboard

- Offers a centralized system for accessing all compliance data, including supplier details, risk status, location files, and DDS history.

Facts To Remember

1. Govt. can issue national IDs to citizens: Centre

The Lok Sabha was recently informed that the Citizenship Act, 1955 provides that the Union government should compulsorily register every citizen of India and issue national Identity Cards to them.

2. Rajiv Anand appointed MD and CEO of IndusInd Bank

IndusInd International Holdings Ltd. (IIHL), the holding company of IndusInd Bank, has appointed Rajiv Anand as the Managing Director and CEO of the bank, according to a statement from the company’s Chairman Ashok Hinduja.

3. Lok Sabha Passes Bill for ST Quota in Goa Assembly

Amid a prolonged protest by Opposition MPs over the Special Intensive Revision (SIR) of electoral rolls in Bihar, the Lok Sabha passes bill for ST Quota in Goa Assembly. The aim is to provide reservations to Scheduled Tribes (STs) in the Goa Legislative Assembly.

4. Doordarshan Aims to Promote Regional Languages and Culturally Rich Programs

Prasar Bharati Chairman, Navneet Kumar Sehgal, said that the endeavour of Doordarshan is to promote regional languages and produce culturally rich family programs.

5. India-New Zealand hold inaugural defence strategic dialogue in New Delhi to strengthen bilateral cooperation

The inaugural ‘India-New Zealand Defence Strategic Dialogue’ was held in New Delhi to discuss security perspectives and further bolster bilateral cooperation.

6. UPSC launches new email alert system for institutions on recruitment advertisements

The Union Public Service Commission- UPSC has enabled a new facility for educational and professional institutions to receive direct email alerts about UPSC recruitment advertisements relevant to their domains.

7. Gajendra Singh Shekhawat inaugurates 64th National exhibition of art, celebrating India’s diverse artistic heritage

Culture and Tourism Minister Gajendra Singh Shekhawat inaugurated the 64th National Exhibition of Art by the Lalit Kala Akademi in New Delhi.